Summary:

- Ford aims for profitability in the first 12 months of launching its next generation of battery electric vehicles (BEVs).

- The automaker plans to invest less capital in large BEVs and focus on geographies and product segments where it has a dominant advantage, such as trucks and vans.

- Ford is adjusting its capital to be more focused on smaller EV products and is testing fuel cell feasibility for commercial vehicles in the UK.

Ford Lightning Electric Truck

RoschetzkyIstockPhoto

Ford Motor Company (NYSE:F) has been contending with what its CEO describes as a “seismic change” in the BEV market over the past six months. The cause? A 20% collapse in BEV prices around the world precipitated by mismatched consumer demand against “a ton of new capacity into one single segment, two-row (BEV) crossovers.”

In order to be among the winners among BEV manufacturers, Farley said during the fourth quarter 2023 earnings call on Tuesday, Ford intends for the next generation of battery electrics to be profitable “in the first 12 months of their launch.” Moreover, BEV profit will (italics mine) be above Ford’s cost of capital – and, thus, not a drag on its balance sheet, the current situation.

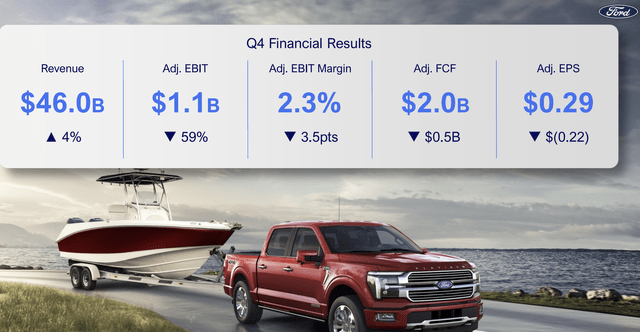

Ford Q4 financials (Ford Motor)

Ford, as one economy measure, will invest less capital on large BEVs. Investors should hope the automaker also will lobby elected representatives and regulators to explain that requiring companies to manufacture automobiles that consumers don’t want to buy, via more and more sanctions and penalties, ultimately will result in business and economic devastation.

Adjusting Capex

Farley noted: “We’re going to focus those large (BEVs) on geographies and product segments where we have a dominant advantage like trucks and vans. And those products will have breakthrough efficiency compared to our Gen 1 products, and they’re going to be packed with innovations that customers are going to be excited to pay for. We’re also adjusting our capital switching more focused on to smaller EV products.”

The Dearborn, Mich., -based automaker has slammed headfirst into the emerging reality that mainstream consumers in the U.S., where Ford and its rivals forecast steadily growing BEV uptake, are adopting BEVs at a slower rate than expected. Some consumers will move from internal combustion engine vehicles of today to plug-in hybrids and to gas-electric hybrid propulsion and only later, BEV technology and charging improve, to BEVs.

Hydrogen fuel cells – in which hydrogen and oxygen combust to emit electricity and water – also may one day play a significant role in zero carbon mobility. Honda (HMC), the world’s biggest maker of ICE engines, is working on a demonstration project, a CR-V powered by a fuel cell. Honda says it will halt the manufacture of ICE engines by 2040. Ford, too, is testing fuel cell feasibility in the United Kingdom for commercial vehicles.

Mainstream coming

The stubborn facts are that BEVs, cherished by environmentalists and some consumers – especially Tesla (TSLA) fans – don’t meet the needs of many mainstream consumers due to a charging infrastructure that hasn’t yet developed, batteries that take too long to charge and other speed bumps such as poor resale value.

The next generation of BEVs may well reflect improvements, while the charging infrastructure should develop with increased investment and initiatives such as harmonization of the two most common charging standards and more so-called “superchargers” that can reduce charging times.

Ford sold a 25,937 electric vehicles in the fourth quarter of 2023, up 24% over the third quarter. The automaker sold a total of 72,608 EVs in 2023, an 18% increase from 2022. The growth established Ford as the second top-selling EV brand behind Tesla. Overall, Ford sold nearly 2 million vehicles.

Ford’s F150 Lightning EV full-size pickup truck has been a shocking – pun intended – disappointment to the automaker and to some consumers. Creating a battery version for Ford’s most popular vehicle model looked like a necessity and a no-brainer, an initiative to transfer some of the popularity of the gasoline full-size pickup to a BEV that was just as big and much more quiet. Some Ford dealers were skeptical. A few Lightning buyers quickly discovered that the advertised range didn’t live up to specifications. Cold weather reduced range as well. The automaker has responded by halving production capacity and reducing the work force.

By December, Ford’s electric pickup truck sales had risen about 50%, according to Barron’s, coming in at about 20,000 units. Cumulatively, Ford F-150 Lightning sales were reported at about 36,000 units. Ford was on track to hit about 40,000 by the end of 2023, about 10,000 to 15,000 less than the company projected in August. Overall, Ford sold about 750,000 F150 pickups last year, overwhelmingly fueled by gasoline.

Many of the first buyers of Ford EVs were willing to pay premium prices to be the first on their block with a new technology.

Mustang Mach e (Ford Motor)

“As the COVID shock retreated,” Farley told equity analysts, “We learned that as you scale EVs to 5,000 to 7,000 units a month and you move into the early majority customer, they are not willing to pay a significant premium for EVs. This is a huge moment for us. What we’ve seen, because we offer everything, is pricing quickly converged to hybrids after any benefit from subsidies.”

Revenue is everything

Farley underscored the point by reminding financial analysts the number of EVs isn’t nearly as important as the revenue they generate, against the headwind of softer pricing.

Ford CY 2024 financial guidance (Ford Motor)

Meanwhile, Ford two years ago convened a “super-talented skunkworks,” Farley said, to design a new low-cost EV architecture: “It was a small group, small team, some of the best EV engineers in the world, and it was separate from the Ford mothership. It was a startup.”

Farley says Ford’s competition in the BEV business will be “the affordable Tesla” (reportedly debuting as soon as 2025) and the wave of Chinese competitors. Chinese BEVs already are landing in Europe and soon may enter North America via Mexican assembly plants. Volvo, jointly owned with Chinese and Swedish capital, is on course to build EVs in South Carolina.

Fortunately, Ford’s No. 1 show horse, the gasoline-powered F150 pickup, continues to sell vigorously and support the automaker’s profitability, along with a significant and growing business that caters to commercial customers. Ford’s Pro division, another profitable and growing business, specializes in Ford Super Duty heavy-duty pickups and Ford Transit Vans – singly and in fleets, along with related software packages.

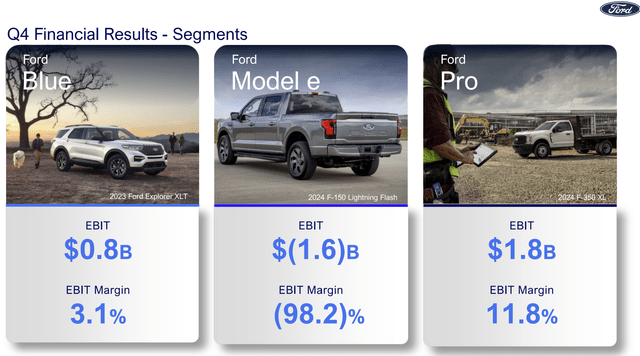

Ford Q4 EBIT results (Ford Motor)

Wall Street analysts and Seeking Alpha’s Quant ratings remain cautious on Ford – and so do I. The Hold rating reflects my conviction that depending on how the political winds blow, strict federal fuel efficiency mandates and penalties constitute an existential threat to the company’s profitability and liquidity. Farley and company astutely comprehend the threat and are adjusting BEV strategy appropriately – the results bear watching as BEV adoption unfolds.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.