Summary:

- On July 20, Johnson & Johnson, the mastodon of the healthcare sector, released its financial results for the 2nd quarter of 2023.

- However, those results were overshadowed by a federal judge’s decision to dismiss a JNJ subsidiary’s bankruptcy filing that sought to resolve thousands of lawsuits related to the talc crisis.

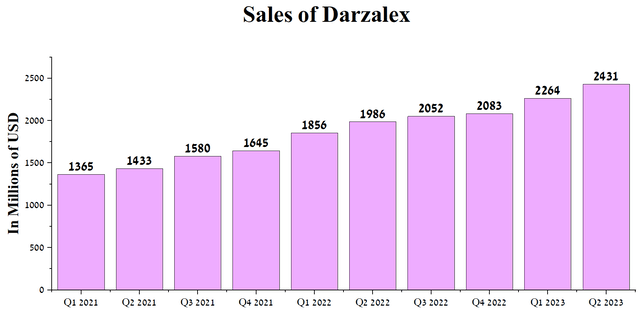

- The total sales of Darzalex amounted to $2.43 billion for the second quarter of 2023, an increase of 22.4% compared to the previous year.

- On June 6, 2023, Johnson & Johnson filed a sBLA seeking approval for Carvykti as a treatment for patients with RRMM who had previously received at least one prior line of therapy.

- We continue our analytics coverage of Johnson & Johnson with a “hold” rating for the next 12 months.

AndreyPopov/iStock via Getty Images

Less than two weeks after Johnson & Johnson (NYSE:JNJ) released its Q2 2023 financial report, its investors were shocked that a federal judge had dismissed the company’s second attempt to resolve thousands of lawsuits related to the talc crisis. As a result, it jeopardizes the company’s $8.9 billion settlement offer, which aims to prevent new lawsuits from being filed. This unfavorable decision led to a stall in the impulse movement of Johnson & Johnson’s share price, and it is currently moving in a tight trading range between $166 and $172.60.

N_Aisenstadt – TradingView

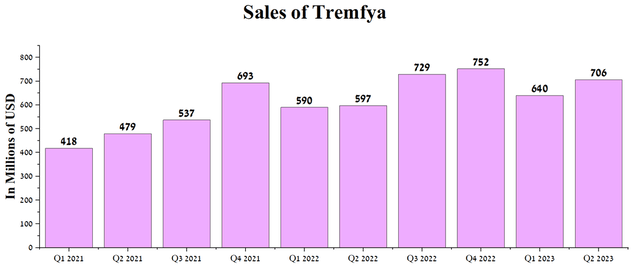

At the same time, sales of medicines for the three months ended July 3, 2023, showed mixed dynamics. On the one hand, demand for Stelara, Tremfya, and Carvykti continues to grow, while sales of Remicade and Imbruvica are declining by double-digit percentages year-on-year, which negatively affects Johnson & Johnson’s pharmaceutical segment revenue growth.

The company continues to make significant progress in developing a portfolio of experimental drugs ahead of the end of exclusivity of some of its blockbusters in the next three years. Given the growth in margins for all three Johnson & Johnson segments, we are raising the level at which the risk/reward profile for investors will be attractive from $144 to $147.50.

We continue our analytics coverage of Johnson & Johnson with a “hold” rating for the next 12 months.

Johnson & Johnson’s Q2 2023 financial results and outlook for the second half of 2023

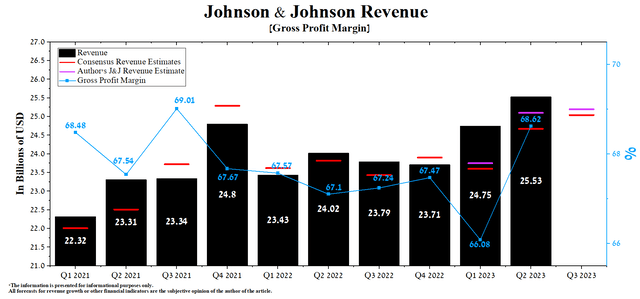

Johnson & Johnson’s revenue for the second quarter of 2023 was $25.53 billion, up 3.2% from the previous quarter and 5.5% from the second quarter of 2022.

Author’s elaboration, based on Seeking Alpha

Both quarterly and year-on-year revenue growth was driven by sales of Tremfya (guselkumab), a drug approved for treating patients with moderate to severe plaque psoriasis and active psoriatic arthritis. The mechanism of action of this medicine is based on the inhibition of interleukin-23 (IL-23), which plays one of the key roles in the development of autoimmune inflammations. Tremfya sales were $706 million in Q2, 2023, up 18.3% year-over-year.

Author’s elaboration, based on quarterly securities reports

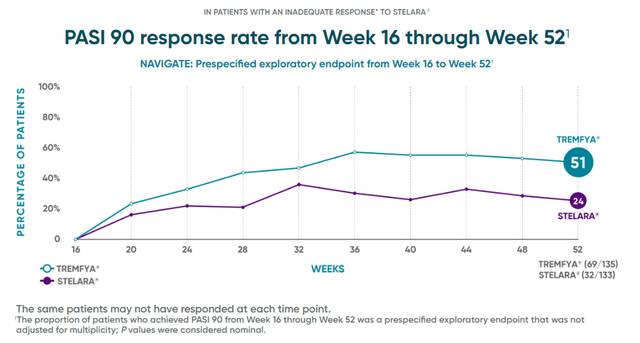

The drug’s sales growth was due to an increase in global plaque psoriasis market share due to competitive advantages over Johnson & Johnson’s Stelara and Novartis’s Cosentyx (NVS).

Tremfya

According to Seeking Alpha, Johnson & Johnson’s Q3 2023 revenue is expected to be $24.72-$25.39 billion, up 1.5% from analysts’ expectations for Q2 2023. At the same time, under our model, the company’s total revenue will be slightly higher than the median value of this range and will amount to $25.2 billion.

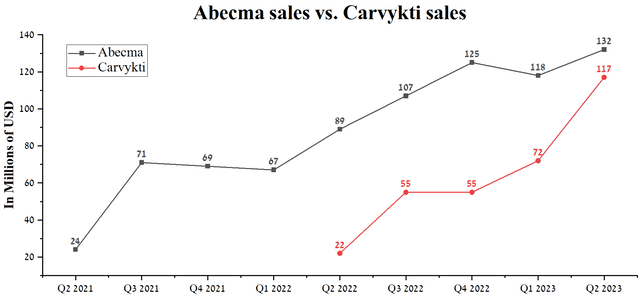

This will primarily be due to the continued high demand for Carvykti (cilta-cel), approved for treating patients with relapsed and refractory multiple myeloma (RRMM) who have received at least three prior therapies. Sales of the product developed jointly with Legend Biotech (LEGN) amounted to $117 million, up 62.5% QoQ, driven by the higher complete response (CR), the median duration of response (DOR), and overall response rate (ORR) relative to Bristol Myers Squibb’s Abecma.

Author’s elaboration, based on quarterly securities reports

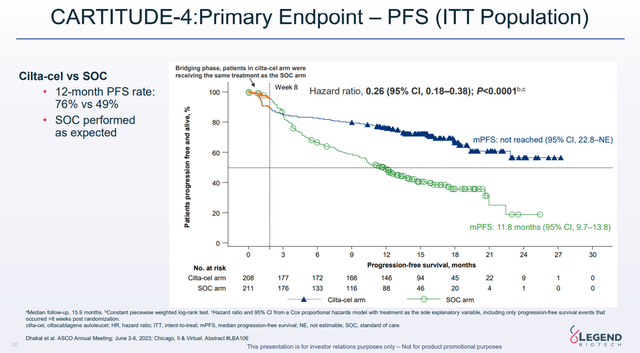

On a larger scale, we expect Carvykti to continue delivering solid sales year-on-year. A key reason for this is the results of the Phase 3 CARTITUDE-4 study, which demonstrated that Johnson & Johnson’s product reduced the risk of death or disease progression by 74% compared to SOC regimens.

Legend Biotech Corporate Presentation

Due to the achievement of endpoints in this clinical study, on June 6, 2023, Johnson & Johnson filed an sBLA seeking approval for Carvykti as a treatment for patients with RRMM who had previously received at least one prior line of therapy. As a result, we expect Carvykti sales to reach $510 million in 2023, rising to $745 million by 2024.

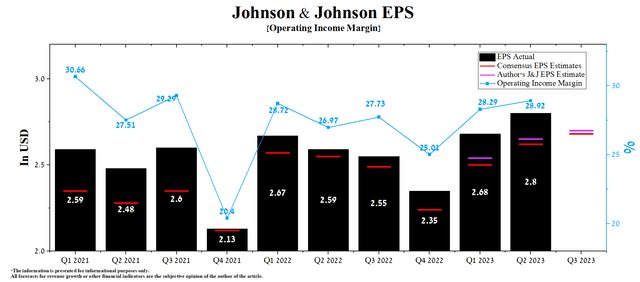

Johnson & Johnson’s Q2 Non-GAAP EPS was $2.80, up 8.1% year-over-year. Thanks to the improvement in the margins of all its segments, the company’s management raised the guidance for 2023 from $10.60-$10.70 to $10.70-$10.80.

These changes result in us increasing our adjusted operational earnings per share guidance by $0.10 per share to a range of $10.60 to $10.70 or $10.65 at the midpoint on a constant currency basis. Constant currency growth of 5% at the midpoint.

According to Seeking Alpha, Johnson & Johnson’s Q3 EPS is expected to be $2.68, down 2.3% from the Q2 2023 consensus estimate. While we believe this is slightly underestimated, our model puts Johnson & Johnson’s EPS at $2.70.

Author’s elaboration, based on Seeking Alpha

Some of the main reasons for Johnson & Johnson’s year-over-year increase in net income are the declining cost of raw materials for the production of medicines, the periodic increase in the prices of its products, and the continued high demand for anti-cancer drugs.

The company’s standout success within its oncology portfolio is Darzalex (daratumumab), approved for treating adults with multiple myeloma and light chain amyloidosis. Thus, the total revenue of Darzalex amounted to $2.43 billion for the second quarter of 2023, an increase of 22.4% compared to the previous year due to the introduction of the subcutaneous version of this drug into clinical practice.

Author’s elaboration, based on quarterly securities reports

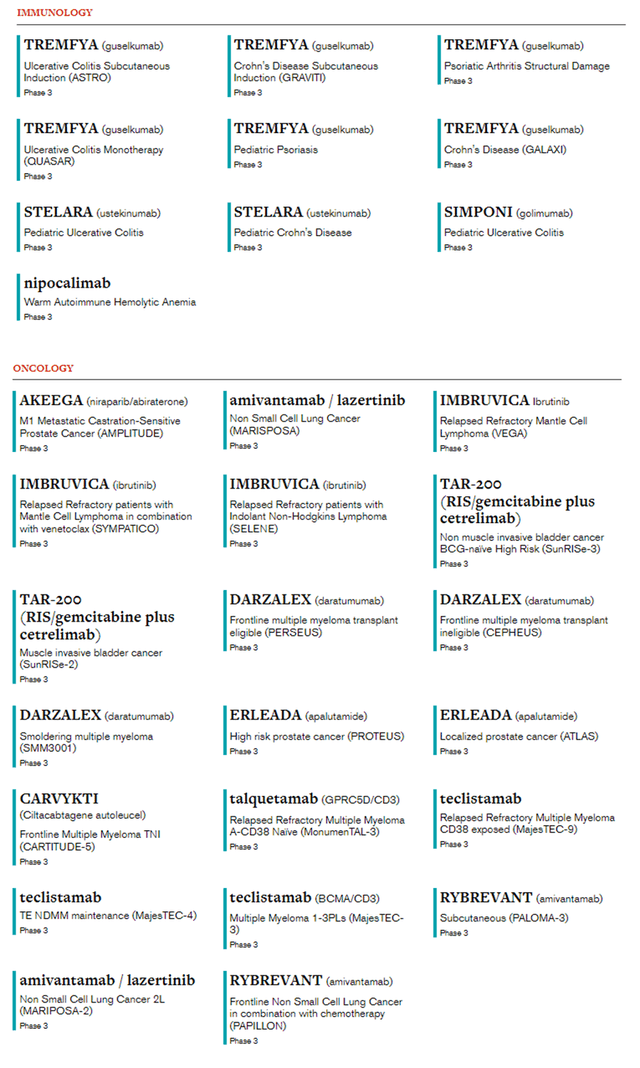

Progress in the development of the Johnson & Johnson pipeline

As one of the leaders in the pharmaceutical industry, Johnson & Johnson develops medicines aimed at treating diseases in therapeutic areas such as neurology, immunology, oncology, and cardiology. The active R&D program implemented under the leadership of Joaquin Duato is primarily focused on switching patients from the company’s blockbusters, whose exclusivity has ended, to innovative drugs, whose effectiveness is the best on the market.

According to our assessment, guselkumab, talquetamab, and daratumumab are the most promising drugs in the company’s pipeline, which can not only improve the quality of life of patients but also improve its financial situation despite the emergence of Stelara biosimilars in the next two years.

Author’s elaboration, based on JNJ’s pharmaceutical pipeline

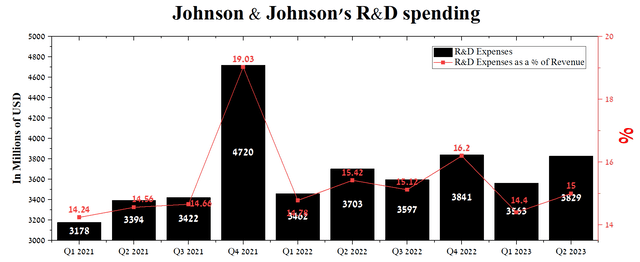

Johnson & Johnson’s R&D expenses were about $3.83 billion in Q2, or 15% of total revenue, up slightly from the previous year. We estimate that the company’s 2023 medicine and vaccine development spending will remain at its 2022 level, partly due to concerns about President Biden’s Inflation Reduction Act.

Author’s elaboration, based on Seeking Alpha

Risks

In our assessment, there are two main risks to consider that could affect both Johnson & Johnson’s financial position and its share price.

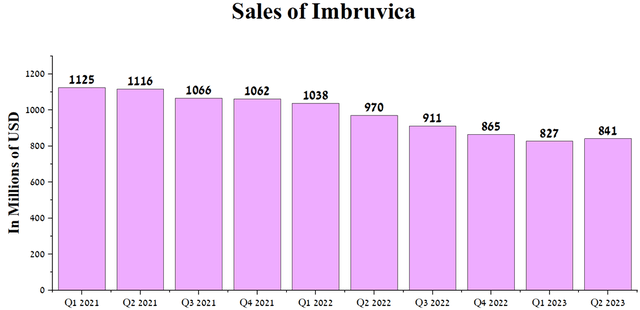

The decline in sales of Imbruvica

Demand for Imbruvica (ibrutinib), a BTK inhibitor approved for the treatment of Waldenström’s macroglobulinemia, chronic lymphocytic leukemia, small lymphocytic lymphoma, and chronic graft versus host disease, continues to decline. Sales of this medicine were $841 million in Q2, 2023, down 13.3% year-on-year. We expect this negative trend to continue due to increased market competition from more effective BTK inhibitors, including BeiGene’s Brukinsa (BGNE), AstraZeneca’s Calquence (AZN), Biogen’s orelarutinib (BIIB), and Eli Lilly’s Jaypirca (LLY).

Author’s elaboration, based on quarterly securities reports

The second failure to resolve the talcum crisis in court

On July 28, 2023, a federal judge denied Johnson & Johnson’s attempt to settle thousands of lawsuits related to talc products in bankruptcy. Although the company will appeal against this decision, it already negatively affects its reputation and increases the risk of severe damage to its financial position in the future.

Moreover, on July 18, a jury in a California state court returned a verdict in favor of Emory Hernandez Valadez, who claimed he developed mesothelioma due to exposure to baby powder. The amount of damage in this case for Johnson & Johnson amounted to $18.8 million.

Conclusion

On July 20, Johnson & Johnson, the mastodon of the healthcare sector, released its financial results for the second quarter of 2023. These not only beat analysts’ expectations but were also able to demonstrate that demand for innovative drugs such as Tremfya, Darzalex, Concerta, and Carvykti is growing at a faster rate than many financial market participants expected.

In addition, on July 24, 2023, Johnson & Johnson released more detailed information about its plans to split off shares of Kenvue. The completion of this exchange offer will allow the company to focus on its high-margin pharmaceuticals division.

However, those results were overshadowed by a federal judge’s decision to dismiss a Johnson & Johnson subsidiary’s bankruptcy filing that sought to resolve thousands of lawsuits related to the talc crisis.

The company continues to make significant progress in developing a portfolio of experimental drugs ahead of the end of exclusivity of some of its blockbusters in the next three years. Given the growth in margins for all three Johnson & Johnson segments, we are raising the level at which the risk/reward profile for investors will be attractive from $144 to $147.50.

We continue our analytics coverage of Johnson & Johnson with a “hold” rating for the next 12 months.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only, and does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.