Summary:

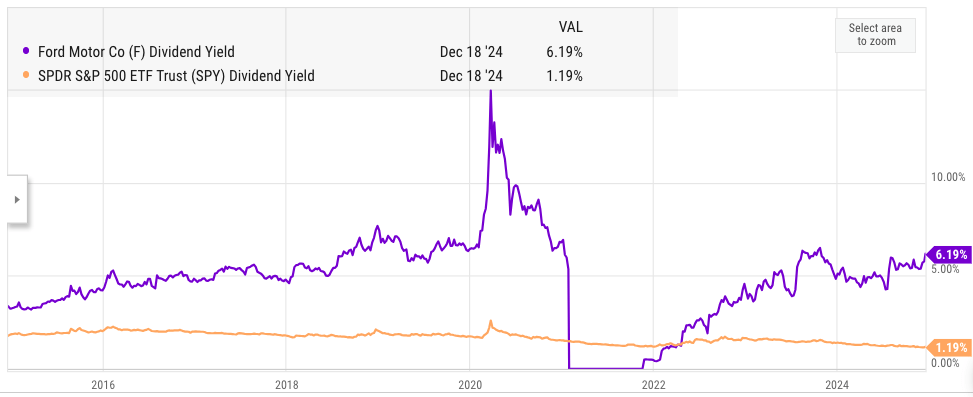

- Ford is giving 6.2% dividend yield which is significantly above the 1.2% dividend yield for the broader S&P 500.

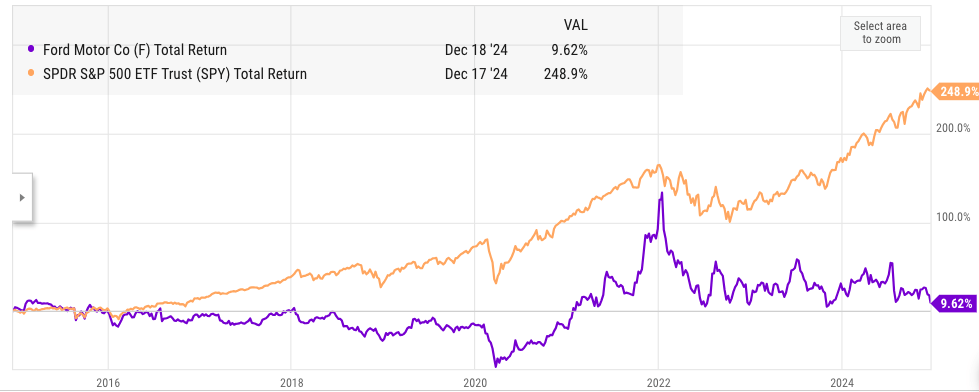

- However, Ford’s total return of 10% over the last ten years significantly underperforms the 250% total returns shown by S&P 500 during this time.

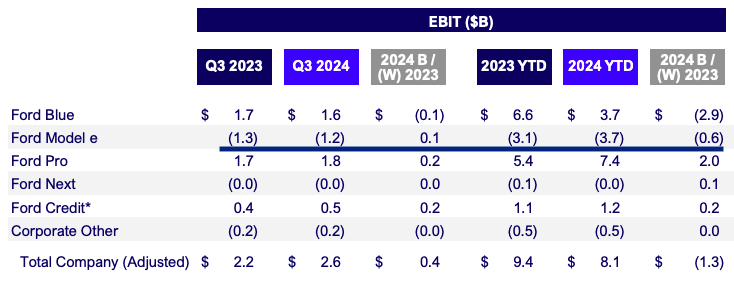

- Ford is facing massive challenges in its core business and is bleeding cash in the EV segment without showing any strong growth trajectory.

- The legacy automakers like Ford will be facing a tough time in the next few years as the overall market shifts to EV and autonomy.

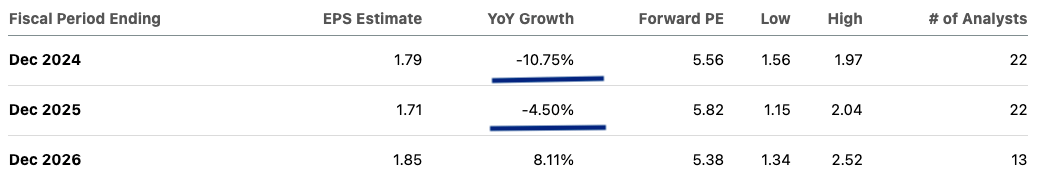

- The stock continues to show major downward EPS revisions in the near term which will make it difficult to gain a bullish momentum despite the low stock price.

Vera Tikhonova

Ford’s (NYSE:F) 6.2% dividend yield has been the focus of income investors looking for good yield in a market that has become quite expensive according to several metrics. Ford’s dividend yield is significantly higher than the mere 1.2% yield given by the broader S&P 500 index. However, it is also important to look at the longer-term moat of the company and the ability to continue to pay dividends without hurting its market position. Ford’s moat is significantly lower than other high dividend yield stocks like AT&T (T), Verizon (VZ), and others.

When we look at the total return, Ford stock has been one of the biggest underperformers in the last decade. Over the last 10 years, Ford stock gave a total return of only 10% compared to a whopping 250% by S&P 500. The legacy automakers are facing a tough challenge from newer automakers, a shift to EVs, and the rapid growth of autonomy.

Ford Model e segment continues to burn cash as it tries to improve the EV business. Despite some good products, the company is losing massive cash in this segment and faces tough challenges from Tesla (TSLA), Rivian (RIVN) and other EV players. In the YTD period, Ford’s EBIT has declined to $8.1 billion from $9.4 billion in the year-ago period. The stock continues to receive big EPS downward revisions for the next few quarters. This will hurt the sentiment for the stock and make it difficult to gain any bullish momentum despite the modest stock price.

Attractive yield but poor moat

Ford’s yield of 6.2% is quite good when we compare it to the broader index and other big names. However, it is very important to look at the company’s moat and its ability to sustain the dividend over the long term. The entire auto industry is going through one of the biggest transformations in its history. The shift to EVs continues at a rapid pace and autonomy is also gaining momentum. Google’s (GOOG) Waymo is rapidly expanding in new regions and is already boasting of close to 10 million trips annually. At the same time, we are seeing massive growth in EV production and export by Chinese companies. High tariffs have prevented their entry in U.S. but Ford will face headwinds in Europe and other international markets.

Ycharts

Figure: Ford’s dividend yield in the last ten years compared to S&P 500. Source: Ycharts

The growth of Chinese auto brands should not be underestimated. Even Tesla is facing big challenges in China where it receives close to 20% of the total revenue. Tesla saw 4.3% YoY decline in sales in China compared to 67% YoY growth by China’s BYD. This massive difference shows the rapid changes taking place in auto sales in China. Even European Union has started to feel the competition from the Chinese automakers and has put up 45% tariffs on these car imports.

It is highly likely that Ford will eventually face these challenges despite a bulk of its revenue coming from U.S. market. The high dividend yield has not helped the stock in the last decade as the total returns were significantly lower than the broader market. Long-term investors should carefully look at this trend as it can hurt their returns potential despite a healthy dividend yield by Ford.

Ycharts

Figure: Ford’s total return in the last ten years. Source: Ycharts

Challenges in core business

Ford has made an effort in all the latest auto trends without showing any good results. Ford tried to build an autonomous service in 2019 but canceled its plan in 2022 after writing down impairment charges of $2.7 billion. It has tried to expand in international markets but continues to face headwinds in many regions. Even newer automakers like Tesla and BYD have had a better result in expanding in international regions. Finally, Ford tried to build a strong EV segment. It is still burning massive cash resources to deliver good results in the EV business. In the latest quarter, the Ford Model e segment reported $1.2 billion in EBIT loss. Over the first three quarters, the cumulative losses have been $3.7 billion in this segment which is up from $3.1 billion in the year-ago period.

Ford Filings

Figure: Ford’s massive losses in EV segment. Source: Ford Filings

Other EV companies like Rivian are also losing money while ramping up their EV products. However, in the case of Rivian, there is a clear trajectory where the company can deliver a positive gross margin and the launch of mass-market R2 could deliver a big jump in deliveries and revenue. Ford has recently canceled and delayed new EV products as the company tries to improve profitability of this segment. The continuous back and forth in EV product launches ends up hurting a clear path for the company.

Quality and warranty issues

Ford is not performing well in its effort to reduce warranty costs. The company had 62 recalls in 2024 compared to 33 recalls by GM (GM). Since 2021, Ford has had an industry-leading recall rate which reflects poorly on management’s ability to reduce the warranty costs and also hurts the brand image. The company has recently announced that it will change its quality leader Jim Baumbick. This is another sign that the current efforts have not given the desired results. The high warranty costs have been a drag on the margin and are one of the reasons for the poor performance of the stock.

Ford has also announced 4,000 job cuts, primarily in Germany and Britain. The company is not able to compete effectively as the Chinese rivals continue to make inroads in Europe. The company is asking for more subsidies from the respective governments but it is unlikely that this will change the long term headwinds for the company in this region.

EPS down revisions and forward projections

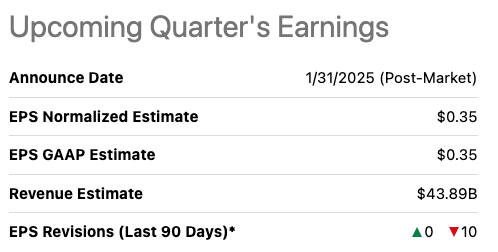

Ford is projected to see a 10% decline in EPS in fiscal year ending Dec 2024 and another 4.5% for fiscal year ending Dec 2025. The stock has also seen lot of downward EPS revision for the upcoming quarter. It is difficult to see how the stock can see improvement in sentiment under these EPS challenges.

Seeking Alpha

Figure: Forward EPS projection of Ford. Source: Seeking Alpha

Seeking Alpha

Figure: Down revisions for EPS in the upcoming quarter. Source: Seeking Alpha

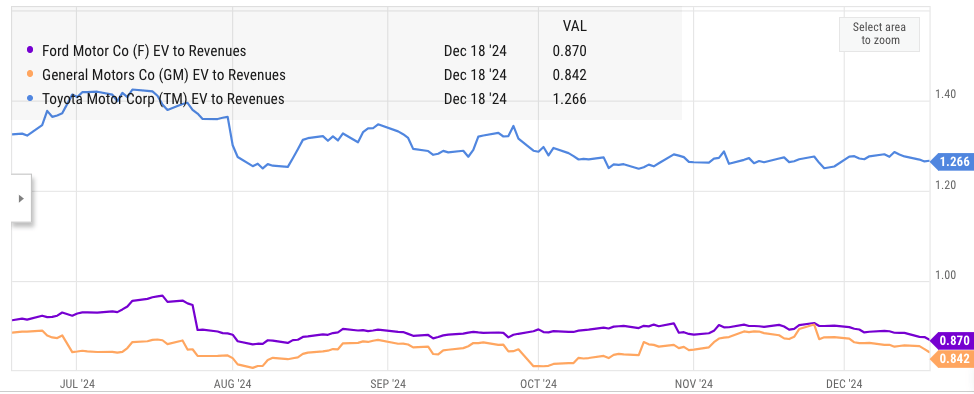

The high debt load of Ford means that the enterprise value of Ford is quite high despite a low market cap. The EV to revenue metric of Ford is close to other legacy automakers which are performing better. Unless Ford makes some big strides in terms of execution, Wall Street would not be eager to give the stock a big premium compared to current price.

Ycharts

Figure: Ford’s EV to revenue metric compared to other peers. Source: Ycharts

The only risk to the bearish thesis for Ford stock is that the company is able to deliver a strong product in the next few quarters. The entire auto sector is going through a major transformation. Even a single good product could turn the sentiment around for a legacy automaker. We have seen the massive bull run in Tesla after the success of its Model 3. BYD has also seen a big bullish momentum after its mass-market products gained popularity. Ford is working on some new EV products and if they gain a strong acceptance in the market, it could build a better sentiment towards the stock.

Until then, Ford stock remains a Sell due to poor execution and a slow ramp-up in the Model e segment. The international business is not very promising and the company will continue to face higher competition within the domestic business over the next few quarters.

Investor Takeaway

Ford has an attractive dividend yield but the company has a very poor moat. It is facing challenges on numerous fronts and is not able to execute well. We could also see the 6.2% dividend yield get slashed if the margins get squeezed further. Investors looking for higher dividend stock could look at other options that have a better defense in their industry.

We will see significant changes in the auto sector in the next few years as EV, autonomy and Chinese competition become stronger. The warranty issues faced by Ford are another negative for the company and the company leads in recall rate over the last few years costing heavily to the bottom line. The challenges faced by Ford stock make it a Sell despite the attractive price and high dividend yield.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.