Summary:

- fuboTV Inc. shares surged 29.7% in midday trading on August 19th, due to a positive development regarding the industry the company operates in.

- A judge’s ruling against a joint sports streaming venture between major companies favored fuboTV, leading to the recent stock price increase.

- Despite recent improvements in revenue, profits, and user growth, fuboTV still faces significant challenges, making it a ‘sell’ for now.

hapabapa

The last two trading days have been explosively positive for shareholders of fuboTV Inc. (NYSE:FUBO). On August 16th, shares of the company closed up 16.7%. But that paled in comparison to midday trading on August 19th. As I type this around noon, Eastern Standard Time, shares are up 29.7% from where they closed on last Friday. This surge higher is not random. Rather, it’s because of a rather significant development regarding the industry that fuboTV operates in.

If you’re reading this article, there’s a good probability that you already know what fuboTV does. But for those who don’t know, the company operates a streaming platform that mostly caters to sports centric content. The company has made a concerted effort to also stream other content like news and miscellaneous entertainment. But at its core are sporting events. Over the past few years, the enterprise has grown rather rapidly. However, the fundamentals have been problematic. Then, earlier this year, the announcement of a joint sports streaming venture between The Walt Disney Company (DIS), Warner Bros. Discovery (WBD), and Fox Corp (FOX, FOXA), sent shares plummeting.

In an article that I wrote about this in early February, I called the development an existential crisis for the business. According to fuboTV itself, those three companies control somewhere between 60% and 85% of all sports content in the markets in which they operate. For a company that relies on the licensing of content and that still generates losses and cash outflows, being able to compete with such behemoths is an absurd notion.

The reason for the recent move higher can really be chalked up to a single development. And that relates to the fact that, just the other day, a judge made a major announcement regarding the streaming venture between the three companies. This announcement certainly works in fuboTV’s favor. Add on top of this the fact that management recently increased guidance for the current fiscal year, and I can understand the market’s enthusiasm. The picture certainly is better now, than it was before. But I still don’t believe that this means that the business makes sense to buy into at this time. I suspect that it would be at least another year or two before the shares are even fairly valued, if they ever get to that point. So, because of this, I expect underperformance relative to the broader market. And that leads me to keep the company rated a “sell” for now.

Digging into the details

Before I get into the fundamentals, I should touch on the main development that has sent shares skyrocketing a total of 51.4% over the last two trading days. As I mentioned at the start of this article, the joint venture between Disney, Warner Bros. Discovery, and Fox created a lot of uncertainty for shareholders of fuboTV. Such a move would put fuboTV at a massive competitive disadvantage compared to these businesses and the platform, Venu Sports, that they had planned to launch in the Fall of this year.

For its part, fuboTV was very active in challenging this joint venture. In fact, it was its suit against the trio in the US District Court, Southern District of New York, that brought to a halt, for now, the streaming ambitions of these media giants. The allegation was that the venture would be a violation of Section 7 of the Clayton Act. It states that mergers and acquisitions where the effect, “may be substantially to lessen competition, or to tend to create a monopoly,” should be prohibited.

According to the judge, Margaret Garnett, who ruled on the matter,

it appears to the Court that Fubo is likely to succeed on its claims that by entering into the JV, the JV Defendants will substantially lessen competition and restrain trade in the relevant market,

in violation of this law. The judge also stated that,

“it also appears that a balance of equities tips decidedly in favor of Plaintiffs and the public interest would be served by the entering of a preliminary injunction.”

This does not mean that the joint venture will be scuttled. Instead, Venu Sports is being enjoined and restrained from launching the service until a final adjudication of the case can be made. There’s not yet any timeline on when this might occur. But between this slowdown and pressure from three democratic lawmakers’ letter sent last month to the DOJ, asking it to review the deal over the impact it could have on the competitive environment, it’s clear that the tides favor fuboTV.

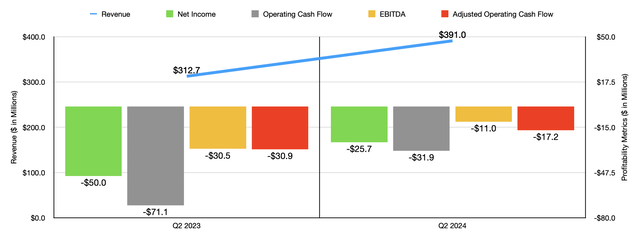

Outside of this, fuboTV has had some other wins as of late. These have been on the fundamental side of the picture. Earlier this month, management announced financial results covering the second quarter of the 2024 fiscal year. Overall revenue for that quarter came in at $391 million. That was 25% above the $312.7 million reported just one year earlier.

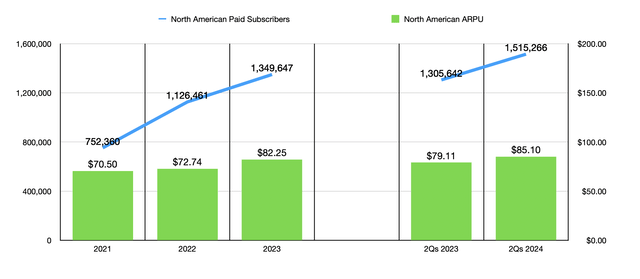

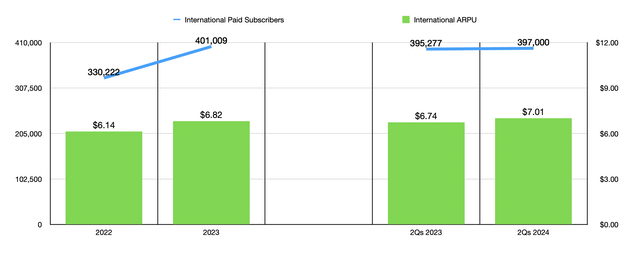

This increase in sales was driven by two factors. First and foremost, the company benefited from a rise in the number of paid subscribers. In North America, it had 1.48 million paid subscribers during the second quarter. That was up substantially from the 1.24 million reported one year earlier. And in its international markets, the number of paid subscribers grew from 393,601 to 394,471.

And second, there was a rise in monthly ARPU (average revenue per user) from $81.62 to $85.69 for North America, and from $6.91 to $7.02 internationally. To put into context just how damaging Venu Sports could have been, it’s worth noting that the plan had been for the company to charge its users $42.99 per month. Considering the sports-related content they controlled, this would have significantly impacted the ability for fuboTV to operate.

There was also an improvement on the bottom line. During the second quarter of this year, fuboTV generated a net loss of $25.7 million. That was just over half the $50 million loss reported at the same time last year. Other improvements on the bottom line came about as well. Operating cash flow improved drastically from negative $71.1 million to negative $31.9 million. If we adjust for changes in working capital, we get an improvement from negative $30.9 million to negative $17.2 million.

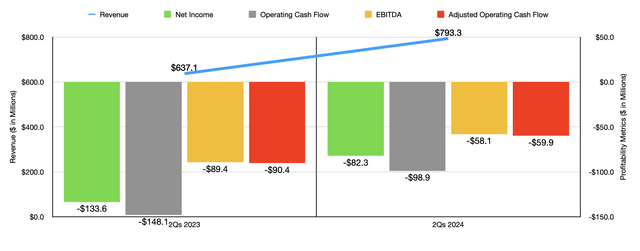

And finally, EBITDA for the company went from negative $30.5 million to negative $11 million. In the chart above, you can also see financial results for the first half of this year relative to the same time last year. The same factors that contributed to the improvements in the second quarter of this year aided the company significantly for the first half of this year compared to the first half of last year.

In many respects, fuboTV has made tremendous progress over the last couple of years. From 2021 to 2023, the number of paid subscribers and the ARPU generated by the company has grown quite a bit. We don’t have international data for 2021. As the chart above shows, in North America, this three-year window has been positive. And in the chart below, the two-year data has been great internationally. And even when it comes to the first half of this year compared to last year, the company continues to see meaningful growth in its subscriber count and in how much it can charge its customers for its services.

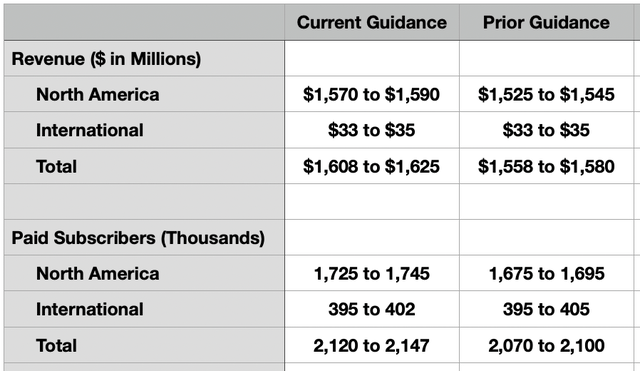

Management also seems quite optimistic about what the rest of this year should look like. When the company announced results for the first quarter of this year, it stated that its North American operations should have between 1.675 million and 1.695 million paid subscribers by the end of the year. But in its second quarter earnings release, it increased this guidance to between 1.725 million and 1.745 million. As a result of this, revenue guidance has also been raised from between $1.525 billion and $1.545 billion, to between $1.57 billion and $1.59 billion. In the table below, you can see that the upper end of the range for the international operations has been pushed lower. But overall revenue internationally is expected to remain between $33 million and $35 million.

When looking at this picture in its entirety, investors might be tempted to say that things are looking really great. You have a company achieving rapid growth in its number of paid users. Profits and cash flows are approaching breakeven. And now the largest competitive threat to the business looks like it’s going to fail or, at a minimum, be materially slowed down. These are all positive things. Having said that, there are some problems that fuboTV has. The fact that earnings and cash flows are still significantly negative is discouraging.

In the chart below, you can see how much in adjusted operating cash flow the company would need to generate to be worth either 10 times or 20 times said cash flow on a price to adjusted operating cash flow basis. The chart also shows the same thing for EBITDA for the EV to EBITDA approach. If we use the most aggressive valuation scenarios, it’s not unthinkable that the company might hit that point in another year or two. But that could be a stretch. Until that occurs, shares look expensive.

Another thing to keep in mind is that a rapidly growing company that’s cash flow negative needs capital to continue operating. Even though most of its debt is convertible, there is no guarantee that a conversion into common stock will occur. As an example, take the notes that come due in February 2026. They have a conversion rate of $57.78 per share. Today, fuboTV is trading at around $2. At maturity, holders of the convertible notes can require fuboTV to make said redemption in the form of cash.

At present, that would be about $162.8 million worth of capital that needs to be paid out. The amount was greater until December of last year, when the company arranged to swap out $205.8 million worth of these notes in exchange for $177.5 million of new ones that mature in 2029. So it might be possible for the company to make a similar transaction as we get closer to 2026.

But there’s no guarantee. Because of this, and because of how far away the conversion the price is from where shares currently are, I doubt that we should ignore these convertible notes in the calculation of the company’s liquidity.

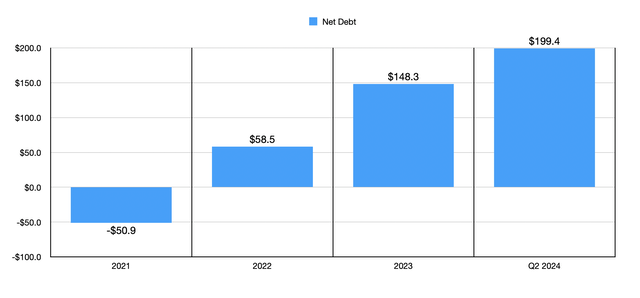

With all of that in mind, the net debt picture for the business has worsened quite a bit recently. At the end of 2021, the company actually had net cash on hand of $50.9 million. By 2023, this had turned to net debt of $148.3 million. And by the end of the second quarter of this year, the company had net debt of $199.4 million. Until the business can reach cash flow breakeven, investors should expect this trend to continue worsening, or they should expect significant shareholder dilution aimed at making sure that net debt doesn’t get worse. Either way, this will inhibit the company’s potential, irrespective of what goes on with the battle it’s waging against the major players in the space.

Takeaway

There’s no doubt that the last couple of days have been great for shareholders of fuboTV. The biggest risk for the company now seems to be dealt with or, at worst, delayed into the future. Management has also been making progress on revenue, profits, cash flows, and user growth. These are all great to see. However, the company still has significant problems, and it’s going to be a while before shares can be considered even fairly valued. So, because of this, I think that keeping the firm rated a ‘sell’ is still a good idea.

Those who disagree with me might point out that, since I last reaffirmed my “sell” rating on the stock in May of this year, shares are up 58.9% at a time when the S&P 500 is up 5%. This is true. But I would also like to point out that, since I first rated it a “sell” in February of this year, shares are down 0.3% while the S&P 500 has jumped 11.5%. When I rate a company a “sell,” it’s not a statement that I think that shares will necessarily drop. Rather, it’s that I expect the stock to underperform the broader market for the foreseeable future. And that is precisely what we have seen up to this point. And likely, this trend should continue.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!