Summary:

- FuelCell Energy reported uninspiring Q2/FY2024 results with negative gross margins and significant cash burn.

- With open market sales remaining the company’s primary funding source, relentless dilution for common shareholders continued.

- Subsequent to quarter-end, the company signed a $160 million long-term service agreement in Korea, which should boost revenues significantly starting in FY2025.

- While investors should continue to avoid the common shares, the company’s Series B Preferred Stock offers a juicy 13.2% dividend yield, for income-oriented investors.

- Considering the company’s almost unlimited ability to finance operations via open market sales, I expect FuelCell Energy to honor its preferred dividend obligations for the time being.

Fahroni/iStock via Getty Images

Note:

I have covered FuelCell Energy, Inc. or “FuelCell Energy” (NASDAQ:FCEL, OTCPK:FCELB) previously, so investors should view this as an update to my earlier articles on the company.

Uninspiring Q2/FY2024 Results

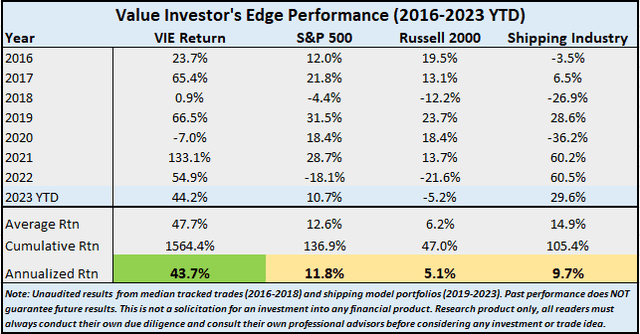

On Monday, FuelCell Energy reported another set of uninspiring quarterly results with substantially negative gross margins and sizeable cash burn:

Company Press Releases / Regulatory Filings

Negative free cash flow of $51 million was partially offset by $13 million in new debt financing backed by the company’s recently completed projects in Derby, Connecticut. In addition, FuelCell Energy sold 6.5 million new common shares into the open market for net proceeds of $5.9 million.

Relentless Dilution Continues

Subsequent to quarter-end, the company sold an additional 38.6 million shares into the open market resulting in net proceeds of $31.7 million.

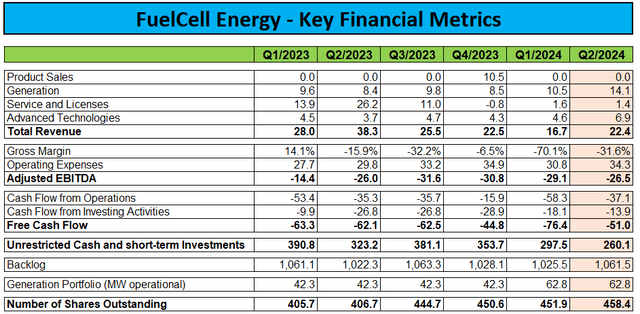

With $260.1 million in unrestricted cash and short-term investments and another $261.4 million still available under FuelCell Energy’s recently amended open market sales agreement, liquidity won’t be an issue for the time being:

Company Presentation

In addition, with more than 500 million authorized shares at hand, the company could increase the amount under its open market sales agreement even further.

However given quarterly cash usage of $50+ million, material dilution is likely to continue for the time being.

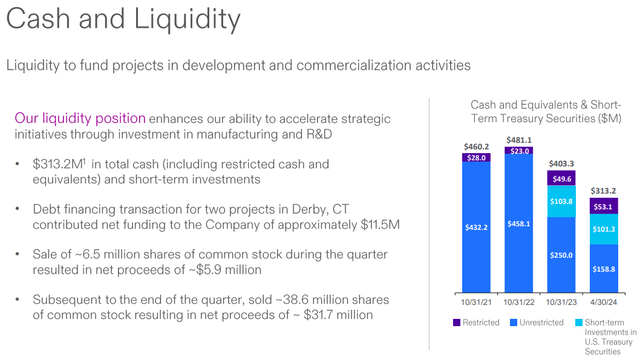

However, FuelCell Energy has decreased FY2024 spending plans by $30 million mostly due to capacity expansion and customer projects shifting into next year:

Company Presentation

As a result, I am increasing my FY2024 free cash flow estimate from up to $(300) million to approximately $(250) million.

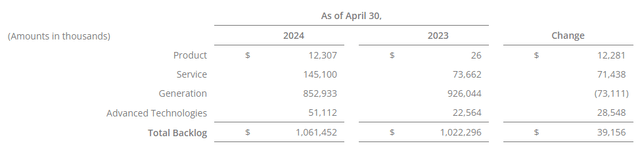

Backlog Up Slightly

Backlog was up slightly quarter-over-quarter mostly due to the recent extension of the company’s carbon capture technology development agreement with a division of Exxon Mobil (XOM):

Company Press Release

In combination, FuelCell Energy’s service and generation backlog had a weighted average term of approximately 17 years at quarter end.

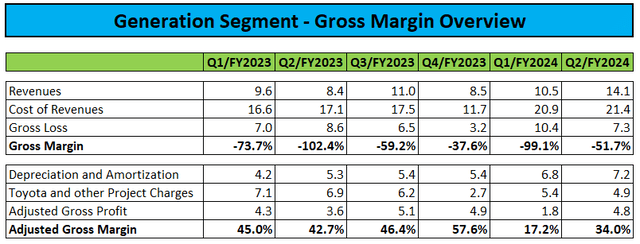

Generation Segment Boosted By Increased Capacity

In Q2/FY2024, the company’s core generation segment got a boost from the recent completion of projects in Derby and Long Beach:

Regulatory Filings

While revenues increased to new highs and adjusted gross profit improved sequentially, margins came in below the company’s usual 40%-50% range.

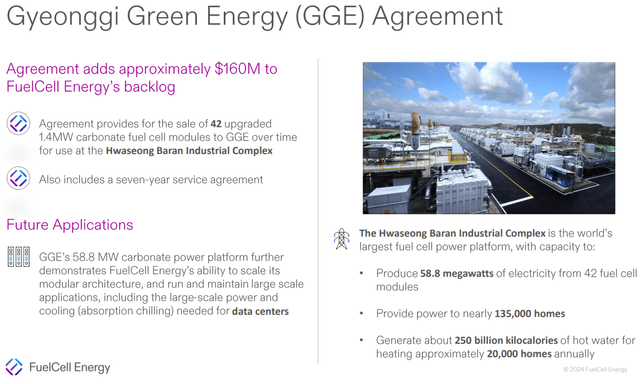

Major Service Agreement In Korea

Subsequent to quarter-end, FuelCell Energy announced a major long-term service agreement with Gyeonggi Green Energy Co., Ltd. or “GGE” (emphasis added by author):

(…) FuelCell Energy, Inc. (Nasdaq: FCEL) and Gyeonggi Green Energy Co., Ltd. (GGE), today announced that pursuant to a long term service agreement GGE has agreed to purchase 42 1.4-megawatt upgraded carbonate fuel cell modules from FuelCell Energy to replace existing fuel cell modules at the Hwaseong Baran Industrial Complex fuel cell power platform, the world’s largest fuel cell power platform, located in Hwaseong-si.

The agreement, which constitutes a significant milestone for supplying clean baseload power to the Korean market, also includes a new seven-year service agreement pursuant to which FuelCell Energy will service the fuel cell modules. Under the terms of the agreement, the Company expects to receive approximately $160 million of revenue over the term of the agreement.

Company Presentation

The company provided additional information in its regulatory filings (emphasis added by author):

The Company’s service obligations under the LTSA will commence with respect to individual Plants as the Company replaces each Plant’s existing fuel cell modules and commissions the replacement fuel cell modules.

The term of the LTSA with respect to each Plant will continue for seven years from the date of commissioning of the replacement fuel cell modules for such Plant.

Commissioning of the first six 1.4-MW replacement fuel cell modules is expected to be completed in the fall of calendar year 2024, with an additional 30 1.4-MW replacement fuel cell modules expected to be commissioned throughout the course of calendar year 2025, and the remaining six 1.4-MW replacement fuel cell modules expected to be commissioned in the first half of calendar year 2026.

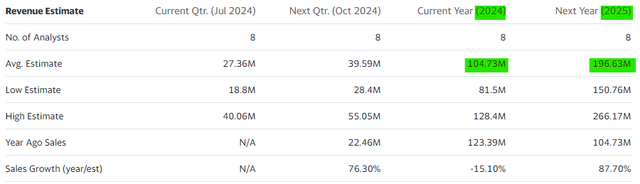

Consequently, FuelCell Energy will start to recognize service revenues under the agreement in FY2025. With the majority of the projected revenues related to the fuel cell module exchanges scheduled between 2024 and 2026, the company’s results should get a nice boost starting next fiscal year as also reflected in current consensus expectations:

Yahoo Finance

However, given the high likelihood of further, relentless dilution as a result of elevated cash usage, investors should continue to avoid the common shares.

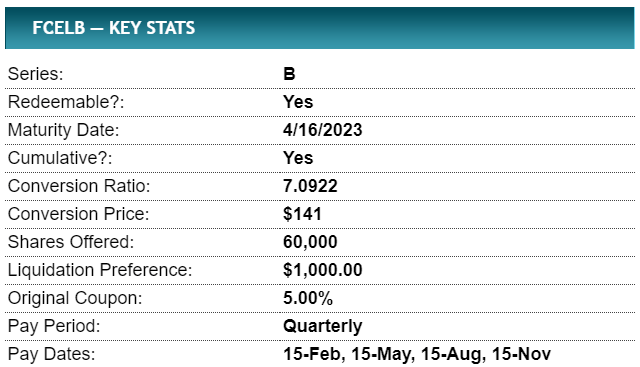

Series B Preferred Shares – 13.2% Dividend Yield

That said, income-oriented investors should consider taking a look at FuelCell Energy’s 5% Series B Cumulative Convertible Perpetual Preferred Shares or “Preferred Shares” (OTCPK:FCELB) which currently offer a juicy 13.2% annualized dividend yield:

Preferred Stock Channel

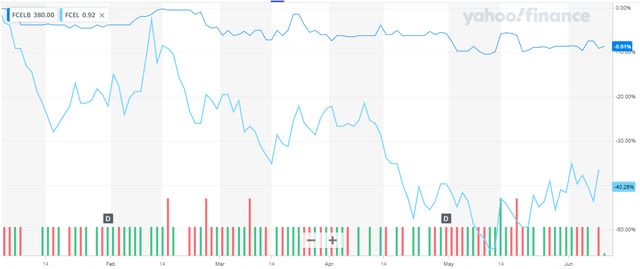

While the Preferred Shares haven’t done great so far this year, I would mostly attribute the weakness to the abysmal performance of the company’s common stock:

Yahoo Finance

However, relentless dilution for common equity holders actually benefits preferred shareholders as the company quickly replenishes funds used for covering losses from operations, capital expenditures, debt service and dividend obligations.

In addition, required quarterly preferred stock dividend payments of $0.8 million aren’t material for FuelCell Energy.

As long as the company retains the ability to sell newly issued common stock into the open market, I consider the preferred stock dividend as rather safe.

With the opportunity to regain Nasdaq listing compliance via reverse stock split, FuelCell Energy’s ability to conduct open market sales is basically unlimited except for some minor constraints:

- Increases in authorized shares and reverse stock splits require common shareholder approval. However, rejecting these proposals would harm common equity holders even more as the company would likely be forced into chapter 11. While ongoing dilution isn’t great, bankruptcy would be far worse, particularly with common shareholders last in line behind creditors and preferred stockholders.

- According to Nasdaq Rule 5810 (b)(3)(a)(iv), FuelCell Energy needs to avoid exceeding a cumulative reverse stock split ratio of 1:250 over a two-year time frame as otherwise the company would not be eligible for the usual 180-day grace period and face immediate delisting in case its stock price trades back below $1 for 30 consecutive business days. However, this should not be an issue either.

Consequently, I expect the company to honor its preferred dividend obligations for the time being even without any reasonable prospects for near-term profitability and cash generation.

However, should FuelCell Energy ‘s business fundamentals miraculously improve, preferred shareholders are likely to be rewarded with some decent capital gains.

Bottom Line

FuelCell Energy reported another set of uninspiring quarterly results with negative gross margins and sizeable cash burn.

With cash usage projected to remain elevated for the time being, relentless dilution for common shareholders is likely to continue.

Consequently, investors should avoid the company’s common stock.

However, income-oriented investors should consider FuelCell Energy’s Preferred Shares which currently offer a juicy 13.2% annualized dividend yield. While certainly not the average preferred stock backed by sufficient cash flows from operations, the company’s almost unlimited ability to sell additional common shares into the open market is likely to result in FuelCell Energy honoring its dividend obligations for the time being.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

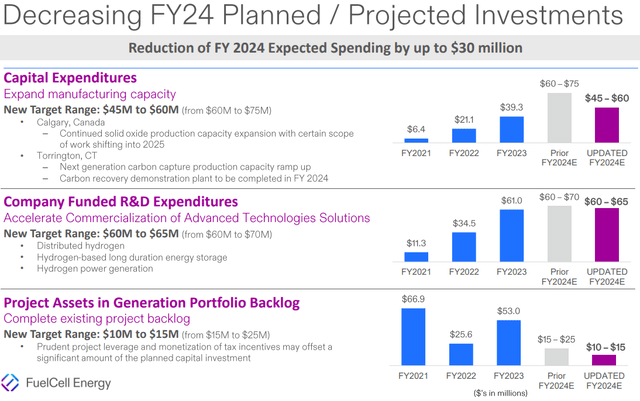

Massively Outperform in Any Market

Value Investor’s Edge provides the world’s best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared towards investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.