Summary:

- GameStop Corp. has crashed in 2022 after a peak in 2021.

- GameStop struggled to bounce in November, but overall behavior remains bearish.

- GameStop stock is expected to decline further based on the recent development and price action.

RiverNorthPhotography

GameStop Corp. (NYSE:GME) peaked in 2021 and then began a steep decline. The stock’s peak in 2021 marked a significant top with further downside potential. According to Casos Exitosos, GME specializes in video game merchandise, such as new and used video games, consoles, and accessories. The company operates a large global network of physical stores in addition to an online store. GME provides the following products and services: new and used video games, gaming consoles, gaming accessories, and electronics. Powerup Rewards is a GME loyalty program that allows members to earn points on purchases that can be redeemed for discounts and other perks.

The stock has declined since its peak in 2021, but demand for games has not diminished. The particular decline in GameStop Corp. stock is due to the appearance of a chart bubble following the crisis of 2021. Based on the negative cash flow seen in the company’s third-quarter report, it is likely that GameStop Corp. stock will continue to decline in 2023.

Historical Analysis – What Happened in 2021?

In 2021, GameStop Corp. was confronted with a variety of compliance issues, including statements of concern and proposals for new laws and regulations. The investigation into GME’s financial records led to market manipulation, which speculators viewed as a casino. The events of market manipulation on the financial markets are detrimental to investors, as prices exceed the limits with extreme volatility and the potential for a rebound.

GameStop Corp. became one of the most shorted U.S. companies in 2021 as a result of this situation. GME was one of the many companies in which long-short hedge funds held substantial short positions, including so-called meme stocks that were popular among individual investors. The majority of outstanding shares held by institutions were pledged, and market awareness of the possibility of a selloff increased. Within a short period of time, GME shares experienced a tremendous surge in value, which was driven by an increase in retail investors’ trading activity on the Robinhood platform, which was coordinated through the Reddit social network.

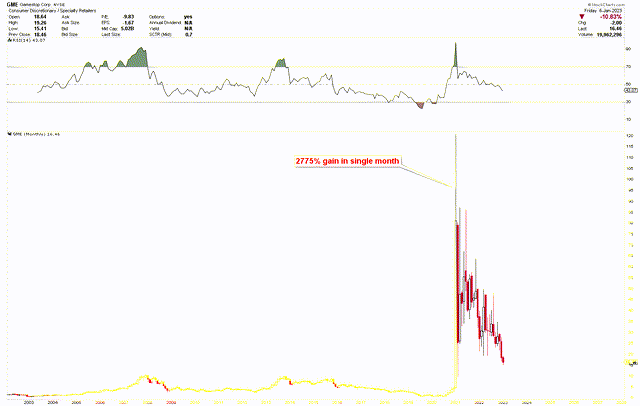

Robinhood (HOOD) imposed restrictions prohibiting new positions, resulting in a precipitous decline in the number of net existing positions and a precipitous decline in the price of the stock. The subsequent rebound in the stock in 2021 produced a bearish double-top scenario, suggesting that the stock will remain lower for a long time. The chart below depicts the monthly price chart for GME, which displays a 2775% price increase in a single month.

GME monthly chart (stockcharts.com)

Recent Developments in GameStop

November 2022 saw an increase in game sales due to the holiday season, but December saw a decline. November was the first positive month, followed by eleven consecutive months of decline. Compared to other market competitors such as Sony (SONY) and Nintendo (OTCPK:NTDOY), the November hardware sales increase was greater in GME. In November, there was a tremendous demand for other video game products and accessories.

In my opinion, this demand was a result of the long December holidays, during which users desire to engage in games and entertainment. The Modern Warfare II video game had the highest sales, followed by the Elden Ring. On the other hand, spending on mobile games continued to struggle, with multiple mobile games leading the sales.

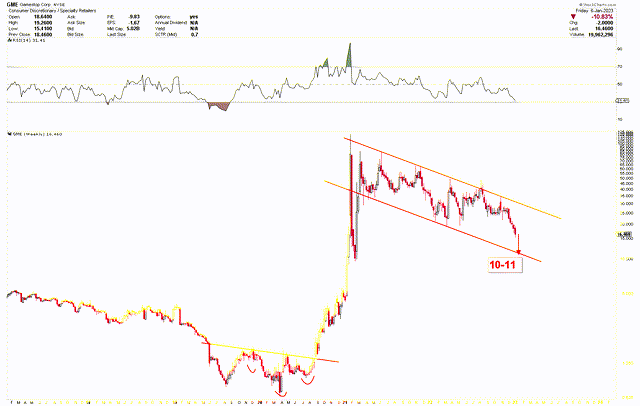

The aforementioned fundamentals can also be understood by GME’s technical weekly chart, which displays a bearish outlook with the possibility of further decline. The chart is displayed on a logarithmic scale, so the falling channel is evident. It is probable that the price will continue to fall further in 2023. As per the chart, the first level of immediate support is located between $9 and $10. It is probable that the stock will rebound from this level before falling again.

GME weekly chart (stockcharts.com)

What Investors Should Do?

The biggest challenge faced by investors over the past two years was that the majority of them were out of the game during the 2021 market peak. However, few investors have maintained positions in anticipation of price increases. As more sellers enter the market, the price of GME stock will likely fall precipitously in 2023.

Typically, when a financial instrument experiences a decade move like the one that occurred in 2021, the instrument tends to decline for a year or two and then fluctuate to stabilize the game. After the stock price has stabilized, it begins to rise in the predetermined direction. The investors holding long-term positions in GME stock and aiming for prices above $100 must re-evaluate the risk and adjust their goals and money management accordingly. Since GME is not expected to surpass $100 in 2023, further fluctuations and consolidations are evident.

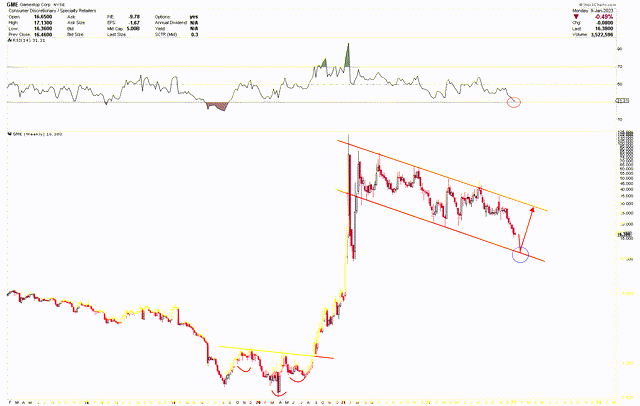

The chart below is self-explanatory for short-term investors. The following chart shows the GME weekly outlook on a logarithmic scale. Since the bottom was supported by the inverted head and shoulders pattern and the price is falling from a 2,775% gain in one month, the stock must continue to decline. However, the chart reveals strong support between $9 and $10, indicating that the stock may experience a rebound. Short-term-focused investors and traders can wait for a rebound from the $9 to $10 region to the $30 region.

Weekly GME chart (stockcharts.com)

Conclusion

According to the preceding discussion, GameStop Corp. stock is likely to decrease further in 2023. Investors with long-term positions at higher prices must wait for the stock to go higher. The recent development and demand in November 2022 caused the stock to increase, but the price was capped by strong resistance and continued lower.

GameStop Corp. stock price is aiming for $9 to $10 in the near future, whereby strong resistance might produce a rebound from this region toward the price of $30. Long-term investors can sit tight and wait for the market to recover before selling their holdings. Since the peak in 2021 was seen as a bubble, GME is likely to fluctuate in wide ranges below $100 with a negative bias. GME stock is unlikely to move above $100 in the near future and tends to fluctuate in a wide range with big volatility for a few years.

Long-term investors can add some positions in GME around $9 to $10 in anticipation of the rally to $30, although any investment in GameStop Corp. stocks carries high risk at the moment. The circumstances may shift with new developments in the market.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.