Summary:

- Market’s moods occasionally swing to absurd degrees.

- In Ford’s case, its current dividend yield (7%) now exceeds its FWD P/E of 6x.

- There are valid concerns over its warranty costs and quality issues.

- However, market’s projection of near-zero earnings growth in next few years is too negative given Ford’s strong ROCE and reinvestment rate.

Marina113

F stock: 7% yield meets 6x P/E

I last wrote on the Ford Motor Company (NYSE:F) back in April 2024. That article was entitled “Ford Motor: P/E Is A Poor Indicator Of Cyclical Low”. As you can already guess from the title, the article analyzed of the status of its business cycle. Quote:

Ford is currently trading at a low P/E ratio of 6.5x FWD EPS. The single-digit P/E certainly does not hurt a value proposition. But the main reasons for my bull considerations are the other signs that indicate F is near or in the expansion phase of a new cycle.

Since that writing, there have been several key developments surrounding the stock. On the top of my list is its recent earnings report (for its FY Q2 2024). The results were weaker than expected. Both the top line and bottom line were well below consensus expectations. The key issues in my view include the uptick in its increased warranty costs and the lingering quality issues of some of its cars. I anticipate further costs and investments are required to address these issues and raise the caliber of its vehicles.

As such, the market has good reasons to be concerned. However, the current market sentiment is so extreme that it has created a very absurd situation in my view. The stock is not providing an FWD dividend yield of 7.05% as you can see from the screenshot below, which exceeds its FWD P/E of 5.9x (that is, if you only consider the numerical values and ignore the percentage sign).

With this background, in the rest of this article, I will argue that the market has overacted and this absurdity has created a very asymmetric return/risk curve.

Source: Seeking Alpha data.

F stock: Market’s EPS growth outlook

As another reflection of the market’s extreme sentiment on the stock, the following chart shows the consensus estimates for F stock in the next five years.

The EPS projections indicate a very gloomy outlook for the company’s earnings growth. In the near term, F is expected to see a decline of -7% year-over-year growth rate for the current FY 2024. Its earnings are then projected to rebound slightly (1.58% and 0.93% for FY 2025 and 2026, respectively) after that. Overall, the market expects its earnings to grow from $1.87 per share in 2024 to $1.92 per share in 5 years, translating into an annual growth rate of essentially 0% in CAGR terms.

Next, I will argue why such a projection is too pessimistic.

Source: Seeking Alpha data.

F stock: my growth projection

My method for estimating the organic growth rate (i.e., not considering bolt-on acquisitions or divestitures) is based on the return on capital employed (“ROCE”) and the reinvestment rate (“RR”). The method has been detailed in my other articles and here I will only quote the end results below:

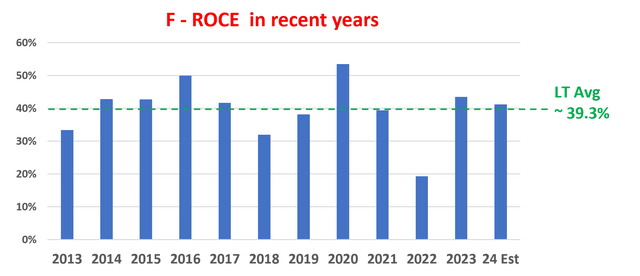

The ROCE for F has been around 39.3% on average in recent years as seen in the chart below. Its RR is about 15% on average. With these inputs, F’s organic growth rate would be ~5.9% (39.3% ROCE x 15% RR = 5.9% growth rate). Note this number is the real growth rate without inflation. To obtain a notional growth rate, one would need to add an inflation escalator, which can further push the growth rate up.

Author

I do see plenty of areas for F to invest its capital with robust returns and support my above growth projection. At the top of my list is its hybrid vehicles. Meanwhile, Ford is making advancements. Sales of hybrid vehicles jumped 34% in the last quarter. Going ahead, I expect the momentum to continue in the next 1~2 years as the adoption of fully electric vehicles has been slower than the market originally anticipated. The company has ongoing projects to ramp up the production of hybrids and is very well-positioned to capitalize on this front.

The next most promising growth area on my list involves its Ford Pro segment. (This segment serves its commercial customers.) This segment has also been reporting strong growth lately thanks to the strong demand for its Super Duty trucks. In response to such demand, the company recently announced plans to build a third assembly plant in Ontario. When the plan is fully operational, I anticipate it to add production of up to 100k units of its popular trucks, adding a considerable boost to its earnings.

Other risks and final thoughts

Since I started with a contrast of its P/E and yield, let me revisit the contrast before closing. As another way to illustrate how absurd the current price-value mismatch is, let’s consider the so-called PEGY ratio. I consider the PEGY ratio to be a more insightful metric for dividend stocks than the usual PEG ratio (P/E growth) because of the following reasons Peter Lynch promoted:

For dividend stocks, Lynch uses a revised version of the PEG ratio – the PEGY ratio, which is defined as the P/E ratio divided by the sum of the earnings growth rate and dividend yield. The idea behind the PEGY is very simple and effective (most effective ideas are simple). If a stock pays out a large part of its earnings as dividends, then investors do not need a high growth rate to enjoy healthy returns. And vice versa. And similar to the PEG ratio, his preference is a PEGY ratio of 1x or below.

Under F’s current conditions, with an FWD P/E of 5.9x and a dividend yield of 7%+, the PEGY ratio is only 0.85x even if you assume zero growth as the consensus projections imply. If you plug in my projected growth rate of 5.9%, the PEGY ratio would only be 0.46x, less than half of the 1x threshold.

To conclude, the market of course has valid reasons to have a negative sentiment on F. Besides the intense competition in the automobile sector (that many analysts have thoroughly discussed), F is also experiencing some more immediate and particular issues. As aforementioned, its ongoing warranty costs and quality issues are at the top of my list. Looking further ahead, F needs to strike a good balance between maintaining quality while reducing manufacturing costs and complexity. It is a crucial and significant challenge as it ramps up its production and develops new models. These issues definitely warrant a discounted valuation to compensate for the uncertainties. My point is that the discount has gone too far to the degree of being absurd. My investing experience has taught me that market absurdity usually creates outsized returns.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of F either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.