Summary:

- Futu Holdings is a strong buy due to impressive revenue and net income growth, despite regulatory challenges in mainland China.

- The company’s international expansion under the Moomoo brand has diversified its revenue streams and reduced its dependence on the Chinese market.

- Futu’s operating leverage and solid balance sheet, combined with a low forward PE ratio, present a compelling investment opportunity.

- While geopolitical risks remain, Futu’s high margins, robust growth, and strategic execution make it a valuable addition to a diversified portfolio.

Sean Anthony Eddy

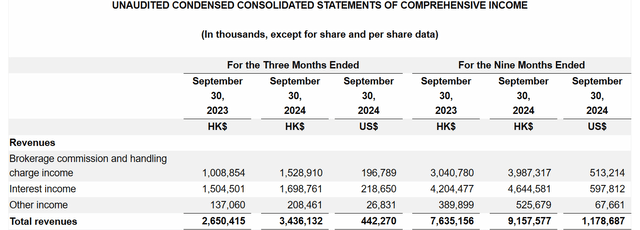

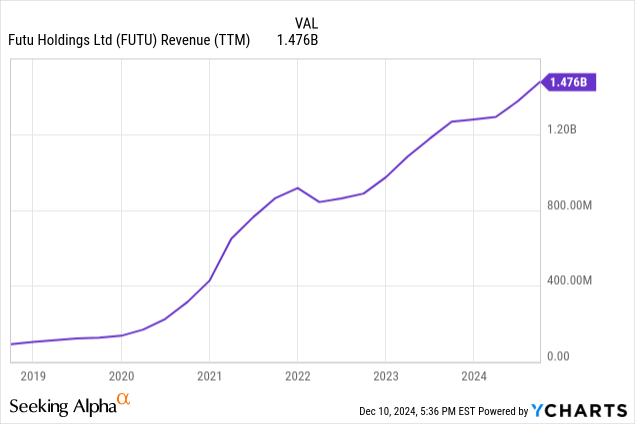

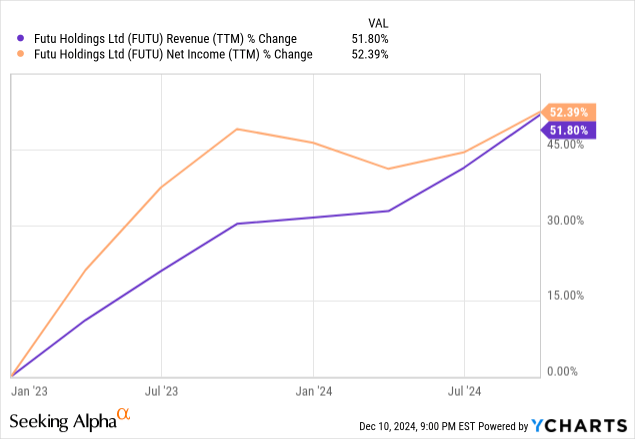

Futu Holdings (NASDAQ:FUTU) stock has been on a wild rollercoaster in the last few years, but now is a clear buy. It increased its value by four times in 2020 alone, then exploded vertically again by 400% in January and February of 2021, only to crash 75% suddenly by the second half of that year. Since then, the stock has made a decent recovery, from the low forties a share to the current high eighties per share, all of this despite the crackdown from Chinese authorities that has prevented FUTU from getting new clients in mainland China since the end of 2022. Besides this, the company has expanded its revenues and paying clients by 50% and its net income by 80% from Q3 2022 to the last earnings report in Q3 2024. This strong fundamental trend, together with an impressively low 15-ish forward PE ratio, makes, in my opinion, a very strong buy investment case for Futu Holdings.

What is Futu, and what is its current context?

Futu is a Chinese digital securities broker with growing operations in seven countries under two main brands: Futubull and Moomoo. Futubull is the branch dedicated to Hong Kong and Mainland China clients. At the same time, Moomoo encompasses the rest of the international operations: Malaysia (February 2024), Singapore (since March 2021), Japan (since October 2022), Australia (since 2022), the US (since 2018), and Canada (since August 2023).

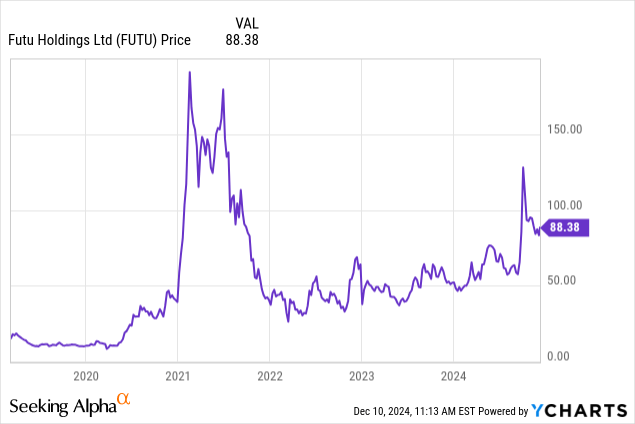

Taking a look at its revenues, Futu grew impressively from the period from 2020 to mid-2021, fueled almost exclusively by the Futubull brand in the greater China region. As a digital broker, Futu’s business is quite simple. It earns revenues by taking a small commission on international trades, platform fees, and interest income by margin funds or taking advantage of the spread in deposits between the current short-term bank rates in each country and what is offered to its clients. Futu also has other relatively minor sources of income like data subscriptions, news, and some plans to get improved services in some countries. Usually, Futu, or Moomoo, depending on which country, offers zero commissions for local stocks and lower fees and margin rates than its competitors. Here are some links to the fee tables for some countries covered by FUTU: Hong Kong, Malaysia, Australia, and Singapore.

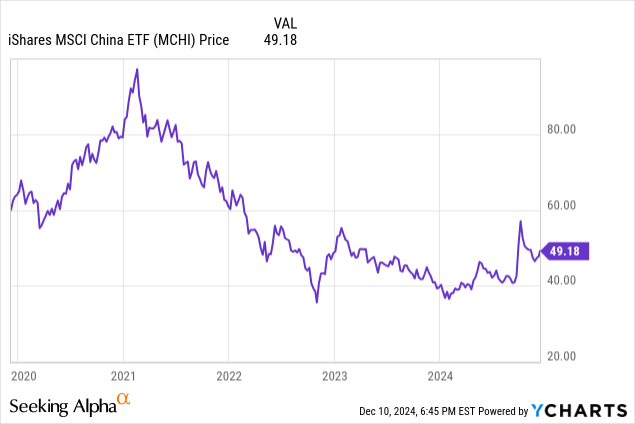

For this reason, Futu’s income depends on the risk appetite of its clients willing to trade more. This income is derived from the well-being of the Chinese stock market for mainland Chinese clients, as well as the local stock markets and the US stock market. This is a big deal, considering that FUTU is a pioneer in bringing access to American markets to these retail clients. Because of this dependence, FUTU’s revenues stagnated in 2022 while the Chinese and Hong Kong stock markets tanked in the same year. Still, revenues recovered in 2023 and 2024 as new clients from the international expansion arrived, and the markets stabilized and subsequently recovered slowly.

Going a little deeper, the bigger part of income currently comes from interest income, but brokerage activities are scaling up quickly from a year earlier. From my standpoint, this is a very good sign of organic growth because more clients are actively using the platform instead of just the company growing with higher interest rates, as the management referred to in the last earnings call.

The dust has finally settled

Although the company has been quite a success with impressive surging revenues, the Chinese authorities required Futu to stop getting new customers in mainland China at the end of 2022 and later in May of 2023 to remove the app from the app stores. This, of course, made the stock tank 40% just in that semester, on worries that the company could receive more harsh measures from the government, and therefore, making it, in my opinion, an investment to avoid.

Nonetheless, the dust has settled, in my opinion, as the Chinese authorities have addressed and rectified the situation with Futu. Additionally, lately, the Chinese Authorities have softened their policy and are trying to make it easier for Chinese financial companies to help the general macroeconomic environment. This added to the long time that has passed since the last authorities’ intervention, and the rapid and material diversification that Futu has achieved across its other markets, makes me think that the company is no longer at such a high risk.

Additionally, in my view, as the company grows outside of Greater China, in other words, with the Moomoo brand, it acquires more strategic value for the Chinese international ambitions of a bigger sphere of influence while providing solid financial and businesswise protection and diversification to its shareholders.

Massively growing revenues, operating leverage, and business stability

Although Futu is still a Chinese securities broker, I think that sooner rather than later, the company will stop its dependence on mainland Chinese income. This is because of its massive international expansion.

For instance, the company has grown revenues and net income by more than 50% in the last two years since it had to stop receiving clients from mainland China. The company also has great operating leverage, with operating expenses increasing just $40 million from Q1 2023 to Q3 2024 while revenues increased by around $124 million.

International expansion based on new customers, digital media, and stable markets

For the last quarter, Q3 2024, the company increased paying clients by 33% year-over-year to 2.2 million customers and 487 thousand new clients just in 2024. This is also 138% more new clients than the period before, showing resilience in growth and optimism. Other client numbers, like users and registered users, increased by 22% and 14% year-over-year, respectively. Although these numbers do not bring current revenue, they are, in my opinion, a good indication that the company is doing effective media spending and getting adequate recognition in its markets. Additionally, these users are likely to become paying clients in the future. The growing client base is, in my opinion, an indication of a good service, while competition is limited because of Moomoo’s US and international assets offered in different countries.

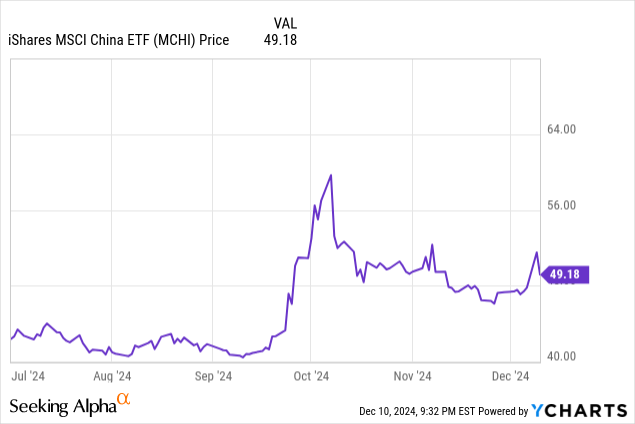

Following the last earnings call, another reason for this revenue growth was higher customer assets and good investor appetite from mainland Chinese clients. It’s worth remembering the huge spike that the Chinese market enjoyed last September, although it has cooled off since October, as might be expected.

Brokerage commission income grew 52%, while volume increased 75%. The commission rate went down from 8.5 basis points to 8 basis points because clients have been acquiring more expensive orders and stocks. Total revenue grew just 30%, but this is counting net interest income, which I don’t expect to take off as quickly as the brokerage income as new clients are added.

The operating margin is still a beautiful 50.4%, and the net income margin is a healthy but lower 38.4% from 41% a year ago. On the other hand, this net income grew an impressive 21% to $180 million in the quarter, year over year. Management expects growth to continue at around 20% in customer acquisition for the next few years.

Operating leverage is remarkable since the SG expenses were up only 18%. Selling and marketing expenses were up almost 50% year-over-year but lower by 7% over the last quarter, while revenues grew 10% quarter over quarter, and income from operations grew 17% for the same period.

Solid balance sheet and special dividend

In my opinion, Futu’s balance sheet is quite decent, without long-term debt and borrowings that can be paid in less than a year of earnings or directly from half of the available cash from the balance sheet. The management also has expressed no interest in entering new markets for the next year, so in accordance with that, it has layed-off around 6% of employees, mainly from the R&D department, and declared a special dividend of $2 per ADS share. Because of this, I do not expect significant acquisitions from the company in the next year.

Futu’s credit rating is still BBB- for its long-term credit, which is a little disappointing but still manageable from a shareholder perspective since it is still investment grade from Standard and Poor’s.

What to expect from Futu stock?

Since the company is growing massively in revenues, expanding overseas, and its risks are decreasing considerably, I think a bright future might be in sight. Fortunately, as the Chinese economy recovers slowly after having bottomed out, which I believe occurred this year, the markets could encourage new clients around the Asia-Pacific region that would eventually become new Moomoo clients.

I think the company will continue getting new clients since the market is far from saturated. For example, Futu’s client base is just around 2.2 million, and as I see it, around 1 million should be from the Chinese Futubull backlog clients because at the end of 2022, and before the sanctions, the company had around 1.5 million paying clients, and operations were incipient or straightaway nonexistent in markets like Malaysia, Japan, Singapore, or Australia, where the company is currently finding important growth.

The Chinese opportunity

In addition to the international expansion seen by the Moomoo brand, it is important to remember that Futubull is still working in China, and since Chinese authorities have winked in favor of a more dynamic financial economy, a revival on the client acquisition in the Futubull brand might be not as far as thought before. Unfortunately, this is just baseless speculation since there are still not actual regulatory measures, but it is still worth noticing this idea since this can provide an unexpectedly higher upside risk for the stock and its client acquisition strategy.

Since its underlying growth business fundamentals are solid, and its perceived risks are vanishing, the stock, as cheap as it is, might be a great investment for 2025. Let’s dig into the valuation.

Valuation

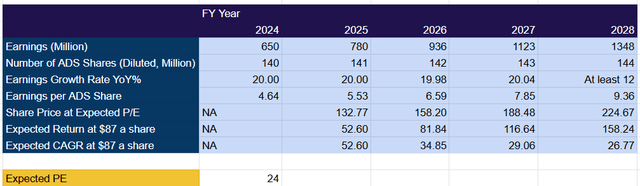

I consider Futu an extremely undervalued company. Although its growth might be quite high, current forward PE multiples are still quite low. If the management executes its growth strategy correctly and the Chinese authorities behave as expected, it might mean we are here upon a great investment opportunity. However, I won’t consider the company able to grow its client base in China.

For my valuation model, I will consider that 2024 will provide $650 million in profits. I also project a 20% earnings growth, which, I think, is a decent earnings growth for the capacity of Futu to get new clients. I forecast a very slow share dilution equivalent to 1 million ADS shares a year, which is close to being in line with the recent dilution trends. I am also not counting new special dividends.

Created by the author based on 20F Projections (Author)

The model suggests a likely 27% CAGR to 2028 if calculating an expected more usual and conservative PE of 24. I believe that the business in 2028 would still be able to grow more than 12%, so starting from now, using a mid-twenties PE ratio seems reasonable since US brokerage companies like Charles Schwab (SCHW) and Interactive Brokers (IBKR) have much higher current PE ratios of around 27 and lower organic revenue growth projected than that initial 20%. Since this is a Chinese company, I think this margin of safety is prudent.

FUTU stock risks

Unfortunately, the stock is cheap for a reason, and while it is slowly expanding its valuations, it still has to climb a huge wall of worry. First, the company is Chinese and, therefore, exposed to geopolitical risks. Any form of aggression between China and the West, namely Taiwan, North Korea, or another unexpected situation, might tank the entirety of the Chinese markets, dragging down Futu as well.

Another important risk is the obvious revival of worries from Chinese regulators applying new measures, but since the situation seems to have been addressed between Futu and the authorities, this risk is diminished. Additionally, the Chinese technological crackdown where the authorities decided to target a vast number of internet companies is almost over, and investment confidence has slowly returned as the Chinese markets have been recovering.

Conclusion

While Futu is far from a riskless company, its quality, high revenue growth, high margins, and execution, combined with a cheap valuation, make this stock a compelling investment for a well-diversified portfolio with low exposure to Chinese equities.

The company shows a light asset capital model, easy expansion in Asia-Pacific, and great margins, which is why I think that as long as risks do not materialize, as it seems, I consider this to be a strong investment opportunity.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2025 Long/Short Idea investment competition, which runs through December 21. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in FUTU over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.