Summary:

- fuboTV is facing increasing competition in the live-streaming market from some of the most well-capitalized companies in the world.

- The company’s financials show slim gross margins, operating losses, and a ballooning net debt figure.

- The rapid rise in competition and poor fundamentals jeopardizes fuboTV’s long-term viability.

simpson33

Thesis

I rate fuboTV Inc. (NYSE:FUBO) a ‘Sell’ primarily due to the rapid surge in competition, with some of the world’s most well-capitalized companies entering the market.

Company Overview

fuboTV is a live TV streaming platform. The company’s platform covers a wide array of media events such as news, live sports, and other entertainment content. fuboTV was founded in 2015 and was one of the original players in the streaming movement that aimed to upend traditional cable and satellite television. David Gandler, one of fuboTV’s original co-founders, currently serves as the CEO for the company. fuboTV is currently headquartered in New York City, New York.

fuboTV went public via an IPO in October 2020-the peak of the pandemic-induced streaming boom. They sold shares in their IPO at around $10 apiece. Since going public, fuboTV’s stock has been through dramatic swings in share price. In early 2021, fuboTV’s shares were trading hands for around $50 per share. However, they began slumping later that year. Today, fuboTV shares trade for around $1.50. This share price puts their current market cap at approximately $430 million.

Financials

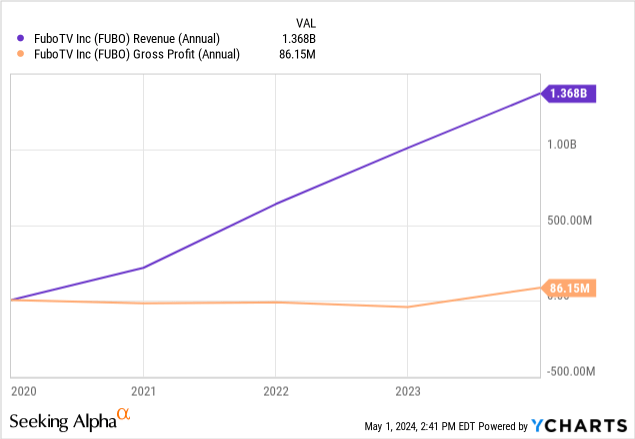

In 2023, fuboTV generated $1.37 billion of revenue, up 35.6% from the year prior. From this revenue, fuboTV produced only $86.1 million in gross profit, representing a 6.3% gross margin.

Although their gross margins are slim, it’s worth mentioning that it was the first time since going public that they generated positive gross profit. Such low gross margins indicate that fuboTV has a pricing issue, cost issue, or both. And due to the asset-light nature of their business model, I’d lean towards the notion that they have a pricing issue.

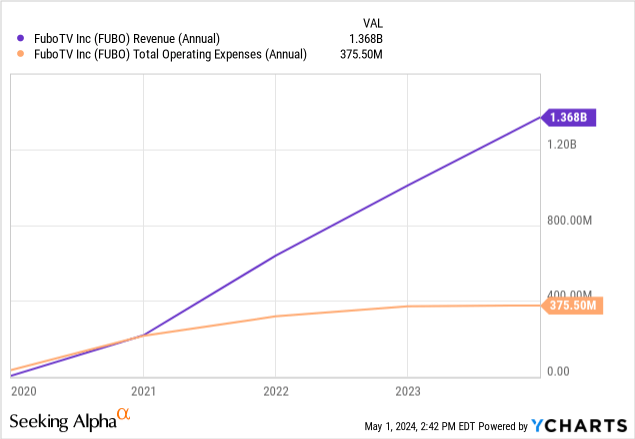

fuboTV finished 2023 with a $289.4 million operating loss. This was less than their $411.9 million operating loss in 2022, but still far from ideal. One positive for fuboTV was the operating leverage that they exhibited in 2023. Despite increasing revenues by about $360 million, the company increased their operating expenses by only about $5 million.

On a cash basis, fuboTV’s financials still aren’t great. They posted a $177.6 million loss in cash from operations in 2023. Although this performance was better than their cash from operations total in 2022, it’s close to being in line with their performance in 2020 and 2021-years during which they generated roughly one-sixth and one-half as much revenue, respectively. So, although fuboTV generated healthy operating leverage in 2023, their cash basis financials tell a different story.

fuboTV benefits from an asset-light business model. They spent only $1.1 million on capital expenditures in 2023. This is not an anomaly, either, as they’ve spent only a total of $5.8 million on capital expenditures since they went public.

One concerning trend for fuboTV is their ballooning net debt figure. 2023 net debt came in at $197.7 million. This is notably higher than their totals from 2020-2022 of -$101.4 million, -$10.3 million, and $105.7 million, respectively. A sizable portion of this trend was fueled by $389.4 million of debt that was issued in 2021. But ever since issuing this debt, fuboTV has only repaid marginal amounts, while their cash balance has fallen close to $120 million to $245.3 million. And if their history of heavy free cash flow losses continues, fuboTV may be forced to raise more money in the near future to finance their operations while they trend towards positive free cash flow.

Another figure from fuboTV’s financials that I find quite interesting is their spending on stock-based compensation. In 2023, fuboTV spent $51.2 million on stock-based compensation. This may not seem concerning. After all, the company generated over $1.3 billion of revenue. But when you consider that fuboTV posted only $86.1 million of gross profit in the same calendar year, it looks imprudent in my opinion.

Sure, the company may have been able to rationalize those levels of stock-based compensation in 2020 when their market cap was north of $5 billion and while they were in the middle of the pandemic-induced streaming boom. But now that fuboTV’s stock price has come back down to earth, $50 million of stock-based compensation seems excessive.

Overall, fuboTV’s financials tell an interesting story. They’ve rapidly grown top-line revenue since going public but have struggled to translate this into profits or positive free cash flow. And now that the streaming market has come back down to earth since it ballooned in the pandemic era, fuboTV appears to be positioned in a haphazard spot moving forward.

Changing Competitive Landscape

When valuing fuboTV, the most critical factor to consider is the long-term sustainability of their business model. In particular, I see two critical trends that jeopardize their long-term viability: the rapid rise in competition and their inability to exert pricing power. Both of these trends are interconnected and simultaneously work to fuboTV’s detriment.

Recently, there has been a proliferation in the number of competitors in the sports media rights market. For example, Apple Inc. (AAPL), Amazon.com, Inc. (AMZN), and Alphabet Inc. (GOOG), (GOOGL) have all entered the streaming market within the last few years. The addition of these new entrants has sent the sports media rights market into a frenzy.

In 2023, Peacock paid $110 million for the exclusive rights to a single NFL playoff game. Fast-forward to 2024, and it was announced that Amazon upped that number to $120 million for the exclusive rights to a single NFL playoff game that will air in early 2025. That’s $120 million for a single event that will last about 3 hours.

This phenomenon isn’t limited to NFL media rights, either. In 2022, Apple agreed to a 10-year deal with Major League Soccer for the exclusive media rights of the sport for $2.5 billion, or at least $250 million per season. This number is up significantly from the league’s prior deal that paid them around $90 million per year.

These are just a few examples of the ballooning growth in demand for sports media rights. There are many more that reinforce the reality of this trend. Now, I understand that fuboTV streams events other than live sports, but I believe that the sports media rights market acts as a microcosm for the rest of the streaming market. After all, live sports are one of the primary reasons why consumers avoid getting rid of cable TV.

In this hyper-competitive environment, fuboTV is left facing a dual challenge: competing on price with other media rights purchasers (who are now some of the most well-capitalized companies in the world), as well as competing on price with consumers. Neither of these forces bode well for a company that is yet to turn a profit and is already eating away at its own pile of cash.

Valuation

fuboTV makes for a difficult valuation as they’re not yet profitable, nor have they produced positive free cash flow. Moreover, they haven’t produced positive cash from operations and their gross profit is only marginal. This leaves investors with primarily revenue-based metrics to value the company.

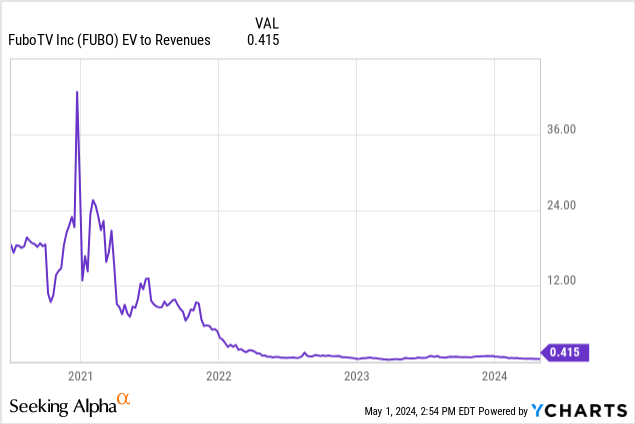

Seeking Alpha’s quant system rates fuboTV’s overall valuation as a ‘B+.’ The company currently trades at an EV/Revenue multiple of 0.45x. Furthermore, their EV/Revenue multiple has been below 1x ever since May 2022.

Multiples at such low levels can appear enticing for investors due to the appearance of a cheap price that they reflect, but this accurately prices the market dynamics that fuboTV is facing, as well as the company’s financial performance to date. It’s also worth noting that fuboTV draws an Altman Z Score of -1.50, indicating that the company is in poor financial health. This risk of financial distress further discounts fuboTV’s valuation.

Overall, their stock appears to be valued appropriately now, and I wouldn’t want to nitpick over whether they should be trading at a 0.3x or 0.6x EV/Revenue multiple instead of their current 0.45x multiple. However, what I do know is that I wouldn’t want to be a holder of their stock for the long term, as I believe they will get beaten out by their competitors. Unless fuboTV were to have a significant catalyst, I don’t see them trading above 1x EV/Revenue. And until that point, I would be hesitant to buy shares.

Risks

fuboTV’s growth potential poses the primary risk for a ‘Sell’ rating on the stock. The company is projected to grow revenue over 20% in 2024, and management is targeting 2025 as the year the company will reach breakeven on a free cash flow basis. It’s possible that fuboTV’s stock will snap out of its slump if they are able to meet these projections.

Furthermore, there are several Wall Street Analysts that are bullish on the company’s stock. Of the 8 Wall Street analysts that cover fuboTV, three rate it a ‘Strong Buy,’ one rates it a ‘Buy,’ three rate it a ‘Hold,’ and one rates it a ‘Sell.’ Investors should be aware that there are analysts that are bullish on the company and its ability to succeed.

Conclusion

At the end of the day, fuboTV is playing a game based on prices that is seeing an ever-increasing number of competitors. Furthermore, most of their new competitors are incredibly well-capitalized and have ample cash to spend. Without a way to differentiate, fuboTV will find itself forced to cut prices, in my opinion. These dynamics beg the question, if fuboTV wasn’t able to capitalize on their early entrance to the streaming TV market, will they ever be able to? For these reasons, I rate fuboTV a ‘Hold.’

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.