Summary:

- Ford stock plummeted 12% after the Q2 earnings report, with investor focus firmly fixed on the notable increase in operating costs.

- At the core of Ford’s lackluster profitability in Q2 was higher warranty costs. In this analysis, I will explain what happened in Q2 and why I am moving past it.

- For the third consecutive year, Ford became the most-recalled automaker in the U.S. in 2023. This is a title Ford does not want.

- As a long-term-oriented investor, I am happy with Ford’s response to quality issues and I believe we will see substantially reduced warranty claims starting from 2025.

Vera Tikhonova

There are companies that keep on giving. And then there are companies that somehow find a way to hurt investors whenever things seem to be going smoothly. Ford Motor Company (NYSE:F), unfortunately, falls into the second category. Since I reiterated my buy rating on Ford last December, Ford stock had increased about 15% as of yesterday’s closing price before the Q2 earnings report, which failed to impress the market and analysts, triggered a selloff that saw F stock plummeting 12% in after-hours trading.

At the core of Ford’s lackluster profitability in Q2 was higher warranty costs. In this analysis, I will explain what happened in the second quarter and why I believe investors should move past this negative development.

Ford’s Warranty Issues In Q2

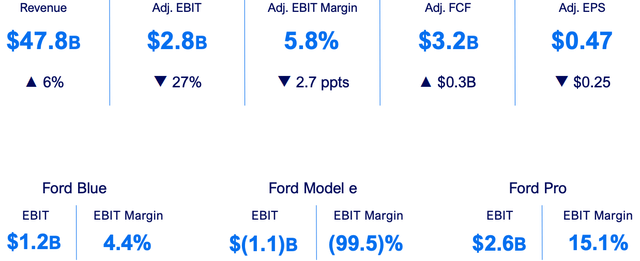

Ford missed earnings estimates for the second quarter, reporting earnings per share of $0.47 against expectations for $0.68. The EBIT margin declined to 5.8% from 8.5%, substantially below the comparable EBIT margin of 9.3% reported by arch-rival General Motors Company (GM) a couple of days ago.

In good news, Ford maintained its EBIT guidance for $10 billion to $12 billion for the current fiscal year. In even better news, the company boosted the free cash flow guidance by $1 billion. None of these, however, could stop the market selloff as investor focus was firmly fixed on the lackluster bottom line the company reported for Q2.

Exhibit 1: Ford’s Q2 financial performance highlights

Q2 presentation

A closer look at Q2 numbers reveals Ford’s profitability problem arose from a massive warranty charge.

During the Q2 earnings call, CEO Jim Farley revealed that warranty costs increased substantially during the quarter due to issues in older models and inflationary repair costs. CFO John Lawler told reporters that warranty costs increased by around $800 million in Q2 compared to the previous quarter. The bulk of the increase in warranty claims resulted from issues with a rear axle bolt in 2021 models and failed oil pump issues in 2016 models.

Elaborating on these issues, CFO John Lawler said:

These are issues that are popping up in the field on these older models. The largest one coming through is on a rear axle bolt for vehicles that were engineered for the 2021 model year was when they were introduced. And if these things come through, at a higher time in service, we’re made aware of them, we need to take care of our customers, we go out to fix them. And we have several of those types of things popping up on older models. We got a failed oil pump issue that’s popping up on, 2016-launched vehicles.

The increase in warranty claims underpins poor quality, no doubt, but as a long-term investor, I am more interested in the company’s response to this challenge.

Ford’s Response To Address The Increase In Warranty Claims

Long-term investors know that quality issues have been prevalent in many of Ford’s popular vehicle models. For the third consecutive year, Ford became the most-recalled automaker in the U.S. in 2023. This is a title Ford does not want to bear. The below table summarizes the vehicle recalls by auto manufacturers in 2023.

| Automaker | Number of recalls | Number of impacted vehicles |

| Ford | 56 | 5.9 million |

| Chrysler | 45 | 2.7 million |

| Mercedes-Benz | 31 | 478,173 |

| BMW | 30 | 332,954 |

| General Motors | 25 | 2 million |

| Nissan | 23 | 1.8 million |

| Kia | 21 | 3.1 million |

| Jaguar | 21 | 85,205 |

| Volkswagen | 20 | 452,762 |

Source: U.S. Department of Transportation

Ford’s track record is poor, and this is something that needs to change for the stock price to break the resistance around $15 and move higher in the long term.

Ford has taken several measures in the recent past to reduce warranty claims.

- The company is investing in advanced technologies and quality control processes to identify potential quality issues before vehicles are moved out from its plants.

- New Ford models are tested and validated using enhanced quality protocols such as extended real-world testing.

- Ford has started collaborating with its third-party component suppliers more actively to identify manufacturing defects in components at an early stage.

- The company has upgraded many of its software including the Body Control Module and Powertrain Control Module to rectify quality issues in vehicles, particularly EVs.

In addition to this, Ford also delayed the launch of many of its most awaited models, including the refreshed Bronco, Explorer, and Maverick, to conduct vigorous quality checks to minimize warranty claims in the future. According to sources, Ford’s advanced quality checks helped the company prevent recalls for the 2024 F-150 truck, saving substantial costs associated with warranty claims.

Overall, I believe these measures will significantly reduce warranty claims in the future, paving the way for Ford to finally emerge as a more reliable automaker. Ford has already made some progress on this front, with the company moving to 9th place in the J.D. Power Initial Quality Study last June from 23rd place in 2023.

Exhibit 2: 2024 J.D. Power Initial Quality Study

J.D. Power

As a long-term-oriented investor, I am happy with Ford’s response to quality issues, and I believe we will see substantially reduced warranty claims starting from 2025.

The Outlook Remains Bright

Ford performed reasonably well in Q2 but increased warranty claims took center stage, diverting investor attention to the notable rise in operating costs. Ford Blue recorded YoY revenue growth of 7% and volume growth of 3% in Q2, while Ford Pro revenues and volume were up 3% and 9%, respectively. Ford Model e, as expected, showed weakness with revenue declining 37% YoY amid broad pressures faced by the EV sector.

As I have highlighted in my previous articles, Ford’s electrification strategy which is centered around electrifying its popular trucks will help the company emerge as a big winner in the EV revolution by 2030. EV adoption in the U.S. has been lackluster compared to Europe and China, and the lack of availability of electric SUVs and trucks has played a major role here. Ford, in my opinion, is well-positioned to fill the market gap in the long run.

In addition to this, there are a few other reasons behind my bullish stance on the company.

- Ford’s expansion into the commercial market with its Pro segment will open new doors to grow.

- Improved vehicle quality will result in reduced warranty claims, paving the way for a major improvement in investor sentiment.

- The company’s expansion plans in the Middle East, Europe, and China also have encouraged me to remain bullish.

Takeaway

Investors were spooked by Ford’s Q2 report as increased warranty claims impacted the company’s profitability. In the face of adversity, I have decided to remain calm and bullish, given my belief Ford is making progress to eliminate abnormally high warranty claims in the future. Although the company is taking a hit by delaying new vehicle launches to focus on quality controls, I believe it is the right strategy to reward shareholders handsomely in the long run. Ford, once it gets out of the mess created by poor-quality vehicles, will be well-positioned to benefit from a notable expansion in valuation multiples.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of F either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.