Summary:

- Ford delivered mixed earnings in Q2 due to warranty expense headwinds in Ford Blue and continual losses in Ford E.

- Ford, however, said that it expects warranty expenses to decrease going forward. The company also raised its free cash flow guidance for FY 2024 by $1.0B.

- Ford’s low P/E and P/FCF ratios reflect a high safety margin.

- Shares of Ford now trade at an 18% FCF yield.

solarseven

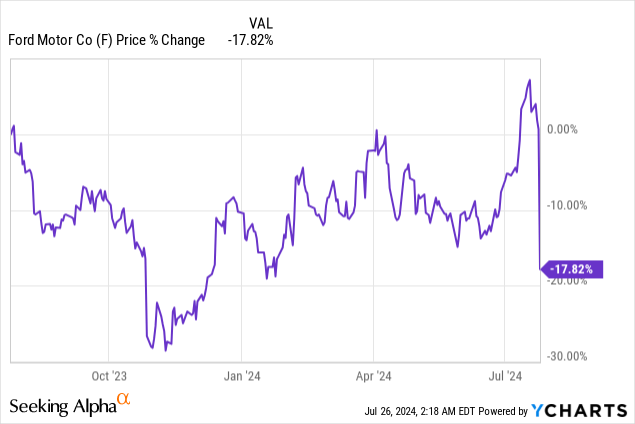

Ford (NYSE:F) delivered weaker than expected earnings for the second-quarter, which caused a major crash of 18% on Thursday. In fact, Ford’s shares had their worst day since 2008 as the automaker reported higher losses related to warranty issues and continual losses in the sluggish electric vehicle segment. In my opinion, the market massively overreacted to Ford’s earnings report — which clearly wasn’t great — but shares are an absolute steal based off of forward earnings and free cash flow right now. Further, investors seem to discount Ford’s $1.0B raise in its free cash flow guidance, which was overshadowed by concerns over profitability. I see a much improved risk profile for shares of Ford following Thursday’s big crash and believe investors are confronted with a unique buying opportunity right now!

Previous rating

I rated shares of Ford a strong buy in April due to the company’s solid revenue growth, ramp up of the F-150 Lightning truck as well as a solid free cash flow performance. Because of Ford’s reliance on ICE sales — only about 3% of Ford’s sales are electric vehicles — I called the automaker a Hedge Against An EV Market Slowdown. Ford not only confirmed its free cash flow guidance for FY 2024 on Thursday, but actually raised its outlook, just like General Motors (GM) did. In my opinion, investors are overreacting to Ford’s warranty issues, and I see a speculative and contrarian investment opportunity.

Earnings card for Q2, warranty issues and profitability concerns

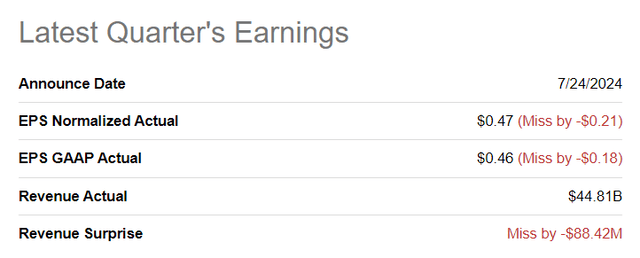

Ford missed Q2 consensus estimates for both its earnings and revenue, chiefly due to warranty issues and continual headwinds in the electric vehicle division. In Q2’24, Ford’s earnings on an adjusted basis came in at $0.47 per-share, missing the consensus estimate by $0.21 per-share. Quarterly revenues totaled $44.8B, which was $88M lower than the average prediction.

Ford’s second-quarter saw a decline in profitability driven by higher warranty costs in Ford Blue, which is where the company is selling its ICE vehicles, as well as higher losses in the Model E segment, which consolidates the automaker’s EV operations. Warranty costs, according to Ford’s earnings call, rose due to “new technologies, FSAs and inflationary pressures for the cost of repair.” Management also stated that it expects to see a normalization of warranty expenses going forward, so this headwind is not nearly as severe as Thursday’s market reaction told investors.

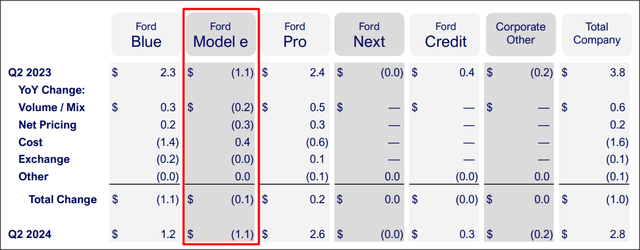

In Ford Blue, the company achieved $1.2B in adjusted EBIT, showing a $1.1B year-over-year decline with the decline being due chiefly due to higher warranty costs as well as higher material/manufacturing costs.

Compounding concerns about Ford’s profitability was once again the electric vehicle segment, which posted a quarterly loss of $1.1B. Losses incurred on the sale of electric vehicles and a slowing demand situation were the reasons why Ford scaled back F-150 Lightning production at the beginning of the year. EV segment losses are more structural and could be a bigger issue for Ford than a short-term inflation of warranty expenses, especially if Ford fails to steer the EV division toward profitability. Year-to-date, Ford lost $2.5B on its EV operations, and the segment is on track to reach $5.0B (as per guidance) in segment losses this year.

These two factors, warranty and EV segment losses, likely explain the market’s distressingly negative reaction to Ford’s Q2’24 earnings scorecard.

Why I think the market overreacted

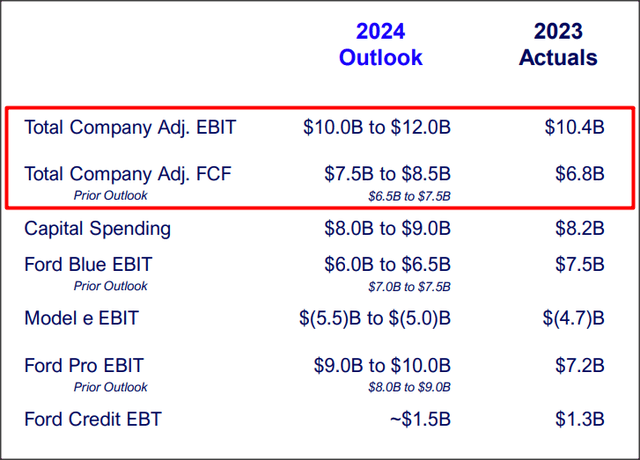

Ford continues to see strong demand for its ICE models in FY 2024, which has resulted in Ford actually increasing its free cash flow guidance by a solid $1.0B (the same amount by which General Motors raised its FY 2024 FCF outlook). Ford now expects to produce $7.5-8.5B in free cash flow this year, which implies an 18% year-over-year growth rate in FCF.

The automaker continues to expect $10-12B in adjusted EBIT this year, however, and this guidance includes at least $5.0B in EBIT losses stemming from the Ford E segment. The fact that Ford raised its FCF on Thursday has been utterly ignored by the market, as has management’s statement about the normalization of warranty expenses going forward.

High safety margin reflected in Ford’s valuation metrics

Based off of Ford’s free cash flow guidance and continual ICE momentum, I believe shares of the automaker are an absolute steal on the drop.

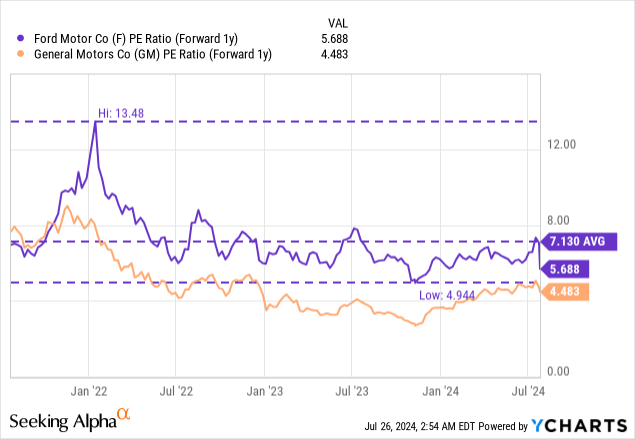

With $8.0B in free cash flow expected in the current fiscal year (at the mid-point), shares of Ford are valued at 5.6X free cash flow and 5.7X forward earnings. General Motors, which expects to achieve $10.5B in free cash flow in FY 2024, at the mid-point, is priced at a P/FCF ratio of 4.7X and a forward P/E ratio of 4.5X. While General Motors has a valuation advantage compared to Ford, GM also raised its adjusted full-year EBIT guidance in Q2, has been more quick to adapt to slowing EV growth and also only has about 3% of total sales falling into the electric vehicle category.

In my last article on Ford, I proposed a fair value P/E ratio of 10.0X — leading to a fair value of $18 — which may now be an unrealistic short-term price target for F, mainly because of the drastic change in investor sentiment that occurred on Thursday. In the longer term, however, Ford could revalue to this valuation range if it gets a grip on its profitability situation in Ford E, in my opinion.

Ford may not be able to revalue to $18 in the short term, but it could achieve an ~8-9X P/E ratio, in my opinion, within the next twelve months, under the assumption that ICE strength persists and EV losses narrow in FY 2025. An 8-9X fair value P/E ratio implies up to 58% upside revaluation potential and a fair value of $15.70-17.70 per-share.

Risks with Ford

While Ford has invested billions of dollars into the electrification of its manufacturing plans, the automaker is overly dependent on ICE sales (regular gas-powered cars) which provides a natural hedge for Ford against a slowdown in the increasingly competitive and crowded EV market. Ford Blue’s earnings strength was solid in Q2, but higher costs for warranties may remain a short-term headwind for the automaker. What would change my mind about Ford is if the automaker lost momentum in Ford Blue, losses in Ford E expanded beyond the expected $5.0B or if the company saw a steep drop-off in free cash flow next year.

Closing thoughts

The market has lost its mind: in no way was an 18% price crash appropriate given Ford’s Q2 results. While profits came in below expectations, investors seem to completely dismiss the positives of the earnings release, most notably the increase in free cash flow (by a significant $1.0B) as well as strength in ICE vehicles at a time when EV manufacturers are struggling with slowing electric vehicle growth. The most attractive feature of an investment in Ford is the high earnings value that shares represent, in my opinion: with a 5.7X P/E and a 5.6X P/FCF ratio, shares of Ford trade at an earnings and FCF yield of a massive 18%. Ford’s valuation therefore reflects an excessive safety margin which investors with a long-term investment horizon could take advantage of. The crash is a golden buying opportunity and I reiterate my strong buy rating after the Q2 earnings report!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of F, GM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.