Summary:

- FuelCell Energy, Inc. is entering a critical phase as it tests its carbon capture technology and scales its hydrogen fuel technology.

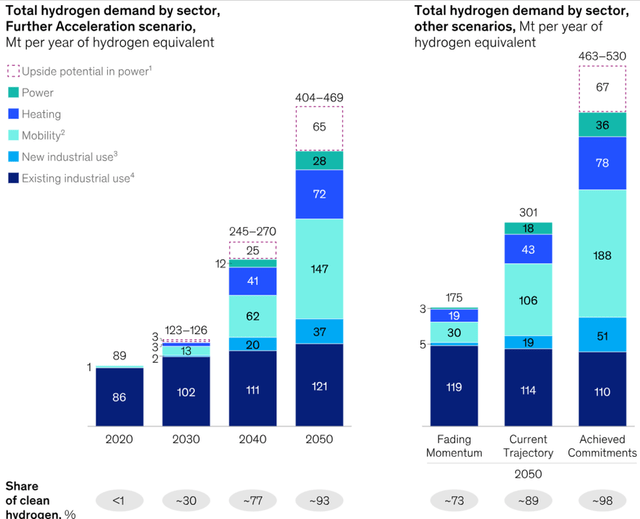

- The demand for clean hydrogen is projected to grow to 125-585MTPA by 2050, up from 90MTPA.

- FuelCell Energy needs to accelerate their scaling efforts as competitors enter and secure hydrogen & ammonia supply contracts domestically.

Petmal

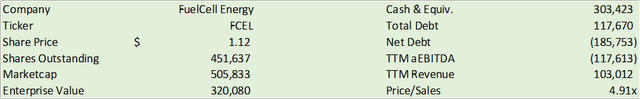

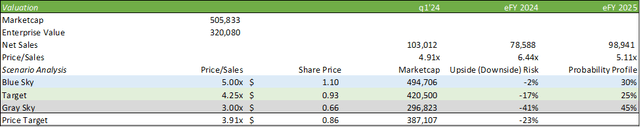

FuelCell Energy, Inc. (NASDAQ:FCEL) is entering into its make-or-break years, as the company’s carbon capture technology is being tested for effectiveness and their hydrogen fuel technology enters the scaling phase. As more competing firms enter the market with little near-term demand, FuelCell must prove that they can scale capacity and effectively penetrate different markets outside of transportation. With near-term headwinds relating to 45V clean hydrogen production tax credits, the firm may become more dependent on international markets until these domestic hurdles are resolved. Given the macro and micro landscape, I provide FCEL shares a SELL recommendation with a price target of $0.86/share at 3.91x eFY25 price/sales.

Macroeconomics

Hydrogen fuel is anticipated to be one of the next competing fuel sources next to electrification for transportation. McKinsey forecasts clean hydrogen demand to grow in the range of 125-585MTPA by 2050, up from today’s 90MTPA. Mobility applications are projected to drive the utilization of clean hydrogen with road transport accounting for 80MTPA, 50MTPA for aviation fuel, and 15MTPA for maritime. The consulting group also anticipates 95% of the total demand for clean hydrogen capacity to be used for industrial applications.

For example, Cleveland Cliffs (CLF) is testing the use of H2 in their blast furnaces as an oxygen reductant to replace coking coal and is in the process of developing their supply chain. LyondellBasell (LYB) is partnering with Chevron (CVX), Air Liquide (OTCPK:AIQUF), and Uniper (OTCPK:UNPRF) to develop a low-carbon-intensive hydrogen and ammonia production facility along the US Gulf Coast to cater to the petrochemicals, power, and mobility markets. New Fortress Energy (NFE) is also developing multiple green hydrogen facilities, one in partnership with Plug Power and another project with Long Ridge Energy Terminal and GE Gas Power in order to create a carbon-free power source. NextEra Energy (NEE) is partnering with CF Industries (CF) to develop the world’s largest generator of renewable energy, a zero-carbon-intensity hydrogen project.

Overall, I believe we will experience a gradual phase-in of hydrogen-based applications across the chemicals and industrials sectors; however, I believe that the economics must align before domestic production reaches the forecasted capacity. Management alluded to the fact that the largest operating cost for their electrolysis technology is energy, which may hamper the case for grid applications. As coal is phased out domestically, other baseload capacity must be brought online to replace the fossil fuel, whether it is nuclear, natural gas, or renewables. I believe that in the near-term, this can create a headwind for FuelCell as nuclear capacity isn’t expected to ramp up domestically until 2030 at the earliest.

In tandem with clean power sourcing to fuel the electrolysis technology, many firms, including Exxon Mobil, have voiced concern in attaining 45v tax credits as a result of tighter policy under the IRA.

“We’re investing billions of dollars to reduce the carbon intensity of our natural gas,” adding that failure of the Inflation Reduction Act to give companies credit would “basically instantly stop investments to reduce carbon intensity by the industry as a whole.”

Darren Woods, Exxon Mobil (XOM) CEO

Though Exxon Mobil’s partnership with FuelCell is for their carbon capture technology, I believe that the same concept applies as the broader industry funnels billions of dollars into hydrogen & CCUS projects while navigating decarbonization policy.

I cannot say for certain which direction policy will fall, whether the IRA will be adjusted to accommodate for carbon capture or remain purely dependent on green hydrogen. I do believe that if the policy is not updated to accommodate for blue hydrogen, as Mr. Woods expects to utilize, the industry may not experience the uplift necessary to get hydrogen utilization off the ground floor.

Operations

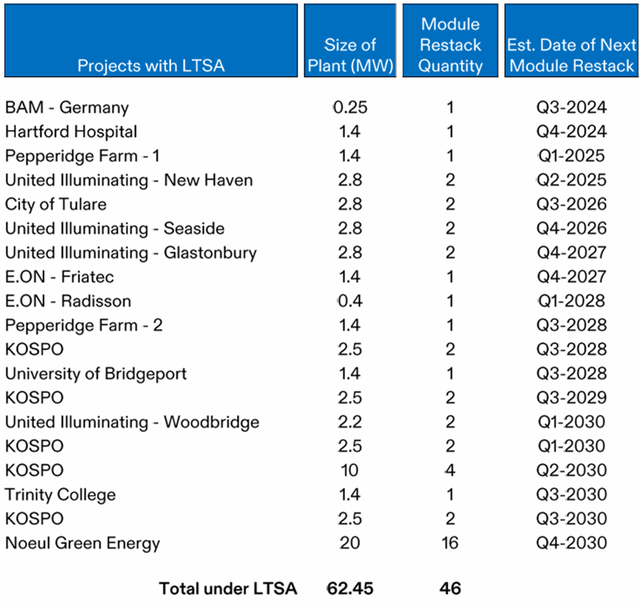

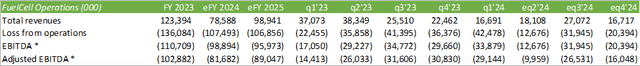

FuelCell Energy added 19.1MW of generating capacity in Q1 ’24 for a total capacity of 62.8MW. The firm recently completed a multi-year fleet upgrade where they replaced 30MW of modules that will allow for the firm to elongate the replacement cycle and should result in improved margins. FuelCell has also secured opportunities to build out new capacity in Korea as the country seeks to leverage hydrogen technology for their baseload. Looking at the firm’s restack outlay, the next set of projects will begin in Q3 ’24 with projects extending out to FY30. This should provide a relatively stable services revenue stream for the years to come.

The firm is also securing new builds in partnership with the Canadian Nuclear Laboratories, or CNL, to explore the pairing of the firm’s electrolysis with nuclear energy as well as a purchasing agreement with the University of Connecticut to install four 250kW solid oxide fuel cell units. Internationally, FuelCell is deepening their entrenchment in Korea with POSCO Energy to service their capacity.

On the generation side, FuelCell is actively building upon this recurring revenue stream with their latest builds, one in partnership with Toyota and the other in Derby, Connecticut, which is projected to recognize its first full quarterly earnings in Q2 2024.

For FuelCell’s Advanced Technology segment, the firm has secured a contract revenue stream with Exxon Mobil to develop their carbon capture technology, which is currently in the development phase. This includes a service agreement with the Esso Netherlands project.

One area that may be fruitful towards the end of the decade is their work with the U.S. Department of State in producing electrolytic hydrogen using SMRs located in Ukraine in order to support ammonia for fertilizer production within the country. This use case may have opportunity domestically as SMRs are anticipated to be adopted stateside around 2030. Though I can see this being a fruitful venture for FuelCell as the firm scales its hydrogen and ammonia production, this is still years out and the firm must survive in order to reap the benefits.

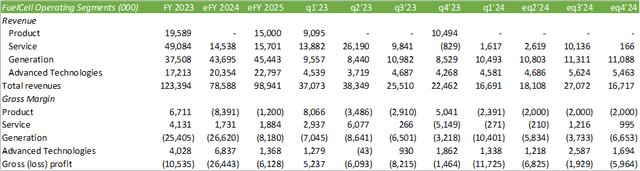

Looking to company operations, FuelCell operates at a significant loss and remains in the cash-burning phase. Though I do believe FuelCell will get its grounding, I believe the firm has a long way to go before achieving profitability. There are a lot of variables that will play into the firm’s future as the industry is gravitating towards the utilization of hydrogen, including regulation, company adoption, and feasibility. I believe I covered the first two topics within the macroeconomic section of this report, so I’ll briefly discuss feasibility from here.

Valuation & Shareholder Value

I believe that in order for hydrogen fuel to make headway beyond proof of concept, hydrogen must prove itself as profitable. Considering the dependency on electricity for generation to occur, the segment has yet to be proven as a sustainable fuel source when compared to other hydrocarbon resources. This area may require a lot more scaling as seen in electric vehicle charging stations before reaching profitability; however, broader adoption must occur before profitability can be sustained.

Given the slow pace of transition, I believe that we will not see a meaningful impact until the end of the decade or in the early 2030s as SMRs begin to take form domestically. With this in mind, I believe FuelCell will continue to rely on outside financing to fund operations, which may make holding this company’s equity too risky for a short-cycled investor. Given the firm’s equity dilution over the years, I do not believe it to be prudent to hold FCEL equity without the preceding events to occur.

Long term, FCEL may turn out to be a strong growth investment as the prospects remain bright; however, I believe the firm has been too focused overseas to realize the growing domestic demand as experienced by competing hydrogen producers. For this reason, I provide FCEL a SELL recommendation with a price target of $0.86/share at 3.91x eFY25 price/sales.

My estimates for the firm come in significantly lighter than consensus estimates as I do not believe the prospects for the firm are as strong given the policy risks in place. Though the firm does have the ability to realize significant upside potential further out, I do not anticipate strong performance until later in the decade.

For the blue-sky scenario to occur, I believe that domestic policy as it relates to the IRA must be loosened up to appeal to blue hydrogen, creating a strong catalyst for FuelCell stateside. I believe the firm must also prove to Exxon Mobil that their carbon capture technology functions as expected and is financially feasible to be scaled and implemented. I most heavily lean on the gray sky scenario to occur, given the status quo. Unless FuelCell receives a tremendous amount of government support to scale operations, I believe the firm will experience significant headwinds until hydrogen is further adopted.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.