Summary:

- Ford’s first battery-powered full-size pickup truck, the F150 Lightning, has fallen short in sales, highlighting slowing consumer demand for BEVs.

- The next generation of Ford’s BEV pickup is under development and scheduled to debut in 2025, banking on increased market demand for BEV pickups.

- Ford is adapting its strategy by developing a small BEV platform and using gas-electric hybrid powertrains to hedge against uncertain consumer acceptance and regulatory climate.

Ford Slashes Price On Its Electric F150 Lightning By $10,000 Scott Olson/Getty Images News

The numbers are in, the reality indisputable: Ford Motor Co.’s (NYSE:F) first attempt at a battery-powered full-size pickup truck has fallen short.

Last week, the automaker announced that it was slashing the workforce at its Rouge EV plant by two thirds to 700 and operating the assembly plant on one shift, rather than the three shifts it had planned.

U.S. Ford dealers simply were unable to sell the number of F150 Lightnings that three work shifts would have produced. This difficult truth speaks to the slowing consumer demand for battery-electric vehicles (BEVs) generally. The numbers call into question demand specifically for BEV versions of large pickups.

Ford Lightning at Rouge plant (Ford Motor)

Ford’s popular gasoline-powered pickup is the number-one model of any kind sold in the U.S. – and the dominant generator of profit for the company. Mustang Mach-e is the company’s other BEV. Sales of the Mach-e fell 51% in January, prompting discounts by the company.

As I noted in my analysis of early February, Ford intends to respond vigorously to the latest developments of slowing growth in the battery-electric mobility sector. The main response will be a move toward smaller BEV models and “adjustment” of capital spending, which I take to mean a more conservative (read: frugal) approach. The company’s management has vowed the next wave of BEVs will be profitable – which means, I guess, it’s staking its tenure on that promise.

Rush to market

The F150 Lightning launched in April 2022. In order to reach market as quickly as possible, it was designed on the architecture of the current internal combustion version – rather than on a purpose built architecture optimized for the large battery needed for propulsion.

The next generation of Ford’s full-size BEV pickup – which won’t necessarily be called “Lightning” – is under development and scheduled to debut in 2025, built at a new Ford assembly plant in Tennessee. This plan rests on an assumption that there’s more market demand for BEV pickups a year from now. Presumably the new version will feature longer range, quicker charging time, a snazzier exterior and new features like over-the-air updates – perhaps front storage.

Ford’s new modular BEV truck architecture might be adaptable to smaller pickup and SUV BEV models as well. But if the next gen architecture runs into weak consumer demand, Ford and its shareholders will face a serious reckoning.

The BEV business is driven mostly by government mandate rather than consumer demand. Governments, as we know, are subject to the political winds.

Cleaner air

New federal emission and fuel efficiency standards from the Biden administration will increase fuel efficiency 8% annually for model years 2024-2025 and 10% annually for model year 2026. They will also increase the estimated fleetwide average by nearly 10 miles per gallon for model year 2026, relative to model year 2021.

The only way most automakers – other than Tesla and the small BEV startups – can meet the standards and avoid huge and potentially ruinous federal fines is by averaging zero-emission (BEVs) into their fleets or buying credits from manufacturers like Tesla.

During the transition to what environmentalists hope will be an all-electric future, building and selling one BEV – even at break-even or a loss – will allow the company to build and sell a number of internal combustion (ICE) pickups at a large profit.

A change in presidential administration or a political backlash from voters could alter this calculus for Ford and other incumbent automakers, which makes model planning and capital investment for the long term quite tricky. Polls show that more than half of US motorists are satisfied with their ICE vehicles, about a third favor a BEV and the rest show no preference.

Ford has disclosed that besides the new BEV truck platform, it’s developing another BEV platform for small passenger vehicles. Farley disclosed the project was taking place at what he called a West Coast “skunk works.”

New design

“We made a bet in silence two years ago,” Jim Farley, CEO, told investors during the company’s fourth quarter and full-year earnings call in February, describing the creation of a “super-talented skunkworks team” that operated outside of the “Ford mothership.” Such a model might sell for as little $25,000 to $30,000 and compete against a similar model in development at Tesla.

A good guess would be that Ford’s West Coast group includes more than a few former designers and software engineers from Apple and Tesla who weren’t interested in relocating to the Detroit area. To be competitive with Tesla, Ford’s BEVs will have to contain a good deal of sophisticated electronics and software.

Ford’s strategy and thinking have shifted toward smaller vehicles, Farley noted. Whether buyers will flock to smaller BEVs is an open question.

The late Henry Ford II would be amused. He was famous for having framed the ethos of old Detroit with the following quip: “Big cars, big profits; small cars, small profits.” If the automaker is being forced to prepare for the day when large, gasoline-consuming pickup trucks are doomed by regulation as a popular choice for personal transportation, development of a small BEV platform does make sense.

Ford Motor Company Common Stock is expected to report earnings on 04/24/2024 after market close. The report will be for the fiscal Quarter ending Mar 2024. According to Zacks Investment Research, based on 5 analysts’ forecasts, the consensus EPS forecast for the quarter is $0.44. The reported EPS for the same quarter last year was $0.63.

An extremely positive development is that Ford is able to maintain overall profitability at a moment when the BEV business is a terrible drain on its resources and the future regulatory climate remains cloudy.

The best news is that Ford management is adapting and hedging as well as it can in the face of uncertainty. The company will be using gas-electric hybrid power trains more, which have been well accepted by consumers. If consumer acceptance of BEVs grows and regulation loosens to allow more time for transition, Ford could weather the next few years in good fashion. If consumers resist and politics lead to a too-tight regulatory climate, the company and its shareholders will suffer.

Management is forecasting a $5 billion loss from battery-electric operations in this year, up from a $4.7 billion loss in 2023.

Ford, in its latest earnings call, said it anticipates full-year adjusted EBIT of $10 billion to $12 billion and will generate $6 billion to$7 billion in adjusted free cash flow, with capital expenditures of $8 billion to $9.5 billion. The guidance presumes flat to modestly higher full-year U.S. industry volume, with overall lower vehicle pricing. Upsides include beneficial pricing and mix from 12 months of sales of the all-new Super Duty work truck that Ford introduced during 2023.

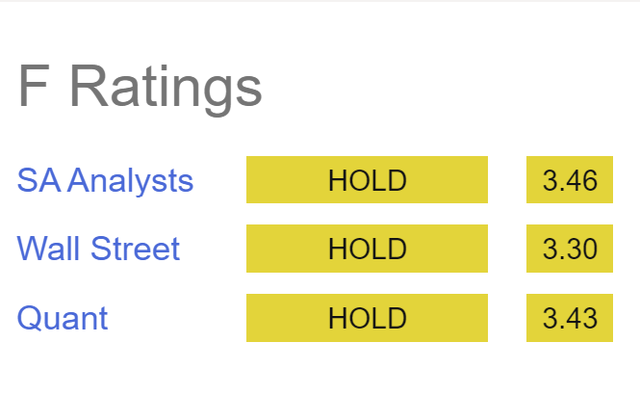

Analyst ratings (Seeking Alpha)

Ford shares could benefit from a strong economy and U.S. vehicle market. The risks are very clear and have been for some time. Hold the stock, don’t add to positions at the current price.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.