Summary:

- F has deservedly lost much of its YTD gains, attributed to the FQ2’24 bottom misses from the eye-watering warranty/ recall costs.

- With the automaker remaining the “most-recalled automaker for the third straight year,” it is unsurprising that there may be more uncertainty ahead.

- Even so, F has already raised its FY2024 Free Cash Flow guidance, with it potentially triggering another rich supplemental dividend payout in FQ4’24.

- With the Fed likely to pivot in the upcoming September 2024 FOMC meeting and the automaker offering increasingly rich dividend yields, we believe that the risk/ reward ratio remains attractive here.

CiydemImages

F’s Investment Thesis Is Currently Supported By Its Rich Forward Dividend Yields

We previously covered Ford Motor (NYSE:F) in May 2024, discussing why we had maintained our Buy rating then, with its dividend investment thesis still robust and safe thanks to the management’s raised FY2024 Free Cash Flow guidance.

With the legacy automaker’s diversified platform offerings continuing to perform well in an inherently cyclical market, we believed that it remained well positioned to survive the slow but sure electrification transition over the next decade.

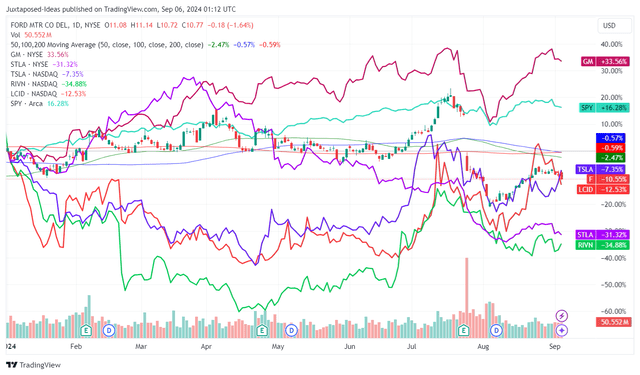

F YTD Stock Price

Trading View

Since then, F has already charted an impressive rally to retest its July 2023 tops, only to be drastically moderated after the double top/ bottom-line misses in the FQ2’24 performance despite the (yet again) raised FY2024 Free Cash Flow guidance.

Even so, we are reiterating our Buy rating here, with the pullback triggering an expanded forward dividend yields, significantly aided by the growing Hybrid sales.

We shall further discuss.

1. F’s Dividend Yields Is Getting Increasingly Rich

For now, F has raised its FY2024 adj Free Cash Flow generation guidance to $8B at the midpoint (+25% YoY) in the recent FQ2’24 earnings call, up from the original guidance of $6.5B at the midpoint (-4.4% YoY) offered in the FQ4’23 earnings call.

While the management has opted to maintain its fixed dividends paid out per share at $0.15, we believe that readers may look forward to a rather rich supplemental dividends usually announced in FQ4 earnings calls indeed, as it has at $0.65 in FQ4’22 and $0.18 in FQ4’23.

Based on F’s dividend policy of returning 40% to 50% of its Free Cash Flow to shareholders, we may see FQ4’24 bring forth supplemental dividends per share of between $0.19 and $0.39.

This is based on $599M of quarterly fixed dividends paid out and the stable shares outstanding at ~4,022M over the next two quarters, with it further supporting the legacy automaker’s robust investment thesis.

These projections are not overly aggressive either, since F has previously generated rich Free Cash Flow of $9.08B in FY2022 (+97.8% YoY) and $6.8B in FY2023 (-25.1% YoY) – with the historical payouts (fixed and supplemental dividends) implying robust shareholder returns at 54.9% and 45.9%, respectively.

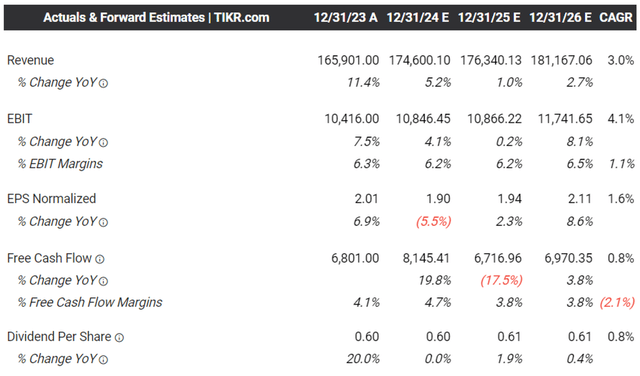

The Consensus Forward Estimates

Tikr Terminal

As a result of F’s consistently raised guidance, it is unsurprising that the consensus have moderately raised their forward estimates, with the automaker expected to generate an expanded Free Cash Flow generation at a CAGR of +0.8% through FY2026.

This is compared to the previous estimates of -0.3% and the normalized growth of -8.6% between FY2016 and FY2023, with it implying the market’s quiet confidence about the automaker’s ability to consistently pay out dividends.

The same has been observed in F’s improving TTM Dividend Coverage Ratio of 7.26%, compared to the 1.23% observed by the end of 2023 and the sector median of 2.66%, with it further underscoring why investors may simply remain patient during the rather volatile fluctuation of the consumer automotive trend.

2. Growing Hybrids Underscore F’s Well Diversified Automotive Offerings

As discussed in our last article, F has had a highly strategic automotive offerings across Hybrid, ICE, and EV platforms – allowing the legacy automaker to switch its growth levers depending on the cyclical market demand.

The same has been observed by August 2024, where the automaker reports 16.39K sales of Hybrids units (-2.5% MoM/ +49.8% YoY) and 125.46K units on a YTD basis (+49.2% YoY), with the accelerating YoY growth well exceeding ICE YTD sales at -0.5% YoY and to a lesser extent, EVs YTD sales at +63.9% YoY.

This is compared to a year ago, with Hybrid YTD sales of +11.9% YoY, ICE at +8.3% YoY, and EVs at +6.5% YoY.

And this is also why we continue to believe that the F stock has been able to perform well on a YTD basis (aside from the impact of the FQ2’24 misses), with it building upon the robust electrification trends observed in the commercial markets and the expanding Ford E-transit van YTD sales to 8.07K (+75.8% YoY).

With the management already postponing much of their EV investments while targeting a +40% YoY growth in its FY2024 global hybrid portfolios, we believe that the automaker’s hybrid sales may continue to accelerate during the stalling electrification trend.

So, Is F Stock A Buy, Sell, or Hold?

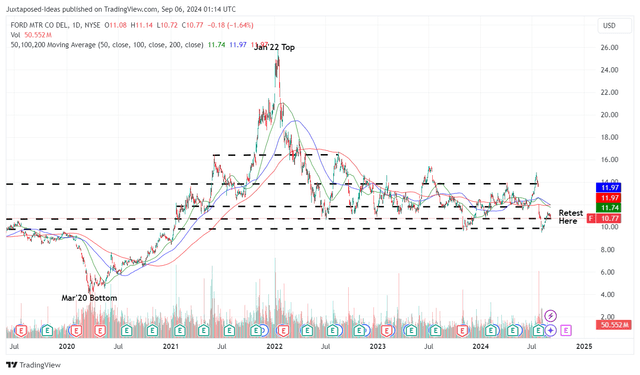

F 5Y Stock Price

Trading View

Thanks to the recent pullback and the stock trading well below its 50/ 100/ 200 day moving averages, F’s dividend investment thesis is even more attractive with an expanded forward dividend yield of 7.12%, compared to its 4Y average of 4.44% and the sector median of 2.39%.

This is especially since the Fed is projected to pivot by 25 basis points in the upcoming September 2024 FOMC meeting, which has also resulted in the moderating US Treasury Yields of between 3.53% and 5.04%, compared to the peak of 4.95% and 5.51% observed in October 2023.

With F being rather volatile in its price movements, traders may consider doing swing trades as well, based on the established support levels of $9.90 and resistance levels of $13.80 – with it allowing investors to take advantage of its minimal growth opportunities during an uncertain macroeconomic outlook.

As a result, we are reiterating our Buy rating here.

Risk Warning

It is no secret that F has had numerous recall issues over the past few years, one that the management has also commented on during the FQ2’24 earnings: “We did see warranty cost increase in 2Q, of course, tied to new technologies, FSAs and inflationary pressures for the cost of repair.”

If anything, the recall volume has been relatively high at:

- 90.73K Bronco/ F-150/ Edge/ Explorer/ Lincoln/ Nautilus/ Lincoln Aviator units with faulty engine intake valves in August 2024,

- nearly 40K Bronco Sport/ Escape SUVs with faulty fuel injectors in April 2024,

- 1.9M Explorers SUVs due to risk of flying trim pieces in January 2024, and

- 112.96K F-150 trucks over rear axle bolt issues in January 2024.

It goes without saying that F’s recalls appear to be outpacing its overall sold volumes at 1.4M vehicles on a YTD basis in the US (+4.4% YoY).

Given these headwinds, it is also unsurprising that the management has reported the bottom-line miss in the FQ2’24 earnings call, with warranty/ recall costs totaling $2.3B (+53.3% QoQ/ +43.7% YoY) and the legacy automaker remaining the “most-recalled automaker for the third straight year.”

Combined with the estimated future Warranty and Field Service Actions higher at $12.55B in H1’24 (+26.8% YoY), we believe that F’s prospects are likely to remain mixed until the quality issues are resolved and consequently, profit margins improve.

As a result, investors may want to temper their near-term expectations, with the only silver lining being its expanding Free Cash Flow generation and rich dividends during the ongoing turnaround.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.