Summary:

- FuelCell Energy reported less-than-stellar Q3/FY2024 results, with negative gross margins and cash usage at all-time highs.

- However, FuelCell Energy managed to replenish its cash balances by aggressively selling new shares into the open market. As a result, outstanding shares increased by more than 20% during Q3.

- On the conference call, management admitted to issues regarding its new solid oxide fuel cell technology, which will require further improvement before being suited for commercial deployments.

- While investors should continue to avoid the common shares, the company’s Series B Preferred Shares offer a juicy 13.5% dividend yield, for income-oriented investors.

- Given the company’s almost unlimited ability to finance operations via open market sales, I expect FuelCell Energy to honor its preferred dividend obligations for the foreseeable future.

Fahroni

Note:

I have covered FuelCell Energy, Inc. or “FuelCell Energy” (NASDAQ:FCEL, OTCPK:FCELB) previously, so investors should view this as an update to my earlier articles on the company.

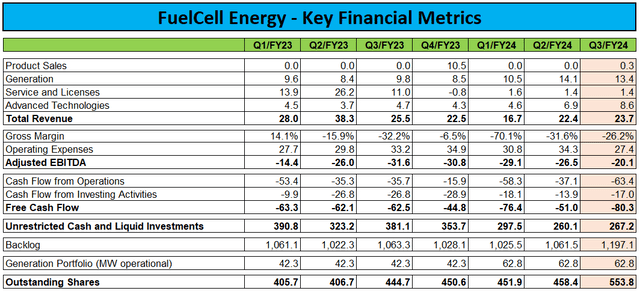

On Thursday, FuelCell Energy reported less-than-stellar Q3/FY2024 results with substantially negative gross margins and very sizeable cash usage:

Company Press Releases / Regulatory Filings

From a free cash flow perspective, Q3/FY2024 was the company’s worst quarter on record, as outflows exceeded $80 million for the first time.

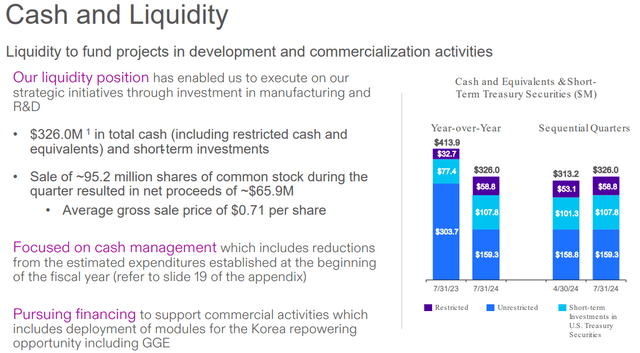

However, FuelCell Energy managed to replenish its cash balances by aggressively selling new shares into the open market:

During the three months ended July 31, 2024, approximately 95.2 million shares of the Company’s common stock were sold under the Company’s Amended Open Market Sale Agreement at an average sale price of $0.71 per share, resulting in gross proceeds of approximately $67.3 million before deducting sales commissions and fees, and net proceeds to the Company of approximately $65.9 million after deducting sales commissions and fees totaling approximately $1.4 million.

As a result, outstanding common shares increased by more than 20%. Subsequent to quarter-end, the company sold an additional 2.2 million shares into the open market for net proceeds of $1.1 million.

With $267.2 million in unrestricted cash and liquid investments and another $225.3 million still available under FuelCell Energy’s recently amended open market sales agreement, liquidity won’t be an issue for the time being.

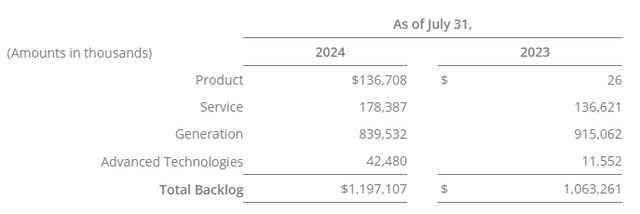

The company’s backlog was up by almost 13% both sequentially and year-over-year as a result of the recent large-scale service agreement with Gyeonggi Green Energy Co., Ltd. or “GGE” in Korea.

In combination, FuelCell Energy’s service and generation backlog had a weighted average term of approximately 17 years at the end of Q3/FY2024.

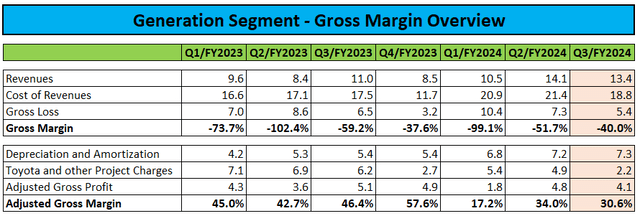

The company’s core generation segment had a somewhat disappointing quarter, with both revenues and adjusted gross margin down slightly on a sequential basis:

In addition, the company’s new solid oxide fuel cell projects are not going according to plan as disclosed in FuelCell Energy’s quarterly report on form 10-Q (emphasis added by author):

Cost of generation revenues for the three months ended July 31, 2024 also includes an impairment charge of $1.1 million relating to project assets under construction relating to the PPAs for Trinity College and for UConn (as defined elsewhere herein). The units to be installed at Trinity College and UConn are first article units of our solid oxide fuel cell (“SOFC”) product. In reviewing our project cost estimates for these PPAs during the third quarter of fiscal year 2024, it was determined that the expected project costs for these contracts would exceed the expected cash flows and therefore an impairment charge was required. The impairment charge of $1.1 million represents the unrecoverable costs incurred through July 31, 2024 for the Trinity College and UConn projects.

As these projects progress, further impairment charges might be required.

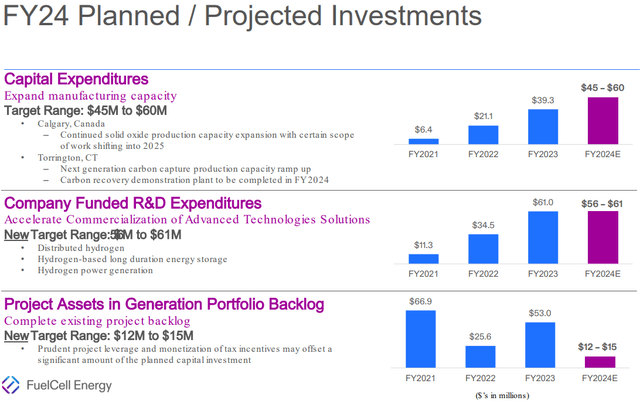

On the conference call, management admitted to the need of improving stack life, performance and efficiency of the company’s solid oxide technology. As a result, FuelCell Energy has delayed deployment of its first commercial solid oxide fuel cells.

With the market taking more time to develop, the company has reduced expected spending levels and implemented headcount reductions.

With the company’s legacy molten carbonate fuel cell technology unlikely to be deployed in additional greenfield projects anytime soon if ever and its newer solid oxide fuel cells requiring further optimization, elevated cash burn is likely to continue for the time being with resulting material dilution for common shareholders.

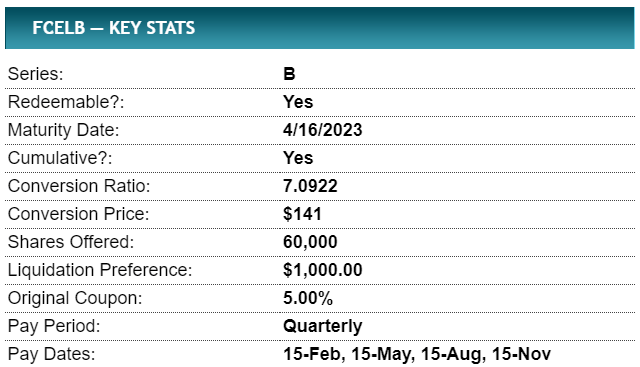

Despite the company’s operational issues, income-oriented investors should consider taking a look at FuelCell Energy’s 5% Series B Cumulative Convertible Perpetual Preferred Shares or “Preferred Shares” (OTCPK:FCELB) which are offering a juicy 13.5% annualized yield at prevailing trading prices:

Preferred Stock Channel

In recent quarters, the Preferred Shares appear to have been impacted by the abysmal performance of the company’s common stock, but at least in my opinion, there’s little reason to worry for investors as long as FuelCell Energy retains access to the capital markets which shouldn’t be an issue in the near- to medium-term.

While readers might rightfully point to the fact that common shares are trading well below Nasdaq’s $1.00 minimum bid price requirement, the company can easily regain compliance by implementing a reverse stock split like it has done several times in the past already and continue selling newly issued shares into the open market.

This approach has worked out very well for FuelCell Energy in recent years (not so much for common shareholders, though) and I fully expect the company to continue raising funds from open market sales for the time being.

Please note also that required quarterly dividend payments of just $0.8 million aren’t material for FuelCell Energy.

Consequently, I would expect the company to honor its preferred dividend obligations for the foreseeable future.

On the flip side, investors need to consider the rather low trading volume of the preferred shares on the OTC market, which often results in large bid/ask spreads.

While I would advise against betting the farm on the company’s Preferred Shares, I wouldn’t mind adding some FCELB to a well-diversified portfolio of preferred stocks and other income-oriented investments.

Bottom Line

FuelCell Energy’s operating performance continues to be underwhelming, with little prospects for profitability and cash generation anytime soon.

Elevated cash burn has resulted in the requirement to increase the pace of open market sales quite meaningfully in the most recent quarter.

With relentless dilution likely to continue unabatedly, and another reverse stock split looming in the not-too-distant future, investors would be well-served to avoid the company’s common shares.

However, income-oriented investors should consider FuelCell Energy’s Preferred Shares, which currently offer a juicy 13.5% annualized dividend yield. While certainly not the average preferred stock backed by sufficient cash flows from operations, the company’s almost unlimited ability to sell additional common shares into the open market should result in FuelCell Energy honoring its dividend obligations for the time being.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Massively Outperform in Any Market

Value Investor’s Edge provides the world’s best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared towards investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.