Summary:

- fuboTV Inc. shares plunged 22.7% after news broke of a joint sports streaming venture by Disney, Warner Bros. Discovery, and Fox Corp.

- The joint venture aims to create a one-stop shop for sports fans, incorporating sports content from all three companies on a new app.

- fuboTV, which already faces financial challenges, may struggle to compete with the resources and market presence of the joint venture, posing an existential threat to the business.

NurPhoto/NurPhoto via Getty Images

Internet and technology-based companies have the potential to grow rapidly. But with that potential comes a significant downside. Sudden changes in the industry or the state of technology, or both, can cause a company that was once viewed as a high-growth prospect to become a firm that may struggle to survive moving forward.

A wonderful example of this that just arose involves fuboTV Inc. (NYSE:FUBO). At its founding, fuboTV set off to become a leading live streaming platform focused largely on the world of sports. This is a great niche to get into, and the firm has had a lot of success from a growth perspective along the way. However, shares have not been performing particularly well as of late.

On February 27th alone, units of the company plunged, closing down 22.7%. This move lower was the result of news breaking that The Walt Disney Company (DIS), Warner Bros. Discovery, Inc. (WBD), and Fox Corporation (FOX) had entered into what might ultimately be known as the largest sports streaming venture in the history of the industry. If fuboTV had some major competitive advantage, I would not be particularly concerned. But with the company generating significant losses, experiencing large cash outflows, and having prices for its service that are already quite high, this could very well pose an existential threat to the business and to the portfolios of its shareholders.

Bad news

According to a press release issued by Warner Bros. Discovery on February 6th, it, as well as Disney and Fox Corp, decided to enter into a joint venture aimed at launching a streaming sports service in the U.S. Significant details are still lacking when it comes to what this all entails. But the company did reveal some interesting info. For starters, the single service will incorporate sports-related content from all three companies as a single service on a new app when it becomes available in the Fall of this year. In what is undeniably a win for Disney, they will also be able to bundle that product with Disney+ and Hulu, while Warner Bros. Discovery will also include a bundling option to include Max (formerly known as HBO and HBO Max).

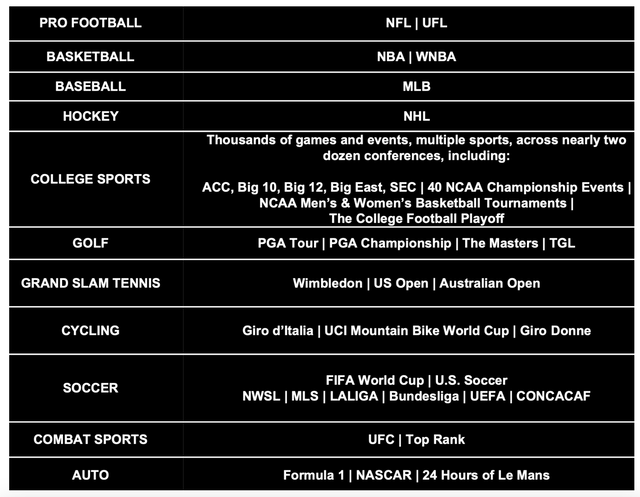

The objective here is to essentially create a one-stop shop for sports fans. It also appears as though the service will have some original content of its own, and each of the three parties will have equal ownership of the business. In the image above, you can see just some of the thousands of high-profile sporting events that will be featured on the service. As you can tell, this is the who’s who of sports, with examples including major soccer events, professional football events, both men’s and women’s basketball, golf, and more. It will even include NASCAR.

This is interesting because all three companies already have a pretty significant foot in the door when it comes to the sporting world. Perhaps the biggest player of the three is Disney. At present, Disney owns 80% of ESPN. This includes both its domestic and international operations. To put into perspective just how big this is, consider that ESPN alone has 71 million domestic subscribers. There are, of course, other branded channels under that umbrella, including ESPN2, ESPNU, ESPNEWS, SEC Network, and ACC Network. Each of these has between 46 million and 71 million subscribers. The international operations of the enterprise include 40 ESPN branded sports channels outside of the us that are cast in four different languages and spread across 105 countries and territories.

Operationally speaking, ESPN is a behemoth. During the 2023 fiscal year, ESPN generated $16.38 billion worth of revenue and about $2.84 billion of profits. This was down from the year prior. But then again, there has been some weakness when it comes to the networks owned by pretty much every entertainment company out there. In addition to ESPN, Disney also owns Star, which caters to 82 million subscribers spread across 10 different sports channels in India. It is considerably smaller than ESPN, however, with revenue of $729 million and only $55 million worth of profit in its latest completed fiscal year.

On top of its 80% ownership over ESPN, Disney also owns ESPN+. For the first quarter of the 2024 fiscal year, the streaming service had 25.2 million paying subscribers. This was down from the 26 million reported at the end of 2023. However, that decrease is almost certainly due to management’s decision to raise prices. Average revenue per user went from $5.34 per month in the final quarter of 2023 to $6.09 per month in the first quarter of 2024. Assuming nothing else changes, that translates to roughly $1.84 billion of additional revenue for the company each year.

The other two players in this are not insignificant, either. Warner Bros. Discovery owns WBD Sports, which has both domestic and international operations. Its portfolio includes events for the NBA, MLB, NCAA, NHL, and the United States Soccer Federation. It also has content associated with international events such as the Olympic Games in Europe, the Global Cycling Network, and the Global Mountain Bike Network. Some of its properties include Bleacher Report, Eurosport.com, House of Highlights, and more. And throughout parts of Central and South America, it also has a separate service known as TNT Sports.

And last, but certainly not least, is Fox Corp. The Fox Sports Networks consists of four major cable networks. The largest of these, FS1, had 72 million subscribers as of the end of its latest fiscal year. The other three ranged between 13 million subscribers and 52 million subscribers each. Content included on these networks includes, but are not limited to, NASCAR, certain collegiate sports, horse racing, rugby, certain soccer events, and more.

According to fuboTV itself, these three companies control between 60% and 85% of all sports content in the markets in which they operate. The company came out with this range in a press release issued on February 7th in response to news of the joint venture forming. They said that while they were not surprised that more sports streaming options would become available for consumers, they believe that what the market wants is differentiated content as opposed to content that comes from major players that are incumbents in the market. They admitted that the trend of seeing consortiums of players come into this market is “concerning” because of its ability to potentially dictate terms in a manner that may run counter to the interests of consumers more broadly. At the end of the day, however, they reiterated their belief that the robust programming and quality experience of consumers cannot be “duplicated” by this joint venture.

Shareholders better pray that management is right. It would be one thing if fuboTV was flush with cash and generating significant cash flows. But that’s not how things are. Yes, the company does have $259.9 million in cash on hand relative to its market capitalization of only $568 million. And it is true that most of the $375.5 million of debt is convertible. But with a conversion price of $57.78 per share relative to a share price that is less than $2 now, the firm could be forced to refinance or pay off that debt when it comes due in 2026. The firm has already started making deals with debt holders to take a haircut on their debt in exchange for securing that debt with assets and extending it from 2026 to 2029. That example was provided on January 2nd of this year when the company convinced holders of its debt to take a $28.3 million hit on a debt exchange.

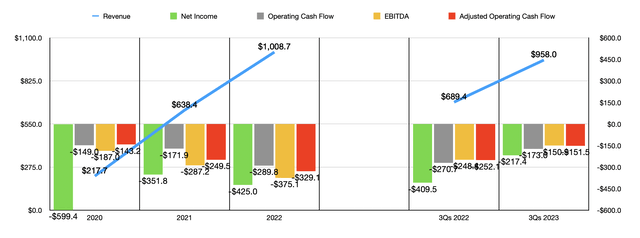

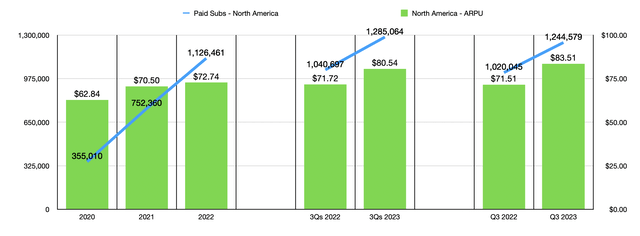

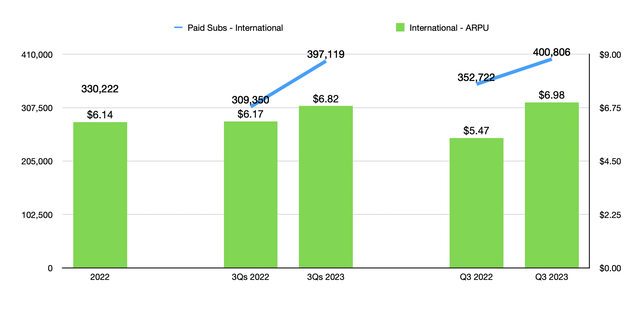

When it comes to the financial picture of the company, things could be better. But make no mistake, there have been some positives over the years. Growth, for instance, has been off the charts. Revenue for the firm went from $217.7 million in 2020 to $1.01 billion in 2022. This was driven by a surge in the number of average paying subscribers from 355,010 to 1.46 million. Along the way, average revenue per user per month managed to increase nicely from $62.84 to $72.74. It was only in 2021 that the company started going international. By 2022, 330,222 of its 1.46 million subscribers were international. But they brought on a significantly lower average revenue per user of $6.14.

Revenue growth for the company has continued into the 2023 fiscal year. Revenue of $958 million achieved during the first nine months of the year dwarfed the $689.4 million in revenue generated one year earlier. This increase was driven in part by a rise in average revenue per user at the domestic level from $71.72 to $80.54. This occurred at a time when the number of paying subscribers at the domestic level grew from 1.04 million to 1.29 million. The number of international users expanded from 309,350 to 397,119. And the average revenue per user per month grew from $6.17 to $6.82.

Given this rapid growth, I would actually be bullish about the company if it weren’t for the fact that its bottom line results are awful. In the three years ending in 2022, the company generated an aggregate net loss of $1.38 billion. Operating cash flows have worsened year over year, and the same can be said of EBITDA.

The good news is that the picture did start to improve drastically in 2023. The company went from generating a net loss of $409.5 million in the first nine months of 2022 to generating a loss of $217.4 million at the same time in 2023. Operating cash flows and EBITDA also recovered nicely as well, but remained significantly negative. Even though management is forecasting a new all-time high revenue that is 34%, at the midpoint, above what was seen in 2022 for the 2023 fiscal year, driven in large part by a rise in paid subscribers from between 1.58 million and 1.60 million, that bottom line is still very painful. This gives the company little wiggle room and no hope of competing dollar for dollar or even close to it when it comes to content spending or advertising.

It doesn’t help that, in addition to this new joint venture and the existing offerings provided by its competitors, fuboTV also has to contend with competition elsewhere. You see, sometime late next year, Disney plans to also launch its own ESPN streaming service for consumers. Although this may seem redundant given this new joint venture and the existence of ESPN+, it’s meant to provide content that the latter service does not since the latter is a low-cost streaming option while this new service is expected to be comprehensive. Naturally, it will also come at a much higher price point, though we do not yet know what that will be.

And even outside of Disney, another major competitor is Apple Inc. (AAPL), which last year scored a 10-year, $2.5 billion deal, regarding Major League Soccer. And in 2022, Disney lost rights to the Indian Premier League to a joint venture between Paramount Global (PARAA, PARA) and an Indian firm for a price of $3 billion.

Takeaway

As much as I love to see small, innovative companies do well, it’s very possible that fuboTV Inc. will experience significant pain from this point on. We won’t ultimately know until data starts coming in regarding this new joint venture, and that is unlikely to occur until next year. So the firm could see some additional growth between now and then.

Given fuboTV Inc.’s small size, however, as well as its limited resources, and given the massive market presence of the companies that comprise the joint venture, I would argue that investors should tread very cautiously. As for me, until we get some clarity on the matter, particularly information regarding how well fuboTV can survive this onslaught, I believe that a “sell” rating makes the most sense.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is an exclusive community of investors who have a taste for oil and natural gas firms. Our main interest is on cash flow and the value and growth prospects that generate the strongest potential for investors. You get access to a 50+ stock model account, in-depth cash flow analyses of E&P firms, and a Live Chat where members can share their knowledge and experiences with one another. Sign up now and your first two weeks are free!