Summary:

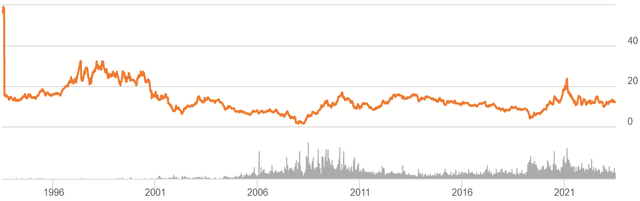

- Ford is a mature company that has historically traded between $10 and $20, given its cyclical nature.

- It should be valued not just as a carmaker, but also a financial company through Ford Credit.

- While the current dividend near 5% is nice, a buy case doesn’t exist unless it goes below $10, at which case, its balance sheet creates a margin of safety.

Vera Tikhonova

Ford Motor Company (NYSE:F) is one of those companies that’s always been around and likely always will be. If you learned from Peter Lynch’s writings and talks in the 80s and 90s, you will probably remember that he had a thesis on it then, and it’s one that must always evolve as this company ages. For my part, I had to take my focus in for service today, and while I’m stranded at my local Starbucks, I figured I’d cover what’s on topic for me.

Throughout most of my life, F has rarely traded above $20 or below $10. Yet, whether today’s price around $12 is reasonable depends on what Ford is worth going forward. I will discuss which factors I think are most useful in understanding the long-term value of Ford, why it’s a Hold, and what prices represent attractive entry and exit points.

What Exactly Is Ford?

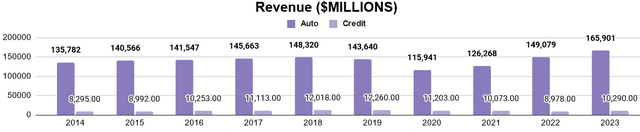

Usually, I have seen Ford discussed as purely an automotive manufacturer and nothing else. Yet, this does not completely capture what the company is and what we own through the stock. Ford is a carmaker, yes, but it is also a financial through Ford Credit, which generates earnings through leases on its vehicles and financing to customers at dealerships.

If we parse the two components by reported revenues, we see a much bigger impact on the Auto side.

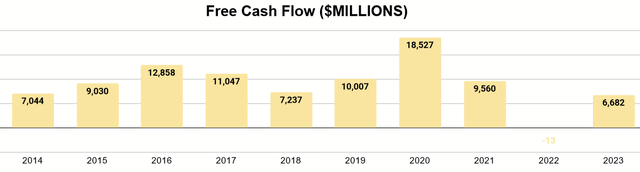

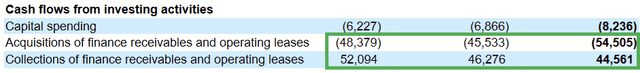

If we look at the traditional calculation of free cash flow, we see it’s generally, positive, but there is more to the cash flow situation than simply operating cash flows minus capex.

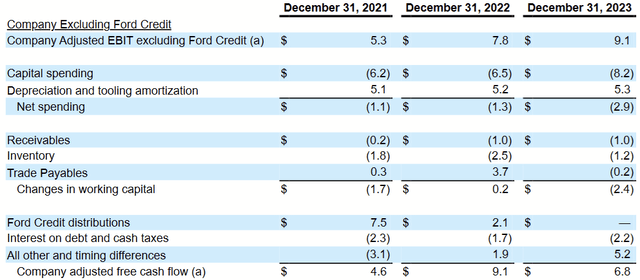

Subtleties such as these require us to consider multiple things for valuing Ford that we might not typically need to do for other businesses. To its credit, Ford attempts to resolve these for investors by providing an Adjusted Free Cash Flow calculation:

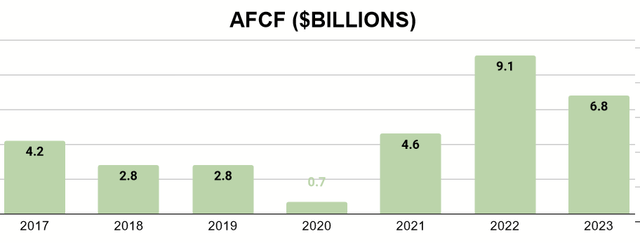

I think these give a much closer insight into Ford’s earning ability because they resolve the somewhat tangled income streams that come from Auto and Credit. As such, I have gathered the AFCF data Ford has provided back to 2017.

While AFCF is where I think we should have our sights, I do think all the charts I showed indicate the cyclical nature of this business and how it is seen through results. The average, annual AFCF through these ups and downs comes to $4.4 billion.

Macro Factors

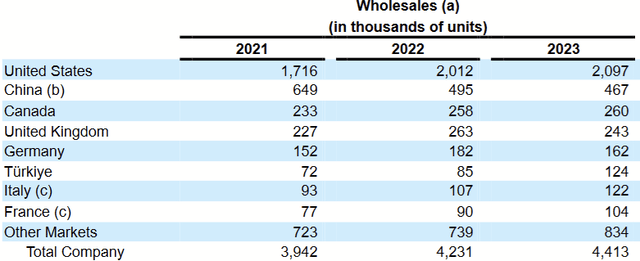

Being such a mature company and one of the prime auto brands, Ford’s returns are necessarily impacted by external factors. The most pertinent are those that affect the United States, as that’s where Ford makes the bulk of its sales, but Ford’s sales in Canada and Western Europe (which may correlate with the U.S.) are also important.

Goodcarbadcar.net provides a breakdown of global car sales by region from 2005 to 2022. These data show that North American and European markets have been chiefly cyclical in nature, while the Asian markets are rising quickly. In spite of this, we see the recent trend for Ford above was declining sales in China and little exposure overall to this space.

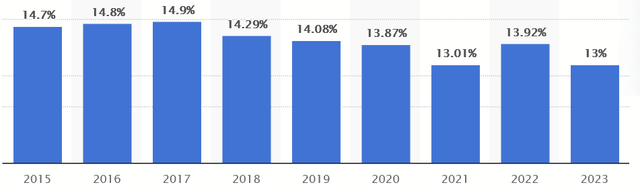

Over time, the auto market has become increasingly competitive. I encourage folks to view this animated graphic that shows how both Ford and General Motors (GM) gradually lost the American market to foreign makers. Ford used to hold between 20% and 25% of market share, but now it’s happy to get as high as 15%.

Ford U.S. Market Share (Statista.net)

For the year 2023, its share of the market was 13%. It’s something of a moat still. I suspect there will always be those drivers that are determined to get a Ford or a Chevy because it’s “buying American.” Yet, the likes of Toyota, Honda, and Volkswagen have firmly established a new paradigm where Ford must compete harder than it did in decades past.

So we’ve established two factors: cyclicality in Western markets and tighter competition. We also need to contemplate what will impact their margins: the rise of EV and commodity fluctuations.

Seeking Alpha

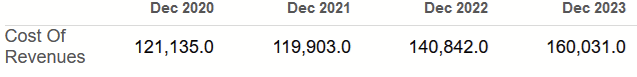

Cost of revenues is, by far, their largest expense, and just the last few years show that it can vary as much as $40B. Some of this is a volume question (they incur less if they expect to sell less), but some of it necessarily follows movements in the price of fuel and steel, among other raw materials. I’ll quote their 2023 Risk Factors (pg. 24):

Ford’s results are dependent on sales of larger, more profitable vehicles, particularly in the United States. A shift in consumer preferences away from larger, more profitable vehicles with internal combustion engines (including trucks and utilities) to electric or other vehicles in our portfolio that may be less profitable could result in an adverse effect on our financial condition or results of operations. If demand for electric vehicles grows at a rate greater than our ability to increase our production capacity for those vehicles, lower market share and revenue, as well as facility and other asset-related charges (e.g., accelerated depreciation) associated with the production of internal combustion vehicles, may result.

EVs and smaller, more fuel-efficient cars are a long-term threat to sales and explain a lot of the competitive pressures.

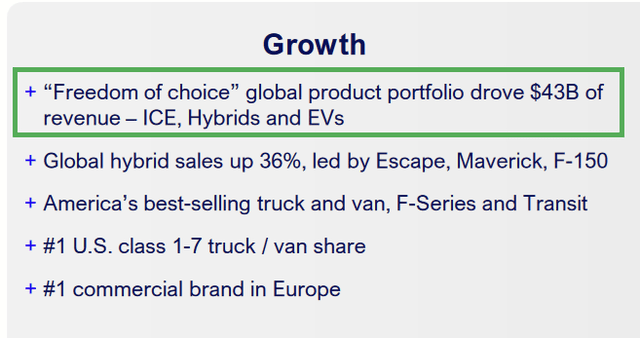

Currently, the company is trying to position itself as a maker for all preferences. The issue, of course, is that even if Ford competes effectively enough to maintain market share as such vehicles become more popular over time, it’s going to be with smaller margins.

I bring up all of these things to say that I think Ford has a lot of juggling to be successful as a company. I don’t have any reason to think it can’t do it, but it’s also why I don’t view an investment in shares of F as anything close to a growth investment. It is, at best, a cyclical play.

Capital Allocation

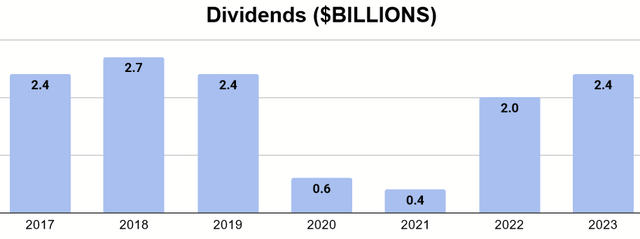

It’s also worth assessing how Ford allocates its capital as it navigates its hurdles over time. First, consider its history in dividend distributions.

For the same years of AFCF I quoted earlier (where Ford averaged $4.4B), dividend distributions averaged $1.8B. As such, I believe shareholders can reasonably expect to receive a modest return by way of the dividend going forward.

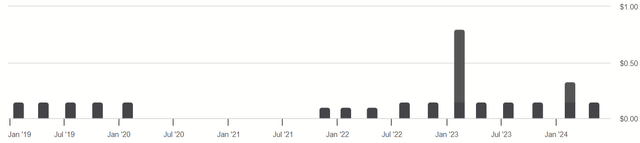

5Y Dividend History (Seeking Alpha)

While COVID created an interruption in distributions, much of that was eventually made up through special dividends in 2023 and this year. The current yield just below 5% isn’t bad, I think the lumpiness of the dividend does not make this ideal for income investors and contributes more to the cyclical argument.

Yet, there’s more to the story than dividends. There are buybacks here and there, but the other key part is how Ford generally grows its tangible book value per share.

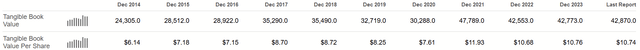

TBV and Per Share History (Seeking Alpha)

While it did peak in 2021, the trend has been growth of TBV, standing at $10.74 per share in Q1 2024.

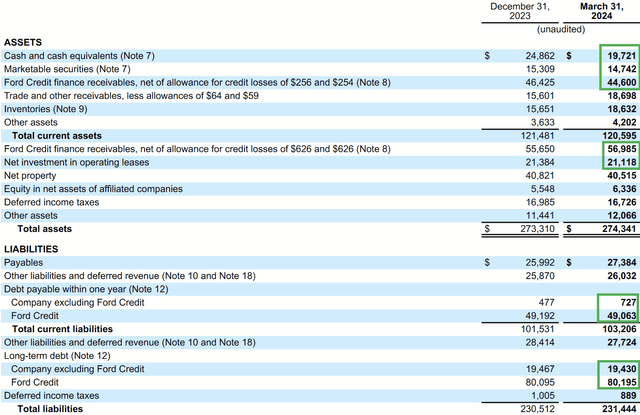

Balance Sheet (Q1 2024 Form 10Q)

As of Q1, Ford Credit’s assets, on top of the company’s liquid position of about $35B total about $157B, all on top of about $150B in debt. In spite of the challenges, Ford has maintained a stable balance sheet and steadily grows its book with what it doesn’t distribute, which I believe to be one of the more redeeming aspects of this investment.

Valuation

I want to use two methods for the valuation, given the dual nature of Ford’s business as a carmaker and a financial: P/FCF (using Ford’s adjusted figure) and TBV per share.

If we use the average AFCF of $4.4B to give us a more perennial view of Ford’s cash generation, the current market cap of $48.5B gives a multiple of 11. It’s not terribly high, especially considering the multiple of tech stocks right now, but we also know that Ford isn’t poised for growth for all the reasons I mentioned before. At best, we might consider it a single-digit grower.

Market Cap History (Seeking Alpha)

Now, we do see that Ford has traded as single-digit multiples before, which presented an attractive PEG Ratio based on that $4.4B figure. We also see that it’s been much higher and less attractive. The current multiple of 11 therefore seems indicative of a fair value to me.

Yet, a low multiple isn’t the only reason to buy Ford. Its TBV per share of $10.74, based on a sturdy balance sheet made possible by Ford Credit, means that a significant discount to TBV would also make F a margin of safety Buy.

It’s been that low before, but with both of these measures as a guide, the current price of $12 per share just isn’t a bargain. In the meantime, long-term investors will have to content themselves with a 4.9% dividend.

Conclusion

Ford is a perennial company, not quite what it was, but also not about to go anywhere. Mainly present in North American and European markets, its results will follow the cycles that affect those regions, and, with those results, the movement of the stock will follow too.

A price below $10 not only gives a low multiple but also starts to create a margin of safety based on tangible book value. These moments, when they do come, represent a great time to buy into an established, American brand. Yet, investors should have an exit plan in the upper teens as the market gets optimistic, remembering that tight margins and stiff competition limit the actual potential for growth. For now, long-term investors get a middle price and should be ready to move on a change in either direction.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.