Summary:

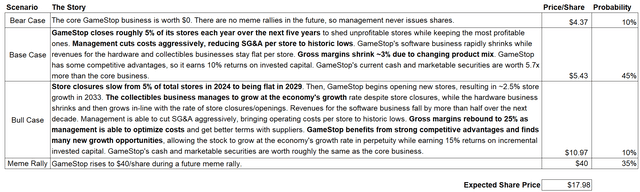

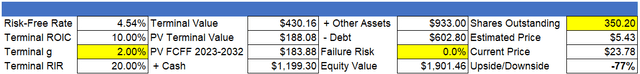

- I estimate GameStop’s intrinsic value to be $5.43/share, but the possibility of a future meme rally increases my estimate of GameStop’s value to $17.98/share.

- Investors should estimate the probability of another meme rally in the future and the peak share price during a future meme rally.

- I believe there’s a 35% chance of a future meme rally, and I recommend selling out at $40/share if that’s the case.

- GameStop’s fundamentals remain weak, but they matter little to the current meme rally thesis.

Adam Gault

Introduction

I valued GameStop (NYSE:GME) last year at $5-$8/share (it was trading at ~$20/share at the time). My thesis that consensus revenue growth was too high played out, considering that revenue declined 11% YoY (whereas consensus revenue growth was roughly flat at the time). GameStop’s shares bottomed at ~$10/share in April 2024.

However, I overestimated the importance of GameStop’s intrinsic value in my initial analysis. Almost all of Gamestop’s value as an investment comes from the possibility of a future meme rally. GameStop’s shares peaked at $64.83/share during the recent meme rally and are currently trading for ~$20/share, so my bearish view of GameStop last year was incorrect. In my updated expected share price calculation for GameStop, the meme rally scenario adds $14/share to the expected share price, whereas the other scenarios add only $3.98/share.

GameStop could easily be undervalued if you take a more optimistic perspective on the price/share during a future meme rally and the probability of a future meme rally (feel free to tweak the assumptions in the “Scenario Analysis” tab of my Excel spreadsheet). I went with $40/share because I expect future meme rallies to be smaller than previous ones (the 2021 rally peaked at ~$125/share split-adjusted, and the 2024 rally peaked at $65.83/share). I also chose $40/share as a hypothetical sell price to reduce the likelihood of my price target not being met during a future meme rally (causing me to sell at a much lower price eventually).

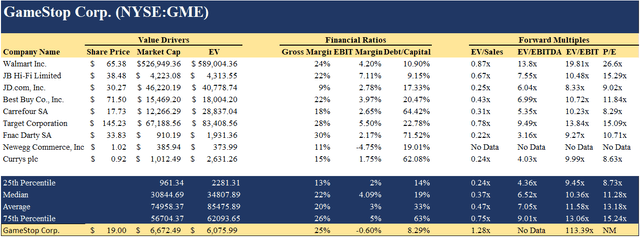

Although GameStop makes sense as a trade, GameStop’s fundamentals remain weak. GameStop’s eCommerce business is shrinking, the NFT business was wound down in Q4 of 2023, and Ryan Cohen doesn’t have a plan to turn the company around. GameStop’s clearest path to increasing its intrinsic value is through stock sales during meme rallies (that may not happen in the future). The core brick-and-mortar business is almost certainly worth less than GameStop’s cash and marketable securities because competition is fierce: GameStop competes with online retailers (Amazon.com), electronics retailers (Best Buy, JB HiFi, Fnac Darty), large retailers (Target, Walmart), and direct-to-consumer sales from Sony, Nintendo, and Microsoft. GameStop is competitively disadvantaged, given their size relative to competitors and lack of profitability. GameStop’s suppliers are requesting credit support, indicating that suppliers are already giving them worse terms because they view GameStop as a distressed customer.

Recent Events

New CEO

Ryan Cohen took over as GameStop’s CEO in late 2023. He is a clear improvement over GameStop’s previous CEO, Matt Furlong, because he owns 12% of the company, meaning his interests are aligned with shareholders. Cohen also encouraged the hiring of executives from Amazon and Chewy in 2021 (before he was CEO), which is impressive given that GameStop is declining. The company’s ability to attract talent should meaningfully increase GameStop’s intrinsic value.

It’s also worth noting that GameStop’s Board of Directors granted Cohen the right to buy stocks with company cash. I see this as an admission that it’s not worth it for Cohen to invest more capital in the business; instead, investing in other companies will generate better returns. GameStop’s cash and investments are likely worth more than the brick-and-mortar business – especially if GameStop can issue shares during future meme rallies (which would increase cash and marketable securities).

At-The-Market Equity Offering

GameStop also raised $933 million in May by selling 45,000,000 shares, translating to an average share price of $20.73/share (well above the recent lows of ~$10/share). GameStop significantly increases shareholder value by issuing shares when the stock is trading above GameStop’s intrinsic value.

Job Cuts/Store Closures

GameStop recently announced that it is cutting an undisclosed number of jobs, which is unsurprising given the declining nature of the business. GameStop seems to be exiting international markets, given that management said GameStop exited Ireland, Switzerland, and Austria in 2023. GameStop’s simplified international footprint should increase margins.

Business Model Disruption

GameStop’s gaming software business continues to be pressured by recent trends in the gaming industry. Xbox recently announced a plan to launch Call of Duty on the Xbox Game Pass, signaling that Microsoft is serious about increasing Xbox Game Pass subscribers. PS4 Plus has also grown ~30% over the past four years, threatening GameStop’s software business because customers don’t need to purchase physical game copies if they have an Xbox Game Pass/PS4 Plus subscription. Additionally, software sales are threatened by game developers making their games free-to-play and console manufacturers launching digital-only consoles (such as the Xbox Series S).

Financials and Data

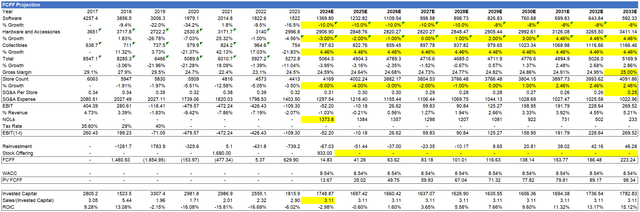

Revenue

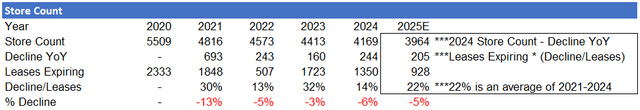

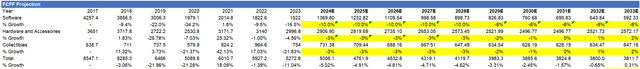

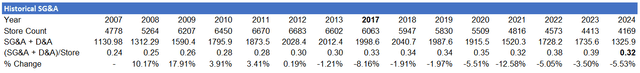

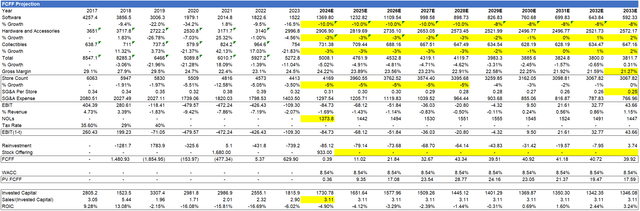

I estimate GameStop’s revenue decline by looking at leases. I compare the annual decline in store count relative to the leases expiring every year. Likewise, I take the historical average percent of expiring leases that aren’t renewed (Decline/Leases) and multiply that by expiring leases in 2025 to get an expected store decline of negative five percent.

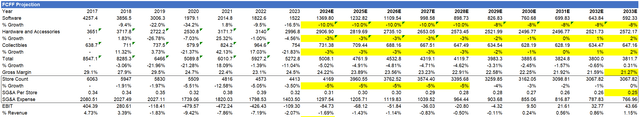

I then assume the collectibles, hardware, and accessories sales growth will be in line with store closures (-5% + 2% inflation = -3%) during 2024-2028. I also assume revenue growth increases to 2% from 2029-2033 as store closures slow down and sales volume per store stays flat (2% is my estimate of inflation). However, I’m less optimistic about the software segment because digital game downloads are replacing CDs. I have revenue falling 10% annually from 2024-2028 and 8% annually from 2029-2033.

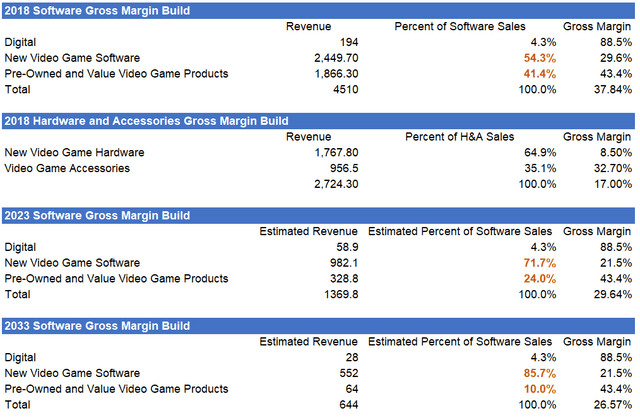

Gross Margins

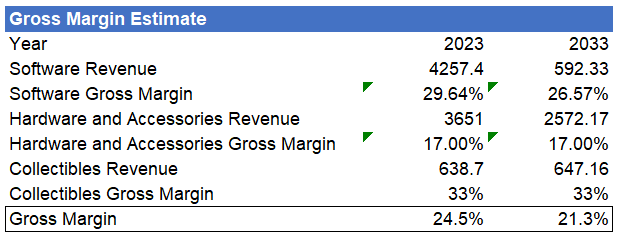

I estimate gross margins by first breaking down the software segment into its sub-segments (digital, new video game software, etc.) and the hardware and accessories segment into its sub-segments. Management stopped breaking down these segments after 2018, so I used the segment gross margins from 2018 and guessed the current percentage of sales from each sub-segment. Gross margins have decreased since 2018, so I assumed that sales of pre-owned and value video game products declined from 41.4% of revenue to 24% of revenue, driving down GameStop’s gross margin from 29% in 2018 to 24.5% in 2023 (because the pre-owned and value video game products are very high gross margin). This assumption makes sense because pre-owned and value video game product sales declined rapidly going into 2018. I also assume the revenue mix between accessories and new video game hardware stays constant, resulting in a segment gross margin of 17%. Additionally, I assume the collectible segment gross margin remains at 33%.

I assume pre-owned and value video game products will decline to 10% of revenue in 2033 as customers switch to digital purchases (and thus don’t need to trade in used physical game copies). I expect the shift away from higher-margin pre-owned products and the decline in GameStop’s software business to cause gross margins to fall from 24.5% in 2023 to 21.3% in 2033.

Author’s Calculations

Operating Margins

Estimating GameStop’s operating margins is tricky because the business is currently declining. Management must reduce operating costs fast enough to prevent operating losses from increasing while attracting and retaining talent. However, management seems to be cutting operating costs aggressively, given that operating costs per store decreased sharply over the last year.

One way to calculate GameStop’s operating margin is by looking at its peers. GameStop’s peers have a median operating margin of 4.09%.

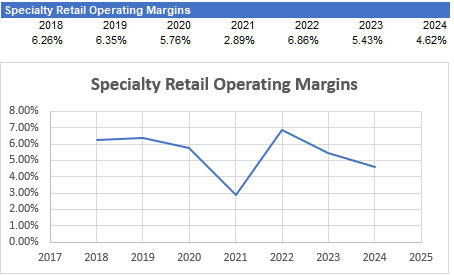

However, Aswath Damodaran’s data shows that operating margins for specialty retailers can climb higher than 6%.

Aswath Damodaran’s Website

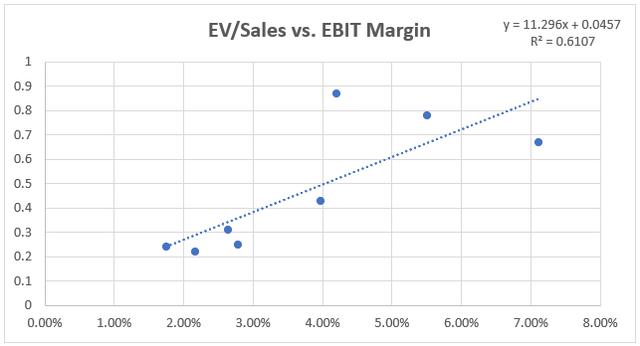

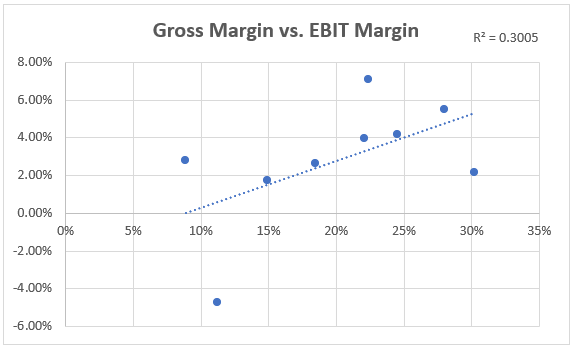

If we regress gross margins for GameStop’s peer group against operating margins for GameStop’s peer group, we find that companies with 20-25% gross margins (my expected range for GameStop) typically have 3-4% operating margins.

Author’s Calculations

However, given GameStop’s competitive positioning, I believe that GameStop’s normalized operating margins will be lower than 3%. Even if GameStop can get SG&A per store down to $250,000 per store (levels last achieved before 2008), I estimate that GameStop’s operating margins in 2033 will be 1.15%. GameStop may be able to increase gross margins through further cost optimizations (like they did this year), but cost optimizations are highly uncertain.

Intrinsic Value

Bear Case

I assume the core GameStop business is worth $0. To calculate GameStop’s intrinsic value, I take GameStop’s cash and marketable securities and subtract debt to get an expected equity value of $1.53 billion. I divide the equity value by 350 million shares to get a price of $4.37/share.

Base Case

Author’s Calculations Author’s Calculations

Reinvestment

I use the specialty retail industry’s average Sales/(Invested Capital) ratio of 3.11 to calculate reinvestment. I divide the increase/decrease in sales YoY by the Sales/(Invested Capital) ratio to get reinvestment for each year.

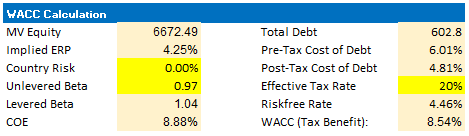

WACC

I use an unlevered beta of 0.97 (the average unlevered beta of specialty retailers, according to Aswath Damodaran’s data), a pre-tax cost of debt of 6.01% (the weighted average discount rate of leases in GameStop’s 10-K), and an equity risk premium of 4.25% (the implied equity risk premium, according to Aswath Damodaran).

Author’s Calculations

Other Assumptions

I assume a terminal growth rate of 2% (the rate of inflation) because I expect no future store growth. I assume that GameStop’s terminal ROIC is 10%, implying that GameStop has some competitive advantages. Also, I assume that GameStop’s tax rate is 20%, below the worldwide average tax rate of 25% because GameStop has net operating losses left in my DCF after 2033.

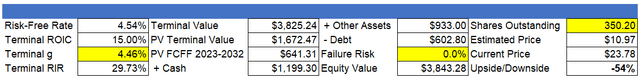

Bull Case

Author’s Calculation Author’s calculations

Assumptions

I use the same assumptions as the base case but change my revenue growth and terminal ROIC assumptions. I assume that GameStop store growth will increase from -5% in 2024 to 2.46% in 2033. I use 2.46% because it equals the 10-year growth rate (a proxy for the economy’s growth rate) minus 2% inflation. I assume the collectibles business does very well, allowing it to grow at the 10-year rate despite store closures. I also assume GameStop’s hardware and accessories sales increase in line with store count (technically, 2% higher than store count because I assume 2% inflation). I assume a 4.46% terminal growth rate, implying that GameStop can find new growth opportunities outside its brick-and-mortar business. Additionally, I assume GameStop’s ROIC in perpetuity is 15%, implying that it has very strong competitive advantages.

Relative Value

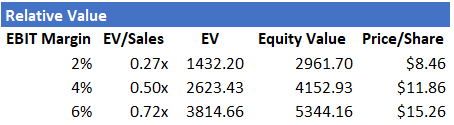

One way to calculate GameStop’s relative value is by regressing the EV/Sales multiple of each company in GameStop’s peer group against the EBIT margin of every company in GameStop’s peer group.

The regression shows that companies with a 2%, 4%, and 6% operating margin typically trade for 0.27x, 0.5x, and 0.72x sales, respectively. I multiplied EV/Sales by GameStop’s current revenue to get an expected value for EV. I then get from EV to equity value by subtracting $602 million in debt and adding back $2.13 billion in cash and marketable securities. I get from equity value to price per share by dividing the equity value by 350 (GameStop has 350 million shares outstanding).

Author’s Calculations

My view is that the 2% operating margin scenario is the most likely one. However, the price/share is likely wrong because GameStop is declining, whereas GameStop’s peer group is growing. Also, management may issue stock during future meme rallies, increasing GameStop’s intrinsic value. I prefer valuing GameStop with a DCF because it’s easier to quantify the impact of GameStop’s fundamentals and future share issuances on its share price.

Will There Be Another Meme Rally?

Keith Gill is the most likely person to start another meme rally, in my view because he was directly involved in the meme rallies in 2021 and 2024. Additionally, the movie Dumb Money, which was released in September 2023, further spotlighted the role Gill played. All eyes seem to be on Gill: he currently has 674,000 subscribers on YouTube, and his recent May 12th post (after years of not posting) currently has 27.9 million views. Gill may post further, which could impact another meme rally in the future. I assume there’s a 35% chance of another meme rally (a very rough guess based on my opinions).

What will GameStop Trade for During a Future Meme Rally?

We know that GameStop reached a split-adjusted peak of ~$125/share in 2021 and a peak of $64.83/share in 2024. If we want to be conservative and assume that the next peak will be roughly half the previous peak (because the 2024 peak was roughly half the 2021 peak), we can assume GameStop will reach $34/share during the next meme rally. However, there are many factors to consider when predicting the next peak. We can safely assume that GameStop won’t return to $125/share because conditions during 2021 were much different:

- Short positions were 140% of GameStop’s shares going into the 2021 rally, but short positions were 24% of GameStop’s shares going into the 2024 rally

- Retail investors were stuck at home with stimulus checks during the pandemic

- Low rates, low inflation, and surging eCommerce sales supported GameStop’s business during 2021 (all of these factors have reversed now)

However, it’s possible to argue that GameStop will rise above its previous $60/share peak because more institutional momentum investors are paying attention to Keith Gill/GameStop. Additionally, Gill recently moved GameStop’s share price by simply posting a picture. Gill may be able to move GameStop shares more if he explicitly says to buy GameStop or if he posts multiple times.

Putting these factors together, we can conclude that GameStop’s peak during a future meme rally will be $34/share on the lower end and somewhere between $64-$125/share on the upper end, but probably closer to $64/share on the upper end.

Risks

Failure Risk

In my analysis of GameStop, I assume there’s no risk of failure because I believe retail investors will continue to prop up the price of GameStop’s shares. However, it’s possible that GameStop will go bankrupt if investors shift their focus to other stocks and the fundamentals weaken.

Meme Rally Risk

The occurrence and timing of a future meme rally are highly uncertain. If I’m wrong about the probability of a future meme rally, GameStop could be worth a fraction of my expected share price ($17.98/share). The timing of a future meme rally further complicates trading GameStop because if it takes five years instead of one year for another meme rally to occur, the annualized return from holding GameStop will be much lower. GameStop is not a buy-and-hold stock because it’s trading well above its intrinsic value, so I wouldn’t hold it for more than five years. However, I could be wrong if a meme rally occurs after more than five years.

Conclusion

GameStop doesn’t make sense as a buy-and-hold investment. I estimate the business is worth $10.97/share using extremely optimistic assumptions and $5.43/share using what, I think, are reasonable assumptions. Electronics businesses also tend to go bankrupt—think Fry’s Electronics in 2021, Circuit City in 2008, CompUSA in 2012, RadioShack in 2017, and Ultimate Electronics in 2011.

However, GameStop is an interesting trade if you’re confident that a future meme rally will occur. Although I’m not interested in GameStop at current levels, I believe there’s an opportunity to build a position after the current meme rally subsides. I believe GameStop is an interesting buy under $15/share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.