Summary:

- Ford faces a confluence of challenges including growing inventory, rising labor costs, and competition from Chinese automakers.

- Management actions prioritize debtholders over stockholders.

- I assign a Sell rating due to the reasons discussed in this article.

Ignatiev

Ford Motor Company (NYSE:F) faces three challenges that are likely to pressure the stock price in the near term: A growing inventory, indicated by rising days of supply, threatens to erode profitability. Additionally, a tight labor market and the recent agreement with the United Auto Workers will pressure margins in the coming years. Finally, looming large in outer years is the potential competition from Chinese automakers, who are rapidly gaining ground in electric vehicle technology, a key battleground for the future of the auto industry.

Rising Inventories

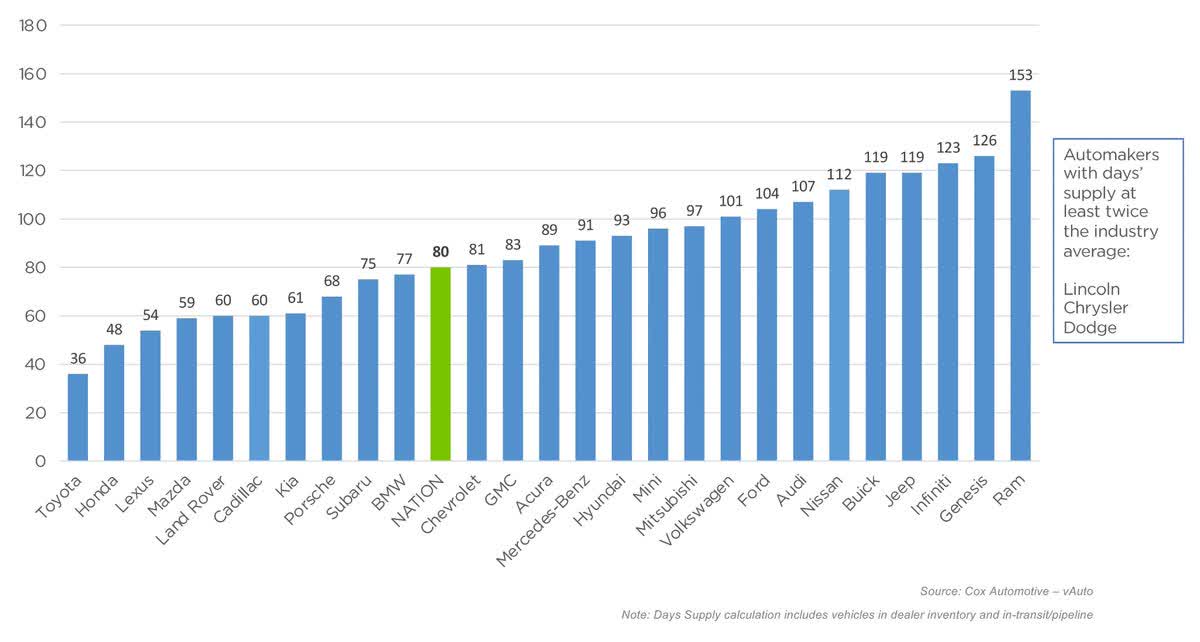

Automakers have a serious problem on their hands, way too many cars sitting around on dealer lots, and the numbers are rising. The following chart illustrates the most recent Days of Supply, my preferred measure of inventory that adjusts for the current pace of sales, by automaker, as of February 2024:

Cox Automotive

Four key takeaways from the above chart:

- The national average is approaching three months of supply, materially above the range of one to two months that is regarded as normal;

- The inventory problem is widespread and affects all automakers, except for certain Japanese automakers, such as Toyota, Honda, Mazda, and Lexus, which is owned by Toyota;

- Stellantis, the parent company that owns iconic automotive brands such as Ram, Jeep, Chrysler, and Dodge, is most exposed to the ongoing inventory problem; and

- Ford’s days of supply metric is now in triple-digits at 104, which is a red flag for current and potential investors in the company.

This whole inventory mess is happening across the industry and doesn’t bode well for the future of Ford’s and others’ stock prices in 2024. Sales are likely to slow down in the months ahead, and Ford may have to deepen discounts or cut back production to get things moving. That’s a recipe for shrinking profits, which is never good news for a company needing to invest in the future.

Rising inventories, however, is not the only problem that is facing Ford.

Rising Labor Costs

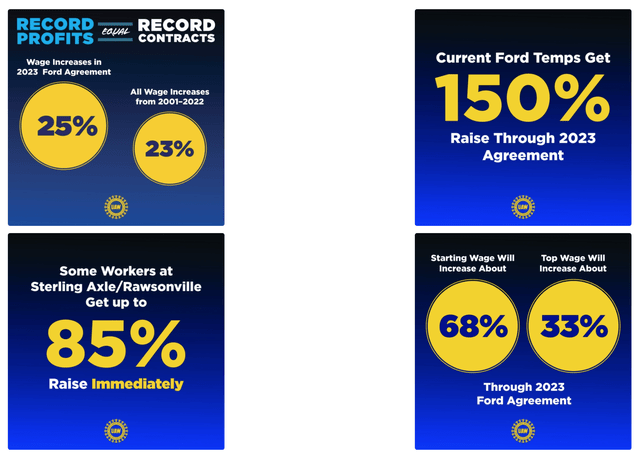

The tight labor market in the United States is also threatening profit margins for automakers. With competition for skilled workers fierce, companies are forced to offer competitive wages and benefits packages to attract and retain talent. The recent labor agreement between Ford and the UAW strengthens this point. The following slides show how much Ford’s labor costs will rise:

As if Ford’s domestic problems weren’t enough, the company is also facing a longer-term, but still material, challenge from abroad.

Intensifying Competition

As is the case with all incumbent automakers, Ford is facing a growing threat on the global stage: the rapid rise of Chinese automakers. These companies, once known primarily for budget-friendly knock-offs, have upped their game considerably. They’re now churning out increasingly sophisticated electric and internal combustion engine vehicles with advanced features and technology, all at competitive price points.

This surge in Chinese auto manufacturing isn’t just a future concern. Chinese brands are already making inroads into established markets like Europe and North America, grabbing market share and challenging Ford’s position. With their government’s backing, significant R&D investments, and efficient production lines, Chinese automakers pose a serious threat to Ford’s future success, particularly in the EV segment.

The situation got even more interesting with BYD (OTCPK:BYDDY), the leading Chinese EV maker, recently announcing plans to build a factory in Mexico:

China’s BYD Co Ltd will set up a new electric vehicle factory in Mexico, Nikkei reported on Wednesday, citing the company’s Mexico head, as the EV maker aims to establish an export hub to the United States.

According to the Nikkei report, BYD has launched a feasibility study for the Mexican plant and is currently negotiating with officials over terms, including the factory’s location.

This factory positions BYD to tap into the North American market, putting them in even closer competition with Ford on their home turf. With lower production costs in Mexico and the potential for tariff advantages, a Mexican-made BYD car could be a significant price challenger to Ford in the US.

Even the seemingly untouchable Tesla (TSLA) isn’t immune to the pressure from Chinese automakers. While Tesla enjoys a head start in the EV segment, Chinese players like BYD are offering feature-rich EVs at competitive prices, threatening Tesla’s growth potential. I discussed the steps that Tesla took in China and elsewhere around the world to keep competition at bay in my recent article titled Tesla: Here’s Why It’s Down 24%, and I recommend reading it.

Back to Ford.

Is Ford’s Dividend At Risk?

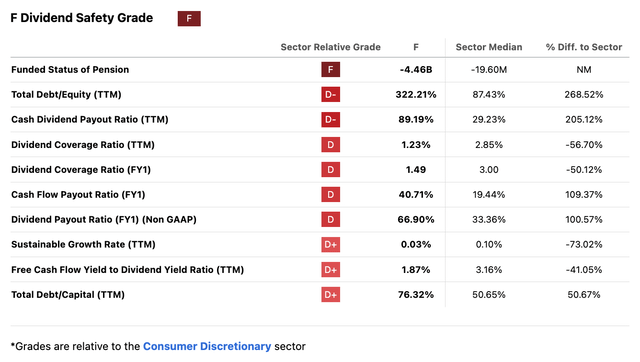

The Seeking Alpha Premium Tool warned on February 1, 2024, that Ford is “at high risk of cutting its dividend,” so let’s take a closer look at the company’s relevant financial metrics and dividend safety.

Since the above warning was issued on February 1, Ford announced financial results for Q4 2023, and although some of the metrics have improved, others have remained in risky territory. Specifically,

- Ford’s Funded Status of Pension remains alarming at negative $5B, posing the primary risk to Ford’s dividend;

- Ratios related to balance sheet leverage are still in risky territory, reflecting Ford’s reliance on offering favorable financing and leasing terms to potential buyers to drive sales and keep production lines humming near capacity; and

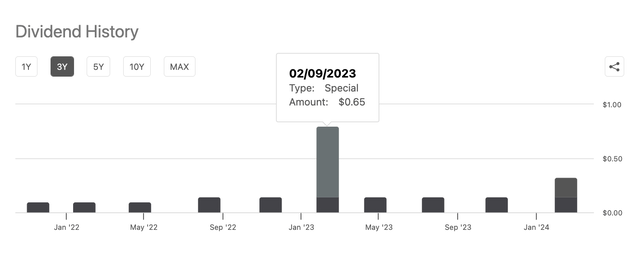

- Metrics related to Ford’s payout ratios improved, reflecting the roll-off of the $0.65 per share of special dividend paid in February of 2023, as the following graph illustrates:

Proving Seeking Alpha Premium Tool’s warning prescient, Ford indeed reduced the special dividend it paid to shareholders from $0.65 per share in February 2023 to $0.18 per share in February 2024, but given the record profitability of the company despite the significant headwinds that I discussed in this article, I do not foresee an imminent risk to Ford’s regular dividend in 2024.

2025, however, is a different story, as I discuss in the next section.

Primary Risk To Stockholders

In recent months, Ford management focused on improving its near-term profitability by taking the following actions:

- Ford shut down its partnership with Argo AI, signaling a move away from pursuing full autonomy in the near term; and

- Ford scaled back planned production for the F-150 Lightning due to the softening demand and canceled a planned battery production facility in Michigan.

By strategically adjusting its EV and autonomous driving efforts, Ford bolstered its near-term financial health. These actions improve cash flow, support the sustainability of the company’s dividend, and instill confidence in debt investors about recouping their capital.

The trade-off, however, is a lower potential return for stockholders: Focusing on profitability in the near term will likely limit Ford’s long-term growth prospects, especially in disruptive areas like electric and autonomous vehicles.

Conclusion

Ford faces a confluence of headwinds that threaten to dampen its stock price in the future: An oversupply of inventory, rising labor costs, and the looming invasion of Chinese automakers paint a challenging picture. While Ford’s dividend may not be at immediate risk, the company’s strategic moves toward short-term profitability limit its long-term growth potential. I assign a “sell” rating for equity investors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.