Summary:

- fuboTV Inc.’s balance sheet shows a worsening net debt position, with $155 million in Q4 2023.

- With projections indicating a potential burn through of $140 million in free cash flow for 2024, the company faces a looming cash crunch.

- The possibility of shareholder dilution, estimated at 25%, further compounds the challenges posed by fuboTV’s financial woes.

Palto/iStock via Getty Images

Investment Thesis

fuboTV Inc. (NYSE:FUBO) was once a high-flying stock with a massive shareholder following. Today, it’s a shadow of its former self. And even though the stock is down significantly from its all-time highs, I argue that not only is this stock not undervalued, but it’s actually likely to sell off further, as fuboTV is likely to dilute investors by early 2025, as it seeks to raise precious capital to keep its balance sheet afloat.

Here, I charge that investors will in the next twelve months look back to fuboTV at approximately $2 per share as a high point to aspire towards.

Here’s why I issue a Sell rating on FUBO.

Rapid Recap

In February, I titled my fuboTV analysis, “Cheapness Has Nothing to Do With It.” There I said,

The bulls can point to 2024 as being the year that fuboTV will at some point reach $2 billion in revenues as a forward run rate.

Meanwhile, the bears rapidly retort that this business is going to run out of cash in less than 18 months and will need to raise more capital on substantially burdensome terms.

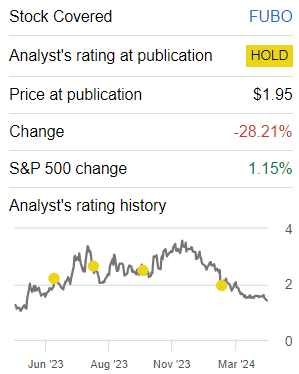

Author’s work on FUBO

Since I wrote that, FUBO has sold off 28%. And yet, I declare, that although the stock is down significantly, it’s far from cheap. In fact, I’m now firmly assured that fuboTV will run out of cash in less than 18 months and downgrade my rating to a sell.

fuboTV’s Near-Term Prospects

FuboTV is a streaming service that offers live sports, where subscribers can access a wide range of sports-related content, including live sports events, through various devices such as smart TVs. FuboTV aims to provide a comprehensive streaming experience with a focus on sports-centric programming.

The bull case is built on the fact that fuboTV’s paid subscribers continue to climb, with fuboTV demonstrating its ability to retain paying customers in a competitive streaming market. This is the bull case in a nutshell.

The problem, though, is that fuboTV hasn’t succeeded in adequately monetizing its paying users. But I get ahead of myself. First, let’s turn our focus to its growth rates.

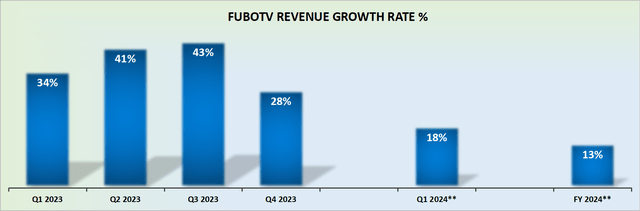

Revenue Growth Rates Will Slow Down

fuboTV had a strong 2023 given that it acquired Molotov. But fuboTV’s ability to continue growing in 2024 will significantly decelerate. Indeed, I question whether fuboTV will succeed in meeting its previously offered guidance.

Nevertheless, one way or another, the verdict is clear: fuboTV is no longer a rapidly growing business anymore.

Consequently, investors will not be inclined to pay a premium for a stock that is pointing toward substantial deceleration in its revenues in the coming year. However, even that isn’t the whole story. There’s a more poignant aspect, which we discuss next.

FUBO Stock Valuation — Shareholder Dilution Likely Coming in Less Than 18 Months

Whenever I come to access any stock, I spend 5 minutes on a company’s balance sheet. This exercise is immediate, but these quick 3-5 minutes pay for themselves with a massive return on investment. Looking over the balance sheet is something that I find few investors pay much heed to.

What we see is that in Q4 2022, fuboTV held a net debt position of approximately $60 million. That’s not great, but that’s not particularly challenging. While this time around, fuboTV finished Q4 2023 with a net debt position of $155 million. Without any further insights whatsoever, you can already see that this company’s balance sheet is worsening. Looking at a company’s prospects in this manner is easy to do. You don’t need to be an accountant.

Next, I believe that in 2024, fuboTV will burn through $140 million of free cash flow. Given that fuboTV holds very approximately this same figure as net cash, this will mean that my previous contention that fuboTV will run out of cash within 18 months is reasserted.

To further complicate matters, given that its market cap valuation has already started to shrink, this will mean that for fuboTV to raise $100 million of cash, its shareholders will be forced to stomach a 20% dilution.

In sum, this is a company that is high on narrative and short on profits. Avoid.

The Bottom Line

In wrapping up, despite the substantial selloff from its previous highs, fuboTV Inc. stock is far from undervalued. Central to my concern is the company’s deteriorating balance sheet, highlighted by its escalating net debt position, which has surged from approximately $60 million in Q4 2022 to $155 million in Q4 2023. This significant increase signals a troubling trend of worsening financial health.

Looking ahead, the impending cash crunch poses a critical challenge for fuboTV, with my projections pointing to a potential cash burn of $140 million in free cash flow for 2024. Coupled with its shrinking market cap valuation, the company may be forced to resort to shareholder dilution to raise much-needed capital, potentially resulting in a 20% dilution for investors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.