Summary:

- Ford stock has underperformed the S&P 500 and General Motors stock as investors have become more skeptical about its EV strategy.

- Ford’s EV strategy is under intense scrutiny amid a competitive market, and there are concerns about its ability to sustain growth and profitability.

- F has solid dip-buying support above the $9 level, potentially attracting more income investors to return.

- I argue why Ford investors should capitalize on its recent recovery, as the market’s pessimism is likely overstated.

Bill Pugliano/Getty Images News

Ford: Underperforming Peers And Market

Ford Motor Company (NYSE:F) investors have had a highly challenging year, underperforming the S&P 500 (SPX) (SPY) and its cross-town arch-rival, General Motors (GM). Therefore, the market seems to have delivered its verdict on CEO Jim Farley and his team (at least for 2024).

In my previous bullish Ford article in May 2024, I argued that Ford’s increasingly profitable commercial business should help bolster its core business, even as the legacy automaker transitions to EVs.

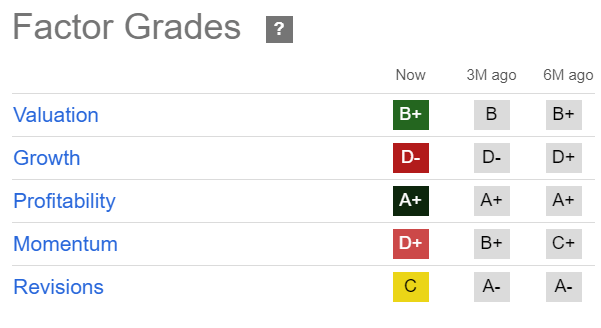

However, Ford’s EV growth roadmap has faced unanticipated stumbles, as the market likely assessed F as falling behind General Motors in its pursuit. Although Ford’s core internal combustion engine business has continued to underpin its sector-leading profitability (“A+” profitability grade), the market seems unconvinced. Although F’s attractive forward dividend yields should attract income investors to stay vested, growth investors have likely turned their attention elsewhere, given GM’s more robust “C+” growth grade, well above F’s disappointing “D-” growth grade.

Ford: Must Prove Its Path Toward Profitable EV Scaling

As someone who never likes to bet against the market, Ford investors must assess whether the market pessimism is reasonable, as automotive companies have undergone challenging growth deceleration over the past year. EV market leader Tesla (TSLA) has faced challenges reigniting its growth profile, likely worsened by its sky-high valuation metrics. Notwithstanding its expensive valuation, TSLA investors have outperformed Ford investors since April, as investors likely placed a higher emphasis on its growth recovery and autonomous driving and robotaxi ambitions.

Ford’s ability to compete more effectively in EVs will likely be crucial in lifting the market’s optimism through 2025. Ford will release its third-quarter earnings on October 28, affording investors an update on its business outlook. As a reminder, Ford is expected to ramp up its hybrid strategy, as the growth in pure-play BEVs has slowed markedly.

Ford reported a 0.7% increase in Q3 US sales, corroborating the market’s caution. Q3’s growth was significantly lower than the 2.7% average Ford notched YTD through September 2024. While the growth profile in hybrids (up 38% YoY in Q2) surpassed the growth rate (up 12% YoY in Q3) of BEVs, investors are likely increasingly concerned whether Ford’s declining ICE business can help sustain its EV transition.

Ford: Growth Environment Has Turned More Competitive

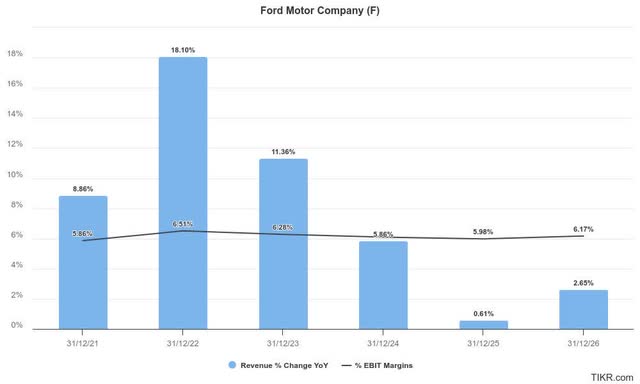

As seen above, Ford has suffered a significant revenue growth deceleration since its peak in 2022. Furthermore, analysts expect Ford’s sales to slow down through 2025, raising the execution risks in an increasingly challenging EV growth environment. Notwithstanding the EV transition risks, Ford’s core ICE business is still profitable, critical to helping to sustain stable automotive adjusted EBIT margins through FY2026.

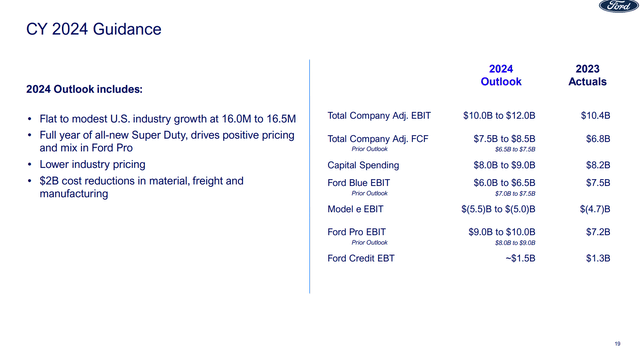

Ford 2024 revised outlook (Ford filings)

As seen above, Ford Blue (ICE segment) is still expected to post an adjusted EBIT of between $6B and $6.5B. However, it was revised downward from its prior outlook of between $7B and $7.5B. However, the strength of its commercial business (Ford Pro) is expected to mitigate the weakness of its EV business and the slowdown of its core ICE business. As a reminder, Ford Pro’s adjusted EBIT outlook was revised upward in Q2, corroborating its growth momentum.

General Motors has also unveiled its mass-market EV model, demonstrating its resolve to compete more aggressively. GM’s trajectory is notable, as the leading automakers have suffered several setbacks in China. Chinese EVs, led by BYD Company’s (OTCPK:BYDDY) (OTCPK:BYDDF) incredible rise, have dented foreign automakers’ market leadership as they struggle to transition effectively into EVs.

Notwithstanding my caution, Ford’s downgraded Wall Street earnings estimates suggest a possible growth inflection point from FY2026. In addition, Ford’s ICE business is still anticipated to be a core profitability driver, bolstering the confidence of income investors. Hence, it should help underpin F’s relative undervaluation, suggesting much pessimism has likely been reflected.

F Quant Grades (Seeking Alpha)

While F’s valuation grades have remained relatively undervalued compared to its consumer discretionary sector (XLY) peers, it has still underperformed. It’s a critical reminder for investors not to focus solely on its valuation when assessing F’s risk/reward profile.

As a reminder, F’s adjusted EPS multiple of just below 6x is more than 60% below its sector median. However, it’s markedly above its automotive peers’ median of 3.6x. Therefore, Ford still needs to justify improved growth prospects relative to its sector peers. Despite that, its relatively low adjusted EPS multiple should also provide a valuation floor for the stock as the company attempts a more profitable transition for its EV business. In addition, its relatively low free cash flow multiple of just under 4x is more than 60% below its sector median. As a result, I assess that the market seems to have baked in significant pessimism, even as the company’s ICE and Ford Pro business are still crucial profit drivers.

Ford’s EV strategy has come under intense scrutiny as it faces an increasingly competitive EV market. The Chinese EV leaders are expected to up the ante in their quest for global domination. Therefore, Ford must justify its ability to demonstrate a clear path toward EV profitability. Thus, GM’s ability to scale faster could impact the market’s confidence in F, potentially affecting its ability to recover from its underperformance.

Despite that, the market sentiments toward automakers could improve through 2025, as the Fed is expected to turn increasingly dovish. With interest rate headwinds expected to have peaked in 2024, investors will likely bank on improved buying sentiments in the automotive business as the drag on large purchase consumer spending becomes less of a drag. Hence, it should also underpin F’s relative undervaluation as the market assesses a potential valuation re-rating to levels more in line with its sector peers.

Is F Stock A Buy, Sell, Or Hold?

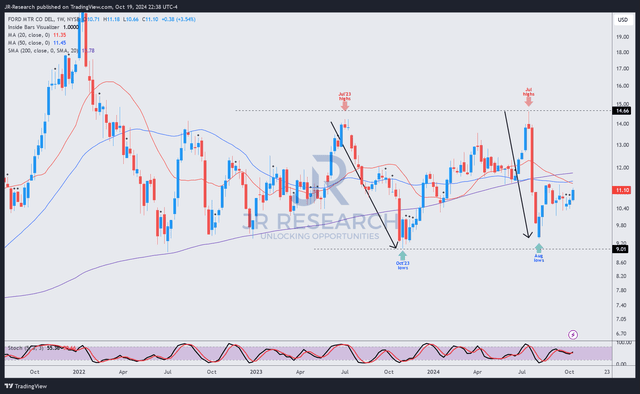

F price chart (weekly, medium-term, adjusted for dividends) (TradingView)

F’s price chart indicates the stock has been mired in an extended consolidation zone above the $9 support level, while buying advances have struggled above the $15 level.

Therefore, I observed robust dip-buying support at F’s October 2023 and August 2024 lows as investors loaded up. The stock’s attractive forward yields should help underpin its appeal, as the Fed is expected to lower interest rates through 2025. Therefore, I assess its $9 support zone should remain constructive, allowing more aggressive opportunities to add exposure.

F’s recent recovery from its August 2024 lows has remained resilient, notwithstanding its relative market underperformance. I assess that the market is likely looking for more proof points in Ford’s EV growth recovery before lifting its battered valuation further. Despite that, its risk/reward still looks attractive, although investors must be cautious about expecting market performance through 2025.

Rating: Maintain Buy (under review).

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!