Summary:

- LOW lags behind HD in professional customer market share, despite commendable progress in enhancing retail fundamentals and omnichannel approach.

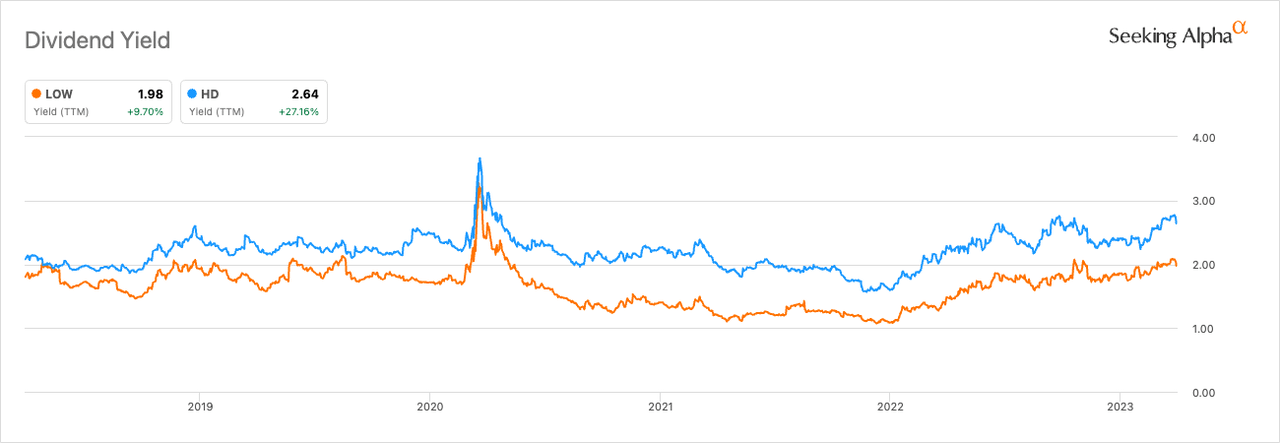

- LOW dividend yield is lower than HD’s but still quite safe, with potential for dividend growth in the future.

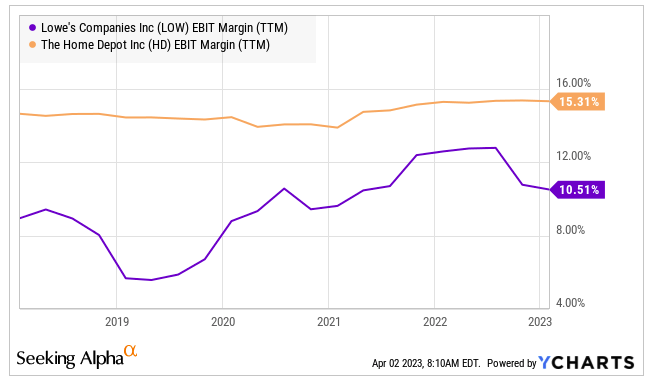

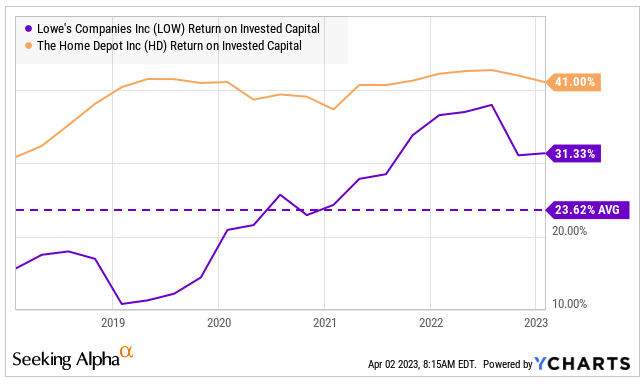

- Despite LOW improvements in margin and capital deployment, HD still boasts a higher returns.

- HD’s shares are currently trading at a larger discount than LOW.

marekuliasz/iStock Editorial via Getty Images

Lowe’s Companies Inc. (NYSE:LOW) has shown significant improvement in its growth and margin strategy in recent years. Despite these advancements, I believe that The Home Depot (NYSE:HD) remains a better investment opportunity for four primary reasons detailed in this article. We will explore LOW current market position, growth opportunities, and strategies, as well as how they compare to HD’s performance. While LOW has made commendable progress in enhancing its retail fundamentals and embracing an omnichannel approach, it still lags behind HD in key areas such as professional customer market share, omnichannel presence, dividend yield, and share valuation. For a more detailed analysis specifically on HD, you can read my article here.

Company Overview

LOW is a leading home improvement retailer, operating more than 1,700 stores across the US. Founded in 1946, LOW offers a wide range of products and services for home improvement, including appliances, tools, paint, lumber, electrical, plumbing, and hardware. LOW caters to both do-it-yourself (DIY) and professional customers, offering quality products and exceptional customer service.

Growth Opportunities and Strategies

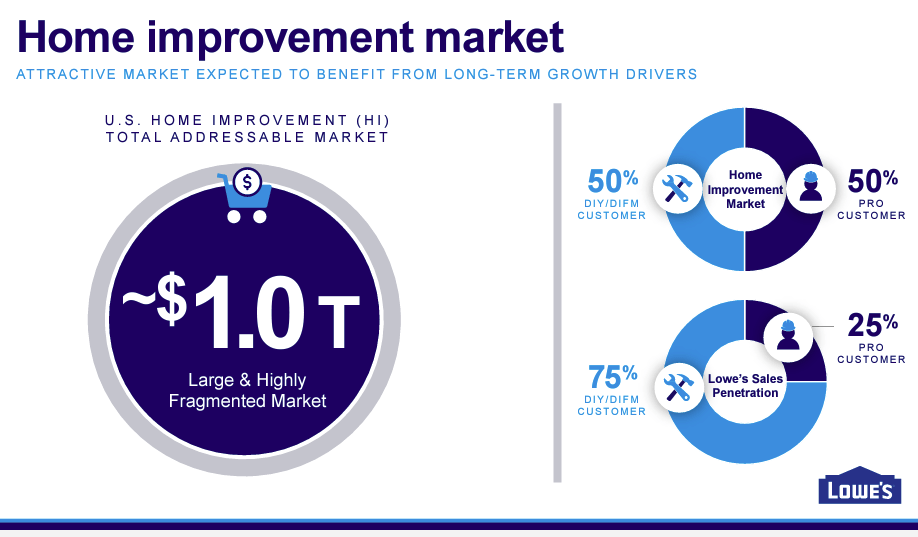

LOW is well-positioned to capitalize on the growing demand for home improvement products and services. LOW estimates its addressable market to be $1 trillion, and LOW, as the second-largest global home improvement retailer behind HD, can gain incremental market share through its extensive distribution network and economies of scale.

Company presentation

After listening to LOW’s 2022 Analyst Conference, I don’t believe that LOW will gain significant market share in the professional segment, as HD’s strategy in this area appears more robust. Furthermore, LOW’s strategy focuses more on enhancing merchandising and optimizing the supply chain rather than catering to the specific demands of professional customers. I anticipate that LOW will continue to have a smaller presence among professional customers, while HD maintains or gains market share. However, I do expect LOW initiatives to strengthen its brand, driving additional same-store sales growth from DIY and DIFM customers and expanding operating margins over the next decade.

Following are the four reasons why I still prefer HD over LOW:

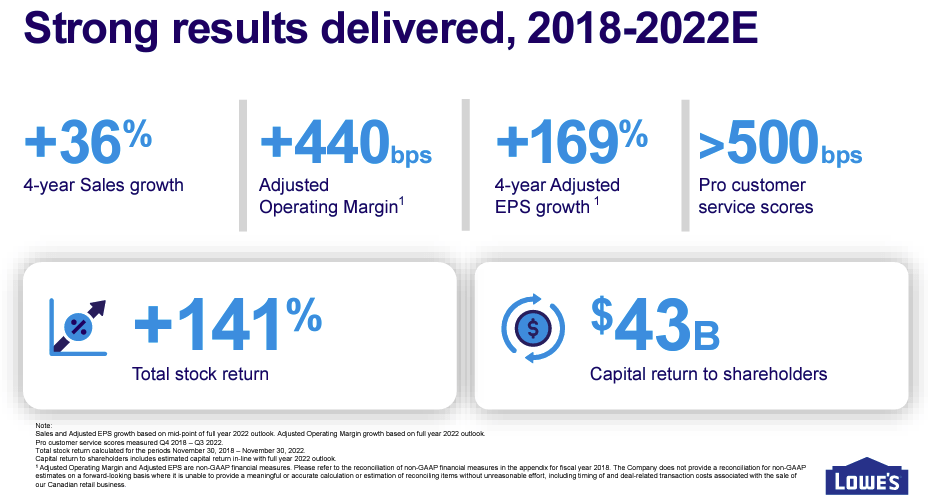

Reason #1: Enhancements Yield Higher Returns, but Still Fall Short of Outperforming HD

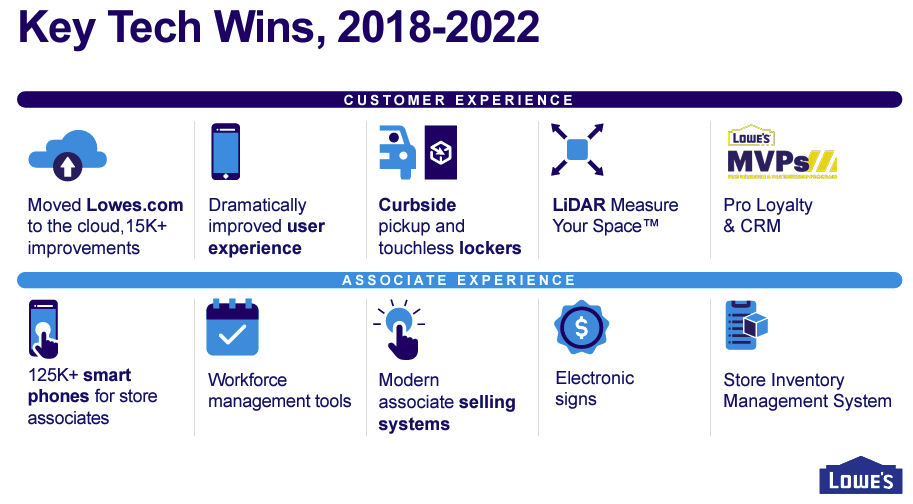

From 2018 to 2020, LOW concentrated on enhancing its retail fundamentals by upgrading its operating capabilities. This strategy has been successful, as revenues have grown by 36% and operating margins have improved by 440 basis points.

Company presentation

However, despite this improvement, LOW’s margin remains 500 basis points lower than HD’s.

Ycharts

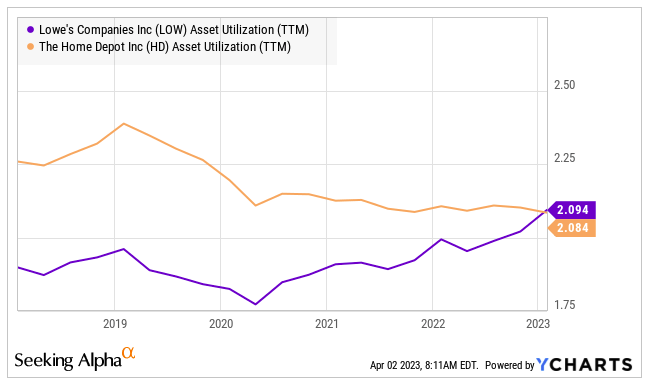

On a positive note, I believe that the technological advancements and network expansion have brought LOW asset turnover to a similar level as HD’s.

Ycharts

Over the years, the digital experience has dramatically improved as LOW moved to an omnichannel strategy accelerated by the COVID-pandemic.

Company presentation

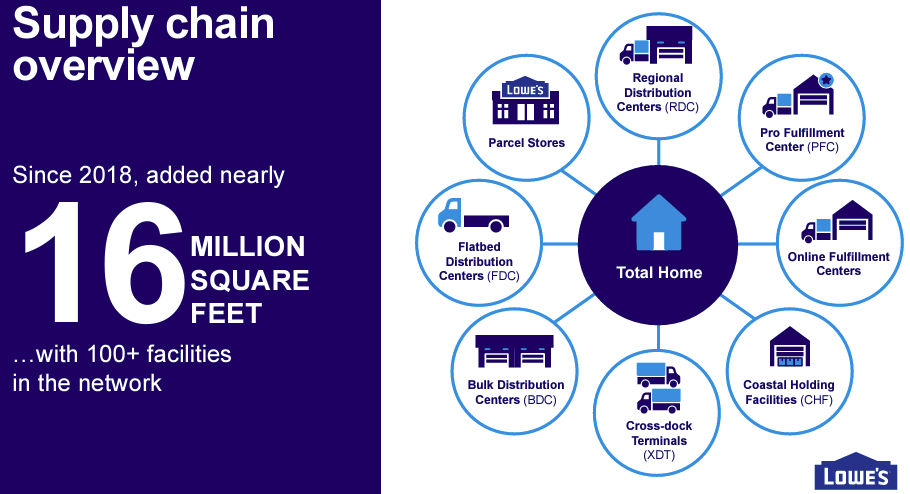

The increased capillary of the supply chain by 16 million square feet with more than 100 facilities, has improved operational efficiency.

Company presentation

I think these improvements in asset turnover and margin are sustainable, and we can expect returns higher than the cost of capital in the medium term, although still lower than HD’s.

Ycharts

Reason #2: Lower Omnichannel Presence

LOW and HD have both recognized the importance of a strong omnichannel strategy in today’s retail landscape. By creating seamless shopping experiences across multiple channels, they have managed to stay ahead of their competitors, especially smaller retailers that struggle to match their pricing advantages and broad product offerings.

LOW has made significant strides in its omnichannel approach by investing in a ground-up technology architecture that aims to provide a smooth and consistent experience across various touchpoints, such as in-store, online, and contact centers. This investment has paid off, with around 60% of LOW’s e-commerce transactions being ordered online and picked up in-store. Furthermore, LOW has partnered with Instacart to offer same-day delivery services in select locations. HD has also prioritized its omnichannel capabilities, with 66% of its customers opting for the convenience of ordering online and picking up at a store. Comparing the two companies’ omnichannel strategies, it is evident that they have both invested heavily in digital transformation and customer-centric services. While LOW has made significant progress in building a robust omnichannel presence, HD’s slightly higher percentage of customers utilizing its online-to-store services indicates that it has a slight edge in this area.

Reason #3: Lower Dividend Yield

On March 24, 2023, LOW announced a quarterly dividend of $1.05 per share, consistent with previous declarations. The dividend yield for LOW is currently at 2%, which is 65 basis points lower than HD. Despite this difference, I believe the dividend is quite safe. At present, the dividend costs LOW $1.9 billion, while I project the medium-term free cash flow to be between $3.8 and $5.2 billion. This leaves ample room for potential dividend growth in the future.

Reason #4: While LOW shares are trading at a 3% discount, HD’s is trading at a 17% discount

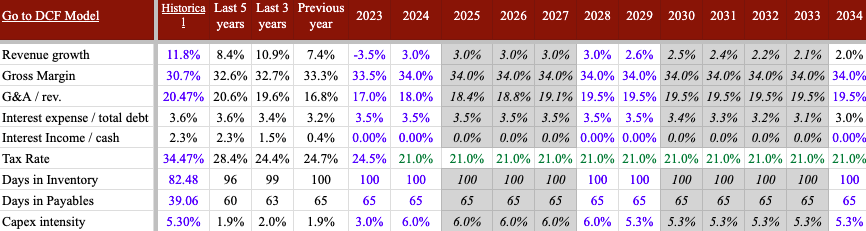

I value LOW’s shares at $205 based on a DCF analysis. In my calculations, I used a cost of capital of 7.2%, which is derived from an unlevered beta of 1.19 for the industry. My revenue growth expectations for the medium term stand at around 3%, supported by the initiatives discussed in this article. Additionally, I anticipate that the margin improvements will be sustainable over the medium term. The main assumptions for my analysis are as follows:

Author estimates & company filings

This valuation contrasts with HD, which is currently trading at a 17% discount to its fair value, as detailed in my previous analysis.

Conclusion

LOW has demonstrated substantial growth and improvement in its margin strategy in recent years. However, when comparing LOW to HD, I believe that HD remains a better investment opportunity. Although LOW has made significant strides in enhancing retail fundamentals and adopting an omnichannel approach, it still falls short in key areas such as professional customer market share and omnichannel presence.

While LOW has the potential to strengthen its brand and expand operating margins through ongoing initiatives, HD’s more robust strategy in the professional segment, a slight edge in omnichannel presence, higher dividend yield, and larger discount in share valuation make it a more attractive investment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.