Summary:

- T stock appears to be attractive on the surface due to its high dividend yield and low payout ratio.

- However, we reveal three reasons why investors would be better served by steering clear of the stock for now.

- We also share two near 10% yielding dividend growers that are far better alternatives.

olm26250

AT&T Inc. (NYSE:T), a prominent player in the telecommunications industry, may appear to be an attractive investment option for retirees seeking passive income due to its substantial dividend yield supported by seemingly stable cash flow. However, after closer investigation, we believe that investors would be better served by steering clear of T stock and investing in two other high-yielding alternatives in Energy Transfer (ET) and Atlantica Sustainable Infrastructure (AY) to meet their passive income needs. In this article, we will look at three reasons why T is a poor passive income investment and why ET and AY are much better choices.

1. Weak Dividend Outlook

While T’s 6.9% dividend yield initially looks appealing – especially with a low payout ratio of 46.1% expected in 2023 – its outlook is quite weak.

First and foremost, T’s heavily leveraged balance sheet in an elevated interest rate environment is forcing management to focus on debt reduction instead of growing its dividend and ultimately making its margin of safety much smaller than its relatively low payout ratio implies.

Second, the ongoing Justice Department and EPA investigation into telecom companies, including AT&T, adds an element of uncertainty to the dividend’s sustainability as the potential fallout could be disastrous for the company, or it could be very minimal. Moreover, the CEO’s relatively evasive response when questioned by analysts about this issue and how it may impact the sustainability of their dividend on the Q2 earnings call further fuels our concerns about the dividend’s medium to long-term outlook.

Third, the telecom sector’s rapidly evolving nature requires continuous investment in infrastructure in order to remain competitive, limiting T’s ability to expand its profit margins and thereby impacting its long-term return on invested capital and assets. Moreover, it also pressures T’s free cash flow generation, thereby reducing its ability to grow its dividend aggressively.

Last, but not least, with analysts forecasting annual dividend increases of less than 1% for the foreseeable future, AT&T’s dividend growth will very likely lag far behind inflation, meaning that investors who depend on dividend income for meeting living expenses will see their purchasing power decline over time with an investment in T.

2. Poor Management Track Record

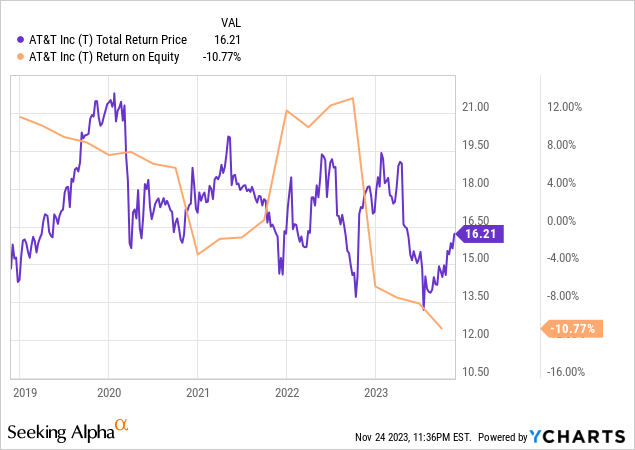

Another big reason to be wary of investing in T stock right now is that its management has an abysmal track record. Over the past half decade, T has generated very poor returns on equity for shareholders while also generating very weak total returns in spite of its hefty dividend payouts:

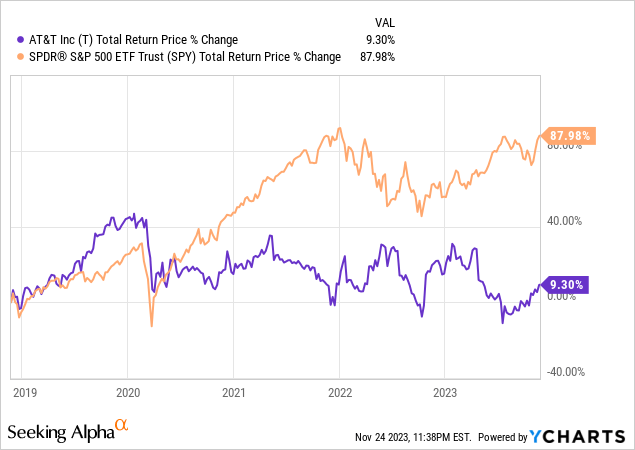

Over this period, T has generated mostly single-digits or even negative returns on equity, with an occasional jump into the low teens. Meanwhile, it has generated an annualized total return of less than 1.8% over that period of time, massively lagging behind the S&P 500 (SPY):

This underperformance is particularly concerning given the company’s strategy of incurring high debt levels to fuel growth as it means that the company’s risk-adjusted returns are even weaker than its headline total return indicates. Additionally, AT&T’s history of making ill-fated acquisitions – such as DirecTV – has not only destroyed shareholder value but has also strained the balance sheet, leading to a fairly recent dividend cut.

Moreover, T lacks a distinct competitive edge in an industry characterized by high commoditization and intense competition, meaning that it will always have a difficult time generating attractive returns on invested capital while also having to invest heavily into its business, thereby creating the likelihood that it will continue to be a relatively poor wealth compounder.

3. Unimpressive Valuation

Last, but not least, T stock is not a particularly compelling investment at the moment because its valuation is nothing to get excited about. Its EV/EBITDA multiple of 6.46x is right in line with its historical average of 6.44x, meaning that it is likely not undervalued, despite interest rates being at relatively elevated levels and T’s growth outlook being quite poor.

When combining T’s weak growth outlook, limited valuation multiple expansion potential, poor recent fundamental performance, and good but not great dividend yield, there is little reason to believe that T stock will be a meaningful outperformer in the future. As a result, investors may want to steer clear of the stock in favor of better alternatives.

For example, both ET and AY offer investors a much better chance of generating outsized total returns along with much better current income and long-term income growth for the following reasons:

1. Solid Dividend Growth Outlooks

While T’s dividend likely will barely inch forward in the coming years, ET’s distribution is set to grow at a solid 3-5% CAGR for the foreseeable future thanks to the facts that it has:

- a recently deleveraged balance sheet that is already near the low end of its target range and likely to move even lower moving forward.

- the potential to start a unit buyback program in the near future.

- a well-diversified and defensive business model that generates stable cash flows.

- significant (~1.9x) distributable cash flow coverage of its current distribution.

- a substantial growth investment pipeline consisting of growth projects, opportunistic M&A (most recently involving the acquisition of Crestwood Equity Partners (CEQP)), and a potential major boon to the business from its ongoing Lake Charles project.

Analysts seem to agree, forecasting a 4.3% distribution CAGR through 2027 for ET.

Meanwhile, analysts see AY’s dividend growing at a 2.5% CAGR through 2026 due to strong sector tailwinds for the renewable power sector as well as AY’s built-in contractual escalators on its power purchase agreements, including significant indexation to inflation. While growth is currently slowing due to an elevated cost of capital environment and AY’s ongoing strategic review, AY is still finding ways to adapt and generate strong returns on the investments that it makes. This, coupled with almost all of its revenues being contracted or regulated, with an average contract life of 13 years remaining, provides stable cash flow for shareholders, underpinning a solid dividend growth outlook that is still more than double what analysts forecast for T and likely to keep pace with inflation’s long-term average pace.

2. Decent Management Track Records

While neither ET nor AY is likely to be found on shortlists for the best-run companies in the world, both management teams have taken prudent approaches to managing their balance sheets in recent years, providing a stark contrast to T.

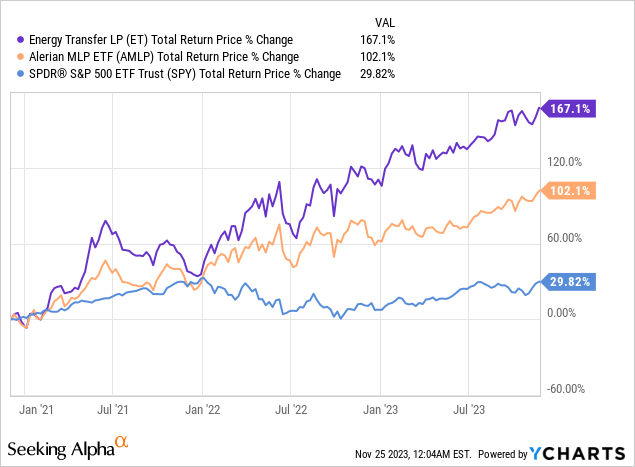

For example, ET’s management has shown a strategic shift towards a lower-risk model as evidenced by their aggressive approach to deleveraging and recent credit rating upgrade. As a result, ET stock has been a massive outperformer of both the S&P 500 and the midstream sector (AMLP) since we added it to our portfolio in late 2020:

Meanwhile, AY stands out relative to renewable yield company peers like NextEra Energy Partners (NEP) for its prudent approach to its balance sheet management. While NEP is trying to deal with substantial convertible equity portfolio financings, corporate debt maturities, and convertible debt maturities over the next several years in a high-interest rate environment, AY has no CEPFs nor convertible debt maturities to deal with, and relatively little corporate debt.

Most of its debt is non-recourse, project-level debt that self-amortizes over the life of its power purchase agreements, giving it a much simpler and lower-risk business profile. While not as flashy during periods with a low cost of capital and unlikely to spur robust dividend growth, it has put the company’s current dividend and dividend growth on a much firmer foundation.

Moreover, management is currently engaged in a strategic review process in which it is trying to find ways to unlock additional value for shareholders. We think this will likely result in a sale of the business outright alongside its largest shareholder Algonquin Power & Utilities (AQN) selling its renewable assets or AY potentially bringing on a sponsor that will help drive a higher growth rate and more attractive cost of capital for the company. Either way, AY’s management has proven to be both a prudent capital allocator as well as one that shows concern for maximizing shareholder value over the long term.

3. Attractive Valuations

Last, but not least, both ET and AY trade at very attractive valuations. ET’s and AY’s NTM distribution/dividend yields are both just shy of 10% and their EV/EBITDA multiples are also quite attractive. AY’s current EV/EBITDA multiple of 8.9x is well below its historical average of 10.3x and also is well below that of its peers. For example, Clearway Energy (CWEN.A)(CWEN) – which has an even lower credit rating than AY – has an EV/EBITDA of 10.6x at the moment.

ET for its part, has an EV/EBITDA multiple of 7.4x that is well below its historical average of 11.4x, and is also well below that of many of its peers. For example, MPLX (MPLX) – which has a similar credit rating to ET and an asset portfolio and distribution growth outlook that is not better and arguably weaker than ET’s – has an EV/EBITDA multiple of 9.0x.

Investor Takeaway

Despite T’s initial appeal as a high-yield stock with a relatively low payout ratio, a deeper analysis reveals that investors are better served by steering clear and investing in superior and higher-yielding investment alternatives. T stock faces numerous challenges such as a weak dividend outlook, high leverage, regulatory uncertainties, and a poor management track record, whereas, ET and AY offer solid dividend growth prospects, better management track records, and more attractive valuations, including NTM distribution yields that are ~300 basis points higher than T’s is at present.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ET, AQN, AY, CWEN.A, NEP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Our Biggest Sale of the Year is Here!

For a Limited-Time – You can join Seeking Alpha’s #1 rated community of high yield investors at the Lowest-Rate-Ever-Offered.

Try it Free for 2-Weeks. If you don’t like it, we won’t charge you a penny! We have over 150 five-star reviews from happy members who are already profiting from our high-yield strategies.

We spend 1000s of hours and over $100,000 per year researching the market for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.