Summary:

- fuboTV has struggled due to its flawed business model as a vMVPD, and the recent announcement of a sports-only joint venture by Disney, Fox, and Warner Bros. poses a significant threat.

- The joint venture will offer a one-stop shop for linear sports-broadcasting networks, making it difficult for fuboTV to compete.

- fuboTV lacks pricing power as a middleman, and the network owners can offer lower pricing through a direct-to-consumer product.

NurPhoto/NurPhoto via Getty Images

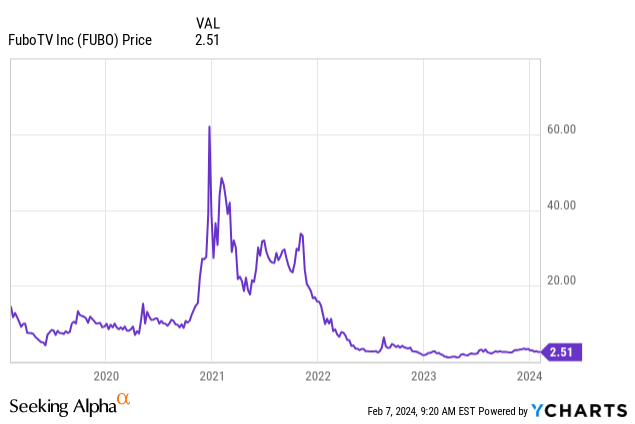

fuboTV Inc. (NYSE:FUBO) operates a sports-focused vMVPD provider by the same name. Over the last several years, FUBO has had an interesting tailwind as the company has served as one of the few streaming pure-play stocks in the public markets after much larger companies like Netflix (NFLX) and Roku (ROKU). I’ve personally covered the ticker for Seeking Alpha four times previously and have bounced around from “hold,” “sell,” and I even called it a “buy” at one point.

- fuboTV: So You’re Telling Me There’s a Chance (September 2023, Hold)

- fuboTV: Abandon Ship (October 2022, Sell)

- fuboTV: I Don’t Hate It Down Here (March 2022, Buy)

- fuboTV Is A Gambling Streamer Parlay Bet That I’m Not Making (March 2021, Hold)

Importantly, my buy call came in March 2022, and it was purely a technical opinion after the company’s shares had been sold off by more than 80% in just a few months. Fundamentally, the selloff wasn’t all that surprising. I have been pointing out the core issue with fuboTV’s business model for the last several years.

Distribution Flow

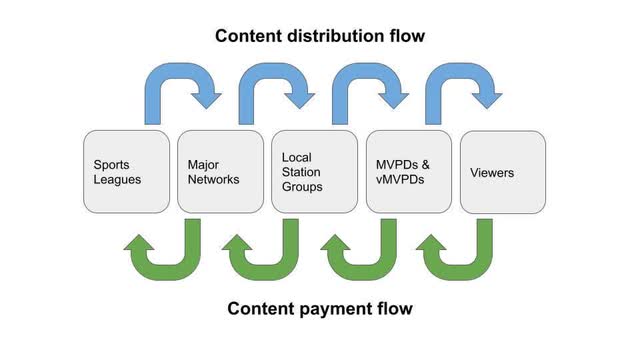

The first time I covered FUBO in March 2021, I shared this crudely prepared infographic detailing the distribution flow from sports leagues to viewers:

Content/Payment Flow Currently (Author’s graphic)

Needless to say, there are far more layers than are necessary, and it has been my view that the MVPDs and vMVPDs will be the first to get cut out of this chain when streaming revenue for the content producers starts to really accelerate.

Currently, the product gets to the end user through a variety of middleman layers. The sports leagues generally license production and distribution deals with major networks like CBS, FOX, ABC, and NBC. These major networks then distribute this sports programming through their affiliate agreements with local broadcasting companies like Scripps (SSP) or Nexstar (NXST). The local broadcasting companies then arrange carriage deals with traditional MVPD and virtual MVPD companies for the rights to provide their signals to subscribers. From there, 10’s of millions of American households get live sporting events through the MVPD or vMVPD service of their choosing.

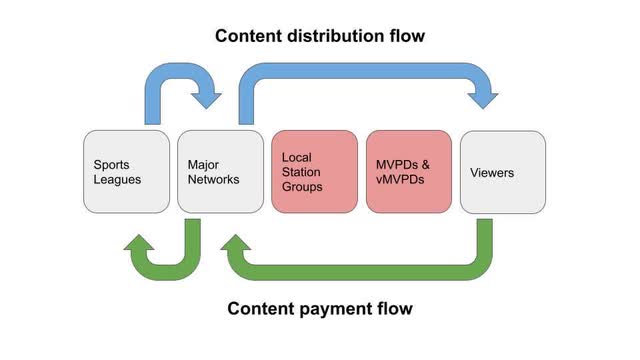

Two years later, viewers are watching Sunday Night Football through the network-owned Peacock streaming app. ESPN viewers can watch certain games through ESPN+. Thursday Night Football viewers are doing so through Amazon Prime (AMZN), and NBA viewers can see TNT games on Max. My view back in 2021 was that the distribution flow will ultimately look more like this:

Content/Payment Flow in the Future (Author’s graphic)

It behooves the sports leagues to continue working with major networks, as these networks are overpaying for the distribution rights and are also producing the content itself. However, when the network owners decide to cut out the additional middleman, that would be very bad for FUBO. And now it looks like it’s going to happen.

Powerhouse Joint Venture

Disney (DIS), Fox (FOX) and Warner Bros. Discovery (WBD) are reportedly working on a sports-only joint venture that will combine sports broadcasts from over a dozen channels and multiple different sports leagues:

The three companies would license their sports content on a non-exclusive basis — but it would still offer a one-stop shop for linear sports-broadcasting networks including ESPN, ESPN2, ESPNU, SECN, ACCN, ESPNEWS, ABC, Fox, FS1, FS2, BTN, TNT, TBS, truTV and ESPN+.

It is very difficult for me to see how fuboTV is going to be able to compete with this because the company lacks pricing power as a middleman. The network owners that fuboTV is doing business with can offer lower pricing than fubo can through a direct to consumer product. And these companies will have a vested interest in doing so because it means a larger share of revenue if they get the pricing right. And that’s the real question that remains to be seen. What is the consumer facing price point for the Disney/Fox/Warner sports streaming JV?

After all, each of these companies has traditional linear exposure that they need to be mindful of. It has been argued previously, and in my personal view accurately, that live sports is essentially the only piece of content left that is still holding up the MVPD model. However, given the announcement of this JV, the signal from the major network owners seems to be that they’re ready to fully embrace streaming as the primary method for video consumption going forward.

Summary

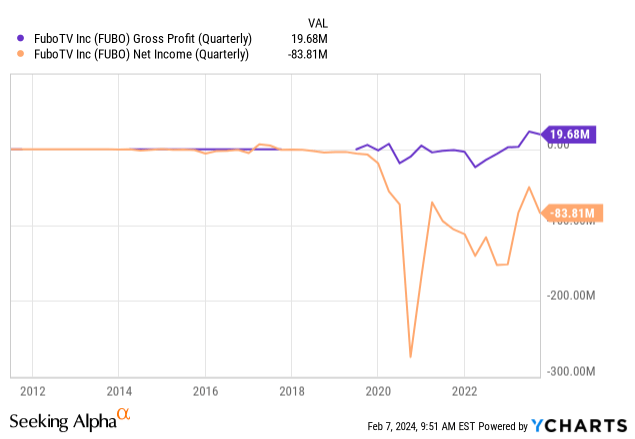

fuboTV has admittedly shown an admirable improvement in crossing over to gross profit over the last year. That said, the company is still operating with a deeply negative quarterly net income.

As I’ve laid out in the previous sections, the business model for fuboTV is deeply flawed as a vMVPD. There is nothing fundamentally different between vMVPDs and MVPDs. If anything, the traditional MVPD companies are in far better shape than vMVPD pure plays like fuboTV because the MVPDs can fall back on simply charging their customers more for broadband services to make up for the lack of pricing power on the live video distribution. This is simply not the case for fuboTV and this puts the company at far greater risk of getting cut out of the distribution chain.

In my view, the Disney, Fox, Warner JV is the worst case scenario playing out for fuboTV. It’s the network owners going it alone. I know it’s probably been a very painful ride down for long term bulls who believe in the future of this company. But if I was holding this stock, I would take what I can get for it at this point.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ROKU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I'm not an investment advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.