Summary:

- Ford faces intense competition from Tesla and Chinese automakers, leading to declining profit margins and challenges in the EV market.

- Despite a low valuation and high dividend yield, they may not be appealing enough to make up for the risks.

- Ford’s focus on long-term investments over share buybacks may benefit future growth but currently hurts the stock’s valuation.

- With declining gross profit margins and low ROE, Ford’s financial metrics are unimpressive, making it less appealing compared to other stocks.

- Ford’s inconsistent earnings beats and poor post-earnings reactions make it a risky investment going into earnings.

Vera Tikhonova

Ford Motor (NYSE:F) has its much-awaited Q3 earnings release coming up on October 28, but I won’t be buying going into the report. Ford is one of those divisive stocks that people often refer to as either deep value or a value trap. I understand why some may believe it’s very undervalued based on its low valuation, high dividend yield, and innovation efforts. However, it’s just not that appealing of an investment to me, even when considering its 5.9x forward P/E ratio.

It faces intense competition from Tesla (TSLA) and Chinese competitors, has declining gross profit margins, and unimpressive profitability metrics. Further, the outlook for US auto sector is not that great. Additionally, it can technically buy back shares at a low valuation, which I’m sure lots of shareholders would like, but it’s choosing not to. I’ll explain why I don’t like that later on.

Overall, it doesn’t look attractive going into earnings, especially when considering previous post-earnings reactions. I rate F stock as a Hold.

Ford Q3-2024 Earnings Preview

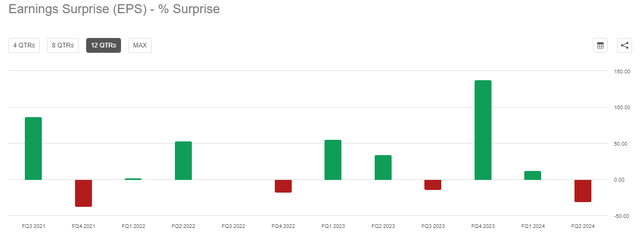

For the upcoming Q3 report, analysts expect $0.48 in EPS and $41.87 billion in revenue. Ford’s track record of beating EPS estimates is a bit lumpy, with four misses in the past 12 quarters. This isn’t horrible, but there are plenty of companies out there that consistently beat estimates, and I’m more confident in those firms.

Ford EPS Surprises (Seeking Alpha)

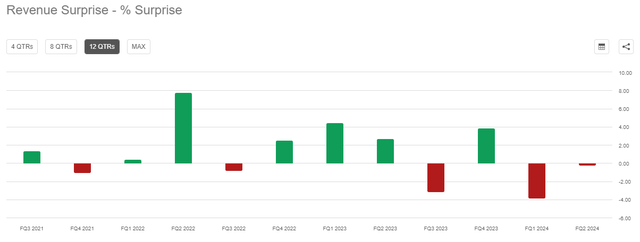

It’s a similar story with revenue misses, with 5 misses in the last 12 quarters (3 of them being in the last 4 quarters).

Ford Revenue Surprises (Seeking Alpha)

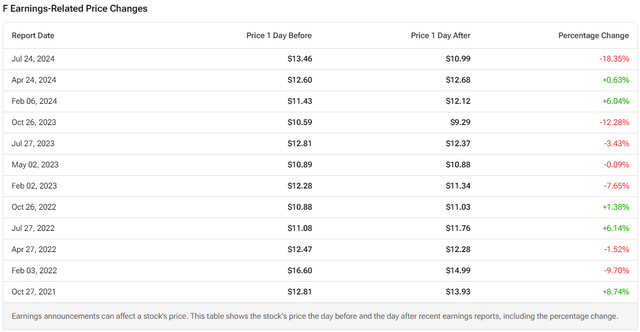

But what I don’t like is the recent reactions to Ford’s earnings reports. As you can see in the image below, there have been more negative earnings reactions than positive ones. The negative reactions also tend to be more extreme than the positive ones. I’m aware that those are just historical figures, but that’s not something I want to be exposed to going into earnings, especially if I’m not 100% confident in the company.

F Stock Historical Earnings Reactions (TipRanks)

Next, for the upcoming quarter, investors will be watching for improvements regarding warranty reserves because that was a problem in the last quarter. Specifically, in its Q2 press release, Ford stated the following: “Profitability was affected by an increase in warranty reserves, though efforts to lift the quality of new products are starting to pay off, with positive implications for customer satisfaction and Ford’s operating performance.” Let’s hope their efforts actually pay off here.

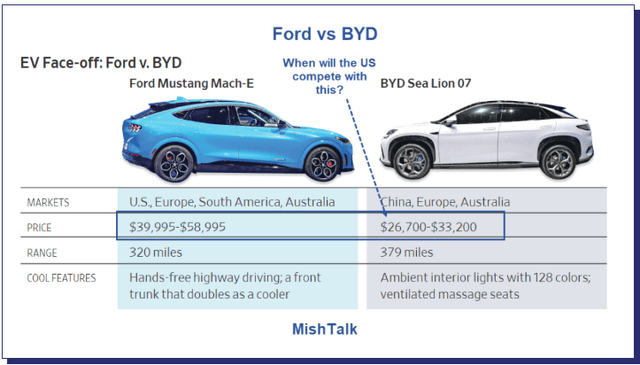

The Competition Is Tough

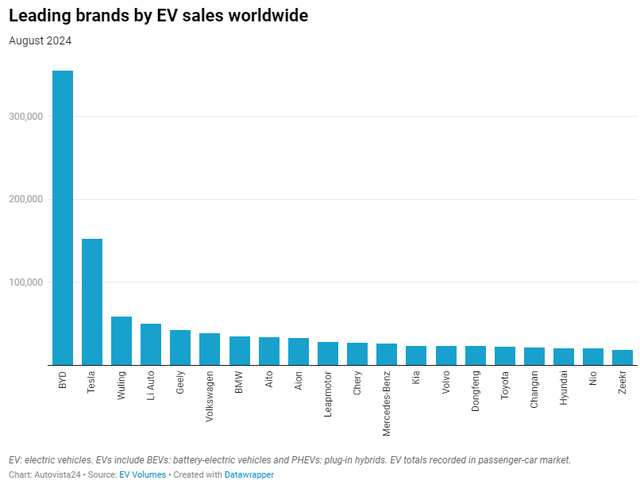

Ford faces tough competition, particularly in the EV space, from Tesla (TSLA) and Chinese automakers like BYD (OTCPK:BYDDF). This obviously pressures Ford to lower costs and improve its EVs. Tesla still dominates the EV market in the US, and its aggressive pricing cuts and innovation have made it hard for Ford to compete. Ford isn’t even listed in the chart below.

EV Sales Data By Brand (Autovista24)

In the Q2-2024 earnings call, Ford’s CEO, Jim Farley, said, “We clearly see China and Tesla as the cost benchmark.” Now, Ford has a goal of making vehicles “priced under $40,000 or even $30,000,” which they can achieve by building smaller cars (smaller cars = smaller battery = lower cost and higher margins). But can it do that profitably eventually? Ford still expects $5.0-5.5 billion in losses for its Model e division this year. How long will it take to become profitable in this segment and achieve economies of scale?

Notably, S&P Global warned recently:

S&P sees significant competitive pressure in 2025 and 2026 for all automakers. S&P pointed to the large market share losses this year for Tesla’s (NASDAQ:TSLA) Model 3 despite multiple price cuts. “This could slow revenue growth and delay profitability parity for EVs relative to legacy products possibly beyond 2027, especially for issuers that do not achieve economies of scale.

Thus, things aren’t looking good for Ford. Plus, Chinese automakers offer great value for their products, not just in China but globally. Based on this image below, Ford has a lot of work to do to catch up to the competition, with the BYD Sea Lion 07 coming in at a cheaper price and offering more range.

Mustang Mach E vs. BYD Sea Lion 07 (MishTalk)

Also, let’s not forget that Tesla will likely release its Model 2 next year, which will be a lower-cost vehicle, adding to the competition. Even though the Model 2 wasn’t mentioned in Tesla’s recent robotaxi event, that could be because they didn’t want to cannibalize sales of their other models like the Model 3.

Ford’s Profitability Isn’t Impressive

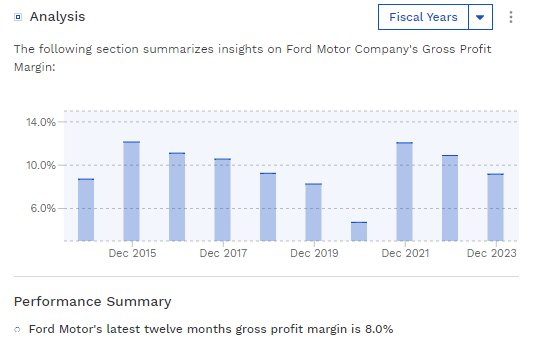

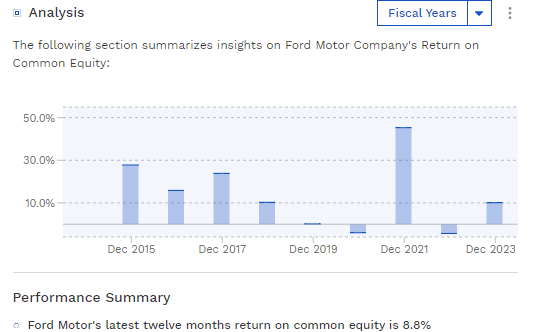

One thing I don’t like about Ford is its relatively low ROE and its declining and low gross profit margins in recent years (due to intense competition).

Its gross margin is at a relatively low 8% for the trailing 12 months, and the trend hasn’t been strong recently. I’m aware that other major automakers have seen their margins decline, but they’re not as low as Ford’s (example: Tesla’s GPM comes in at 17.7%, while General Motors’ (GM) margin is 11.8%). But either way, I don’t like that for either of those 3 companies. It’s a highly competitive industry for all, making it unattractive.

Ford’s Historical Gross Profit Margin (Finbox)

I also don’t like how its ROE is inconsistent and hasn’t been high in recent years, with the exception for 2021. Its current ROE is 8.8%, lower than its cost of equity of 12.23% (calculated using the CAPM model), meaning that it’s returning less than the cost of its equity.

Ford’s Historical ROE (Finbox)

The Valuation Still Isn’t Low Enough

Although Ford is trading at a forward P/E ratio of 5.9x for 2024 and 5.8x for 2025, it’s not low enough for me because of the risks associated with competition. Ford also expects $7.5-8.5 billion in adjusted free cash flow for the year (they raised guidance by $1 billion), giving it a forward price/FCF of 5.52x at the midpoint.

Still, the higher FCF guide was due to “lower-than-planned CapEx.” But is this just a temporary drop in planned CapEx? I think that Ford will have to maintain high CapEx going forward to stay competitive. Additionally, analysts expect Ford’s FCF to fall to around $6 billion (per simplywall.st) by 2025.

Anyway, what I’m getting at here is that with these FCF estimates, the dividend yield won’t be high enough. In the Q2 investor presentation, Ford said that it is “targeting a consistent return of 40% – 50% of adj. FCF to shareholders.”

If it pays, say, 45% of its FCF in dividends (if a special dividend is instituted again), then the annualized dividend per share will be about $0.906 per share using the current share count of 3.975 billion. That gives you a yield of 8.16%, but the growth prospects for this dividend aren’t great, especially if FCF falls next year. Combined with a cost of equity of over 12%, I just don’t see the value — at least not relative to other stocks that I’ve given Buy ratings to.

Lack Of Buybacks Won’t Help The Valuation

And it’s not as if management will buy back a notable number of shares to boost the valuation. That’s because it can’t — again, because of the competitive nature of the industry. Ford has to invest heavily in the future to remain relevant, to the point where it doesn’t have much money left over for buybacks. If the industry was less competitive, or if Ford had a better competitive advantage, it would have more money left over. That’s what I don’t like about it.

In the Q2 earnings call, Adam Jonas asked Ford’s CEO if he thought the stock was undervalued, to which he replied “Yes.” Then, Adam Jonas asked why the company isn’t repurchasing shares if that’s the case, asking if the CEO sees better opportunities to use capital.

Here’s what Ford’s CEO said:

Yes, we do [see better uses of capital]. And I have to tell you that it’s hard for people to understand those possible uses of capital, but we have so many exciting businesses to invest in. And Pro is a great example. I’m not going to get into specifics, Adam, but I think people will understand over time how many exciting opportunities there are at Ford. And I’m not just referring to vehicles, I’m referring to non-vehicle activities. We have 27,000 service base. There’s lots of opportunities.

And as I said, when you look at Ford Pro, I’ll just deep dive on that one, and I’m so glad you asked this question, by the way. So Ford Pro is a very, very high percentage of our company’s profit. Just look at the ratio between the overall company’s EBIT in Pro and our guidance. And then think about our after-sales business, only 24% of our revenue comes from Pro-related vehicles.

And we could spend a lot of time talking about this opportunity, but that’s why I highlighted in my comments, there are so many places for us to grow Pro on the physical services. They’re like 35% margin, but it’s hard stuff, right? It’s like bays and technicians and a lot of work. We have very exciting electrical architecture investments that we have to make in our future that will really change our ICE vehicles and their revenue potential. Because that revenue won’t be just when we sell the vehicle, it will be over time, which we’re seeing with Pro already.

So I don’t want to belabor the point. I’ll just tell you there are plenty of opportunities.

Now, I’m not saying that Ford shouldn’t be investing in the future. It’s just hard to know if it will pay off, and it’s hurting the stock’s value in the short term.

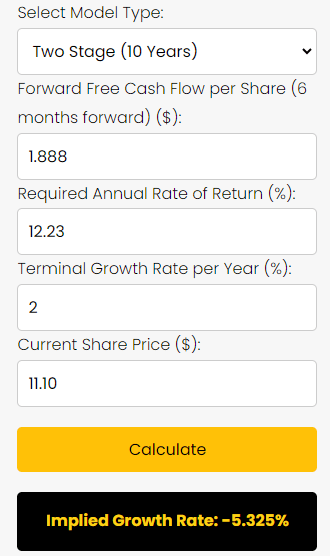

Reverse DCF Valuation

Here’s another way of looking at its valuation using a reverse DCF calculator that I’ve created. For this calculator, I’ve used the forward free cash flow per share based on the midpoint of management’s guidance, but I removed $497 million of SBC expense (SBC in the TTM is $497 million, so I’m assuming it will stay at that level for simplicity’s sake). I discounted the forward cash flows back 6 months, and I used the basic share count of 3.975 billion. The cost of equity was calculated using the CAPM model, with a beta of 1.63 and an equity risk premium of 5%. I set the terminal growth rate to 2%, in line with long-term inflation expectations.

At the current price, that means the market is pricing in that Ford’s free cash flow per share will fall by 5.325% every year for the next 10 years and then grow at 2% in perpetuity. Yes, admittedly, this seems very pessimistic. However, it could be justified, given the high competition and the need for Ford to maintain high CapEx to stay competitive — not to mention that analysts expect FCF to fall. If you think Ford will surpass this growth rate, then it’s undervalued, but I’m not willing to take the risk, especially with the auto market only expected to grow by 1-2% in 2025 and 2026, according to S&P Global.

F Stock Reverse DCF Valuation (Author)

The Takeaway

While Ford has a low valuation, there are challenges. Ford faces tough competition from Tesla and Chinese automakers like BYD, which harms Ford’s profit margins and its ability to operate a profitable EV business. Plus, I’m not a fan of its declining (and low) gross profit margin as well as its low and unpredictable ROE.

With earnings coming up, one of the things investors will be watching for is signs of improvement in its warranty reserves, which have been a drag on recent earnings. However, the lack of consistent earnings beats and poor post-earnings stock reactions make it a risky bet going into the report, in my view.

Moreover, even though Ford’s dividend yield may seem appealing, I believe it’s not high enough relative to its cost of equity and the fact that the dividend growth prospects are not strong. Additionally, Ford’s decision to prioritize investments in areas like Ford Pro over share buybacks may benefit the company in the long term, but in the short term, it hurts the valuation.

While Ford’s management sees exciting opportunities ahead, including its focus on software and services through Ford Pro, it’s hard to know if these efforts will pay off. With the factors mentioned above, combined with the high level of competition in the EV market and the need for significant capital investments, F stock may not be the best buy at the moment.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.