Summary:

- Ford canceled some plans for electric vehicle production due to weaker-than-expected consumer demand and potential losses.

- The company shifts focus to profitability and gas-electric hybrid models, reducing capital expenditure on BEVs.

- Ford’s balance sheet weakens, raising questions about future cash dividends and the potential for investment due to a strategic shift.

A row of new Ford E-Transit vans with Amazon Prime livery at a fulfilment centre Teamjackson

Ford Motor Company’s (NYSE:F) cancellation of its planned three-row large SUV, which was to have entered production next year at a new $5.6 billion factory complex in Tennessee, is no surprise amid weaker-than-expected consumer demand for battery-electric vehicles (BEVs) in the U.S., compounded by losses on units sold.

With this announcement, the financial impact of Ford’s BEV strategic reversal is beginning to take shape, though the game is still in the early innings, with more write-offs and expenses possible.

Ford’s move vindicates the stance of Toyota Motor Corp., which has maintained a mixed strategy of increasing market penetration of gas-electric hybrids while introducing BEVs in line with consumer demand.

Less is more

Five months ago, the company said it would delay the three-row as well as the next generation of its battery-powered full-size pickup truck. At the moment, Ford is developing a smaller BEV pickup truck at a “skunk works” in Irvine, Calif., led by a former Tesla executive.

The California installation is devoted to a lower-cost EV system intended to improve profitability and to create viable competition to lower-cost Chinese BEVs that are beginning to infiltrate overseas markets and may one day reach U.S. shores.

“We believe that the fitness of the Chinese in EVs will eventually wash over our entire industry in all regions,” CEO Jim Farley told analysts last month.

Company executives, in response to questionable consumer demand, now are saying they will not introduce BEVs unless there’s a clear path to profitability in the first year. The stance departs from a previous strategy to sell BEVs at a loss to grow their share of the market, meanwhile benefiting from their positive impact on meeting fuel-efficiency regulations.

The automaker will take a $400 non-cash charge to cover certain manufacturing assets directly related to the canceled project plus “additional expenses and cash expenditures of up to $1.5 billion” over the next several quarters.

2025 Ford Maverick midsize pickup is rated at 42 mpg in the city (Ford Motor)

Ford said it will begin manufacturing battery cells at the Tennessee plant starting next year, as planned. The company will push forward with a new battery-powered commercial van, which will be built at a factory in Ohio starting in 2026, as well as accelerating the development of gas-electric hybrid powertrains to be used in several models, including large three-row SUVs.

Changing focus

“As we’ve learned in the marketplace, and we’ve seen where people have gravitated, we’re going to focus on where we have a competitive advantage, and that’s on commercial land trucks and SUVs,” Ford CFO John Lawler said Wednesday.

Lawler additionally noted that future capital expenditure plans targeted to BEVs will be reduced to 30% of total capex from the current proportion of 40%. Ford’s EV business is on a path to lose $5 billion this year.

While the market for BEVs grows in the U.S., so does the resistance among some consumers who regard the new technology as too expensive, as well as impractical due to the limited range of current batteries, insufficient charging infrastructure, and lengthy charging times.

Unlike China, where the government has a monopoly on power and has guided the growth of its BEV manufacturers, the U.S. is subject to political winds, which can change the direction of subsidies, incentives, tariffs, and other measures influencing BEV pricing. Presidential candidate Donald Trump has said that he would, if elected, consider abolishing the $7,500 credit for BEV purchases.

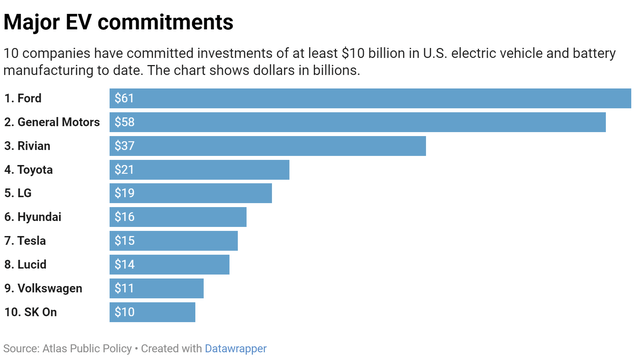

According to Atlas Public Policy, which tracks alternative fuel investments, Ford previously allocated $61 billion toward BEV projects, placing it first among major automakers in terms of amount. How much of that amount actually will be spent, or is recoverable by changing strategy, is unclear.

The industry has committed $223 billion toward BEV vehicle manufacture, about two-thirds since the passage of the bipartisan infrastructure law in November 2021 and the Inflation Reduction Act of August 2022.

Ford’s market capitalization currently stands at about $43 billion, suggesting that management had been prepared to “bet the company” on the advent and consumer acceptance of BEVs.

My guess is that some of the capital that Ford would have invested in pure BEVs will now be diverted toward the manufacture of batteries needed for gas-electric hybrid models.

Cash cow

Fortunately, Ford still has one gargantuan moneymaker, the full-size pickup truck, and all its variants, in addition to a few other segments, such as paid software subscriptions for commercial customers, that are showing promise. In the second quarter, the company’s Ford Pro commercial business posted earnings before interest and taxes that exceeded both its fossil fuel and its (losing) BEV business.

Of the 1.2 million vehicles sold in the U.S. – its most important market – through July, about 87% are internal combustion powered, 9% are hybrids, and the rest are BEVs.

Unfortunately, Ford’s balance sheet is now materially weaker than it was a year ago, with its cash net of debt down to $6.2 billion from $10.3 billion a year earlier.

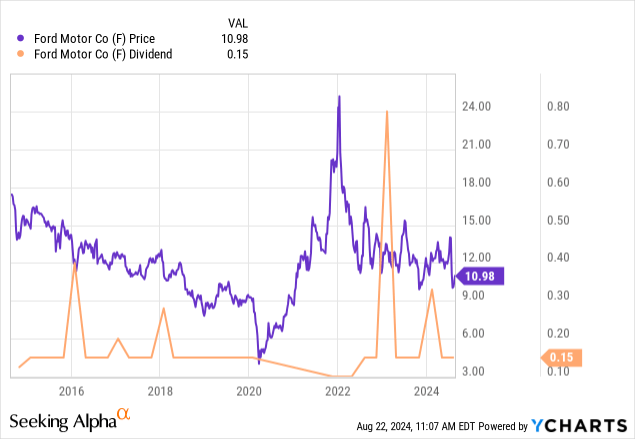

These trends combine to create a large question mark over the future of Ford’s cash dividend, which was reinstated in 2021 after a two-year hiatus. While the current dividend yield based on recent payouts is about 7.2%, Seeking Alpha gives the company a D+ grade for safety, based on a variety of factors.

Nevertheless, an argument could be made for investing in Ford shares at their current price, which has stabilized between $9 and change and $11 after collapsing from about $14 in late July. Chief among the reasons to grab Ford is the company’s recognition of its flawed strategy and willingness to change direction. (General Motors Company (GM), by contrast, has been less willing to deal directly with an all-BEV direction and is only slightly less committed than Ford).

Considerable risks remain: The short-term economic picture is not good given weakness in the employment sector; longer-term, competition is strengthening with the threat from China not too far in the distance, as Ford’s own CEO acknowledges.

On balance, given that the bad news is likely priced into the stock, Ford is a Hold for all but the most risk-tolerant, especially those who believe that a longstanding brand like this one ultimately will find a way to prevail in its home market.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.