Summary:

- Ford has continued its remarkable recovery since mid-January 2024, corroborating the strength in its previous bottom in October/November 2023.

- The market has returned its focus to Ford’s core automotive business, after the UAW debacle late last year.

- Ford’s management is reassessing its aggressive push into EVs and plans to temper its EV-related investments in 2024, given the recent “seismic change.”

- I explain why the EV growth slowdown is good for Ford, allowing it more time to milk its more profitable core business and work on its next-gen products.

- With F forming its long-term lows in late 2023, the recovery momentum looks set to carry on. Maintain Buy.

Matt Cardy/Getty Images News

Ford Motor Company (NYSE:F) investors who picked F’s lows in mid-January 2024 have benefited from its recovery, corroborating the strength of its previous bottom in October/November 2023. As a result, I assessed that the market had moved well past the battering attributed to the UAW labor agreement. I urged investors to capitalize on F’s recovering momentum in my December update, seeing a more constructive setup as we headed into 2024. Therefore, with the market returning its focus to Ford’s core automotive business, it should offer investors more clarity, notwithstanding the vagaries surrounding its Model e segment (Ford’s EV business) in 2024.

Accordingly, F gained nearly 40% (adjusted for dividends) from its October 2023 lows through this week’s highs, stunning the bearish prognosticators. The relative success of Toyota (TM) has likely spurred Ford management to reassess the momentum of its push into full-fledged EVs. Notably, Toyota is well-known for not having “fully embraced” the rapid switch to BEVs, seeing a more diverse roadmap through a combo of ICE/hybrids/BEVs.

As a result, the market has rewarded TM investors with a premium valuation, consistent with the robust performance in Japanese equities, as F and GM struggled over the past year. Unsurprisingly, Ford management attempted to convince analysts and investors that Ford had tempered its enthusiasm for its BEV push, sensing a “seismic change in the last six months” of 2023. As a result, Ford telegraphed it will recalibrate investment spending on EVs. Notwithstanding the near-term caution, the company anticipates allocating 40% of 2024’s CapEx to Model e.

Management’s ability to execute ongoing cost savings from an industrial redesign has remained intact, bolstering its ability to achieve the targeted $2B in cost reduction. Consequently, Ford is confident; it should help mitigate the impact of “higher labor and product refresh costs.” As a result, I don’t assess imminent risks on its forward dividend, an essential underpinning in sustaining its recent bottom. With a forward yield of 5.2% at the current levels, it should continue to attract income investors looking to partake in its ongoing recovery. Morningstar also indicated that it doesn’t anticipate significant risks that could render its payout ratio at risk in the near term. Coupled with the company’s commitment to consider the balance between profitability and BEV transition carefully, we shouldn’t expect a significant EV growth momentum in 2024.

Ford Management guided for a full-year adjusted EBIT of $11B at the midpoint of its guidance range, surpassing analysts’ estimates. However, Model e is expected to register a higher burn in 2024, with losses “expected to widen to a range of $5B to $5.5B.” Ford attributes these challenges to ongoing “pricing pressure and investments in next-gen vehicles.” As a result, the company doesn’t anticipate reaching its previously telegraphed 8% adjusted EBIT margin by 2026.

Notwithstanding these challenges, I believe the automaker’s more constructive full-year adjusted EBIT guidance indicates robust momentum in its Ford Pro and Blue segments. It corroborates my conviction that the Detroit Duo has profitable core businesses mitigating the uncertainties emanating from the EV segment. As a result, Ford has been given more time and flexibility to adjust to the cyclical EV downswing, even as it continues to invest in its next-gen EV lineup to take on Tesla (TSLA) and its Chinese EV peers.

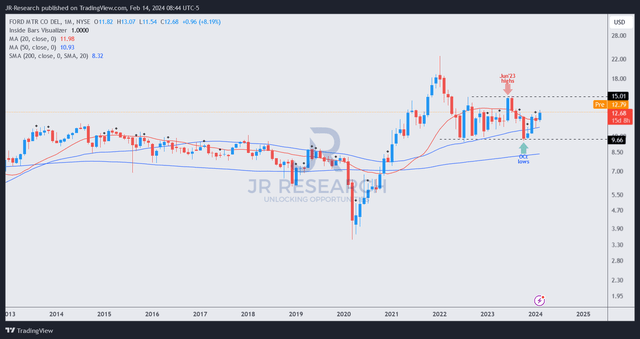

F price chart (monthly, long-term) (TradingView)

I assessed that F’s price action suggests it remains in a consolidation range, bounded by the $15 resistance and $9.5 support levels. With F having recovered its key support zone remarkably, the most attractive buying opportunities are likely over.

Despite that, I gleaned that F’s long-term uptrend remains intact, as seen above. Therefore, I assessed the risk/reward bias remains relatively favorable at the current levels. Consequently, I anticipate F should gain momentum in 2024 to re-test its $15 resistance zone if the market assesses a better-than-expected performance from its core business.

As a result, Ford must remain focused on trying to outperform its guidance over the next two quarters to bolster confidence for investors. Notwithstanding the long-term appeal of the EV segment, the market’s penchant for aggressive EV investments has waned. Therefore, Ford shouldn’t reverse course on its commitment to pay more attention to profitable growth in 2024.

Despite that, investors should anticipate near-term downside volatility, given the post-earnings recovery, as F looks to have hit a near-term resistance zone. For longer-term and income investors, I assessed the buying opportunity as still apt to add exposure.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!