Summary:

- Ford’s stock is under pressure due to failed EV ventures, with no signs of value creation for shareholders, making it a sell-rated stock.

- Despite a bullish PPO, the stock remains neutral and range-bound, with weak seasonality further discouraging investment.

- Ford’s EV business is a significant loss-maker, dragging down overall margins and earnings, with no improvement in sight.

- Trading at low valuations, Ford’s future remains uncertain due to high capital investments and declining earnings estimates, making it unattractive for investors.

Wirestock

Legacy automaker Ford (NYSE:F) has been consolidating for months after a massive decline following earnings this past July. Shares are nowhere near their prior peak as the market has found no reason to buy them.

I am of a similar mind as I look at Ford, with the stock under pressure due to Ford’s failed venture into electric vehicles. Below, I’ll detail why Ford is a sell-rated stock, with the odds firmly in favor of the bears over the long term.

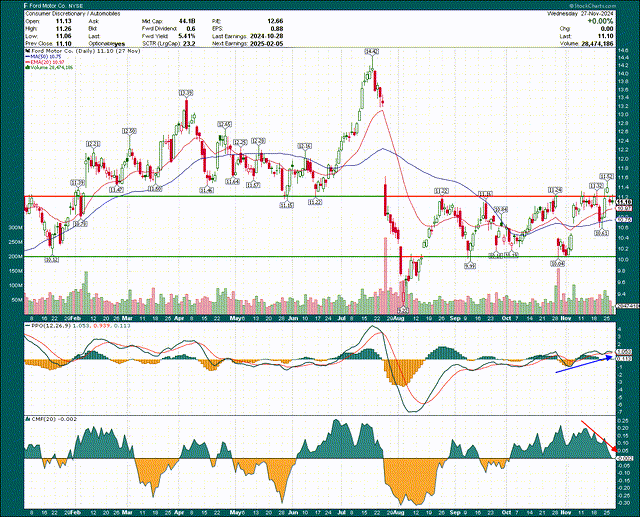

Consolidation until proven otherwise

Let’s start with the daily price chart, which shows a range-bound trade since August that remains today. That range has contained almost all daily price action since the earnings-driven decline, and a breakout earlier this week failed to hold.

The PPO is drifting higher and is above the centerline, which is bullish. The Chaikin Money Flow Index, however, is showing the opposite behavior. Momentum indicators are secondary to price, which in this case are neutral. I have to say price is neutral at the moment too, unless and until it sustainably breaks out of this channel either up or down. Until that happens, I don’t see any reason to want to get involved in the stock.

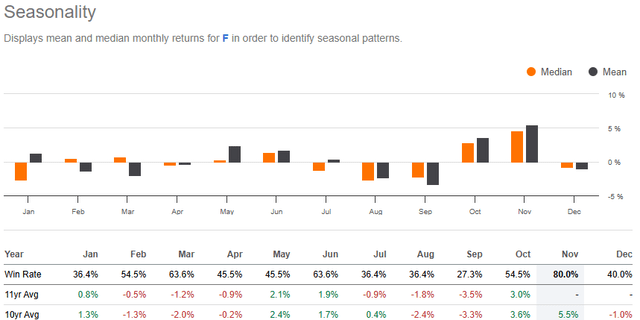

On the bearish side of the ledger, however, we have seasonality.

December is weak for Ford, as is January, with the two combining for positive returns less than 40% of the time during this period. February through April offer negative average returns, although the win rate is at least better. Still, this is not a time of year to own Ford, making it even harder for the bulls to take control.

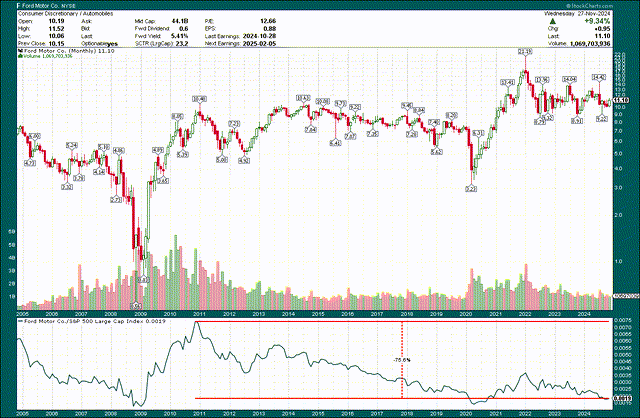

Now, one thing that I have thought about Ford for a very long time is that I’m not interested in owning it for one simple reason: this company seems totally incapable of creating value for shareholders. I’m sure some will point out the dividends that have been paid over time and to be fair, they’re substantial. But just have a look at the 20-year monthly chart and tell me this is a stock you are excited to own.

The stock is scarcely above the levels we saw in 2010, a full fourteen years on. It’s underperformed the S&P 500 by enormous sums, ceding 76% of its relative value in that span. If this company were a good one to own, this chart would look much better. But it doesn’t, and it isn’t. There may come a time when Ford ends years of mediocrity and underperformance, but I have little faith that time is now.

EVs remain the path to despair for shareholders

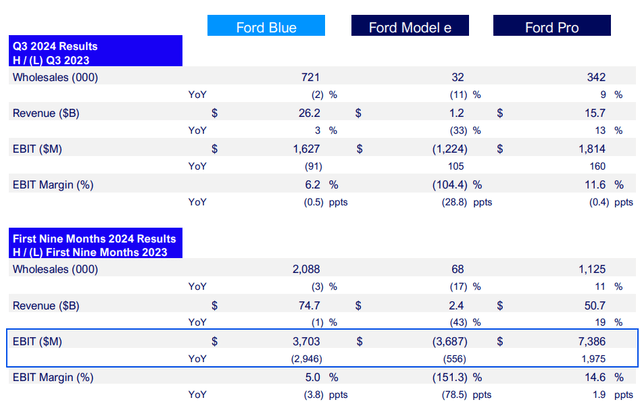

The thing that’s frustrating about Ford is that if it would simply cease selling its EVs, it would generate a lot more profit for shareholders. The EV business has been a massive loser, and it’s getting worse, not better.

The business itself is terrible as Ford loses tens of thousands of dollars on each vehicle, and the recent news cycle suggests it will likely continue to get worse. Proposed tariffs threaten to raise the cost of producing all kinds of vehicles, which means Ford’s deeply negative EV margins are likely to deteriorate further, if those tariffs come to fruition.

The company also recently announced job eliminations on “soft” EV demand, among other reasons. The fact is that Ford’s Pro business is outstanding and a massive cash cow. Its Blue division is less so because margins are much worse, but it’s quite profitable nonetheless. Model e essentially cancels Blue, however, as the segment’s EBIT margin is an unbelievable -151% so far this year.

Pro is one of the best businesses in the automotive industry, except for Tesla and Ferrari, both of which command premium margins on strong pricing power. But for the legacy automakers, Ford Pro is a crown jewel. If Ford were only selling through its Pro division, the stock would be enormously higher than it is today. But management stubbornly sticks to a doomed EV plan that has shown absolutely no signs of actually working. The fact is that consumers don’t want the EVs Ford produces in sufficient quantities. That’s not my opinion; the table above bears that out in hard facts.

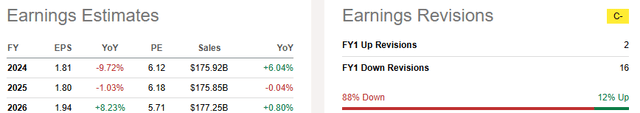

That is reflected in poor earnings growth going forward, and why Ford shares never seem to have a respectable valuation. This business – with so much investment in EVs – takes an enormous amount of capex to run, and for what?

We’re looking at yet more years of sub-$2 EPS figures, continuing a long line of similar results. And if the revisions on the right side of this table are to be believed, it’s possible even these estimates are too high.

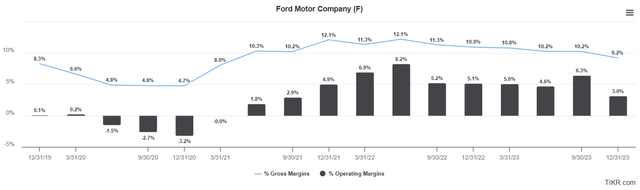

The longer Ford sticks to trying to make EVs work, the worse it will likely get. Below, we can see the impact of EV investment on the company’s consolidated trailing-twelve-months operating margins, and it’s not pretty.

Gross margins have moved from 12%+ to just ~9%, a decline of 24%. Operating margins have fared much worse, losing 64% of their value since the middle of 2022. With EV losses accelerating, potential tariffs making margins worse, and EV demand being weak enough that job cuts are now the right course of action, I simply cannot understand somebody wanting to own this stock.

Is it at least cheap?

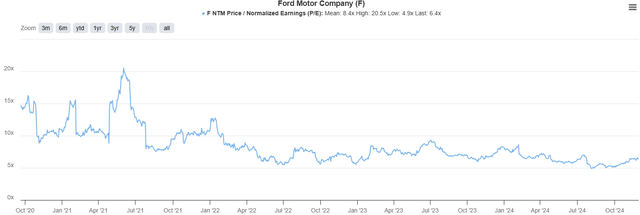

Sort of. It is trading for just over 6X forward earnings, but I’d invite you to remember that earnings estimates continue to decline, and it’s a business with a very uncertain future and massive required capital investments. Nothing that fits that description will ever have a high earnings multiple, and Ford is no different.

Shares are toward the lower end of the valuation history in the past couple of years, but I would hardly call this cheap. The valuation has had a lid on it because the business’ prospects continue to weaken, not because Ford offers a big value proposition to shareholders today. At least, not in my view.

If we wrap all of this up, until Ford realizes EVs are simply a path to burn money, the stock is likely to go nowhere. Other companies have made EVs work for them, but Ford’s EVs have nowhere near sufficient demand and therefore, like any other losing product, should just be cut. It is my belief that Ford shares would soar on an announcement that it was going to stop selling EVs because that would remove a massive overhang on earnings. But barring that, this stock is dead money.

It’s a long-term loser, and it will remain so in my view until something changes materially in its EV business. To be clear, I’m not suggesting anybody short this stock, I’m simply rating it a Sell because there are zero reasons to own it.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you liked this idea, sign up for a no-obligation free trial of my Seeking Alpha Marketplace service, Timely Trader! I sift through various asset classes to find the best places for your capital, helping you maximize your returns. Timely Trader seeks to find winners before they become winners, and keep you out of losers. In addition, you get access to our community via chat, direct access to me, real-time price alerts, a model portfolio, and more.