Summary:

- I am bearish on FuelCell Energy, Inc. due to its weak financial health, declining revenue, consistent net losses, and high cash burn.

- FCEL’s restructuring plan, including a 17% workforce cut and 15% cost reduction, is insufficient to reverse its financial struggles and achieve profitability.

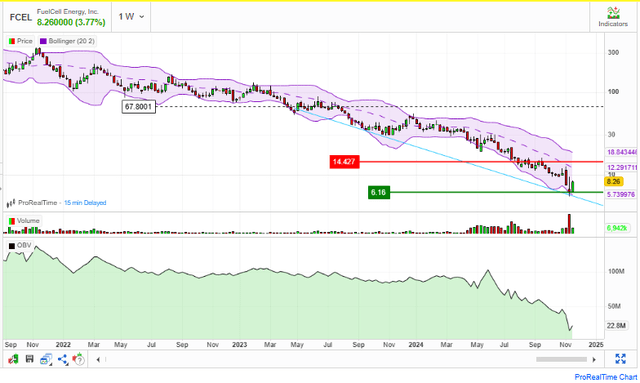

- The company’s technical indicators, such as trading below key moving averages and bearish OBV and Bollinger bands, confirm a strong downward momentum.

- Given FCEL’s dire financial situation, I rate the stock a sell, expecting the downtrend to persist.

bunhill

Investment Thesis

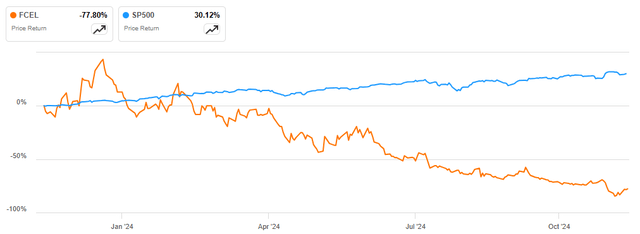

I am bearish on FuelCell Energy, Inc. (NASDAQ:FCEL) due to its weak financial health and momentum. The stock has slumped more than 77% over the last year underperforming the S&P 500 by a margin of about 107%.

I believe this has been a result of the company’s weak financial performance characterized by declining revenue, consistent net losses, and high cash burn. While the company has what some could term as turnaround measures through its restructuring plan, I don’t think it will have any significant impact on the stock’s downward trajectory since the expected cost savings are way below pushing the company to profitability. Consequently, I believe the downtrend will persist warranting a sell rating for this stock.

Brief Company Overview

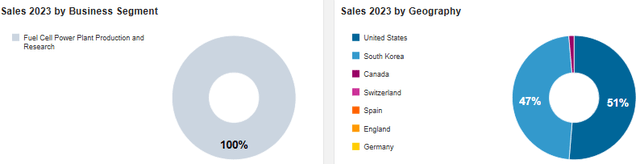

FCEL is a publicly traded company founded in 1969 and headquartered in Danbury, Connecticut. It specializes in designing, manufacturing, installation, maintenance, and operationalization of stationary fuel cell power plants. The plants use molten carbonate fuel cell technology to generate power, heat, water, and hydrogen. It operates largely in the United States, South Korea, and Europe. The revenue distribution for its business line and geography is shown below.

Financials: Very Precarious

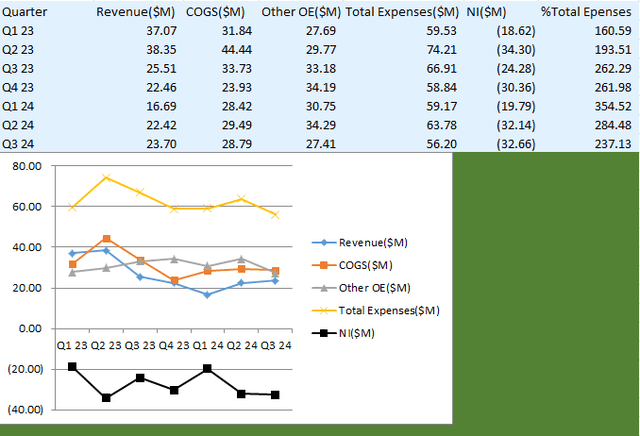

Undoubtedly, one of the most important considerations when making investment decisions is financial health. As a result, I will go into detail about FCEL’s financial performance, paying attention to its sales, expenses, and profitability over the last seven quarters. The raw data and graphical representation are displayed below.

From this analysis, several observations can be made the most obvious being that this company’s revenue has been persistently below its cost of goods sold [COGS] and total expenses [Total Expenses](COGS+Other Operating Expenses) a scenario that has seen its net losses persist with no signs of turning profitable. Let’s dive deeper here and evaluate each of these variables.

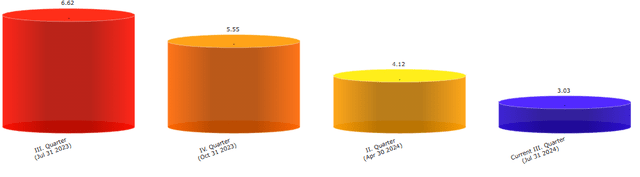

Looking at the revenue it has a downward slope although, in the last three quarters, there are some signs of improvement. However, although the revenue seems to have grown in the last three quarters in absolute terms, the YoY growth rates have been negative meaning that the company’s revenue generation is weak implying a weakening demand for its products and services. For example, in Q2 2024 when its revenue YoY growth was negative 41.54%, its service agreement revenue fell by about 95%, and in the MRQ its service agreement revenue fell by approximately 85.7% from $9.8 million in Q3 2023 to $1.4 million in Q3 2024, a testament of weakening demand.

Revenue generation is not the only concern. The company’s elevated costs are a rough sea for this company to navigate if profitability is to be achieved. To begin with, its COGS has been consistently above its revenue since Q2 2023. This implies that the company is not able to cover its production costs with its sales. This alludes to operational inefficiencies, which raises concerns. To support my assertion on inefficiencies, its trailing net income per employee is negative $194.5K compared to the sector median of positive $21.1, which I believe implies that there is an inefficient utilization of the workforce because ideally, each employee should contribute positively to the company’s net income. This potentially explains why the company plans to lay off about 13% of its workforce. The other aspect that supports inefficiencies is the company’s negative 12.11% trailing ROA compared to the sector median of 5.29% which means that the company is not utilizing its assets efficiently to generate income in my opinion.

The company’s operational struggles and inefficient cost management are underscored in its high total expense as a percentage of revenue. Since Q3, its total expenses as a percentage of revenue have been above 200%, something which speaks volumes on how far this company is from realizing profitability in my view.

While this performance is already enough to avoid this stock, my biggest concern with the company is its high cash burn. Over the last seven quarters, the average quarterly operating expense is $31.04 million, which is above the average quarterly revenue of $26.6 million. This translates to a high cash burn rate, given that its operating cash flows have been negative. Considering the average quarterly operating expense of $31.4 million and the available cash of $267.61 million, the company has an estimated runway of about 8.6 quarters, approximately 2 years.

Given its weak revenue generation and negative cash flow from operations, this leads me to its low Altman Z Score of negative 0.78 which is way below the minimum threshold of 1.8, thus underscoring how strong its financial risk is. In my view, this apparent financial risk explains the company’s high short interest which stands at 21.4% alluding to negative market sentiments.

Restructuring Plan: Why I Am Not Moved

FCEL has adopted several measures in an attempt to change the status quo and improve efficiency for better results. The first one is its restructuring plan, where the company aims at cutting its workforce by about 17%. The company also plans to cut its expenditure on product development and overhead costs. Cumulatively, it aims to reduce its total operating cost by about 15% through such measures. While the feasibility is speculative, I would like to assume that they will achieve it and evaluate the net effect of such a move on its financials. As earlier indicated, the company’s total operating expenses account for more than 200% and although that was a quarterly trend, it still holds with its 2023 total operating cost accounting for 208.34% of its total sales. Assuming that they achieve the 15% cost saving projected, that takes its total operating expenses to about 177% which still translates to net losses assuming its weakening revenue trajectory doesn’t worsen. Above all, cost-cutting initiatives have nothing to do with its trailing total liabilities of $203.9 million amid weak revenue generation and cash flow. In other words, the restructuring plan likely has nothing substantial to offer in solving the company’s current financial struggles, in my opinion.

The Technical Take

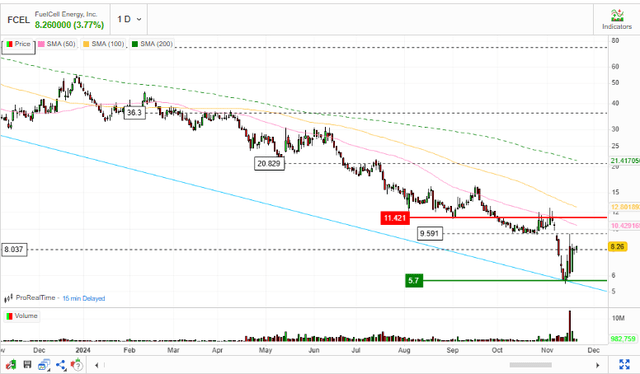

From a technical point of view, FCEL has a strong bearish momentum. Over the last years, it has formed a consistent descending pattern which is a bearish pattern and the stock is yet to show signs of a consolidation which would mark a potential turning point.

This bearish trend is confirmed by the moving averages. The stock is trading below the 50-day, 100-day, and 200-day moving averages [MAs]. When a stock is trading below downward-sloping MAs, it implies that it is in a strong bearish trajectory. Above all, the 50-day MA crossed below the 100-day MA in March forming the death crosses which is a confirmatory signal of a strong bearish momentum.

Looking at the OBV and Bollinger bands, it is very apparent that FCEL is in a solid downward momentum. To begin with, the Bollinger bands are diverging while moving downwards, this implies that there is an increasing momentum in the downtrend with no signs of a reversal and therefore the downward movement is likely to persist. On the other hand, the OBV is a dominant downward slope an indication of a growing volume in down days than on the up days. Notably, the OBV is trending south alongside the price which is a bearish confirmation signal.

In summary, FCEL is on a solid bearish trajectory, with no signs of a reversal warranting a sell rating.

Risks

Although I am bearish on this stock, my thesis is not without risk. A major risk would be the possibility of unanticipated technological breakthroughs or partnerships. If FCEL develops a new and more efficient fuel cell technology or gets a major partnership or contract that significantly alters its prospects, the stock’s trajectory may turn positive thus shifting my bearish thesis.

Conclusion

In conclusion, this company is in a rough financial situation with a problem in generating sales as discussed previously as shown by its declining account receivable turnover ratio.

Above all, I believe its profitability is set to continue following its elevated total operating costs and weak revenue growth which I believe can’t be resolved through its restructuring plan. Above all, the company has a high cash burn amid weak cash flow generation. Given these weak fundamentals and the weak technical outlook, I rate FCEL a sell.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.