Summary:

- I see fuboTV’s aggressive share dilution as a red flag for investors.

- I’m concerned about its heavy debt load, making it a risky play.

- I believe fuboTV’s modest growth outlook doesn’t justify its valuation.

- I’m wary of recommending a business that still far from free cash flow profitability, together with all these blemishes.

hapabapa

Investment Thesis

fuboTV (NYSE:FUBO) is not a cheap stock. Even though it looks like a bargain at less than 1x sales, the underlying business is more expensive than it seems.

Not only is the business still working to reach clean profitability, but also, the business operates in a highly competitive environment while holding a substantial amount of debt.

And if all that wasn’t enough, fuboTV is actively diluting shareholders to pay back its debt.

Altogether, I recommend that investors kick FUBO far away.

Rapid Recap

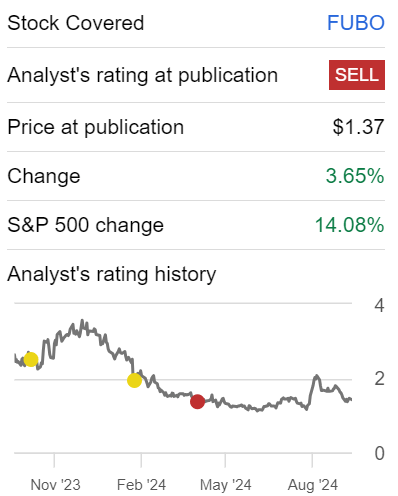

Back in April, I said,

fuboTV was once a high-flying stock with a massive shareholder following. Today, it’s a shadow of its former self. And even though the stock is down significantly from its all-time highs, I argue that not only is this stock not undervalued, but it’s actually likely to sell off further, as fuboTV is likely to dilute investors by early 2025, as it seeks to raise precious capital to keep its balance sheet afloat.

Here, I charge that investors will in the next twelve months look back to fuboTV at approximately $2 per share as a high point to aspire towards.

Author’s work on fuboTV

Even though the stock appears to have caught a bit recently, I remain steadfast in my assertion that FUBO is a sell.

fuboTV’s Near-Term Prospects

fuboTV is a streaming service focused on offering live sports. Its main appeal is providing sports enthusiasts with a diverse lineup of live sports channels and events at competitive prices compared to traditional cable packages.

fuboTV differentiates itself through an aggregator strategy, meaning it aims to bring together multiple streaming options into one platform, offering everything from live sports to ad-supported free channels, all in a single interface.

The argument from fuboTV is that this approach gives users flexibility in making it easier for users to find and enjoy their favorite live sports without dealing with multiple apps and interfaces. That’s the bull case for fuboTV.

Meanwhile, on the same day that fuboTV was reporting its Q2 2024 earnings result, it was notifying investors of its intentions to dilute shareholders further through an at-the-market offering.

At-the-market offerings (ATM offerings) are a way for a company to sell its stock gradually, directly into the open market, rather than selling large quantities all at once.

In this case, fuboTV can sell up to $118.7 million worth of its shares. This method allows fuboTV to raise money over time without committing to a specific amount upfront. The shares are sold at current market prices, and the sales agents (Needham, and other Wall Street banks) will try to sell as much as possible, but with no guarantee of how many shares will be sold.

Most likely, the money raised will be used for general business needs, including buying back some of its debt, similar to what fuboTV did in Q2 2024.

Consequently, consider what I said back in April

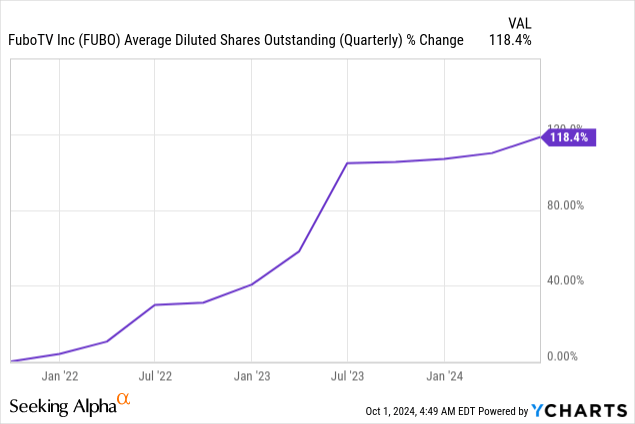

[…] given that [FUBO’s] market cap valuation has already started to shrink, this will mean that for fuboTV to raise $100 million of cash, its shareholders will be forced to stomach a 20% dilution.

Furthermore, note that these new share sales are on top of the nearly $40 million raised in Q2 2024, which was made after my cautionary article in April. Thus, I believe it’s worthwhile to reiterate my message, that the facts beyond its rosy narrative show that fuboTV is far from stable.

Revenue Growth Rates Are Moderating

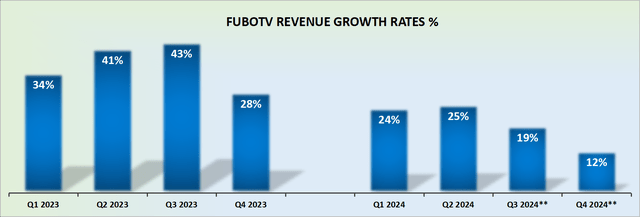

FUBO revenue growth rates — author’s work

Even as fuboTV’s comparables will start to ease up in Q4 2024, I suspect that management will not materially raise its guidance for Q4. As such, I believe that for 2025, fuboTV is likely to grow its topline at less than 20% CAGR.

What’s more, keep in mind that analysts following fuboTV are expecting substantially less than 20% revenue growth rates in 2025.

Next, fuboTV operates in a highly competitive market dominated by large players like Disney (DIS), Fox (FOX), and Warner Brothers Discovery (WBD). These companies have formed partnerships that control a major share of the premium sports market, giving them significant leverage in terms of pricing.

Given this backdrop, let’s now discuss its fundamentals.

FUBO Stock Valuation – Less Than 1x Sales

fuboTV holds about $200 million of net debt. That’s nearly the equivalent of 40% of its market cap. That’s not a good position for an Inflection investor to position themselves.

On top of that, consider further facts that get in the way of fuboTV’s colorful narrative.

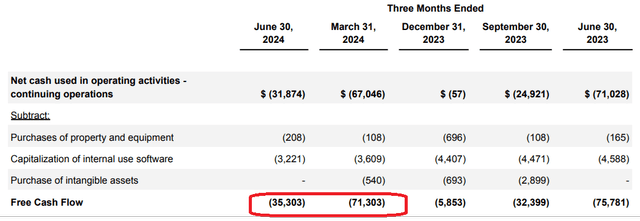

The business is still far from reporting positive free cash flows. Even as fuboTV continues to reaffirm its path to profitability in 2025, when that profitability does finally arrive, it’s likely to be heavy on adjusted profits, and light on free cash flow.

With all this in mind, even though I recognize that paying less than 0.5x this year’s sales for fuboTV may seem cheap, but it is, in fact, a heavy price tag.

Generally speaking, when I see this sort of graphic that follows of an increasing number of shares in a short period of time, I urge investors to steer clear.

In sum, I recommend that investors avoid this stock.

The Bottom Line

Although fuboTV may seem cheap at less than 0.5x sales, a deeper look reveals a business struggling with profitability, ongoing dilution, and significant debt in a fiercely competitive market. These factors make fuboTV a costly bet despite its low sales multiple.

In the end, I suggest investors cut the cord on this stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.