Summary:

- Ford is struggling with consumer acceptance of BEVs and has postponed $12 billion of its $50 billion BEV investment due to market and political uncertainties.

- The election of Donald Trump and potential regulatory relaxations could reduce pressure on automakers to develop BEVs, impacting Ford’s strategy and profitability.

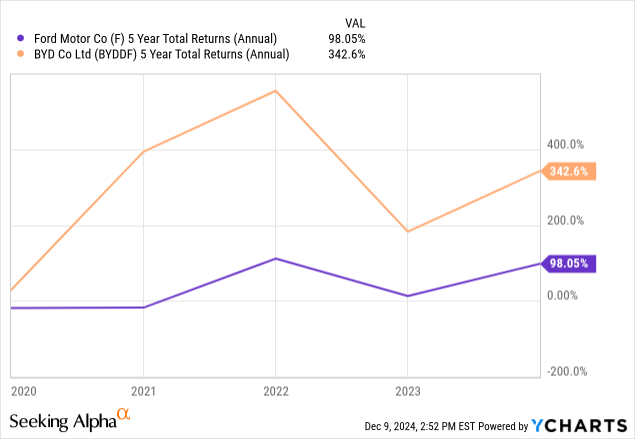

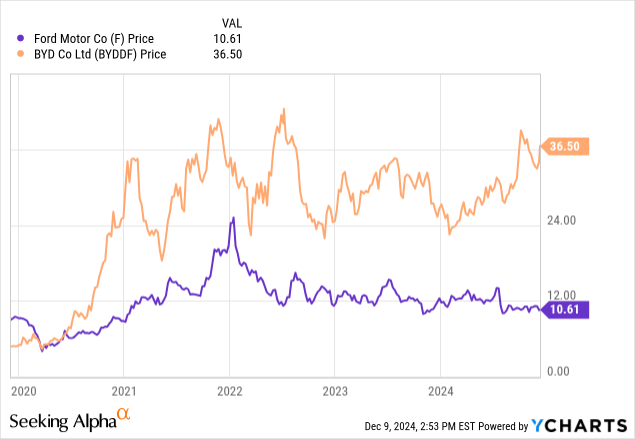

- Ford is shifting focus to gas-electric hybrids to bridge the gap until BEVs become more affordable and practical, while Chinese automaker BYD excels in BEV and hybrid technology.

- Ford’s current challenges include lowered earnings guidance, warranty costs, and a canceled electric SUV project, making it a Hold, while BYD is a stronger long-term investment.

Ford Mustang Mach-E all-electric SUV

jax10289

The Ford Motor Company (NYSE:F) and other incumbent automakers heavily invested in battery-electric vehicle (BEV) technology have been scrambling to contend with consumers’ lukewarm acceptance of their new models.

As of 2022, Ford vowed to invest $50 billion in BEVs. The automaker has since postponed $12 billion of that amount.

The predicament of Ford and many other automakers making the transition from fossil fuels to electricity grew more challenging on Nov. 5 with the election of Donald Trump. Trump will be backed by a GOP majority in both houses of Congress – affording the new president broad power to influence regulations governing the auto industry. He has criticized what he terms the “insane electric vehicle mandate.”

Though no such mandate technically exists, stringent clean air and fuel efficiency regulations in the U.S. and in the European Union exert pressure on automakers to introduce BEVs into their lineup and sell them vigorously or suffer large fines. Trump, via executive orders, will have the power to relax emission and fuel economy standards and has promised to do so.

Easier rules

Assuming he follows through, the result will be less pressure on Ford and others to design, build and market BEVs. Yet planning and manufacturing new models is a long lead-time business. Each time an automaker is forced to change direction due to a change in government policy or regulation – or because of consumer resistance – costs go up, delay is inevitable and profits get hit.

In 2021, Ford and others decided that transitioning swiftly to an all-BEV future was the optimal strategy for meeting government regulations and delivering vehicles that consumers were expected to demand. In the past year, consumer reluctance to fully embrace BEVs has become pronounced. A new administration along with a GOP sweep of both houses of Congress further muddies the water regarding how quickly automakers must reduce emissions.

Electrification of vehicles has morphed into a political and cultural issue in the U.S., and a polarized one at that, as environmental activists push for emission-free vehicles as a means of battling climate change. At the other end of the spectrum, consumers remain wary of a technology that’s costly and inconvenient, given the paucity of charging stations compared with the ubiquity of gasoline filling stations.

Ford is backtracking on its original strategy, attempting to square the circle by introducing more gas-electric hybrids, which reduce CO2 emissions, until innovation and research make BEVs more affordable and practical. Ford’s approach is reasonable and well could bear fruit since advances in battery technology and economics are unfolding at a rapid pace.

Enter China

While Ford and other Western incumbent automakers contend with the disruption of the fossil-fuel automotive industry, the most impressive electrification developments are taking place in China, by automakers such as BYD Company Limited (OTCPK:BYDDF). BYD, China’s top seller of BEVs, has pulled neck-and-neck with Tesla, Inc. (TSLA) in vehicle sales and passed it in revenue in the third quarter of 2024. Less prominent in the West is the development by BYD of multiple gas-electric hybrid strategies.

Ford and other incumbent automakers heavily invested in battery-electric vehicle (BEV) technology have been scrambling to contend with consumers’ lukewarm acceptance of their new models.

Two Ford BEV household (Ford Motor)

New path

A case in point is BYD’s introduction of the fifth generation of its DM-I extended range electric tech whereby a gasoline engine is used mainly to charge an on-board battery. The range for the BYD Seal DM-i U is about 1,300 miles and the price starts at about $40,000 in the United Kingdom. Neither Ford nor any Western automaker to my knowledge offers a similar product. (General Motors Company (GM) produced the Chevrolet Volt extended-range electric with a similar system; GM discontinued the Volt in 2019.)

In light of tariffs from the U.S. and trade tensions between the two countries, BYD has said it has no plans to import passenger vehicles to the U.S. The automaker has been importing to Mexico and scouting potential factory sites in the country, prompting predictions of exports eventually to the U.S. President-elect Donald Trump has promised to impose prohibitively high tariffs on Chinese vehicles imported from Mexico.

BYD – which counts Berkshire Hathaway as a minority investor – is hewing to a diplomatic course, professing little current interest in the U.S. vehicle market. I understand the practicality of such a stance – and believe that BYD one day will come to the U.S. with its vehicles and probably as a manufacturer.

Wall Street analysts, citing softening conditions generally for the U.S. automotive industry in 2025, are looking at Ford as potentially more vulnerable than its peers. On Nov. 20, Ford said it was cutting 4,000 jobs in Europe on soft BEV demand.

Less black ink

In October, Ford lowered its earnings guidance to $10 billion EBIT for the year, the lower end of previous guidance that was $10 billion to $12 billion. The reason for the change was warranty costs, a suggestion that the automaker hasn’t yet delivered on promises to improve quality and reliability. The automaker also cited a slower-than-ideal pace of cost-cutting.

Ford also took a non-cash $1 billion charge against earnings for a canceled three-row electric SUV the company had been developing.

With the new administration about to take power, “John Bozzella, President of the Alliance for Automotive Innovation, which represents 42 car companies that produce nearly all the new vehicles sold in the United States, wrote that in order for the auto industry to remain ‘successful and competitive,’ it needed ‘stability and predictability in auto-related emissions standards,’” according to a report in the New York Times.

Is Ford better off with tough emission standards and efficiency rules that amount to a de facto BEV mandate in the U.S.? Or would a relaxation of rules and standards give Ford more time and allow it to earn more in the meantime on its cash cows, such as the F150 gasoline-powered pickup?

These questions are vexing Ford strategists, lawmakers, and their staffs – and investors. Until they’re resolved, the dilemma of whether to buy shares at their current depressed price is significant. On the plus side, the current dividend implies a fat yield of nearly 6% – assuming Ford isn’t forced to trim or omit the payout to save cash, a move it’s made more than once.

BYD Seal with 5th-gen tech (BYD)

Ford remains a Hold.

As an investor focused on the long term, a stronger bet in the automotive sector, given current information, is BYD. The company is growing fast, gets an A+ Factor Grade for profitability from Seeking Alpha, and demonstrates admirable technology chops in its newest vehicle models.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.