Summary:

- Ford’s stock has underperformed, shedding nearly 50% from 2022 highs and lagging behind General Motors.

- Ford offers a robust 4.3% dividend yield, providing an appealing income opportunity for investors.

- Ford plans to utilize its free cash flow primarily for special dividends, with no current plans for stock buybacks, aligning with the Ford family’s preference for income over reducing share.

- Strategic cost cuts and a diversified model, including Ford Pro operations, aim to enhance profitability.

- Plans to improve production efficiency and capture demand for trucks and hybrids support potential profitability and returns.

JHVEPhoto/iStock Editorial via Getty Images

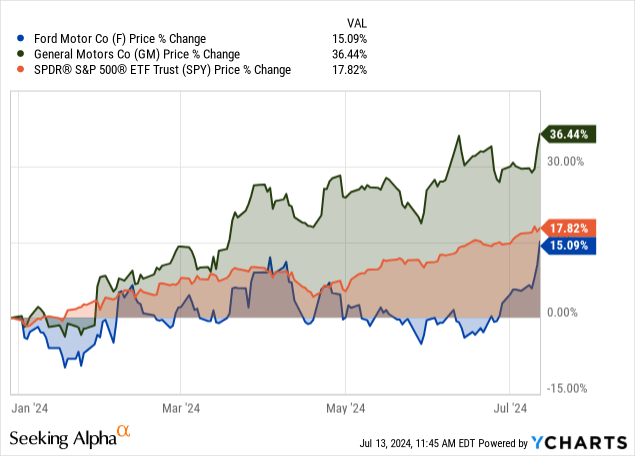

Investment Thesis

Ford Motor Company (NYSE:F) is one stock that has struggled to live up to expectations compared to other stocks in the auto industry. The stock has shed nearly 50% in market value from its 2022 highs of around $26 per share. Likewise, the stock has traded for less than $15 per share over the past two years, returning 15% year to date, compared to General Motors Company’s (GM) outperformance at 36%, well above the index. This performance differential concerns how these two companies return value to their shareholders, and it’s just hammering Ford.

Ford Motor Company has navigated a challenging period marked by increased ownership costs, decreased affordability, and supply chain disruptions. While the stock has underperformed the S&P 500, it has delivered a respectable return of 28%, including dividends, since my last coverage in April 2022. The automotive industry, including Ford, is recovering as the significant headwinds started to subside since COVID-19. The supply chain has improved, pent-up demand is being realized, and there is greater cost absorption at the customer level. These factors are setting a foundation for a more stable and profitable future.

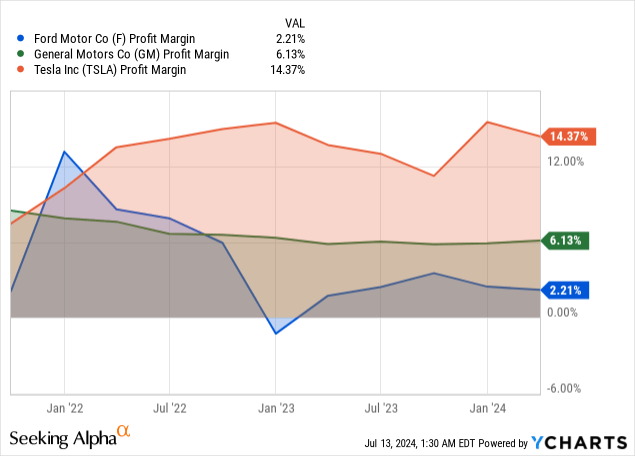

Ford’s profit margins, previously in negative territory, have shown significant improvement. This turnaround is driven by the company’s strategic initiatives to enhance production efficiency, reduce operational costs, and focus on high-demand segments such as trucks and hybrid vehicles. Even with EV business-related drag, a diversified Ford model—powered by its profitable Ford Pro operations—and strategic cost cuts look to support improved financial performance for the company.

Despite these positive developments and the attractive valuation and dividend yield, the macroeconomic environment and Ford’s company risk profile remain high. The escalating US-China economic conflict, significant debt levels, and competitive pressures pose substantial risks. Given these risks, I assign F a hold rating, considering the balance of its current undervaluation metrics and the significant challenges ahead.

Ford’s Profitability Struggles: Can Dividends Compete with GM’s Buybacks?

Ford still needs to achieve significant profitability to finance dividends rivaling GM’s buybacks. Its free cash flow nest is under pressure more than ever, having shrunk from $2 billion as of the end of last year to negative $500 million; the drop reflects the effects of working capital from a 60,000 vehicles inventory slated for shipping in the second quarter. Nevertheless, the company remains in a solid financial position with $25 billion in cash and nearly $43 billion in liquidity as of Q1, 2024.

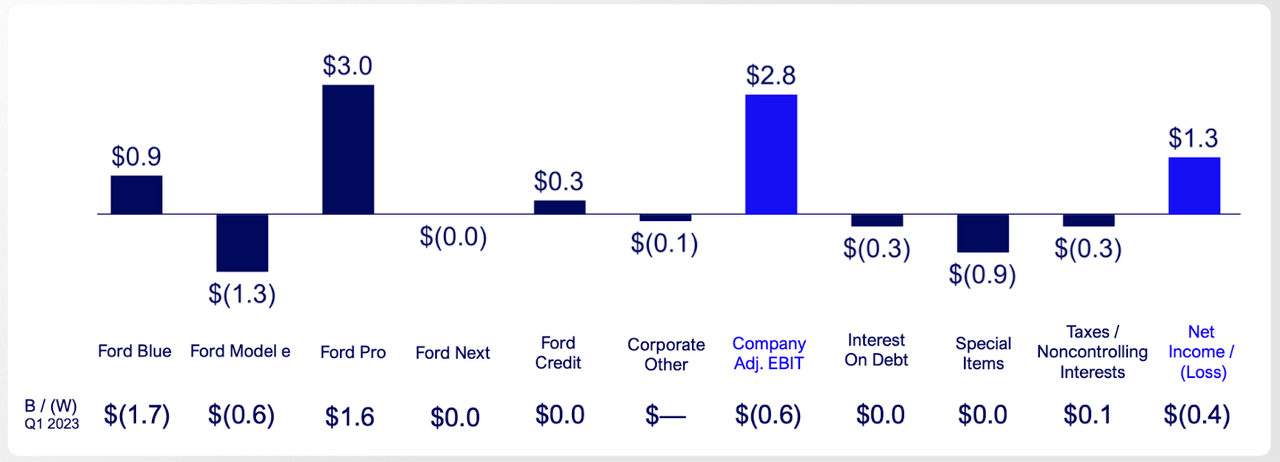

For Ford’s stock price to achieve substantial gains like those seen by General Motors and Tesla, Inc. (TSLA), its top competitors, the company must do more than rely on dividends. Its profit margins currently languish at 2.21% compared to 6.93% for General Motors, as the company is incurring more costs, making it challenging to generate significant free cash flow to return value to shareholders. The company’s margins were still under pressure in the first quarter of the year as adjusted EBIT fell 18% yearly to $2.8 billion as adjusted EBIT margin fell by 1.7 points to 6.5%.

Nevertheless, the company has already begun to bolster its profit margins. It has already confirmed plans to cut its costs by $2 billion. The cost cut will affect some programs, including its cars’ automated parallel parking feature. Additionally, the company is targeting cost reductions by changing car designs and other real-time technologies that were unpopular among users.

The company plans to significantly change the complexity of vehicle designs while cutting the number of hours used to develop cars to reduce labor costs. Automation is one aspect of manufacturing that the automaker plans to enhance to lower production costs. In addition, the company is targeting cuts in the materials used in manufacturing, freight, and the overall manufacturing process.

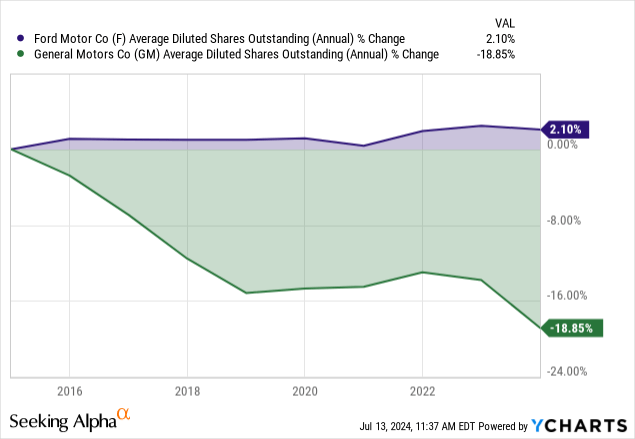

GM vs. Ford: Buybacks and Dividends Fuel Investor Sentiment

While General Motors has prioritized both buybacks and dividend payments, Ford has focused solely on dividends and avoided buybacks. General Motors has already completed a $16 billion buyback, which has reduced the number of shares in circulation.

While General Motors rewarded investors with $2.62 adjusted EPS in the first quarter, Ford merely paid shareholders 49 cents a share. The difference in earnings return is just one factor strengthening General Motors’s sentiment among investors relative to Ford.

Notably, General Motors has already confirmed a new $6 billion buyback exercise as part of its commitment to returning value to investors. The automotive giant is now turning its focus on heavy EV investments and catching up with Tesla. Buybacks and a 0.98% dividend yield have gone a long way in boosting GM sentiment in the market, bolstering its resilience and, therefore, driving the stock higher.

In contrast, Ford has always had a policy against stock buyback programs, since the Ford family still maintains about 40% of the company’s voting power. Considering that the broader Ford family is content with dividends, given the yield of around 4.3%, it is unlikely that they would be willing to reduce their holdings by accepting buybacks. Ford has already committed to distributing 40% to 50% of its annual free cash flow as special dividends. The Ford family holds many shares and focuses on a bigger payoff than approving buybacks.

Instead of resorting to buybacks, Ford is expected to offer more special dividends, with its free cash flow expected to rise to $21 billion over the next three years. Even if the company spent up to 50% or $10 billion on dividends over the next three years, it would still lag GM, which has already spent $16 and is planning to spend an additional $6 billion on buybacks.

Ford Faces Tough Road Ahead: Trimming EV Losses to Boost Free Cash Flow

For Ford to achieve the $21 billion in free cash flow it is targeting, it will have to control losses and trim operational costs in its electric vehicle sector. Model e, the EV division, incurred a loss of $1.3 billion in the first quarter. The unit has struggled to achieve scale and turn in consistent profits.

Consequently, Ford has been forced to rely on its Ford Pro division, which produces trucks, vans, and other commercial vehicles. To mitigate losses in electric vehicle production, Ford has confirmed plans to reduce spending in its EV division, down to $5.5 billion for model e. Amid the reduced spending, the company has already reduced its capital spending for the year to between $8 billion and $9 billion from an initial guidance of between $8 billion and $9.5 billion.

The electric vehicle unit achieved a 12% year-over-year revenue increase in 2023 to $5.9 billion, while the unit incurred a loss of $4.7 billion. With the EV unit facing its issues, management was forced to postpone $12 billion in EV manufacturing investments as it slowed down demand in the segment and faced stiff competition from Tesla. Lastly, the company insists consumers are not ready to pay a premium price for EVs over internal combustion or hybrid cars.

Amid the strong demand for the company’s F trucks, the automaker is projecting earnings before interest and taxes between $10 billion and $12 billion. It also expects free cash flow to range between $6.5 billion and $7.5 billion, despite shrinking to negative $500 million in the first quarter.

Ford Rides High on Truck Sales and Growing US Car Demand

Even as Ford focuses on reducing production and operational costs to try and boost its margins, it remains well positioned to benefit from increased spending on cars by Americans. Bank of America (BAC) Analyst John Murphy expects Americans to purchase 16 million vehicles in 2024, up from 15.5 million purchased last year.

In the first three months of the year, the company registered a 7% increase in unit sales, and hybrid sales increased 42%. The increase was the catalyst behind the company’s 3% revenue increase to $42.8 billion.

While average car prices declined by 3% in the second quarter, Ford registered a 1% year-over-year increase in overall sales volumes. The increase was driven mainly by the company’s trucks, which experienced a 5% volume increase. In addition, sales of the company’s flagship F Series truck increased 30% to 199,463 as the company ramped up production of the new F 150 truck.

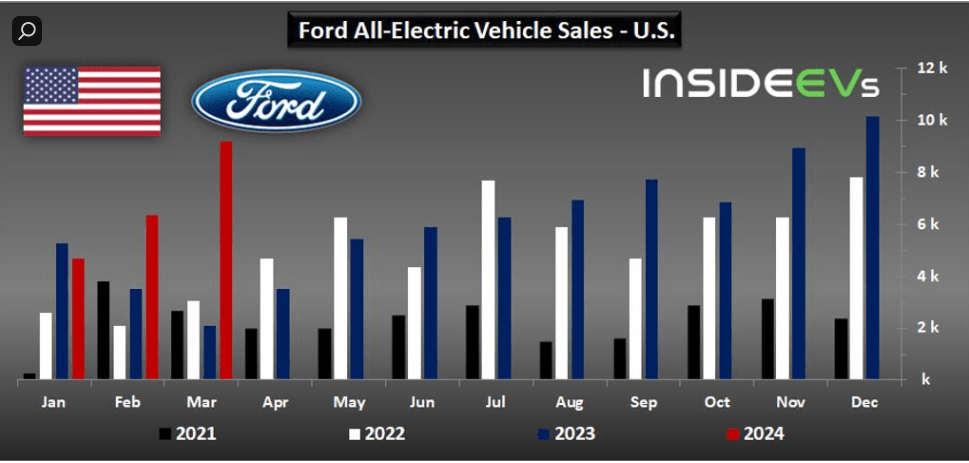

insideevs.com

Ford’s Stock: Undervalued Potential Meets Market Risks and Rewards

Ford stock has risen about 15% this year, and its current price-to-earnings multiple of 14.46 suggests it may still be undervalued. Similarly, Ford trades at a P/S ratio of 0.32, close to its 5-year average but well below the sector median of 0.92. The analysts’ EPS estimate 2024 midpoint is $2.02, supporting a forward P/E multiple of 6.9. If the company can deliver on its promises and expand margins, its stock could trade between $14-$20, based on a P/E multiple of approximately 7x-10x. However, this optimistic scenario depends on the macroeconomic environment and the company’s successful turnaround progress.

Ford’s improving fundamentals, together with solid trends in vehicle sales in the US, have the potential to act as catalysts that enable the company to deliver financial results better than expectations over the coming quarters, deserving a much better valuation. However, automakers such as Ford have to face rub-off pressure from stiff competition posited by General Motors, Stellantis, Toyota Motor, and Tesla, which could impact their growth metrics concerning vehicle sales.

While the newly introduced 100% tariffs on Chinese EVs, in place to protect American companies, might not have that much of an impact in the short term, there easily could be long-term consequences as Chinese companies find ways to circumvent these barriers or come to dominate other global markets. Additionally, Ford stands on poor financial footing, with an Altman Z-score of 1.08, so high indebtedness—$126 billion net debt—leads to high interest costs and lower financial flexibility. While there has been some recent recovery, margins are still under pressure, particularly in Ford Blue and Ford E. A deepening US-China economic battle could raise the price at which US consumers can purchase products, thus cutting into their purchasing power to Ford’s detriment.

The Chinese may also begin favoring their domestic brands more and more. The near 1-year low dividend yield might keep income seekers at bay. Ford’s performance is linked with general economic conditions, putting it at risk from more significant economic downturns. Therefore, the risk profile remains high due to these factors, although recent insider buying actions have shown some confidence in the stock.

Bottom Line

Undoubtedly, Ford has paid the price of focusing on dividends at the expense of buybacks or both over the years. While the stock’s gains in the market have been limited, it appears to be trading at a discount based on revenue and earnings growth in the first quarter. With the company trimming its capital expenditure and moving to grow its free cash flow, it should be a solid play for any investor looking to profit from the lucrative 4.3% dividend yield. However, caution is needed amidst the challenging macro environment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.