Summary:

- Ford’s stock remains a buy due to strong free cash flow and low valuation, despite weak growth and a challenging industry backdrop.

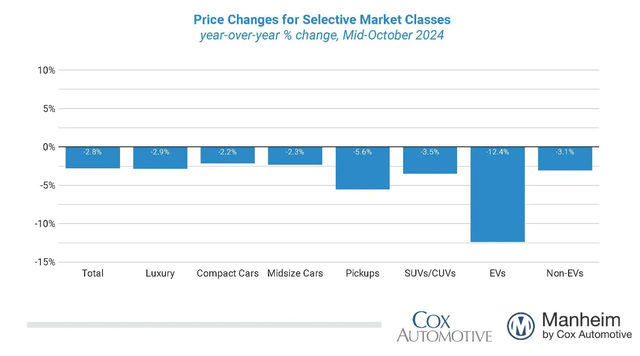

- The Manheim Used Vehicle Value Index shows declining auto prices year-over-year, and the outlook for new car pricing is soft, per S&P Global.

- Ford’s Q2 results were disappointing, but the company maintained its FY 2024 EBIT estimate and raised its free cash flow guidance back in July.

- Technical indicators show Ford consolidating with resistance near $14 and support near $9.50.

Vera Tikhonova

The mid-month update of the Manheim Used Vehicle Value Index revealed more weakness in auto prices. While the first half of October showed a modest rebound compared with September’s final pricing update, used vehicles remain lower in price versus 12 months ago. The market continues to normalize, and auto inventories are now much higher than we saw in the fall of 2022.

The real concern among investors in traditional automakers is the rise of EVs and the potential for slower demand for ICE vehicles. While EV prices are down sharply in the past year, Ford (NYSE:F) stock continues to sell at a depressed price-to-earnings ratio ahead of its Q3 profit report due out later this month.

I reiterate a buy rating given its still-solid free cash flow and modest valuation. Back in Q2, I outlined a bullish idea with an emphasis on a potential rally to $14. That played out well, but F did not trade above $14 for very long. Today, the technical situation is lackluster, but I assert the long-term case is still bullish.

Vehicle Prices Down YoY

Back in July, Ford reported a very weak set of quarterly results. Q2 non-GAAP EPS of $0.47 missed the Wall Street consensus forecast of $0.68 while revenue of $44.8 billion, up 6% from the same period a year earlier, was a modest $70 million miss. The management team left its FY 2024 EBIT estimate unchanged at $10 billion to $12 billion and raised its adjusted free cash flow guidance by $1 billion to be in the range of $7.5 billion to $8.5 billion. Ford also declared a $0.15 per share dividend.

The problem was higher warranty costs and losses in its EV division. The stock plunged by more than 18% in the session that followed – not only was it the worst earnings reaction in more than a decade, but the stock dropped by the highest percentage since the Great Financial Crisis. CEO John Lawler intimated that his company has “lots of work ahead” to raise its vehicle fleet quality and manage costs.

Looking ahead to the upcoming quarterly report, data from Option Research & Technology Services (ORATS) show a 6.5% earnings-related stock price swing when analyzing the at-the-money straddle expiring soonest after the October 28 earnings release date – that’s slightly above the long-term average of a 6.2% straddle. Seeking Alpha’s data show a consensus operating EPS figure of $0.48, which would be a material increase from $0.39 of actual non-GAAP per-share earnings in Q3 2023. Revenue is seen climbing year-on-year to $41.87 billion.

The stock now has a high 12% free cash flow yield, but key risks include ongoing weakness in China, no imminent signs of a rebound in EVs, and lower average transaction prices for new vehicles in 2025 – S&P Global recently published a report underscoring increasing incentives and more price-conscious consumers in the year ahead. Moreover, labor costs could be an issue as workers demand steeper compensation increases.

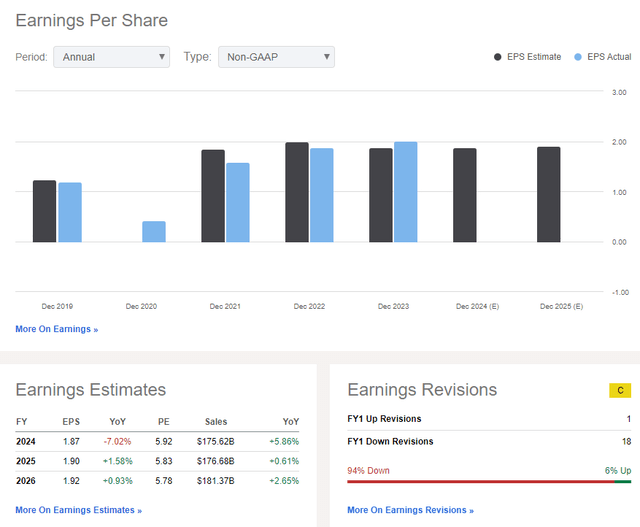

On the earnings outlook, Ford’s operating EPS is expected to drop 7% this year, but modest profitability growth is seen in the out year and through 2026. Sales should be about flat after 2024’s 6% increase, so investors will depend on the return of capital, through dividends and buybacks, as well as any multiple expansion for returns.

What’s concerning is that there have been a high 18 negative sellside EPS revisions in the past three months, versus a lone upgrade. But that could also present an opportunity in the quarter about to be reported. I concede that the earnings picture is not ideal, but that’s why shares trade with a mid-single-digit P/E. Let’s check that out further.

Ford: Revenue, Earnings Forecasts, EPS Revision History

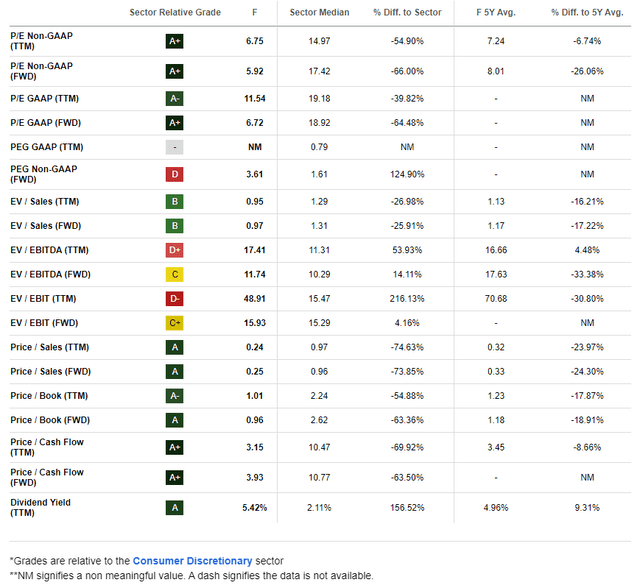

On valuation, I continue to see Ford as a deep value play even though there’s scant growth priced into the stocks. The forward non-GAAP earnings multiple has actually expanded slightly from my June analysis, largely due to the downward EPS forecast trends over the next 12 months.

If we assume $1.90 of FY 2025 operating EPS and apply the stock’s 5-year average P/E multiple of 8, then shares should trade near $15. My intrinsic value estimate is below the previous $16.50 calculation given the soft Q2 report. But Ford still sells quite cheaply on a price-to-sales basis.

Ford: Very Low Earnings and Sales Multiples

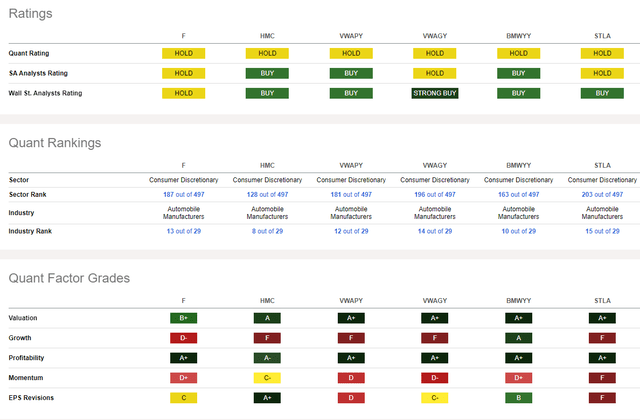

Competitor Analysis

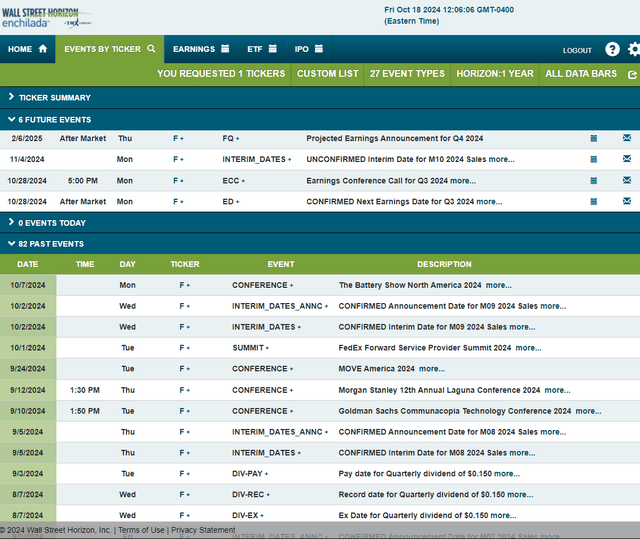

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q3 2024 earnings date of Monday, October 28 AMC with a conference call immediately following the release. After that, we’ll get a monthly auto sales update from Ford on Monday, November 4.

Corporate Event Risk Calendar

The Technical Take

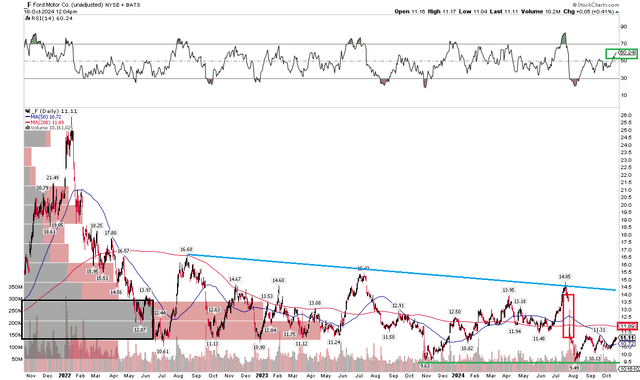

With an uncertain fundamental backdrop and downbeat sentiment given the P/E multiple right now, the technical situation is not all that impressive. Notice in the chart below that it was a quick trip to above $14 in July before the awful earnings reaction.

Today, support is seen in the mid-$9s – the lows from October 2023 and this past August. F is merely consolidating after a small Q3 bounce, and the long-term 200-day moving average is materially above today’s share price, suggesting that the bears control the primary trend.

But take a look at the shorter-term 50dma – it has inflected positive, with the stock now above that indicator line. Moreover, the RSI momentum gauge at the top of the graph has perked up to the best level since right before the July earnings release.

With a high amount of volume by price up to about $13.50, the bulls will have their work cut out for them in the months ahead to break the stock out above this congestion zone. Resistance is seen near $14 – the downtrend line off the August 2022 rebound high.

Ford: RSI Momentum Picks Up, Shares Still Below the 200dma

The Bottom Line

I have a buy rating on Ford. The growth backdrop is weak, but free cash flow is strong, as the company navigates a tough industry backdrop. The low earnings multiple and dreadful reaction to the Q2 report could make for depressed expectations heading into the October 28 Q3 report.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.