Summary:

- The valuation is not as cheap as it seems.

- Ford’s most important market, the US, is stagnating.

- Southeast Asia, South America, and Africa may see increased importance in the car market over the next decade.

- Ford has too many bad developments and risks compared to the upside.

jetcityimage/iStock Editorial via Getty Images

Investment Thesis

In my opinion, the risks and negative aspects of Ford (NYSE:F) outweigh the positive potential. After analyzing the company and the market in detail, I find it difficult to find arguments in favor of an investment. The valuation is only cheap if you use the non-GAAP figures. In addition, the company has been stagnating for years, and its most important market, the USA, is also stagnating. There is a lot of competition, which is reflected in meager margins. The tariffs on Chinese vehicles might save the company in the US but will probably only hurt it in all other markets.

Industry Overview

A few days ago, I wrote an in-depth article about Western brands in the Chinese EV market. This article also contains information about the development of the American market, and I think it is highly informative for anyone invested in car manufacturers. Here is a table from the article that shows the sales development of some selected markets over the last ten years.

| Region | 2023 | 2019 | 2016 | 2013 |

| Europe (EU+UK+EFTA) | 12,847,500 | 15,805,800 | 15,131,700 | 12,308,200 |

| USA* | 15,457,400 | 16,965,200 | 17,465,000 | 15,531,600 |

| Japan | 3,992,700 | 4,301,100 | 4,146,500 | 4,562,300 |

| Brazil* | 2,180,200 | 2,665,600 | 1,988,600 | 3,579,900 |

| India | 4,101,700 | 2,962,100 | 2,966,600 | 2,554,000 |

| China | 25,798,000 | 21,045,000 | 23,693,400 | 16,303,700 |

Here is my explanation and expected further development with reference to the relative importance of the various geographic markets.

Based on all this data, I would summarise that the markets in the USA, Europe, and Japan are stagnating, maybe because they are saturated. The percentage of car owners is already so high that it can hardly increase further. Add to this is an unfavorable demographic development, an economy that is tending to stagnate, especially in Europe, and the ever-increasing focus on climate and environmental protection, all of which are contributing to the fact that more and more people either don’t want a car or can’t afford one, or want to drive their existing vehicle for as long as possible before replacing it with a new one.

In contrast, the demographic development in many Southeast Asian countries and India is considerably better, i.e., considerably younger. Furthermore, the car is seen even more as a status symbol here, as a sign that one has made it from the lower social class to the middle class. I suspect that the importance of Southeast Asia, South America, and probably also Africa will increase in relative terms over the next ten years.

Power Shift Part 2: Western Brands In China’s EV Market

This significant development needs to be understood first: The US car market has stagnated for years; the growth is happening in other countries. If Ford doesn’t participate in the development there, they probably won’t grow at all.

On top of that, in the past few years, the market has been additionally divided into combustion cars and electric vehicles, which means there is now new competition for EVs that did not previously exist. However, all the different combustion vehicle manufacturers are also switching to EVs simultaneously, so overall, the competition for EV vehicles is significantly greater than for combustion vehicles. If ford were to decide to simply abandon the electric vehicle market to focus on internal combustion only (which some EV skeptics are calling for), they would still be impacted by the new EV competition that didn’t exist just 10 years ago.

What about the Chinese tariffs?

The newly introduced 100% tariffs on Chinese EVs have caused quite a stir recently. Even Elon Musk mentioned that Chinese brands would “demolish” their competitors without trade barriers. These tariffs will not change much for now, as hardly any Chinese cars have been sold in the USA. Instead, these changes aim at the future and protect American companies from cheaper competition.

There has already been a similar situation with solar panels in recent years, from which we may see the longer-term consequences of such decisions. 25% tariffs on Chinese solar panels were introduced in 2018 and recently increased to 50%. Despite this, China continued to dominate the global market.

In 2024, despite efforts to build new factories in the U.S. and across the globe, China’s share in all manufacturing stages of solar panels (such as polysilicon, ingots, wafers, cells, and modules) still exceeds 80%, and 90% in some parts of that global solar supply chain. And that does not include the significant Chinese investments in solar panel factories across Southeast Asia.

That market share also does not include the five foreign adversary controlled Chinese solar companies that have announced investments in new manufacturing plants being constructed in the U.S. and benefitting from Inflation Reduction Act incentives, as observed by the House Foreign Affairs Committee earlier this year. .. you can’t make this stuff up.

And not only that. The USA continued to import large quantities of solar modules anyway, especially from Southeast Asia, which are probably just Chinese companies in disguise. This shows a general problem (if you want to call it a problem, I’m not so sure it is one): individual companies’ adaptability is faster. Global markets are more complex than political decisions can react to them.

According to data from S&P Global, the United States imported a record 54 gigawatts of solar panels in 2023, up 82 percent from 2022.

Back to the car industry. What will the effect of the Chinese car tariffs be? Chinese companies may try to circumvent these tariffs by producing in Mexico, Canada, or the USA. Or perhaps they will refrain from trying to penetrate the American market, as they anticipate the American government will beat down any attempts to circumvent the tariffs. Only time will tell. However, I am sure that Chinese car companies will continue to focus on global markets, especially growing ones such as South America, India, and Southeast Asia. In the long term, Chinese companies will produce in such quantities that they will be permanently superior to the American competition in terms of price and probably also quality.

If this happens, American companies might only be able to sell on the domestic US market and only because their tariffs protect them. That doesn’t sound like a positive or successful prospect to me. I would like to point out that this is by no means an unlikely scenario for the future, but we are already well on our way in this direction.

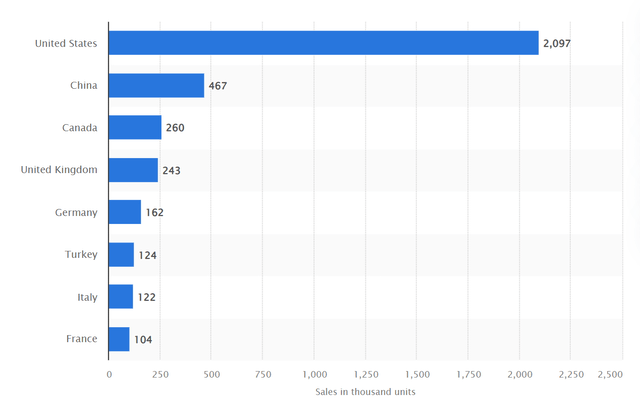

Ford’s bulk of sales are made in the US, but there are still sales in China and various other markets where the US tariffs will not protect them from competition. According to Statista, these are the Ford vehicle wholesales in FY 2023 by country. However, Ford doesn’t mention the Chinese market in its Q1 reports, so I’m not quite sure what the plan is exactly.

Statista

The past: Financial Progress & Trends

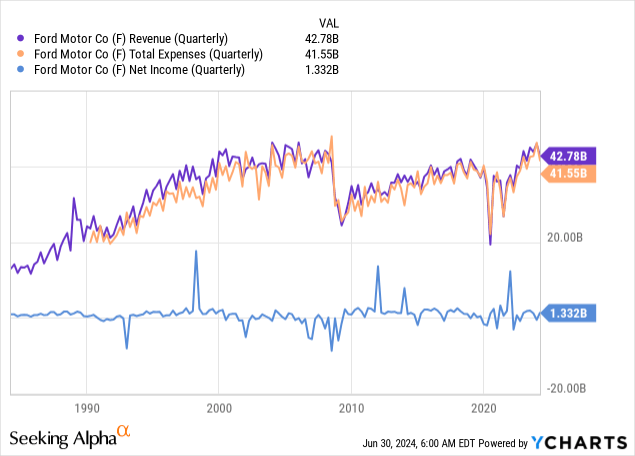

Let’s start by looking at revenue, expenses, and net income for a really long period of time. Normally, I wouldn’t include such a long period, but in this case, it illustrates some points. Ford was once a growing company, but as I mentioned earlier, the entire U.S. auto market is stagnant, and so is Ford. Also, while revenues were growing, net income was not; it was always a low-margin business.

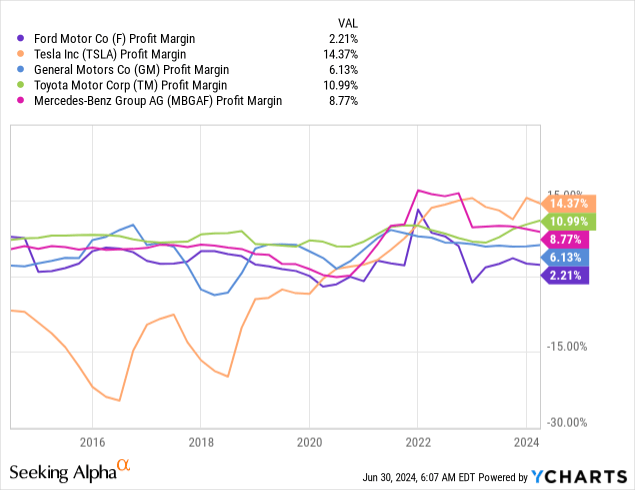

As can be seen in the profit margin comparison, which is tiny for Ford and the lowest among these peers.

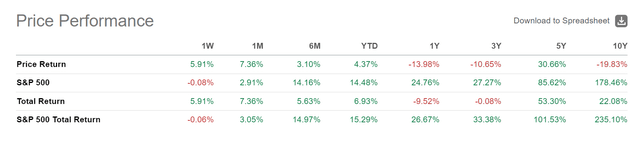

Not surprisingly, the share has underperformed the broad market by a wide margin.

Seeking Alpha

The present: Valuation & current developments

This is the past; what about the present and future? The company has an enterprise value of $176B, a market cap of $50B, and, according to Seeking Alpha, a massive net debt of $126B. The income statement shows that interest expenses totaled $1.3B in the last twelve months. To put this into perspective, net profit for the same period was around $4B. So, the debt is not yet a problem; obviously, the company also owns many assets. In general, however, it can be said that the higher the level of debt already is, the less room there is to increase it further.

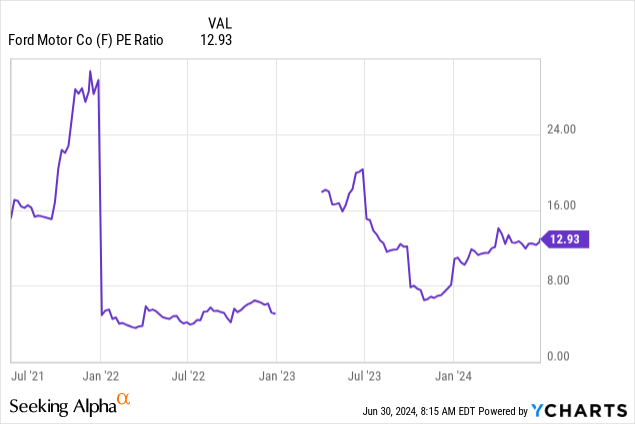

Let’s compare the current PE valuation to the average levels of the past three years. Notice that these PE numbers are GAAP numbers, which look much less rosy than the non-GAAP numbers.

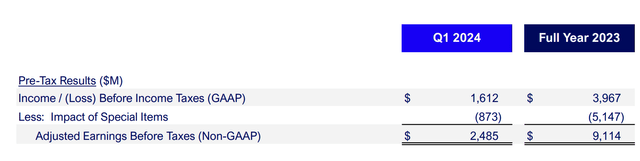

In many articles, I criticize the often huge difference between GAAP and non-GAAP numbers. Non-GAAP numbers, for example, don’t include stock-based compensation and other special expenses. It seems like most other analyses use mainly non-GAAP numbers, and companies often like to put more focus on these, too. I’m not saying one is always more accurate, but we should remember that both exist and sometimes differ significantly. Just look at the 2023 results and Q1 2024 and how huge the impact of so-called special items is. Based on my analysis of various companies, I think it’s fair to say there are always some extraordinary expenses for such large companies. Non-GAAP numbers are hiding these, but the costs are real.

Ford Investor presentation

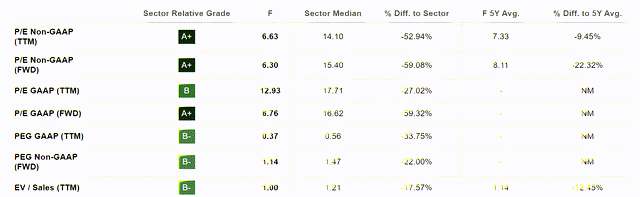

Looking at non-GAAP valuation and enterprise value/sales, Ford is currently less expensive than its 5-year average.

Seeking Alpha

Overall, I think you can say that the valuation is on the cheaper side, but if we take the GAAP numbers, then it’s not as clear-cut as it seems – a P/E of 13 with these risks and the general business development, I wouldn’t consider cheap at all.

Ford Pro

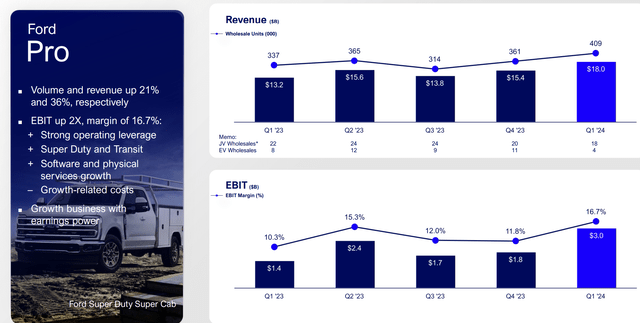

The Ford Pro segment is growing rapidly and achieves better margins than all other segments.

Ford Pro is Ford’s new global vehicle services and distribution business, that will be its own division of Ford building on top of its current commercial Ford truck market, and while transitioning into an electric truck and van market. It’s Ford’s investment into the future of commercial trucks and the technology that will power it to increase uptime and productivity, while decreasing total cost of ownership for businesses and fleets.

Ford Investor presentation

According to an Morgan Stanley analyst, this business segment alone has tremendous potential.

Morgan Stanley analyst Adam Jonas pointed out that Ford Pro’s profit before interest and tax reached 8 billion US dollars. According to a 10-fold EV/EBIT valuation, its independent value may be as high as 80 billion US dollars. However, the total value of Ford’s electric vehicles is only $40 billion, which indicates the existence of large corporate group discounts.

Jonas believes that Ford Pro is probably one of the strongest and most profitable businesses in the global automotive sector

Ford Blue & Ford E

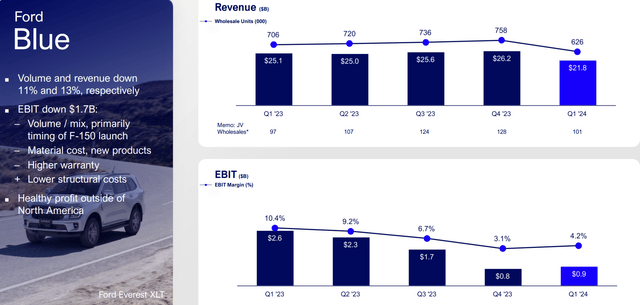

However, their primary business division, which they now call Ford Blue, is not doing well. Both volume and revenue are declining, and the EBIT margin seems to be falling.

Ford Investor presentation

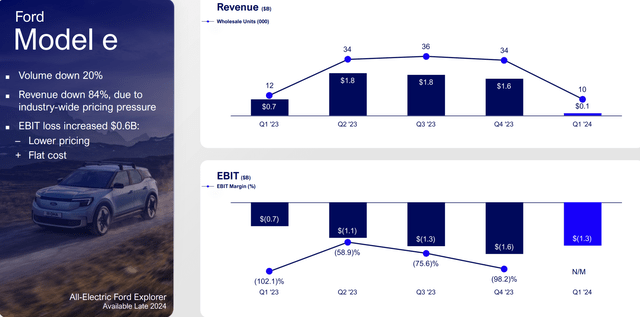

The electric division, Ford E, is doing even worse. Volumes are down 20%, revenue is tiny. The EBIT margin for Q1 was not stated, but in Q4 2023, it was (98.2)%. So overall, it seems that Ford’s electric segment is not in a good state; instead, it is constantly operating at a huge loss.

ford Investor presentation

Q1 numbers

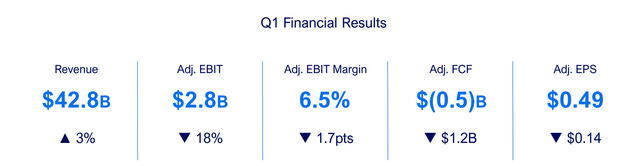

Just a brief overview of the Q1 figures, which the company described as “a strong start to 2024”. Revenue is up slightly, but EBIT and FCF are down, margin is worse, and EPS is down. Some figures were better than analysts’ estimates, but in my opinion, the company should be judged on its overall performance and not in reference to analysts’ estimates. As shown, Ford Pro is the only segment performing very well.

Ford Investor presentation

The future: Outlook

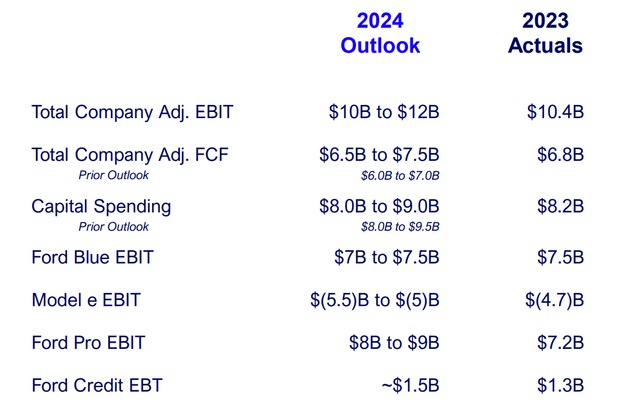

When we compare the 2024 outlook to the actual 2023 numbers, we see a very similar picture: Ford Pro is doing well and growing, Ford Blue is in slight decline, and Ford E was already bad and is getting even worse.

Ford Investor presentation

Risks

Some downsides have already been mentioned, but there are more risks.

Of course, there are obvious risks, such as the company being cyclical and dependent on general economic development. It could be that the company will be indirectly damaged by the US-China economic war, which will make many products more expensive for US consumers, leaving them with less money in their pockets to buy costly products such as cars. The US consumer will ultimately pay the tariffs in one form or another.

Ford could also be affected much more directly. The hotter the economic war gets, the more American companies in China will also be attacked. Either indirectly through soft power measures such as social media influence, Chinese consumers could be encouraged to buy mainly Chinese products. Or this influence is not even necessary, and people will naturally buy less American products out of national pride.

This is a theory I can’t prove, but I think something similar has happened recently: Chinese consumers are increasingly buying Huawei smartphones out of pride that they are back in the game, and Apple’s sales have suffered. A similar fate could be in store for Tesla (TSLA) and Ford.

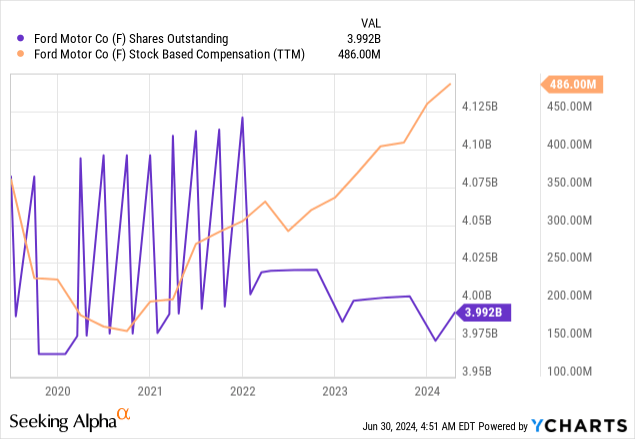

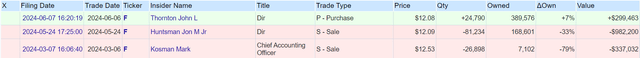

Share dilution, insider trades & SBCs

These three things are standard checks I make in every article, as excessive stock dilution and stock-based compensation can disadvantage shareholders. In addition, insider trades sometimes contain valuable information about management’s confidence.

These are all insider trades from the last six months; there’s not much going on (which is a good sign, so it’s still worth mentioning).

openinsider

Conclusion

Overall, I find it difficult to find reasons to invest here. Sales and profits have stagnated for years, margins are poor, debt is high, Ford Blue is stagnating at best, Ford E is burning money, then there’s the China risk, and the most important market, the US, is in itself stagnating. Yes, Ford Pro is growing and generating better margins, and the dividend yield is high. But I think the few bright spots are not enough to justify an investment. In addition, there is the question of whether the valuation of the share should be based on GAAP or non-GAAP figures, and if you take the GAAP figures, the valuation is not cheap. These are all reasons why I would not even hold the stock but give it a sell rating. In my opinion, there are better and safer opportunities in the stock market.

Here is a quick checklist to summarize some of the most important aspects.

|

Investor’s Checklist |

Check |

Description |

|

Rising revenues? |

No |

Increasing over longer periods |

|

Improving margins? |

No – falling margins instead |

Possible competitive edge |

|

PEG ratio below one? |

No (PE is low but no growth) |

PEG ratio below one may suggest undervaluation |

|

Sufficient cash reserves? |

Yes |

Vital for the survival & growth, especially of unprofitable companies |

|

Rewards shareholders? |

Yes |

Returning capital to shareholders |

|

Shareholder negatives? |

SBCs, but they are not exceedingly high |

Actions that disadvantage shareholders |

|

Stock in an uptrend? |

No |

Trading above its 200-day moving average? |

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.