Summary:

- FuboTV shares have dropped 97.11% from their all-time high, but a recent court victory and a partnership with DirecTV offer potential upside.

- A court ruling blocked Disney, FOX, and Warner Bros from launching Venu Sports, preserving Fubo’s competitive edge in sports streaming.

- DirecTV’s dispute with Disney led to a partnership with Fubo, providing a new distribution channel and potential subscriber growth.

- Despite high risks, Fubo’s unique sports-focused streaming service and recent wins make it a compelling buy opportunity.

Jose Luis Pelaez Inc/DigitalVision via Getty Images

Co-Authored By Noah Cox and Brock Heilig

Investment Thesis

fuboTV Inc. (NYSE:FUBO) shares have suffered a significant drop-off since 2021, as shares have fallen 97.11% from the company’s all-time high of $62.29/share. As self-described on their website, Fubo is “the world’s only sports-focused live TV streaming service.”

FUBO Shares (Seeking Alpha)

Over the last 3 years, however, the company has suffered from a series of growth shocks, as interest rates rose due to high inflation, depressing their business model and their share price.

Revenue growth for Fubo has been stronger as of late, but there is a growing risk that larger streaming services provided by incumbents such as The Walt Disney Company (DIS), Warner Bros. Discovery, Inc. (WBD) and Fox Corporation (FOX) could team up and develop a competitor that would be an existential threat to the platform.

Through this, Fubo has been able to pick up an unlikely ally in DirecTV, as their dispute with Disney over the costs of content slates, has recently pushed DirecTV to offer a $30 credit to any customer who signs up for Fubo.

At the same time, Fubo got a key court ruling that helped stop industry incumbents Fox and Disney from teaming up to build a streaming competitor. The key court ruling has barred Disney and FOX from following through with their plans of developing a competitor.

In essence, after 3 years of shares drifting lower and competition heating up, Fubo might have found their bottom. Don’t get me wrong, this stock is an extremely high risk, but I think if the company can see their current strategy pay off, then I think the stock is a buy.

Background

Founded in January 2015, by co-founders David Gandler and Alberto Horihuela, Fubo’s mission is “to aggregate the best in TV, including premium sports, news and entertainment content, through a single app.”

Originally, Fubo was launched exclusively as a soccer streaming platform. But in 2017, Fubo expanded its reach by including a larger variety of sports. The service currently offers three main subscription options. The cheapest option, ‘Pro,’ costs $79.99 per month and offers 199 channels, Unlimited Cloud DVR and the ability to watch on up to 10 screens. At $99.99, the ‘Elite With Sports Plus’ package includes 301 channels and Sports Plus with NFL RedZone. The most expensive option is the ‘Deluxe,’ which offers 322 channels, MGM+ and International Sports Plus. It costs $109.99.

I’m including all of this info on pricing and options to show that Fubo is more than a TV aggregation service. They offer a comprehensive suite of content. This makes them a real threat to legacy cable incumbents.

To counter this threat, incumbents this fall comprised of Disney, Fox, and Warner Bros had planned on launching Venu Sports, a sports streaming platform and a potential direct competitor to Fubo.

This continues to be a risk in the future, but for now, a judge ruled in mid-August that Disney, FOX and Warner Bros could not go through with the launch of Venu Sports as it would violate US antitrust laws.

“Consumers benefit from a market with healthy competitive dynamics,” Gandler, the CEO and Co-founder of Fubo, said in an earnings call in August.

We continue to fight for competition and better prices in a market in disruption, contrasting with the Walt Disney Company, Fox Corporation, and Warner Brothers discovery -Earnings Call.

A Series Of Recent Wins

Based on the recent court ruling from Judge Margaret Garnett, a preliminary injunction has been granted to prevent Venu Sports from launching this fall as they had initially hoped. This blocks the competitive streaming service just as College Football and the NFL kickoff. This is a big win for Fubo.

It appears to the Court that Fubo is likely to succeed on its claims that by entering into the JV, the JV Defendants will substantially lessen competition and restrain trade in the relevant market in violation of Section 7 of the Clayton Act -Judge Garnett.

Based on the findings of the ruling, stock in Fubo jumped as much as 24% after the favorable ruling.

Football is by far the most watched sport in the United States, helping power Fubo here with an estimated subscriber base of over 1.45 million in America alone. Fubo is now well set up for a strong fall season. As previously mentioned, Fubo offers an ‘Elite With Sports Plus’ package, which comes with NFL RedZone, so this is a fantastic opportunity for Fubo to expand its sports-watching audience and become the No. 1 option when it comes to sports streaming.

According to CEO Gandler’s reports from the Q2 Earnings Call:

the second quarter marked our sixth consecutive quarter of global year-over-year improvement in our profitability metrics, while in North America, we exceeded expectations. In North America, we closed the second quarter with double-digit year-over-year growth, posting $382.7 million in total revenue, an increase of 26% year-over-year, and 1.45 million paid subscribers, up 24% year-over-year -Q2 Call.

Adding fuel to the fire and another big win for the upstart streaming service is the aforementioned partnership with DirecTV amid the dispute between Disney and DirecTV.

On Sept. 1, Disney channels, including ESPN, went dark on DirecTV. It’s been nearly two weeks since the blackout started, and DirecTV is scrambling to find a sustainable fix without paying Disney what they believe to be an excessive amount for content rights.

As part of their plan to keep sports fans happy, DirecTV is offering this $30 credit and $30 off the first month for any customer who signs up for a seven-day free trial of Fubo’s ‘Pro’ or ‘Elite With Sports Plus’ plans.

This partnership offers DirecTV customers the opportunity to get involved with Fubo, which in turn could result in more customers for the sports streaming service. In my opinion, it’s a very nimble move that opens up an incredible new distribution channel.

DirecTV wins by providing their customers with a full-service sports streaming service while they hammer it out with Disney. Fubo wins with a key lifeline to help accelerate their subscriber base.

Keep in mind, this blackout is new, having just started on 9/1 and after the last earnings call. Fubo likely did not see this blackout coming, which means their subscriber estimates are likely too conservative.

Valuation

As things currently stand with Fubo’s valuation, the current price/sales (FWD) ratio is 0.35 compared to the sector median of 1.25. As I mentioned before, I think expectations currently are low for forward growth. DirecTV really threw them a lifeline in my opinion. Growth should be strong from here.

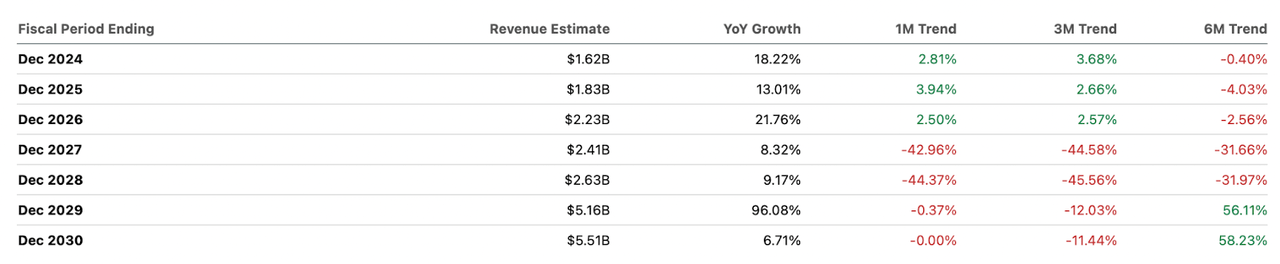

While there has been a series of upward revisions to revenue over the last month, I think the 2.81% average upward revision feels low given that DirecTV has brought in a key new distribution channel.

Revenue Revisions (Seeking Alpha)

In essence, I think there is more upside. If the price-to-sales figure were to convert to the sector median number of 1.25, this would represent a roughly 257.14% increase.

Risks

Although there have been a number of recent wins, let’s be clear: Fubo is not completely out of the woods.

The elephant in the room is the court case. If the Disney, FOX and Warner Bros streaming service ends up winning in court against Fubo now, or on appeal, and can ultimately launch Venu Sports, it would likely be detrimental to Fubo.

As previously mentioned, Judge Garnett filed a preliminary injunction to prevent the trio from launching Venu Sports, but the partners have indicated that they intend to appeal the decision, which could result in a radically different outcome.

For now, with Venu Sports still watching from the sidelines, Fubo is in a good position to thrive. If Judge Garnett’s decision gets overturned, things could change rather quickly.

Venu Sports would act as a direct competitor to Fubo, and with an already-announced monthly subscription rate of $42.99, it would be a significantly cheaper option than anything Fubo has to offer.

This is a high risk, but with the recent court case victory, the partnership with DirecTV and football just beginning its regular season, Fubo is in a much better position than it was even a few months ago.

On this same note, Fubo now has this key partnership with DirecTV, which, I think, will become a key part of DirecTV’s strategy going forward. DirecTV has woken up to the risks of being dependent on Disney. I expect them to continue to promote Fubo even if a deal with Disney is reached. This is also a nice hedge for DirecTV as more consumers cut cable. This is a way for them to get into the streaming business.

Bottom Line

To recap, Fubo has a big opportunity ahead of itself given the recent court win and DirecTV lifeline.

It’s unknown how long Disney and DirecTV will fight over rates, but the longer this carries on, the better for Fubo. NFL fans will become more interested in watching football as the season progresses, and if DirecTV customers are unable to watch games on ESPN, Fubo will become an increasingly attractive option, helping boost subscriptions.

Adding to this silver lining, Fubo will remain the only sports-centered streaming service for the foreseeable future. Until or unless Judge Garnett reverses the decision to block Venu Sports, Fubo will be in a good position to succeed.

Don’t get me wrong, this is a high-risk investment, but the risk could well be worth the reward. I think shares are a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (main account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.