Summary:

- Ford is shifting its focus from electric vehicles to hybrid vehicles due to challenging margins and consumer preference for hybrids over fully electric vehicles.

- The company has delayed the launch of new electric vehicles and cut back on production targets for the F-150 Lightning.

- Ford is expanding its Ford Pro segment, which focuses on software and electric commercial vehicles, and anticipates growth and margin expansion in this area.

fullvalue/E+ via Getty Images

Ford (NYSE:F) made a pivotal announcement on April 3, 2024, as the firm refocuses their attention to favor hybrid vehicles over electric. Despite the 80% sales growth for their recently released F-150 Lightning, challenging margins have encumbered the total business outlay and do not appear to be easing up. Given this shift towards in-demand vehicles, I believe Ford will experience stronger-than-forecasted tailwinds as they navigate through eFY24 and its challenging macroeconomic environment. I provide F shares a BUY recommendation with a price target of $15.14/share at eFY25 EV/aEBITDA.

Operations

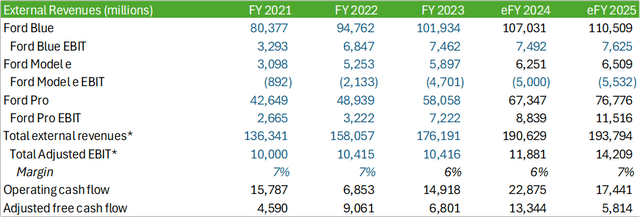

Ford is finally coming to their senses when it comes to electric vehicle adoption and scaling back and delaying new EV releases while prioritizing hybrid electric vehicles. As denoted in their Q4’23 earnings call, management is heavily focusing on rightsizing operations to meet the market demand while becoming more capital-disciplined. From FY22 to FY23, Ford’s EBIT loss for Model e worsened from a margin of -40.6% to -79.7% for a FY23 loss of -$4.7b. Considering that management had forecasted an EBIT loss in the range of $5-$5.5b for their electric vehicle segment, I believe that this is a prudent deployment of capital as consumers favor internal combustion and hybrids over fully electric.

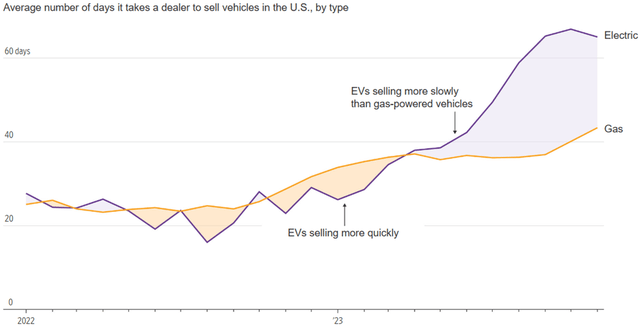

As a result of this, Ford delayed their second battery plant as they cut back on their ambitious F-150 Lightning production targets. Given Ford’s recently released Q1’24 vehicle sales release, it is clear that consumers favor hybrids as the step up from internal combustion. Ford reported that hybrid sales were up 42% y/y for Q1’24 with the Maverick hybrid growing by 77% y/y. The firm’s electric vehicle fleet grew significantly as well in lower volumes at 86% y/y. Despite reporting 80% growth in sales for the F-150 Lightning, management made the decision to make cuts at their Dearborn, Michigan F-150 Lightning facility. In addition to this, management pushed back the launch date of their all-new, three-row electric vehicles at their Oakville, Ontario assembly plant to 2027. This should allow Ford to curtail production in order to better manage inventory. Also, this should help Ford across other vectors, including managing pricing pressure at the dealership resulting from bloated inventory as well as improving overall business margins. I believe that this will also allow Ford the flexibility to refocus their electric vehicle fleet strategy to ensure that the electric vehicles produced are the right types of vehicles the market demands.

Wall Street Journal

On the Ford Pro side, Ford is expanding their Ohio Assembly Plant to produce their all-new electric commercial fleet and anticipates production beginning mid-decade. I believe that Ford’s refocusing of their EV efforts primarily to Ford Pro is a strong strategic move, as demand for these vehicles may fall under corporate and government ESG-related mandates. This moat should allow Ford to have the flexibility to control more of the costs for the less cost-conscious consumers. As alluded to in their FY23 earnings call, bigger ICE vehicles result in stronger margins and bigger EVs result in tighter margins due to battery costs. I believe that commercial customers will be more open to paying a premium for EVs over retail customers as commercial customers are expected to better understand the utility as a result of the battery costs vs. judging the cost on the visuals.

I anticipate Ford Pro to drive both growth and margin expansion going forward as the firm enhances their software subscription offerings. Ford plans on significantly enhancing their vehicle offerings for this segment by making more new vehicles connected, which I believe will allow for a stronger software attachment rate as well as faster and higher-quality maintenance. Management hinted that they are developing predictive maintenance features to detect when various components are reaching end-of-life in their fleet, which should drive continued strength for the segment as it will minimize the risk of downtime for the vehicle owner. Ford Pro has a strong market share of 40% for Class 1-7 full-sized trucks and vans. As the firm transitions the fleet to all electric offerings, I believe that the firm’s market share will continue to grow.

Looking ahead to growth, management anticipates flat-to-modest growth in US automotive sales in the range of 16-16.5mm vehicles. Management also anticipates strength in their Ford Pro segment as they roll out their new Super Duty, which should result in positive pricing and mix for the Pro segment. Management did note that their cost-savings initiatives that are expected to save $2b in eFY24 will be offset by losses in their electric vehicle fleet. This information may be dated as it was released during their presentation with Bank of America at their 2024 Automotive Summit. I believe that since announcing curtailment of their electric vehicle production, Ford may experience some additional cost tailwinds paired with potential pricing tailwinds if demand for the remaining electric vehicles produced remains strong.

I do believe that there may be challenges for Ford in the future as the firm redirects their next line of electric vehicles to smaller, more compact cars. As mentioned in their April 3, 2024 press release, their hybrid trucks and SUVs drove the best-ever quarterly hybrid sales record. Though vehicle preferences may be regional, I believe that consumers lean more towards SUVs and CUVs over smaller sedans. For this reason, I believe that the smaller EV fleet might face challenges when launched, despite the lower cost structure.

Financials

Corporate Reports

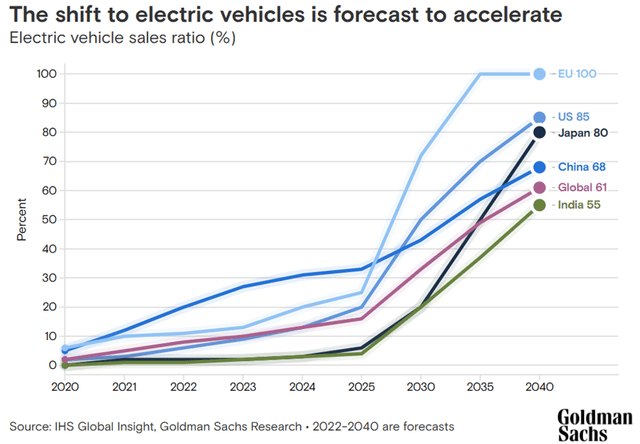

Looking to financials, I anticipate Ford to experience strength in eFY24 as the firm refreshes their F-150 and Maverick. I believe that the firm refocusing efforts on their hybrid fleet will benefit the firm in both revenue growth and margin expansion. I believe Ford Pro will also create some tailwinds as the commercial fleet becomes more connected, offers growing software services, and enables more readily available servicing offerings. I do believe EVs will experience continued revenue growth; however, I do anticipate pricing headwinds to persist, deteriorating EBIT margins for the segment. Though I do believe that there will be a shift to electric vehicles, I do not expect there to be as much urgency from consumers as with commercial customers. I do anticipate free cash flow to be bolstered as a result of their mix shift in eFY24; however, I do expect this figure to decline as the firm reengages the EV segment in anticipation of a ramp in production in CY26-27.

Goldman Sachs

Valuation & Shareholder Value

Corporate Reports

For shareholder value, management maintained the $0.15/share quarterly dividend with the addition of an $0.18/share special dividend. I believe that the dividend rate for the next cycle has room to improve, as I expect some margin expansion as a result of the expansion of Ford Pro and the slower progress towards total electrification. Management is currently targeting paying out 40-50% of free cash flow to shareholders through dividends with the addition of buybacks. I believe this poses as a relatively appealing return, as the trailing dividend rate yields just shy of 6%.

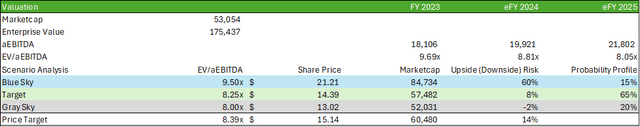

F shares are currently trading at 9.69x EV/aEBITDA, which I believe is priced well in the market. Given my financial forecast, I expect Ford to have the flexibility for margin expansion as they reduce their EV exposure and bolster their higher margin hybrid fleet. I do anticipate some contraction in eFY25 as hybrids begin to reemerge; however, I do believe F shares are undervalued, given the forecasted growth. I provide F a BUY recommendation with a price target of $15.14/share at 8.39x eFY25 EV/aEBITDA.

Corporate Reports

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.