Summary:

- Hydrogen as an alternative fuel source has been sidelined due to inefficiencies in production and conversion, favoring other energy sources like solar and wind power.

- Recent advancements in electrolyzer technology show promise for a green hydrogen economy, but incumbent companies like FuelCell are at a technological disadvantage.

- Additionally, FuelCell has an unsustainable business model reliant on debt and dilution, making it an unattractive investment for long-term green hydrogen focus.

Petmal/iStock via Getty Images

Thesis

I have been very skeptical of hydrogen as an alternative fuel source to replace fossil fuels for quite some time, due primarily to two reasons: the requirement of a fossil fuel (natural gas) to cheaply and efficiently make hydrogen via contemporary mass production methods, and the low efficiencies from converting renewable energy to make hydrogen and vice versa.

Due to the inefficiencies of so-called “green” hydrogen sourced from renewable power, and the fossil fuels required to make “gray,” “brown,” and “blue” hydrogen, this alternative energy source/energy storage medium has been sidelined in favor of other alternative energy sources, like nuclear power, hydropower, geothermal power, and solar/wind power combined with various forms of energy storage. The energy efficiency from these is often high enough to make them satisfactory for customers in many industries, boxing out possible entry points for hydrogen while these other alternative fuel sources gain popularity and market share.

However, there are certain areas where hydrogen would be exceedingly useful if its fossil fuel dependence and inefficient conversion to and from energy were able to be mitigated, such as in rocket fuel, airplane fuel, and other uses. Recently, it appears that efforts to make hydrogen a viable fossil fuel replacement with high conversion efficiency have started to pay off, boosting my hope for a true green hydrogen economy to emerge in the next 10-20 years. It is now increasingly likely that hydrogen will eventually find its niche(s) in a future in which fossil fuels are abandoned – a future that appears to be on the horizon and approaching faster than many think.

Unfortunately for incumbent fuel cell producers like FuelCell Energy (NASDAQ:FCEL), they are at a significant technological disadvantage. I believe producers of next-generation electrolyzers and fuel cells will soon begin to scale up and outcompete them in scalability and energy conversion efficiency. I think this publicly listed incumbent will continue to flounder in becoming a green hydrogen leader, and its stock is likely to decline as investors realize that while the green hydrogen economy may soon start to grow, the company won’t grow with it.

FuelCell has also been a consistent money loser, bringing in inadequate revenues to sustain its operations. As a result, the company has relied on a steady diet of debt and dilution to stay afloat, hurting investors who put their faith and capital in this name hoping to capitalize on the growth of hydrogen. Even if FuelCell had industry-leading hydrogen technology, it would be difficult to recommend buying FCEL stock due to how investor-unfriendly it has been thus far.

For these reasons, I think investors with a long-term focus on green hydrogen should consider selling FuelCell and other green hydrogen plays reliant on inefficient and soon-to-be outdated hydrogen technology.

Next-Gen Electrolyzers – The Lynchpin of a Green Hydrogen Economy

The main driver for renewed optimism that a green hydrogen economy may have a chance to thrive is the improving energy efficiency of electrolyzer technology. Capillary-fed electrolysis has been demonstrated in the journal Nature to be much more efficient than conventional electrolyzers, and companies like Hysata are using this new electrolyzer technology to mass-produce cost-effective electrolyzers that will be critical in producing green hydrogen. If its claims are to be believed, Hysata’s electrolyzers achieve an efficiency of 95%, a reduction in energy input of 20% compared to current electrolyzers, and had a 40 gigawatt backlog as of late 2023. Each Hysata electrolyzer should produce energy at a 5 megawatt rate, meaning Hysata had a backlog of 8000 electrolyzers to work through at the end of 2023. The company appears to aim for customer deliveries by 2025, meaning a probable ramp up of electrolyzer production in 2026 and beyond.

The 95% conversion efficiency is incredibly important if true, for this efficiency level is about the same as the efficiency of storing energy in lithium-ion batteries. This would make Hysata’s electrolyzers technologically competitive with one of the faster-growing renewable energy storage mediums, an appealing benefit since hydrogen can be used for more than just energy storage, unlike batteries.

FuelCell – Old Dog in a New Age

FuelCell has been attempting to produce hydrogen and fuel cells at scale for decades. In the end, customers don’t want them – as I have mentioned throughout this piece, they are simply too inefficient to be worth their while. Batteries for energy storage, on the other hand, are ramping up nicely, no doubt due to batteries’ high energy conversion efficiency of 95%. This is as true for transportation as it is for storage – battery electric vehicles have been selling like hotcakes in the past decade, while hydrogen cars barely register on automotive sales charts.

Compare the 95% conversion efficiency of batteries to the conversion efficiencies of FuelCell’s technology: FuelCell’s solid oxide fuel cells have a conversion efficiency (see footnote 4) of 50% when fueled with only hydrogen gas, with perhaps a 10-15% efficiency boost with heat recovery. These efficiencies are clearly inferior compared to both batteries and next-generation electrolyzers, like those of Hysata and others.

Considering how much R&D investment has gone into FuelCell’s technology, I don’t think a pivot to more efficient hydrogen technology is in the cards for the company. I suspect that the company’s management has by now been taken in by the sunk cost fallacy, preventing it from fundamentally altering the base technology at this point in time. Even if it did, it might be too late to catch up to competitors, whose advanced electrolyzer tech is about to ramp in just the next few years. Can FuelCell replace its existing technology and scale totally new and more efficient technology before competitors who have more experience with that technology capitalize on it? I don’t think so.

The above technological reasons should be good enough on their own to not bet on FCEL over the long term. As they say, you can’t teach an old dog new tricks.

Financials and Valuation

As if the technological picture for FuelCell wasn’t bad enough, the financial picture of the firm is downright disheartening. In sum, it is less than impressive.

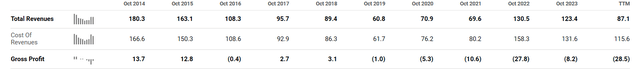

FuelCell’s revenue isn’t really rising at all, yet its cost of revenue is still outpacing it, and gross profit is therefore trending negative.

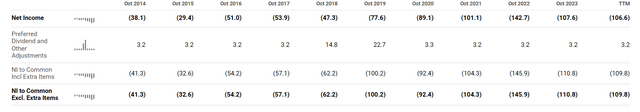

With negative gross profit, net income was destined to disappoint. Interestingly, net income for FuelCell is worsened by payouts made to preferred shareholders, i.e., those holding FCELB shares. Henrik Alex made a good case for owning FCELB, but I am content to say that owning many securities would yield more benefit than owning FCEL common shares right now. Still, for any investor interested in investing in FuelCell in some capacity, suffice it to say, it pays to pick the preferreds.

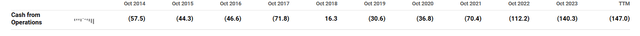

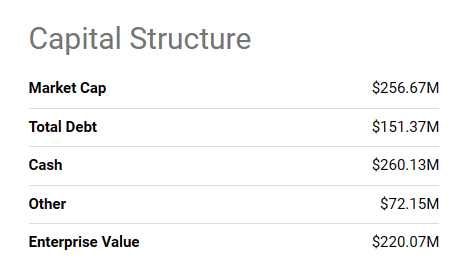

As shown in the above, FuelCell’s core business is lossmaking and unprofitable. Sufficient cash to fund its operations? Probably not, though at least FuelCell’s cash is greater than its debt.

Seeking Alpha

And to be fair, FuelCell’s quarterly cash burn is around $25 million. With about $260 million in cash remaining, the company has a runway of about 10 quarters left, so about 2.5 years (though this falls to about 1 year if the company uses its cash to pay off its debt). Still, if losses continue to accelerate as they have recently, this cash runway estimate could be optimistic.

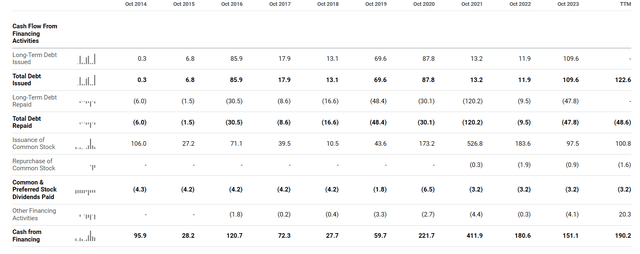

So how does FuelCell survive? Issuance of debt and severe dilution. Still, FuelCell’s business is fundamentally incapable of standing on its own two feet, and is unlikely to be able to do so long term due to its technological disadvantage.

FuelCell has decided to pursue strong dilutive measures to sustain itself, making debt a less prominent aspect of its financing. All the while, its stock price has ticked reliably downward.

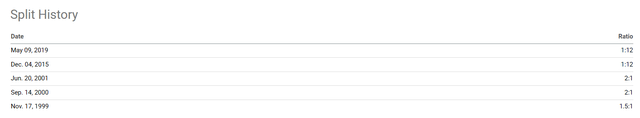

And yet, after all the dilution, and after all the price drops, and after the two 1-for-12 reverse splits FuelCell issued just in the past 10 years (with another reverse split possible in 2024), investors still come back for more.

As the well-known quote goes, “the market can stay irrational longer than you can stay solvent.” The question is, for FuelCell, is the reverse true? Will the company be able to stay solvent for longer than the market is irrational? Based on how FCEL’s market cap has precipitously fallen since 2021, I think not.

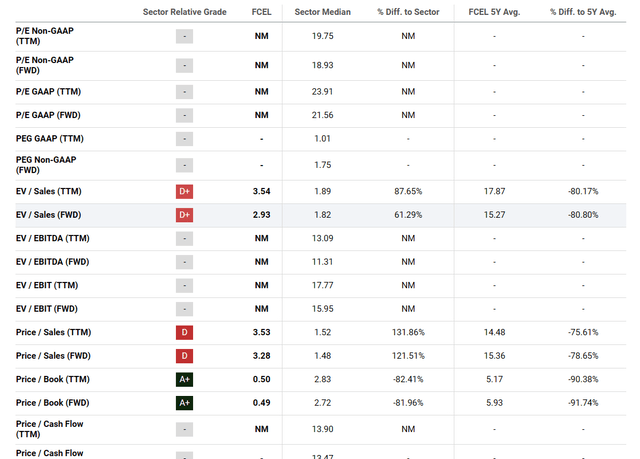

Lastly, FCEL’s valuation. Available Sales-based metrics imply that FCEL is overvalued compared to its sector, while the Price/Book indicates FCEL is severely discounted. But regardless of the metrics, FuelCell seems nearly uninvestable at this time due to poor financials, lagging technology, and FCEL’s historical destruction of investor capital.

Looks Like Lordstown, Buyer Beware

The last time I was this bearish on an underwhelming company in a promising space, I was reviewing Lordstown Motors. In early 2023, the electric vehicle market was booming as EV sales went from strength to strength for multiple quarters, and consumer interest in EVs was very pronounced. However, as I noted in my article, EV truck maker Lordstown wasn’t benefiting from that EV boom. Instead, it was plagued by weak sales, missed sales targets, anemic consumer interest, delayed production ramps, unsustainable financials, and subpar technology compared to others in its industry. Sound familiar?

A few months after my article was published, Lordstown Motors went bankrupt. After selling off its assets, the company reemerged as a shadow of its former self in the form of Nu Ride Inc (OTCPK:NRDE). I suspect that unless FuelCell pivots hard on either its business model or its hydrogen technology, it may eventually meet a similar fate; the parallels here seem too strong to ignore. Investors ought to pay close attention to how things unfold for FCEL in the coming years, and watch out for the same downward trajectory that Lordstown suffered.

Risks to Thesis

For the main risks to my thesis, there is a chance that even new electrolyzer technology for hydrogen is unable to profitably scale, and that new electrolyzer tech from FuelCell’s rising competitors is unable to see the same high laboratory efficiencies when operating at maximum capacity or in typical-use field conditions. If this risk bears out, the competition that endangers FuelCell would be greatly exaggerated, giving the company a longer runway to develop and sell products running on existing hydrogen technology.

Another set of risks is that hydrogen incumbent FuelCell either significantly improves its energy conversion efficiencies, pivots to copy the approach of these new competitors, or buys up competitors who have high efficiencies and incorporate those competitors’ technologies into its products. I see all of these as being rather unlikely, since such endeavors would require committing to actions that either strain the company’s weak financials even further or require a complete abandonment of its business’s status quo. Still, investors should be aware that these drastic sweeping changes are far from impossible for FuelCell.

Lastly, FuelCell might price its products far below competitors’ products in order to undercut them, prompting customers to buy FuelCell’s devices in spite of their lower efficiency. This also seems rather unlikely since it would mean eating greater losses in the short and medium term, and increased lossmaking is something that neither the company’s financials nor its investors can sustain much more of.

Conclusion

I think that due to significant improvements in electrolyzer/fuel cell technology, there is a chance that a green hydrogen economy can find niche spaces to prosper in a world free of fossil fuels. However, incumbents in the hydrogen industry like FuelCell are not likely to see the benefits of these improvements, since they are still relying on last generation’s hydrogen technology that customers have been dismissing for decades. Emerging competitors are scaling new and highly-efficient hydrogen tech that FuelCell can’t beat.

Additionally, the returns of FCEL stock over many years have been totally unproductive, and outright financially destructive, for buy-and-hold investors interested in a future hydrogen economy. This stock has been a money pit for investor capital, and the only justification for investment in FCEL would be that FuelCell was a technology leader in hydrogen production that was the closest to successfully and widely launching hydrogen technology. Unfortunately, that condition for investing in the company probably won’t be met now that more advanced, lower-cost, and more efficient hydrogen technology from competitors is on the horizon.

As such, investors should drop this losing hydrogen name, as well as any other hydrogen incumbent whose value as a company is reliant on outdated technologies. Accordingly, I rate FCEL stock a sell.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.