Summary:

- Despite reaching nearly 50 MW installed PPA capacity, FCEL has not achieved profitability, reaffirming our previous concerns about its structural product issues.

- Molten Carbonate Fuel Cell technology has seen modest improvements over the decades. Concerns over durability and ownership costs persist.

- The company incurs a significant financial burden under warranty and service contracts to keep its fuel cells running.

David McNew

Investment Thesis

In previous articles, at the height of the pandemic rally, we argued that while the hydrogen economy presents growth opportunities, FuelCell Energy (NASDAQ:FCEL) grappled with an uncertain future, primarily due to low-profit margins, capital-intensive Power Purchasing Agreements ‘PPA,’ and obsolete technology.

A key uncertainty in our analysis was whether FCEL could scale up, potentially invalidating our concerns over margins. Additionally, technological advancements, particularly those targeting platform temperature (a key factor impacting durability,) also risked our cautious stance. At that time, FCEL had already capitalized on the market’s rally to strengthen its balance sheet, allowing it to pursue R&D initiatives, which could have resulted in design optimizations to improve quality and reduce maintenance costs. It also expanded its sales team, risking our cautious outlook via potential economies of scale.

However, recent developments have reaffirmed our 2021 stance. Despite approaching 50 MW installed PPA capacity – the threshold set by management for achieving breakeven – profitability remains elusive.

This situation underlines our belief that FCEL’s profitability struggles are not economic but deeply rooted in structural product issues. These include inherent limitations in their technology, high maintenance costs, and fierce competition within the renewable energy sector; the latter likely gives consumers an advantage during warranty contract negotiations, which include maintenance and often minimum electricity output guarantees. In other words, FCEL is overpromising and underdelivering for its customers, incurring a significant financial burden due to warranty and service covenants, leading to negative gross margins.

Our sell rating is rooted in our belief that FCEL will be forced to raise equity capital. It faces a similar fate as Plug Power (PLUG), whose growth narrative wasn’t enough to support the share price.

Significant Drawbacks of Age-Old Tech

FCEL has championed Molten Carbonate Fuel Cell ‘MCFC’ technology since 1969 when it was founded as a research company specializing in MCFC tech. These cells, operating at a scorching 650 Celsius, are a double-edged sword. On the one hand, they are capable of generating utility-grade power at above-average electrical efficiency, making them appealing to utilities and energy-intensive projects. On the other hand, the durability of components under such extreme conditions is a major concern for consumers, given the notoriety of frequent maintenance and high long-term costs.

Despite five decades of research and two decades of commercial operations, FCEL’S technology progression appears gradual, marked by modest improvements in efficiency and durability. This observation suggests that the industry continues to grapple with longstanding challenges inherent in the technology, which dates back two centuries.

We don’t expect any breakthroughs in MCFC technology in 2024. This assessment, while not derived from an exhaustive academic review (based primarily on a cursory examination of Google Scholar results), is also supported by the absence of mentions of such advancements during earnings calls. Additionally, FCEL’s recent venture into Solid Oxide electrolyzes, driven by incentives for green hydrogen production by the Biden administration, marks a strategic shift. This move contrasts with FCEL’s traditional focus on MCFC cells, their primary revenue source. On the company’s website land page, there is a digitally-generated image of what appears to be a solid oxide fuel cell as opposed to a MCFC cell.

Profitability: Broken Promises

Most of FCEL’s customers, predominantly savvy utility companies with a deep understanding of the energy sector, are fully aware of the high maintenance of MCFC fuel cells. In 2023, Korea Southern Power, a subsidiary of Korea Electric Power Corp (KEP), Korea Fuel Cell Ltd, and Connecticut Light and Power – aka Eversource Energy (ES), represented 60% of total sales in 2023 and 65% of sales in 2022.

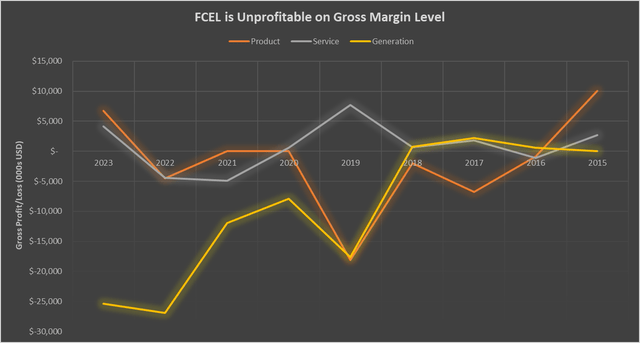

In almost all deals, be it a direct purchase or a lease, a maintenance contract is a non-negotiable part, accompanied by a promise that the fuel cell will generate a certain minimum of electricity. The gross margin from Service contracts was negative in two out of the past three years. Over the ten-year period, service revenue barely broke even, with the segment either delivering a thin margin or an outright loss on a gross level. These figures are particularly troubling since service contracts include high-margined licensing revenue, indicating deep losses from warranty expenses.

More and more customers are choosing PPA contracts over buying hydrogen cells directly from FCEL. This trend shifts the financial burden to FCEL, compelling it to secure bank financing for upfront capital costs while income from electricity sales trickles in over time. The yellow line in the chart below illustrates a concerning pattern: the Generation segment gross sales are plunging into negative territory, deteriorating further as sales rise. Since introducing PPAs in 2016, this segment has amassed $86 million in losses. Contrary to management’s guidance of improved economies of scale, gross margins have deteriorated with increasing sales. The financial picture darkens further for FCEL’s Generation segment when accounting for the interest expenses related to its PPA projects.

FCEL. Graph created by the author

Advanced Technology? Not Really

FCEL and Exxon Mobil (XOM) are promoting a carbon capture technology, asserting it can capture 90% of carbon emissions. More importantly, they claim this system generates energy, in contrast to other carbon capture technologies that consume electricity. If this is true, it would be a disruptive technological breakthrough in the industry full of research teams around the world working to reduce the energy consumption of carbon-capture devices.

However, we believe a closer examination of the patent reveals significant inaccuracies in these claims.

The process, as described in the patent, involves using electricity to transform CO2 into carbonate ions via an MCFC electrolyte. These ions then react with hydrogen to produce electricity, CO2, and water.

The issue lies in the energy balance: the electricity required for the initial conversion of CO2 most likely exceeds what is later generated. This imbalance is a fundamental aspect of chemistry, where energy losses, typically in the form of heat, occur during chemical transactions. This means that it is likely that the energy input is larger than the energy output in our view.

Thus, we believe that the claims made by FCEL and XOM seem exaggerated. This raises concerns about the potential for retail investors to be misreading into this, putting them at financial risk.

On a positive note, the company’s Advanced Technologies segment, which earns revenue primarily from ExxonMobil research grants, is profitable on a gross margin level.

FCEL has also been developing a Solid Oxide electrolyzer called Tri-gen, which is capable of producing Electricity, Hydrogen, and Water. The Tri-hydrogen, developed with Toyota (TM), passed its final inspection and approval process and transitioned to the operating phase in November 2023. Management seems excited about the project, which comes with potential government subsidies under the Inflation Reduction Act ‘IRA’. However, it is also worth noting that the Toyota tri-gen project has faced material challenges that led to write-offs to the value of the project related to multiple issues, including loss of a PPA and high costs of Green Hydrogen, as noted in its recent SEC filings.

Balance Sheet Nose Dive

FCEL’s financial stability is in a precarious condition due to high operating expenses and low gross margins, resulting in a dwindling cash reserve. Management will likely raise equity in 2024 before the stock value declines further as the company heads into a liquidity crisis.

The company appears to be prioritizing growth over profitability. In 2024, management plans to increase capital expenditure and R&D, upgrade aging manufacturing facilities, and launch new product lines to leverage incentives under the Inflation Reduction Act ‘IRA’ for hydrogen production. This strategy, while growth-oriented, lacks a clear trajectory towards profitability.

In October 2023, FCEL prepared for a potential equity raise by increasing its authorized shares from 500 million to 1 billion. The subsequent share price decline of PLUG following its equity capital raise last week is, in our view, indicative of what is likely to happen to FCEL’s stock once it potentially prices new shares.

Over the last three years, FCEL has burned through $365 million in cash from operating expenses and capital expenditures, averaging $121 million annually. With roughly $350 million in cash and marketable securities as of October 2023, we estimate the company’s financial runway to be three years in the best-case scenario. This duration could be shortened if the company escalates its spending.

Considering the uncertain path to profitability, it’s likely that management will opt to raise equity this year before its stock gradually declines with its dwindling cash reserves. Selling FCEL now could be a strategic move to avoid potential financial pitfalls as the situation unfolds.

Preferred Stocks: A better Alternative?

For those who still wish to gain exposure to the hydrogen economy, we believe that FCEL’s cumulative preferred shares (OTCPK:FCELB) (currently yielding 12.5%) are a slightly more attractive investment avenue. FCELB shares will likely fluctuate with changes in the company’s financial position. However, they benefit from the expected equity raises in terms of dividend safety.

The fact that they are cumulative preferred shares also adds a return-predictability element that contributes to their appeal. Weighing these dynamics against the company’s challenges, we see FCELB’s rating one notch higher than the common equity with a ‘Hold’ rating.

Summary

FCEL’s prolonged struggles with profitability, stemming from the high maintenance costs and limited advancements in its MCFC technology, cast a significant shadow over its future prospects. The company’s efforts in Carbon Capture and Green hydrogen seem insufficient to overcome the inherent structural issues in its core Utility-grade fuel cell segment.

The likelihood of an equity raise in the near term, as evidenced by changes in articles of incorporation (increasing shares issued from 500 million to 1 billion shares), and market trends (PLUG’s stock price drop subsequent to equity capital raise), underscores the risks associated in holding FCEL in 2024.

Given these factors and FCEL’s unconvincing path to profitability, we are cautious about the ticker.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.