Summary:

- Despite the ongoing warranty issues, Ford remains a Buy due to the rich FY2024 Free Cash Flow guidance and consequently secure dividend investment thesis.

- If anything, investors may continue to look forward to rich FQ4’24 supplemental dividends, based on the shareholder return policy at between 40% to 50% of its Free Cash Flow.

- This is significantly aided by the robust Ford Pro sales and accelerating Hybrid sales in the US, which underscore Ford’s well-diversified platforms and end markets.

- Management has hinted at the ongoing improvements in its warranty issues, with FY2025 likely to bring forth improved numbers and easier YoY comparisons.

- Lastly, the F stock’s sideways movement at current levels continues to point to its robust bullish support, with the worst of the pessimism likely baked in.

beast01/iStock via Getty Images

Ford’s Rich Dividend Yields & Great Diversification Remain Tempting

We previously covered Ford Motor Company (NYSE:F) in September 2024, discussing why we had reiterated our Buy rating then, despite the FQ2’24 bottom misses from the eye-watering warranty/ recall costs, as the automaker remained the “most-recalled automaker for the third straight year.”

Our optimism was attributed to the management’s raised FY2024 Free Cash Flow guidance and the potentially rich supplemental dividend payout in FQ4’24, with its dividend investment thesis still attractive for those with higher risk tolerance.

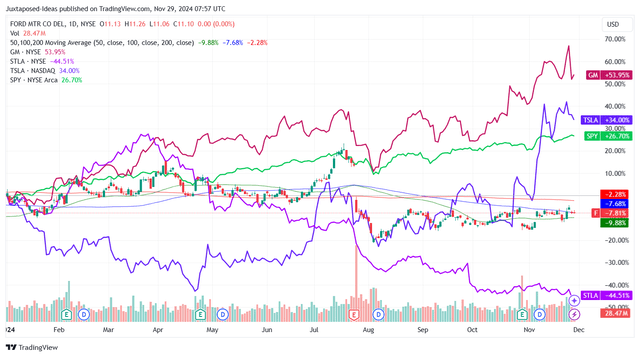

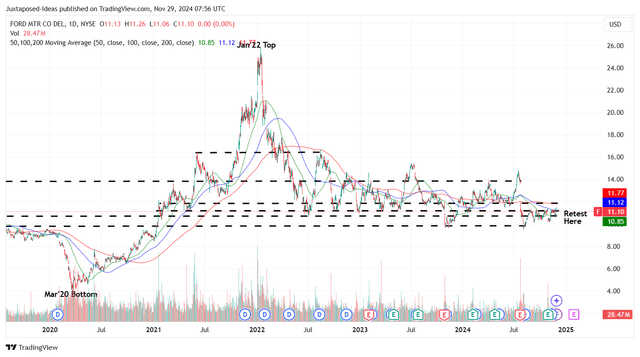

F YTD Stock Price

Since then, F has mostly traded sideways at +4.6%, well underperforming the wider market at +10.2% and many of its automaker peers, aside from Stellantis N.V. (STLA).

Much of the underperformance is naturally attributed to the ongoing quality and warranty issues, of which the estimated future warranty and field service action costs have risen drastically to $13.31B on a YTD basis (+23.4% YoY/ +154.9% from the first nine months levels of FY2019 at $5.22B).

These issues have also directly contributed to Ford Blue’s impacted EBIT margins of 6.2% in FQ3’24 (+1.8 points QoQ/ -0.5 YoY) and Ford Pro’s EBIT margins of 11.6% (-3.4 points QoQ/ -0.4 YoY), with it triggering F’s moderating overall EBIT margins of 5.5% (-0.3 points QoQ/ -0.5 YoY), compared to the peak of 7.3% recorded in FY2021.

Combined with the yet profitable Ford e segment, as the management guides -$5B in EBIT losses in FY2024, it is unsurprising that the market has been pessimistic about the legacy automaker’s prospects, as similarly observed in the underwhelming YTD stock price performance.

The only silver lining to F’s prospects is the robust sales observed in the Ford Pro segment at $50.66B on a YTD basis (+18.7% YoY) and higher estimated ASPs at $45.03K per unit (+7.2% YoY), underscoring why the segment has been able to report richer adj EBIT margins of 14.6% on a YTD basis (+1.9 points YoY), despite the impact from the higher warranty related costs.

This is on top of the accelerating Hybrid sales at +44.6% YoY on a YTD basis, which underscores the automaker’s well-diversified offerings across Hybrid, ICE, and EV platforms, along with the well-diversified end markets across retail, commercial, government, and rental customers – allowing the legacy automaker to switch its growth levers depending on the cyclical market demand.

If anything, the legacy automaker remains well capitalized to weather the near-term headwinds as well, based on the rich net cash of $16.3B on its balance sheet (-21.3% YoY).

Even so, with the two other segments reporting lower ASPs on a YoY basis, we believe that F may continue to underperform expectations, especially given the softer EV demand in the EU and the “unprecedented” competition from cheaper Chinese imports, despite the tariffs.

Combined with the low-single digit US sales growth, it is unsurprising that the management has delivered another dose of pessimism through the lowered FY2024 guidance, with adj EBIT of $10B (-3.8% YoY) and adj Free Cash Flow generation of $8B (+17.6% YoY).

This is compared to the previous guidance of $11B (+5.7% YoY) and $8B (+17.6% YoY) offered in the FQ2’24 earnings call, respectively.

The culprit is naturally attributed to Ford Blue segment at a lower FY2024 adj EBIT guidance of $5B (-32.9% YoY), compared to the prior number of $7.25B (-2.8% YoY), thanks to the “higher warranty costs than originally planned.”

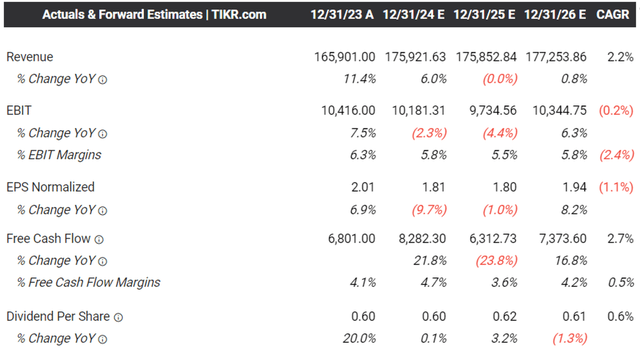

The Consensus Forward Estimates

These developments may also be why the consensus has lowered their forward estimates, with F expected to generate a decelerating top/ bottom-line growth at a CAGR of +2.2%/ -1.1% through FY2026.

This is compared to the original estimates of +4.8%/ -0.7% and the historical growth at +2.3%/ +9.1% between FY2018 and FY2023, respectively.

On the other hand, F’s reiterated Free Cash Flow guidance continues to imply the safety of its dividend investment thesis, based on the LTM ordinary dividend obligations of $2.38B.

At the same time, the consensus estimates continue to highlight a somewhat stable cash flow generation along with projected dividends paid out over the next few years, as similarly observed in its higher Seeking Alpha Quant Dividend Coverage Ratio at 3.02x compared to the sector median of 2.88x.

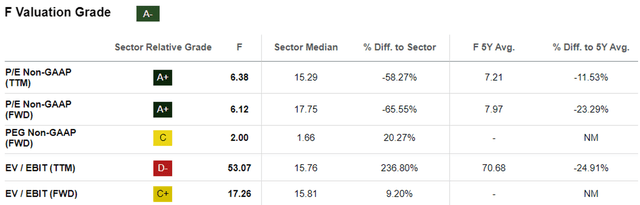

F Valuations

For one, the dismal results and the management’s ongoing warranty issues/ demand softness in the EV market have directly triggered the F stock’s underperformance and the discounted FWD P/E non-GAAP valuations at 6.12x.

This is compared to the 5Y mean of 7.97x, 10Y mean of 7.04x, and the sector median of 17.75x.

If anything, the lack of growth prospects continues to point to F’s uncertain intermediate-term prospects, with the same discounted valuations also observed in its direct legacy automotive peers, including General Motors Company (GM) at FWD P/E non-GAAP valuations of 5.42x and STLA at 4.95x.

While the potential cancellation of the $7.5K consumer tax credit for EVs may potentially be a boon for legacy automaker players, including F, it remains to be seen when the management may be able to reverse the market’s pessimistic sentiments, given that warranty issues remain a bottom-line headwind to the company’s recent performance.

So, Is F Stock A Buy, Sell, or Hold?

F 5Y Stock Price

These results may have also been why the F stock has continued to trade sideways at current levels, with the stock seemingly unable to break out the $11s resistance levels.

Even so, the stock’s underperformance has been a gift indeed, since the fixed quarterly dividends of $0.15 per share imply a relatively rich forward dividend yield of 5.4%, one that well exceeds the sector median of 2.11%.

At the same time, we maintain our belief that F remains well positioned to return 40% to 50% of its Free Cash Flow to shareholders, with FQ4’24 potentially bringing forth rich supplemental dividends per share of between $0.19 and $0.39 – leading to an expanded forward dividend yield of 8% at the midpoint.

At the same time, the management has hinted at the ongoing improvements in its warranty issues, with its “MIS, or three months in service, quality is getting a lot better, a 31% increase in the last three years,” as “improvements to warranty will take time to reduce our warranty expense, maybe up to 18 months, but we’re moving the needle on all the inputs.”

Therefore, while F may continue to record elevated warranty costs, it appears that the worst may very well be behind us, with FY2025 likely to bring forth improved numbers along with easier YoY comparisons.

If anything, the stock’s sideways movement at current levels continues to point to its robust bullish support as well, with the worst of the pessimism likely baked in.

As a result, we are cautiously maintaining our Buy rating for the F stock here, with the caveat that the stock is only suitable for dividend-oriented investors with a long-term investing trajectory.

This is because the stock price recovery is likely to be prolonged, depending on when the management achieves notable improvements in the warranty issue and consequently, delivers improved bottom-line performance.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.