Summary:

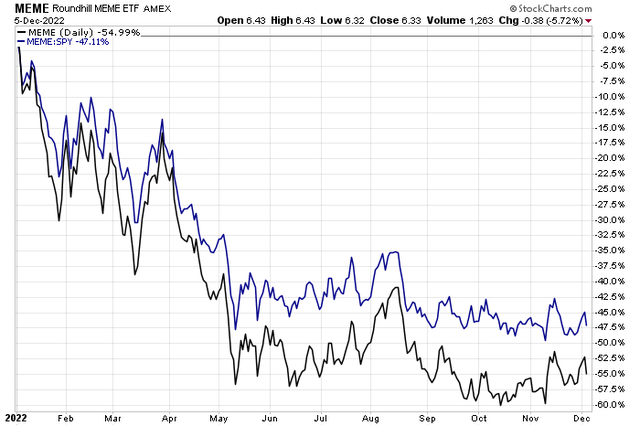

- Meme stocks have been crushed this year after a wild 2021.

- GameStop has had some interesting developments, but soft overall video game sales is a fundamental headwind. One big investor is bearish.

- I see more downside risks than upside potential given poor profitability and a still-high valuation.

- The options market has priced a relatively small move post-earnings, however.

Justin Sullivan

Meme stock mania recently made a brief comeback as stocks rallied off their October lows. Those gains were quickly given back though as speculation in 2022 is nothing like that of last year.

All eyes are now on how shares of the king of the memes – GameStop (NYSE:GME) – react to what should be a bleak earnings report Wednesday night.

Meme Stock Crash Of 2022. Big Absolute and Relative Declines.

Stockcharts.com

According to Fidelity Investments, GameStop provides games and entertainment products through its e-commerce properties and various stores in the United States, Canada, Australia, and Europe. The company sells new and pre-owned gaming platforms; accessories, such as controllers, gaming headsets, virtual reality products, and memory cards; new and pre-owned gaming software; and in-game digital currency, digital downloadable content, and full-game downloads.

The Texas-based $8.4 billion market cap Computer and Electronics Retail industry company within the Consumer Discretionary sector does not have positive trailing 12-month GAAP earnings and does not pay a dividend, according to The Wall Street Journal.

Ahead of earnings on Wednesday, Axios reports that the firm has begun a round of layoffs in a bleak sign for both the company and the broader consumer picture. This comes as billionaire investor Carl Icahn is reported to have a large short stake in GME shares according to his recent comments. GameStop is expected to report a per-share drop in profits, though there has been some upbeat commentary regarding the launch of its recent iOS NFT/Web3 wallet. Across the industry, however, video game sales fell 5% in Q3, according to data from NPD Group.

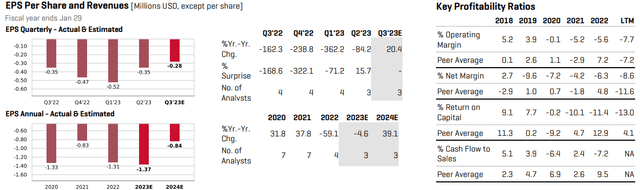

On valuation, GameStop has no imminent signs of turning profitable, thus traditional DCF valuation is tough. CFRA Research shows a forecast EPS loss of $1.31 this year and $1.37 in 2023. On the plus side, total revenues are seen as rising from just above $5 billion in 2021 to nearly $6.5 billion by 2024.

For Wednesday’s Q3 report, the top-line is seen as rising by a few percentage points from a year ago. With negative operating and net margins, the company has a lot of work to do to turn things around. Seeking Alpha rates the stock with a not-so-high C+ valuation, which I generally agree with. With no earnings and negative cash flow, one of the few useful valuation indicators is the price-to-sales ratio – currently at 1.24 using forward estimates – that’s above its 5-year average of 0.81.

GameStop: Earnings Outlook and Key Profitability Ratios

CFRA

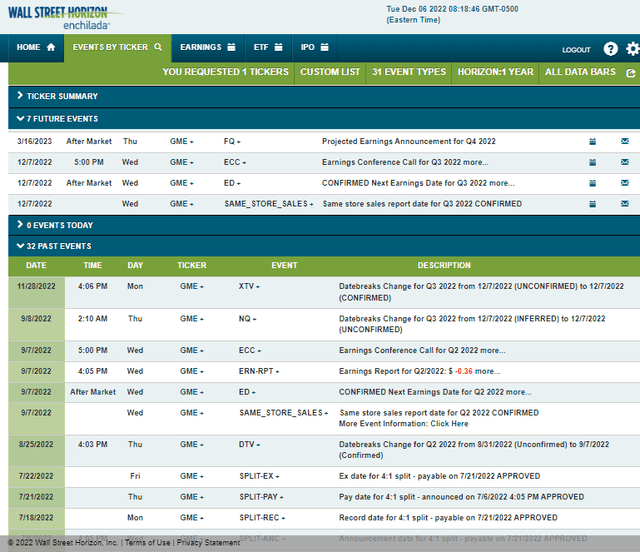

Looking ahead, corporate event data from Wall Street Horizon show a confirmed Q3 2022 earnings date of Wednesday, Dec. 7 after market close with a conference call immediately after results cross the wires. You can listen live here. The event calendar is light aside from earnings this week.

Corporate Event Calendar

Wall Street Horizon

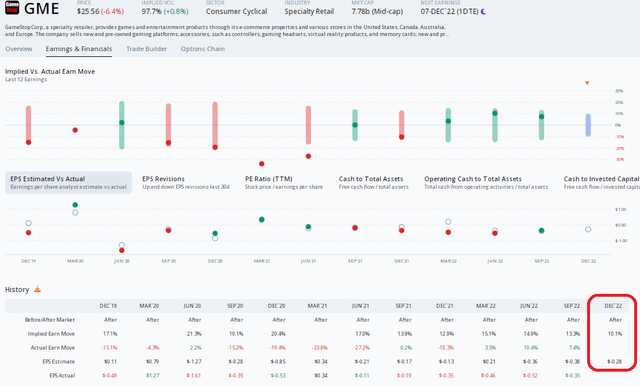

The Options Angle

Digging into the Q3 report and expectations, data from Option Research & Technology Services (ORATS) show a forecast per-share profit decline of $0.28. That would be a slight improvement from -$0.35 earned in the same quarter a year ago. I see bearish risks considering GameStop has missed on earnings in four of the past five quarters. The stock, meanwhile, has traded higher after the previous three reports, so perhaps all of the negativity around quarterly losses gets baked in.

The options market has priced in a 10.1% post-earnings stock price swing according to the nearest-expiring at-the-money straddle. That is actually the cheapest earnings straddle in the last three years – dating back to before meme stock mania. Notably, shares have not moved more than 10.4% up or down in the last five earnings reactions. Overall, I’m inclined to go long options here given that pricing.

Are Options Finally A Value on GME?

ORATS

The Technical Take

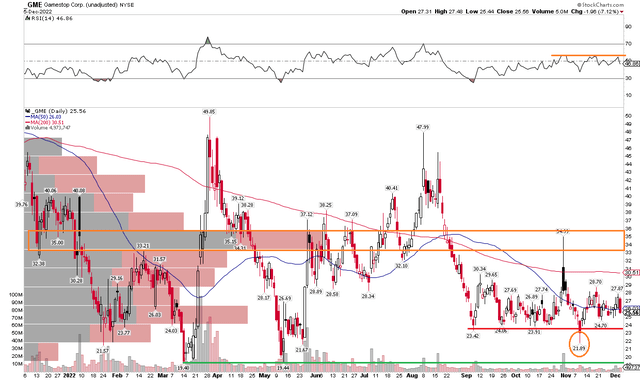

GME’s chart is one of the ugliest I see as there is no discernable trend when looking back a year. Perhaps there’s some support in the $23 to $24 range – notice how shares had a bullish false breakdown to $21.89 a month ago, but gains were capped at $28.70. I assert that if the stock falls below $23, a test of the $19 to $20 zone is immediately in play.

On the upside, there was a mini-meme move to $34.99 on Halloween that got the bulls excited, but that rally was capped at a range where there was a high amount of shares traded. Also important is the RSI at the top of the chart which has found resistance at the 60 level – it’s thought that the 20 to 60 range in RSI is bearish, so that is a feather in the bears’ caps.

GME: Messy Chart, But A Few Clues Seen

Stockcharts.com

The Bottom Line

I see risks of lower prices ahead for GME. The stock is expensive on a price-to-sales basis, and I do not see much in the way of bottom-line improvement. The technicals, meanwhile, are not favorable either.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.