Summary:

- The American Tower Corporation is a top cell tower REIT in the United States with essential assets for the modern economy and successful management.

- The company offers a decent yield, high expected dividend growth, and a resilient business model against long-term threats like satellite communications.

- The stock is a perfect fit for a portfolio seeking growth and better long-term risk/reward compared to slower-growing REITs.

hachiware/iStock via Getty Images

Introduction

Very recently, I wrote an article covering real estate giant AvalonBay Communities (AVB), the nation’s largest residential REIT. In that article, I noted that despite its valuation and attractive business model, I prefer REITs that come with more growth and a better long-term risk/reward. One of these companies is the American Tower Corporation (NYSE:AMT), the biggest cell tower REIT in the United States.

In this article, I will explain why I put this stock on my watchlist, as it’s the perfect fit for my portfolio. Not only does the company operate assets that are essential to the modern economy, but it also manages these assets highly successfully. The company has a decent yield, high (expected) dividend growth, and a business model capable of resisting long-term threads like satellite communications.

So, let’s dive into the details!

A Perfect Business With Value And Growth

As I often explain in articles, a lot of REITs have decent yields but very slow growth, causing them to underperform the market by a wide margin.

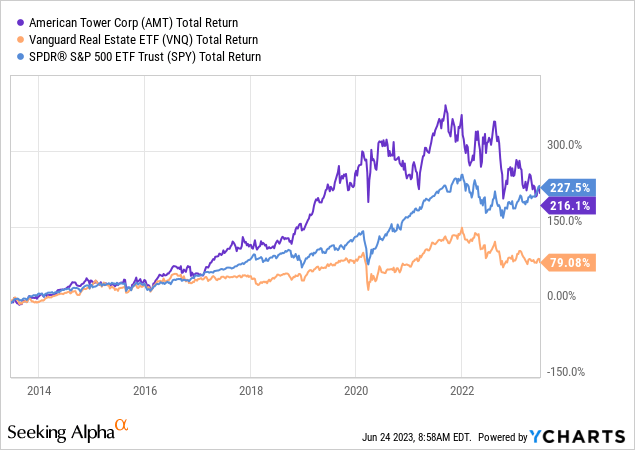

Over the past ten years, the Vanguard Real Estate ETF (VNQ) has returned just 79% – including reinvested dividends. The S&P 500 returned 228%. American Tower returned 216%.

American Tower outperformed the S&P 500 by a wide margin until the Fed started to aggressively hike interest rates.

While AMT has an anti-cyclical business model, investors started to flee real estate due to the dependence on affordable funding. While this applies to companies in general, the S&P 500 recently benefited from its tech exposure.

For what it’s worth, without the recent rotation from value to growth, AMT would still have outperformed the S&P 500.

Not only AMT, but fast-growing REITs, in general, are feeling pressure from higher rates and shifting investor sentiment.

Personally, I’m fine with that. While my REIT holdings are suffering a bit, I’m constantly looking for new stocks to buy.

As someone who is looking for stocks that come with both growth and value, I believe that AMT is perfect for my portfolio.

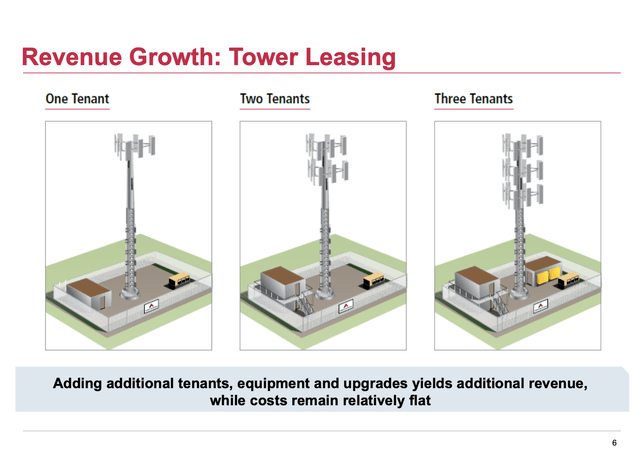

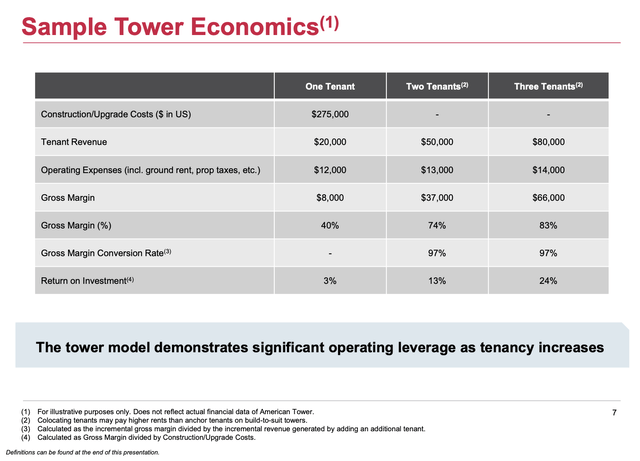

With a market cap of roughly $87 billion, AMT has a perfect business model. The company owns/operates towers that can be easily leveraged. For example, the average tower can easily be scaled from accommodating one tenant to three tenants.

American Tower Corp.

For example, one tenant usually provides the company with a 3% return on investment. Three tenants boost that number to 24%, as the company does not include new construction costs to add new tenants.

American Tower Corp.

In the case of AMT, it mainly deals with rent costs, real estate taxes, utilities, and everything related to monitoring and maintenance. A bit part of these expenses are directly passed on to tenants.

88% of the company’s 2022 revenues in North America were generated by T-Mobile (TMUS), Verizon (VZ), and AT&T (T). Roughly half of its revenue came from North America (ex-Mexico). While its revenues are dependent on a few large players, these players are in great financial shape and unlikely to quit AMT’s services, as it would do tremendous damage to their coverage.

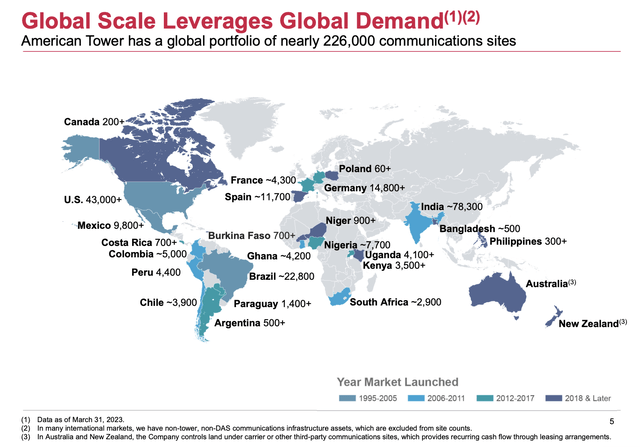

American Tower Corp.

Hence, by efficiently managing costs and relationships with its tenants, AMT can maintain strong margins.

Thanks to this business model, the company has a well-covered dividend, which currently yields 3.4%.

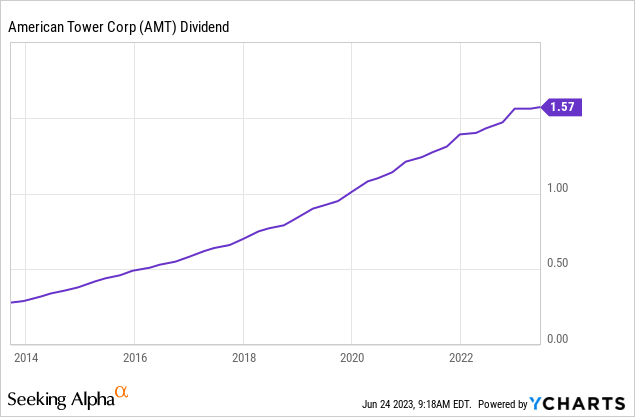

- On average, over the past ten years, this dividend has been hiked by 17.6% per year. That number has barely come down, as it’s still 14.2% over the past three years.

- The dividend is covered by a 66% forward FFO (funds from operations) payout ratio, which is in line with the sector median.

That’s the value part.

The growth part is even more impressive.

Essentially, the company’s growth is driven by ongoing growth in 5G deployment and the potential for major densification in the future.

This year, the company aims for 10% dividend growth, as the company expects high single-digit growth rates for AFFO per share in the long term.

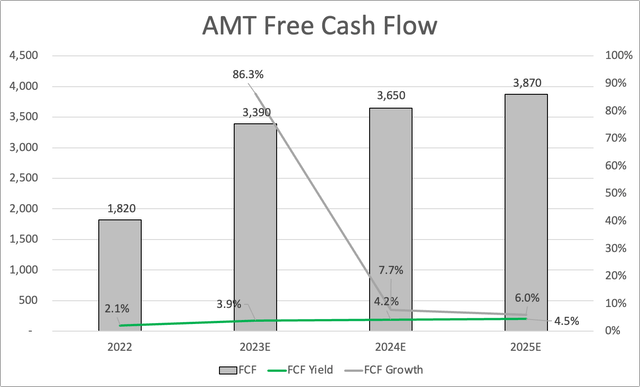

Looking at the chart below, we see that the company is expected to grow free cash flow to almost $4 billion by 2025. This means that the dividend is not only safe, but we can expect that the company can maintain above-average dividend growth rates on a prolonged basis.

Leo Nelissen

The company’s capital investment focuses on high-growth opportunities, including its build-to-suit program for towers and the expansion of the data center platform. During the 2023 Nareit REITweek this month, the company emphasized the importance of delivering results to customers and mentioned the steady growth in these areas, providing double-digit returns on investment.

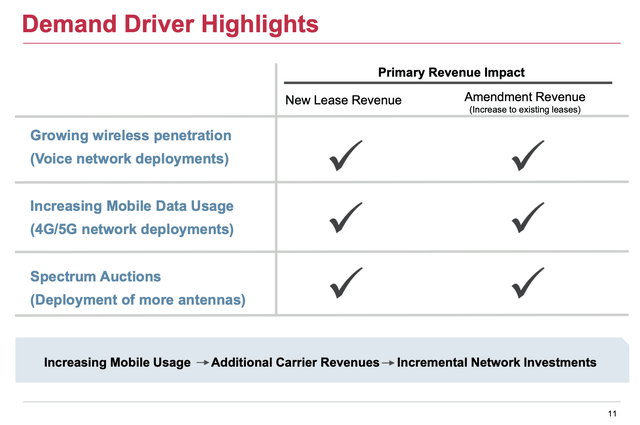

For example, the company is expected to benefit from the general deployment of more wireless devices, increased usage due to new applications and faster support services like 4G and 5G, and the deployment of more antennas.

American Tower Corp.

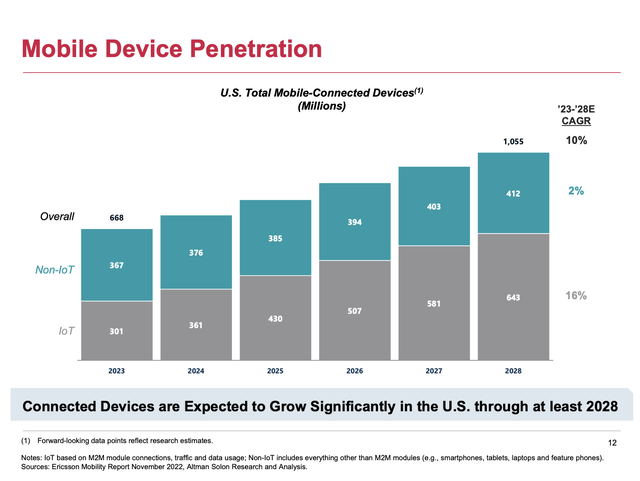

For example, the penetration of Internet of Things technologies (technologies that connect everything to the Internet, so to speak) is rising by 16% per year between 2023 and 2028. Non-IoT technologies are expected to rise by 2%, potentially providing the mobile-connected devices industry with 10% annual growth.

American Tower Corp.

During this period, data traffic is expected to rise by 17% for non-IoT devices.

Total data traffic in the US is expected to rise by 21% per year until 2028, reaching more than 21 petabytes per month.

On top of these secular trends, emerging markets are expected to benefit from the absence of wireline infrastructure. The company’s strategy is to invest in markets with favorable conditions, including the rule of law and a competitive framework.

In the aforementioned conference, AMT management mentioned the challenges faced in the Indian market due to rapid consolidation, government regulations, and changing market dynamics.

As a result, American Tower is exploring options to maximize returns from its investments in India and other markets and aims to deleverage its balance sheet.

Deleveraging its balance sheet is also a response to higher interest rates. The company is focused on reducing floating-rate debt.

The company has a strategy of monetizing certain assets to decrease floating rate debt further. Despite the impact of interest rates, AMT believes that the fundamentals of the business remain strong, with record levels of co-location and amendment activity and significant demand for its sites.

Furthermore, the company aims to maintain a net leverage ratio of less than 5x EBITDA.

Our overall leverage ratios are north of 5x. I think we kind of maximize the value of the firm when we’re below 5x.

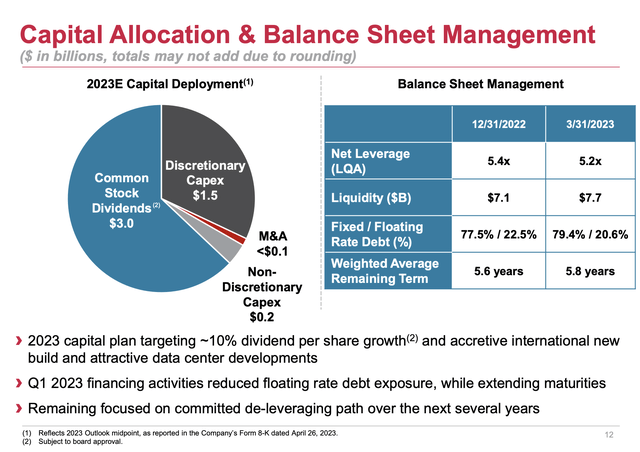

As of March 31, 2023, the company has a 5.2x net leverage ratio, $7.7 billion in available liquidity, and close to 80% in fixed debt. The weighted average remaining duration of its debt is 5.8 years, which buys the company a lot of time in this elevated rate environment.

American Tower Corp.

The company’s debt reduction plans are on fertile ground, given fundamental growth tailwinds and the expected upswing in free cash flow.

It also needs to be said that the company is well-protected against satellite connectivity. While satellite technology may be suitable for areas without terrestrial network coverage, it cannot replicate the efficiency and quality of service provided by macro towers, at least not in the foreseeable future.

Valuation

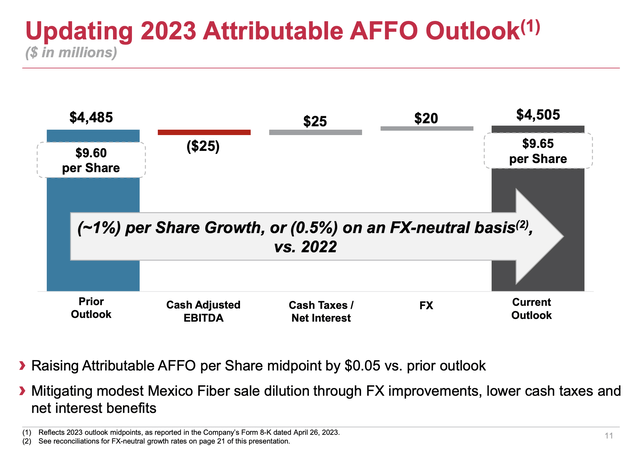

On a full-year basis, the company expects to generate $9.76 in AFFO per share, which is $0.05 higher than previously expected.

American Tower Corp.

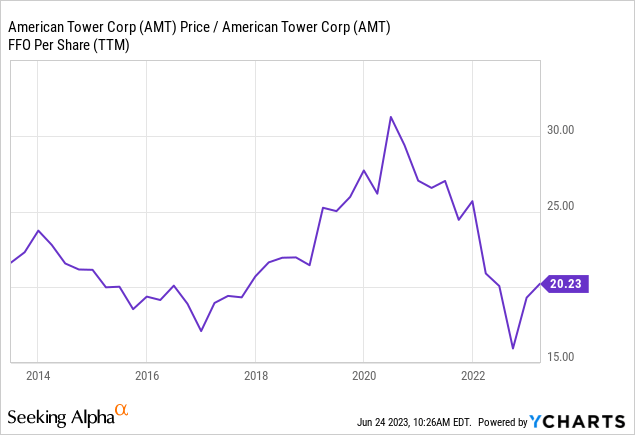

Using these estimates, the company is trading at 19.3x 2023 AFFO.

The median sector valuation is 14.2x AFFO, which shows that the company’s ability to grow thanks to secular drivers is priced in, at least in the short term.

Moreover, AMT used to trade close to 22x FFO prior to the current sell-off.

With that said, AMT currently trades 38% below its all-time high, making it one of its steepest sell-offs.

While I make the case that the post-pandemic world is different due to sticky inflation and rates well above 0%, I believe that AMT is trading at an attractive price.

The current consensus price target is $241, which is 30% above the current price. While I do not believe that AMT shares can start a meaningful recovery until the Fed is in the clear to lower rates on a prolonged basis, I do believe that current prices offer the chance to start a position.

However, I would start small and buy gradually over time. If shares continue to drop, which is likely if the Fed has to keep rates elevated for longer, investors can average down. If the stock suddenly takes off, investors have a foot in the door.

This is how I currently approach all of my investments, especially my REIT holdings.

Pros & Cons

Pros:

- Strong growth potential, driven by 5G deployment and future densification.

- A resilient business model with easily leveraged tower assets and efficient cost management.

- Well-covered dividend with a history of annual hikes and a decent yield.

- Benefits from secular trends like increasing data traffic and emerging market opportunities.

Cons:

- Sensitivity to interest rate movements.

- Potential market volatility affecting short-term stock performance.

- Regulatory and market risks, particularly in the Indian market.

- The current valuation reflects growth expectations and may take time to recover.

Takeaway

After careful consideration, I have placed American Tower Corporation on my watchlist as the perfect fit for my portfolio. While many REITs offer decent yields but slow growth, AMT stands out with its impressive performance.

Despite the recent challenges faced by the real estate sector, AMT has proven resilient due to its anti-cyclical business model and efficient cost management.

With a well-covered dividend yielding 3.4% and a history of consistent dividend growth, AMT offers both value and growth. The company’s focus on high-growth opportunities, such as 5G deployment and densification, positions it for continued success.

Although the current market conditions present challenges, the attractive valuation and potential for future recovery make AMT an appealing investment opportunity.

As with all investments, it’s wise to start small and gradually build a position to mitigate risk.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.