Summary:

- Ford’s 2Q24 was a debacle with $1.1 billion losses in the Ford Model e segment, but Ford Pro segment is estimated to generate $9 to $10 billion EBIT.

- Commercial customers prefer EVs based on total cost of ownership, leading to success in hybrid trucks like the Maverick and F-150.

- Ford’s focus on software technology and services paid subscriptions, as well as the Ford Pro segment, has offset some of the bad results, but revenue growth remains scant.

wellesenterprises

Ford’s (NYSE:F) 2Q24 earnings release was a complete debacle. The company reported losses of $1.1 billion in the Ford Model e segment due to lower sales and pricing pressures, which compromised the ability to dilute the high costs of production. The outlook for the whole year in this unit is projected to be a loss in the range of $5 billion to $5.5 billion. On the bright side, more than offsetting these losses is the Ford Pro segment, which is estimated to generate EBIT in the range of $9 to $10 billion.

Ford identified a difference between commercial customers’ adoption of EVs and retail customers. The main difference is that commercial clients look at the total cost of ownership and choose the battery option that maximizes their use. There is a big difference between ICEs and EVs in terms of larger premium vehicles. Larger vehicles need bigger batteries, so the costs of production end up eroding the traditional margins from such vehicles. This has been a problem for traditional automakers trying to use the SUV playbook in the EV market.

This resulted in a fantastic performance in the hybrid segment. That makes total sense once we realize that the larger EVs do not bring better margins and that customers are not ready to pay a huge premium on BEV vehicles compared to an ICE equivalent. For instance, hybrid trucks like the Maverick and F-150 have been stellar performers. All-in-all, the company has just acknowledged that it will only be launching vehicles that are financially viable, meaning that there were mistakes in the current line-up of products.

Rethinking Business Organization

Fortunately, for Ford, there is good news on other fronts that helped offset some of the bad results.

The success of the company’s software technology and services paid subscriptions has made the company eager to reorganize and try to emulate Tesla’s success in software and services paid subscriptions. The results are interesting, with the company achieving double-digit revenue growth on 50%+ gross margins, according to the CEO in the earnings call.

Another high-performing segment is the Ford Pro. This segment includes EV and ICE tailored to meet the needs of businesses, ranging from small to large corporations. In this segment, the company has observed that their blended offering of ICE and EV vehicles has been well-received by the market. The company will now be pushing for subscription services for telematics fleet management, which has been growing at 35% YoY.

Financials

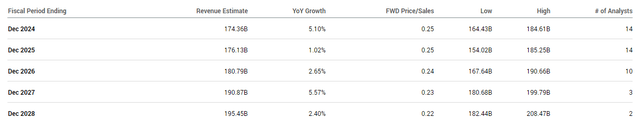

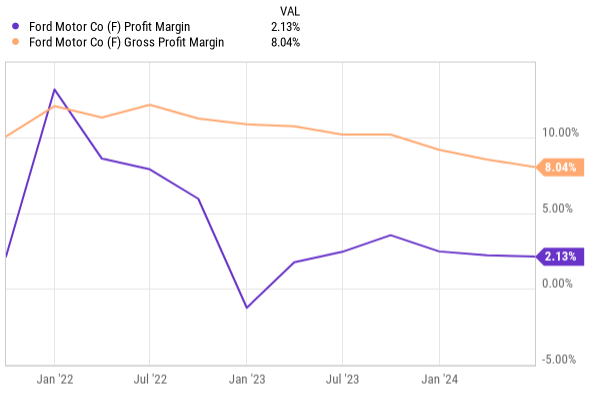

Looking at the company’s revenue estimates we can see that growth seems to be scant. That explains why the market reacted to the earnings release by dumping the stock.

Basically, the problems in the Ford Model e segment are adding pressure to the margins at a time when revenue growth was already absent and the focus was on improving margins. This is basically telegraphing the market that things will take a lot longer to look better.

YCharts

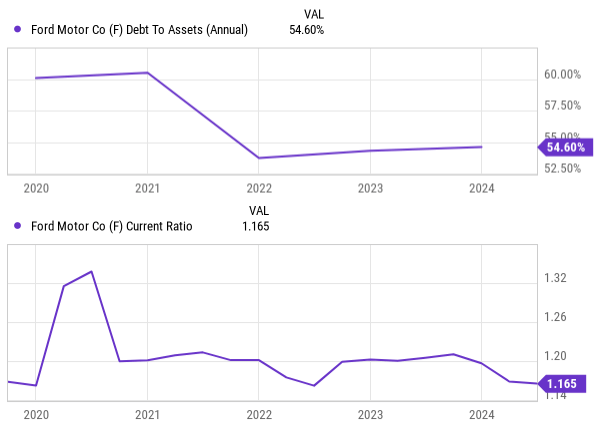

The debt levels on the balance sheet are already high, however the trend seems stable. The current ratio is in line with the past and seems reasonable absent a global liquidity issue.

YCharts

Wrapping up, we can clearly see that the EV portfolio allocation has brought problems to the company. They designed interesting cars, like the Mach-e, but the ambition to drive change fast made them rush those cars into the market even at a loss. They discovered that the traditional thinking that volume will drive costs down and make the cars affordable might not apply here because volume growth has just evaporated. Acknowledging this was a good step in the right direction.

Valuation

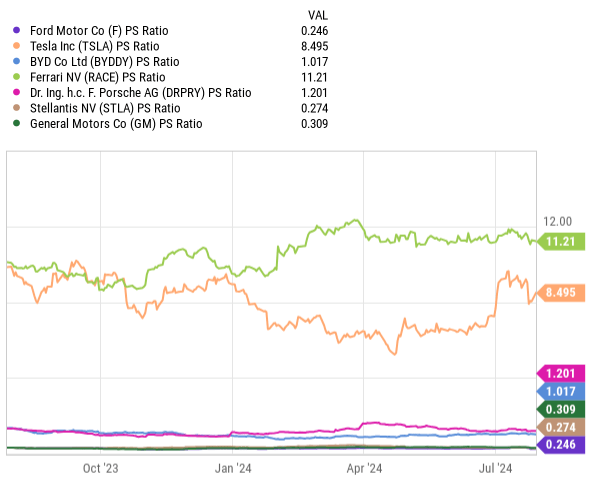

In other pieces on the auto industry (you can check them here and here), I have argued that the valuation for auto manufacturers is now divided into three buckets: EV native, Luxury, and traditional OEMs.

Below you can see an illustration of this. Ferrari (RACE) and Tesla (TSLA) are pure luxury and EV plays, respectively. Porsche (OTCPK:DRPRY) and BYD (OTCPK:BYDDY) are more hybrid forms of this play and enjoy much lower multiples, but still higher than the traditional automakers like Stellantis (STLA), General Motors (GM), and Ford.

YCharts

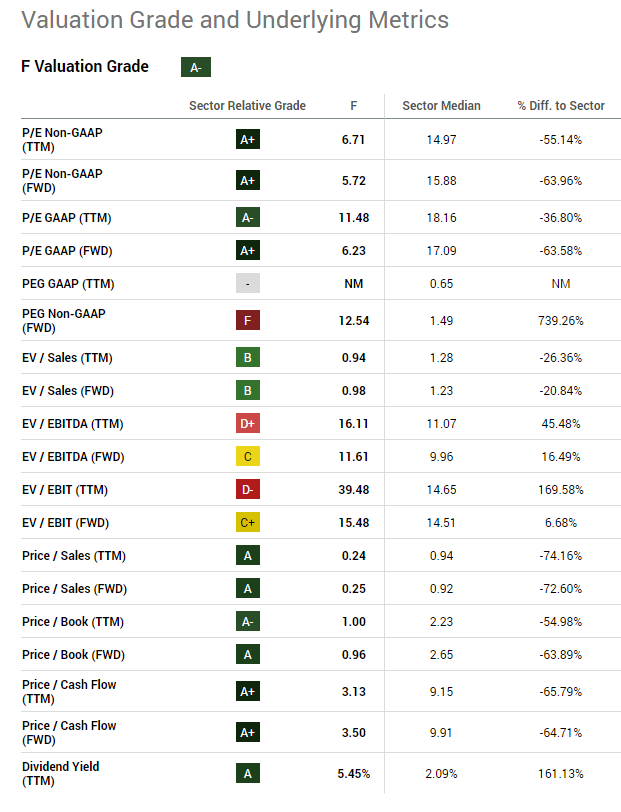

It is very important to look at valuation from this perspective because from most other perspectives Ford will look like an obvious value play. Previously, I saw Ford taking the path to grab some EV premium due to their fast-pace of execution. Unfortunately, we have now realized that their fast pace got them into trouble.

Seeking Alpha

Conclusion

I still think that Ford can carve a market share for itself if it learns from this turbulence. The secret is not to throw the baby out with the bathwater but to be more tactical with the moves that imply huge Capex. For me, it is evident that they have already derived some powerful insights. They should not go full-on EV, they should instead focus on their Ford Pro offerings where the EV portfolio has been well-received, and keep scaling their products there. Clearly, the commercial clients are figuring out better how they can take advantage of the EVs than the individual customers.

Likely, the way to go for traditional automakers regarding non-commercial clients is not to make bravado commitments to fully electrify their fleets in a decade but to offer hybrid solutions that drive down emissions significantly in an urban setting, while not putting the clients at risk in longer distances.

From the tone of the earnings call, I think the company has learned just that. If they execute the strategy to rebalance their offerings, I think later on they might get a sales multiple re-rating to a value closer to that earned by BYD. Using last year’s revenue as a reference ($165 billion), that would value the company at $41.25 per share (diluted shares of 4 billion).

However, there are many risks to the execution. As we have seen, Ford feared not being fast enough in the transition to EVs and ended up moving too fast. This is unchartered territory and many other traps lurk around. Ford will have to face many obstacles and tough choices before getting the market re-rating. Additionally, the company might have to overcome possible financial risks stemming from an economic downturn and/or tighter credit markets. In that sense, the current state of the balance sheet while not alarming, is not comforting in case we see another financial crisis. For all those reasons, I will keep an eye on the stock but will remain on the sidelines for now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This text expresses the views of the author as of the date indicated, and such views are subject to change without notice. The author has no duty or obligation to update the information contained herein. Further, wherever there is the potential for profit, there is also the possibility of loss. Additionally, the present article is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Some information and data contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. The author trusts that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.