Summary:

- GameStop holds $4.2 billion in cash, has minimal long-term debt, and is near break-even, but lacks a compelling growth narrative to drive a major stock run.

- Management focuses on cost-cutting and shifting towards collectibles, but this strategy doesn’t excite investors looking for high-growth potential.

- Despite upcoming big console releases, these fundamentals are unlikely to significantly boost GameStop’s stock price in the near term.

- Selling a January 26 $20 strike put for $5.80 seems reasonable given the company’s strong balance sheet and focus on profitability; overall, I rate it a hold.

Melissa Kopka

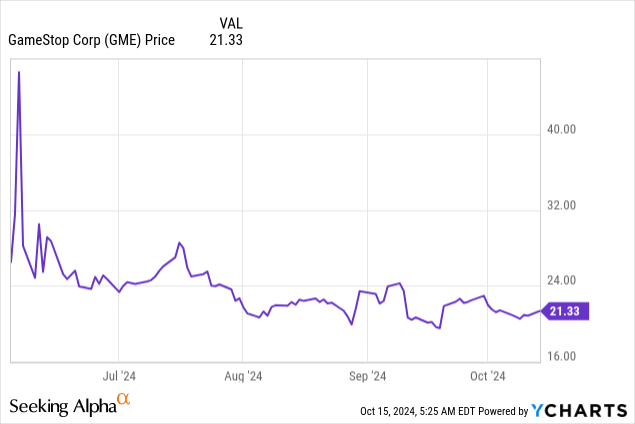

My last article on GameStop (NYSE:GME) dates back to June 4. At the time, GameStop was already turning into a cash box. That is even more true now as the company issued stock in September (an average of $20 per share) and raised another $400 million. It holds $4.2 billion in cash and has virtually no long-term debt (if you disregard store leases). At the time, I figured $40 would be a soft ceiling and concluded the following:

I’m not inclined to participate on the long side. It is too volatile and unpredictable for my liking, and I don’t have enough confidence the rally is likely to continue towards $60. What I did do is to sell a small amount of short-dated out-of-the-money puts. Their pricing reflects the very high volatility in the name. I can imagine the stock giving up most of the gains, but possibly option markets overestimate the likelihood it will fall below $10 given the cash raised through fresh stock issuance and the optionality of that being repeated.

The stock went up quite a bit but disappointed afterward.

Currently, no one is really thinking about GameStop, and the realized and implied volatility has come down massively.

It seems unlikely the stock will go on a significant run ($40+) anytime soon.

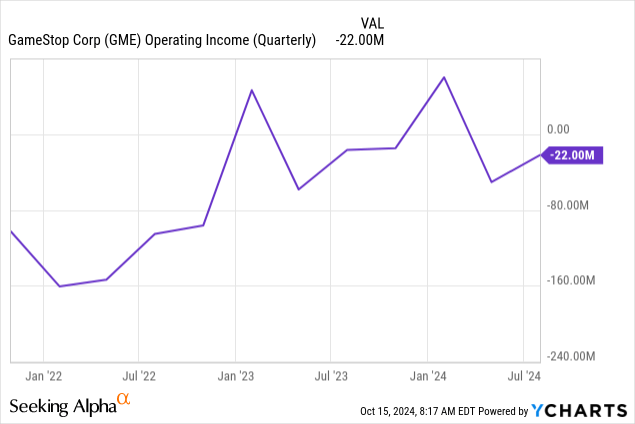

1) Management is mainly talking about rightsizing the ship, cost-cutting, shutting down unprofitable shops, and focusing on collectibles instead of categories that are clearly going away. Don’t get me wrong; they are doing the right thing. But generally, this is not a narrative that gets the WSB crowd going. There is currently simply no positive or inspiring story.

2) It isn’t entirely clear to me why the company needs $4.2 billion and continues to raise money. Why raise another $200 million when you’re close to break-even, have virtually no debt, and are not investing it? In my experience, cash boxes have traded quite poorly over the last decade or so.

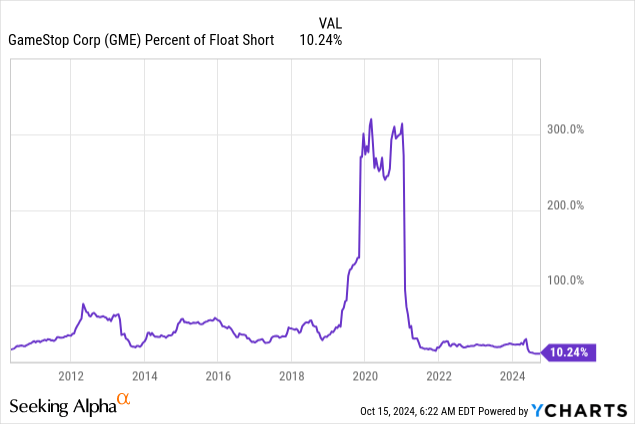

3) There wasn’t really a positive story either at the time of the first epic GameStop squeeze. However, this developed as hedge-fund short sellers were trapped, turning into a Main Street vs. Wall Street battle—Roaring Kitty vs. Maplelane Capital. The short interest isn’t really at that level.

There are some positives, though. The company’s operations are pretty close to break-even.

Big console releases are planned for the Holiday season. Titles like Call of Duty: Black Ops 6, Sonic X, and Dragon Age could benefit GameStop. The launch of the PS5 Pro could also help. I don’t think these business fundamentals will make a meaningful difference to GameStop’s upside in the near term, but they do make a difference on the downside.

The company holds around ~$10 in cash per share. Its business generated $4.5 billion in revenue over the past 12 months—a business that’s been improving from terrible to bad. Before 2018 (different times) the business often generated 2x as much revenue. It would make $400-$600 million per year in operations. That’s $1 or more per share. I don’t see how it could get back to that. The hedge funds shorting it correctly saw the way games are distributed, as well as retail generally, was changing. But management is changing the mix of what it’s selling. It’s possible the company gets to $0.50 or so per share in operations. There’s no management guidance, and analysts don’t foresee it anytime soon. But it should be doable given the number of stores and the revenue base and how close to operating profitability the company currently is. Put a 10x multiple on it, and it’s worth $5.

Then, there is the option of management doing something cool with that cash hoard. Buy a strategic asset that synergizes with the store base. An acquisition that puts some growth back into the entire business. Many people are rooting for this stock, so it could go on a run if that happened.

Talking about the stock going on a run brings me to the last piece of the value puzzle. This is a meme stock. The most famous one, actually. It has one of the most remarkable share price histories. There is value to that optionality, even though it is hard to explain through fundamental analysis. It can be clearly observed in the options markets. GameStop calls have rarely traded this cheaply, but they are still relatively expensive for a retail company. Given the history, it makes sense to ask a bit of a premium to sell calls here.

This leads me to believe that the stock isn’t especially mispriced at ~$20. You could argue there is $15 in fundamental value and ~$5 worth of optionality. I don’t like the equity enough to buy it, but I definitely wouldn’t short it. Last time, I sold a few $10 puts (at very high implied vol) because I wasn’t comfortable with the stock. That worked out fine, but the implied volatility is much lower this time around.

Let me first emphasize that selling options is risky. Selling calls exposes you to unlimited losses. Selling a put also exposes you to losses that are much greater than the premium you’re getting on the sale. Still, selling a January 26 $20 strike put that goes for $5.80 looks pretty interesting. This seems reasonable to me because, given all the equity issuance and the absence of an organic growth driver, I don’t think it is very likely the stock will have another considerable run-up. At the same time, the company is paying a lot of attention to profitability, and the balance sheet is loaded. It seems quite possible we’ll be in a similar situation as today, 12 months from now. In any case, be very mindful of selling puts. It is less risky to sell a put spread (capping risk). Only do it when you know what you’re doing. Overall, I’ll rate it a hold. Remember, it is hard to justify the share price solely on fundamentals as they are. It is essentially a company in turnaround and a lottery ticket.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.