Summary:

- Shareholder dilution is likely to continue for some time in order to improve the debt situation.

- But revenue growth, customer growth and FCF are all on a positive trajectory.

- And a positive FCF, I think, would improve sentiment and lead to a multiple re-rating.

hapabapa

The fuboTV Investment Thesis

Seeking Alpha

More than a year and a half ago, I first wrote an article about fuboTV Inc (NYSE:FUBO) and now I want to see how my thesis has evolved and update it if necessary. Although Fubo did not match the S&P 500 in terms of total return, it did better than I expected at the time. One criticism was the cash burn rate, which would likely result in Fubo having to raise cash, which has happened and will likely continue to happen.

But the growth and the execution of fubo has been better than I thought it was going to be. Therefore, I believe that despite the dilution, which is the right move for the company, the growth justifies a slight upgrade to Hold.

fuboTV’s Business

With fubo, it is possible to stream live TV sports and TV without having cable TV. The majority of revenue is generated through subscriptions, but also through advertising and upselling in the form of add-ons. Add-ons include Starz, NBA League Pass, NFL Redzone and many more. Plus there is also a Latino package for the very large Spanish-speaking community in the USA. Features such as MultiView, DVR Storage or Lookback complete the offering. The starter plan called fubo pro contains almost 200 channels.

FUBO’s Journey

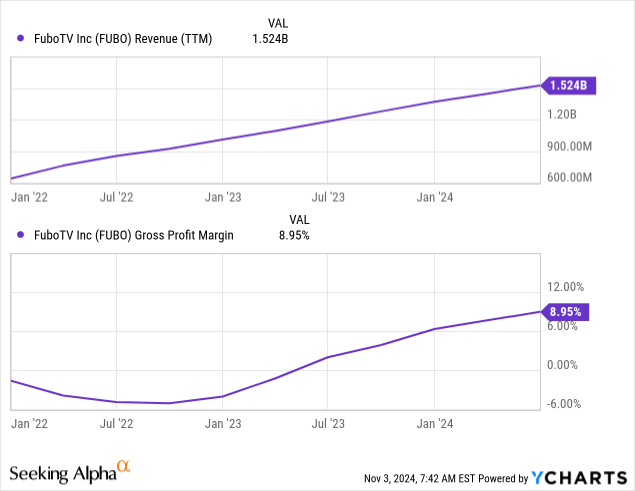

If we separate the company from the share price and just look at the underlying business, we see that both revenue and margin development have been positive over the last three years. In other words, the company is better off today than it was then and has improved. And other metrics show positive trends as well. In fubo’s primary market of North America, the average number of subscribers is expected to increase from 1,126,461 as of December 2021 to approximately 1.66 million to 1.7 million in FY24, while the average revenue per user increased from $72 to $85 (Q3/24).

From a business point of view, Fubo is still a growth company in North America. But in Europe I still think they have no chance against DAZN because they are a huge leader in Germany, Italy and Spain. But DAZN’s playbook could be interesting for fubo, as they also have DAZN Bet to cover the sports betting market, their own content, and an e-commerce platform for merchandise. Therefore, I think that fubo still has many upsell opportunities that could help them in the future. But the fact that Europe is not a growth market for fubo at the moment is also reflected in the guidance, which assumes a 14% decline in revenue in ROW because I think DAZN is just too strong in Europe.

fuboTV’s Valuation

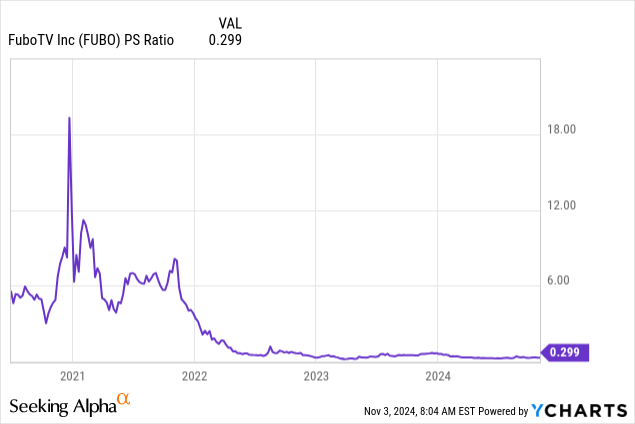

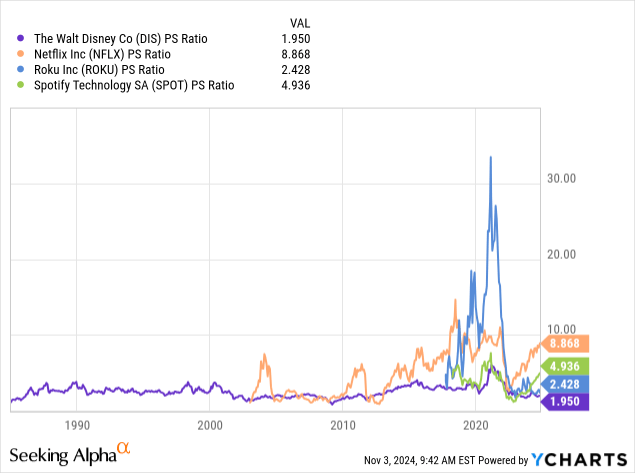

Sure, there are the two big threats of Venu Sports and the ongoing shareholder dilution, but the poor performance of the stock, in my opinion, is more due to the fact that the company has been very overvalued in the past. The ~20x PS multiple in 2020/2021 was simply out of touch with reality, and I think the 3x to 6x multiples in 2021/2022 were overvalued as well. But I think the current ~0.3x multiple is fair given the threats, but also given the growth opportunities that remain. If at some point Fubo manages to avoid shareholder dilution and FCF turns positive, I think the multiple will be in the 1x to 2x range. Therefore, I see strong upside potential if the turnaround to profitability is achieved.

While I do not consider the multiples of the higher quality competitors in the range of 4x to 8x to be realistic, the peer comparison should show that multiples in the range of 1x to 2x are quite realistic. And even a 1x PS multiple, which is still well below the peer group, would mean significant upside for fubo shareholders.

Surely the competitors have partly larger offers and several business segments, but FUBO is also just at the beginning with the possibility to set up the company more broadly in the future.

FUBO’s Balance Sheet And Shareholder Dilution

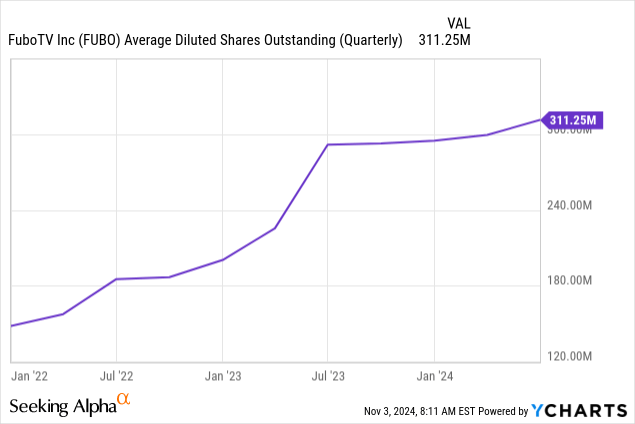

Over the last 3 years, the outstanding shares have experienced a steady uptrend, leading to more than a doubled number of shares and a substantial dilution of shareholders. And I think this trend will continue as Fubo has only $152m in cash but negative FCF TTM of about $113m. However, on a positive note, they were negative $209 million a year ago, which is an improvement. Plus there is the plan that the FCF should be positive by 2025.

Should fubo manage to turn its FCF into positive territory, I think it would lead to a strong sentiment change. And with the Venu Sports joint venture blocked, there is one less strong competitor to contend with for the immediate future. And I also find the judge’s reasoning plausible, namely that she does not want the same players to repeat their dominance in the streaming sector as they did in pay TV. Still, competition from Netflix (NFLX), DAZN, Hulu Sports (DIS), YouTube TV (GOOGL) and Amazon Prime (AMZN), some companies with the deepest pockets in the world, remains fierce.

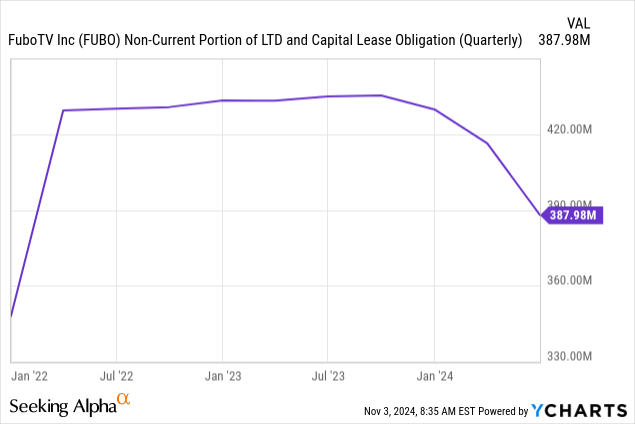

Fubo’s debt situation also seems to be slowly improving, as debt maturities are being pushed further and further out and parts of the debt are being paid off. So, I can see long-term debt and current lease obligations going below $300 million in 2025, depending on how much money is raised and whether a positive FCF is achieved.

Conclusion

Fubo is in a very competitive market where they are working to reduce debt and achieve profitability, which has led to very negative sentiment towards the stock. But the underlying business in terms of top-line growth and the path to profitability, I think, is better than the sentiment. Sure, FUBO is still in a risky situation, but should FCF turn positive and share dilution come to an end, I think the multiple would appreciate very quickly. Ultimately, it is a bet on whether Fubo’s management team can achieve long-term profitability.

In the short term, I can see the stock remaining under pressure, but overall for the long term (3+ years) I have to upgrade my original Sell rating to Hold as I believe the company has shown it is doing the right thing. Of course, shareholder dilution is not pretty, but it paves the way to profitability and could be offset in the future by share buybacks. And to see how quickly a company’s stock price can explode when sentiment changes, look no further than Carvana (CVNA), which went from loved to hated to loved. And Fubo is currently in the hated stage, but could also go back to the loved stage.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.