Summary:

- GameStop posted what can only be called a really solid quarter at a time when sentiments regarding the business were incredibly negative.

- Cost-cutting initiatives are working and the firm is benefiting from strong industry demand on the hardware side.

- Its collectibles business continues to expand and management hopes to make further improvements this year.

- The prospects of the company in the long run are still bleak, but the firm has definitely leveled up from here.

Justin Sullivan/Getty Images News

March 21st was a fantastic day for shareholders of video game retailer GameStop (NYSE:GME). After announcing financial results that exceeded expectations on both the top and bottom lines for the final quarter of the company’s 2022 fiscal year, shares of the business roared higher, trading up around 45% in after-hours markets. This surge certainly serves as something of a reprieve for those who are long GME stock. In addition, the move demonstrates that management is making some progress in improving the operations of the company. In the long run, I still maintain that the prospects for the company look bleak. But the picture is now good enough for me to change my rating on the company from a ‘strong sell’ to a ‘sell’.

A welcome surprise

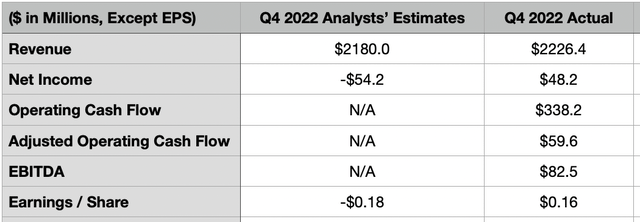

Shares of GameStop shot up around 45% in after-hours trading on March 21st after management announced financial results covering the final quarter of the company’s 2022 fiscal year. To begin with, it would be helpful if we go over the headline news that I believe was largely instrumental in pushing the stock price higher. At the very top, we have revenue. During the quarter, sales for the company came in at $2.23 billion. Although this is still down about 1.2% compared to the $2.25 billion the company reported one year earlier, it exceeded the $2.18 billion in revenue that analysts were anticipating.

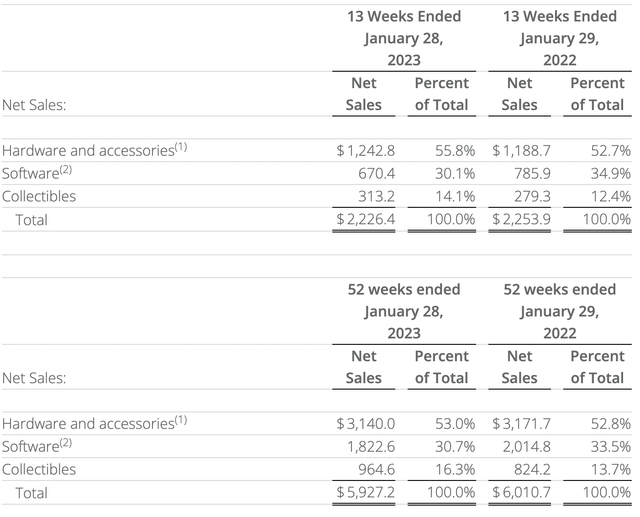

Digging deeper into the numbers, we find some rather fascinating results. On the negative side, software revenue for the company, which I have long believed to be the most important in determining the firm’s potential, actually declined year over year. Revenue of $670.4 million came in 14.7% lower than the $785.9 million reported only one year earlier. The overall trend here is not surprising, but the magnitude of it was. After all, in the three months that made up the final quarter for the year for the business, software sales in the video game industry were down only about 3.5% year-over-year.

On the positive side, we had a couple of developments. The biggest portion of the company includes its hardware and accessories. Revenue of $1.24 billion beat out the $1.19 billion reported one year earlier. That translates to a year-over-year increase of 4.6%. This is hardly a surprise. In December of last year, for instance, when sales were at their highest for the company’s final quarter, hardware sales came in 16% higher than they were only one year earlier. This offset a 1% decline in software and a 2% drop in accessories revenue. At the same time that revenue increased here, it also rose under the collectibles category for the company. Overall sales of $313.2 million came in 12.1% above the $279.3 million reported only one year earlier. This is an area of the business where management has expressed an interest in continuing to grow, not only in the near term but also in the long run. But because it still accounts for only a small portion of the firm’s overall sales, it is not exactly that significant at this time.

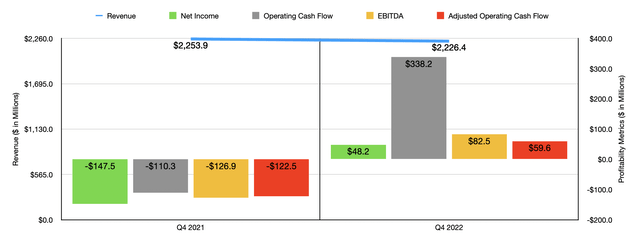

Although there’s no denying that the revenue figures reported by management were a welcomed surprise by investors, the bigger surprise had to have been the bottom line. Earnings per share came in at $0.16. That’s far better than the $0.49 per share loss that the company reported one year earlier and it handily exceeded the $0.18 per share loss that analysts were expecting. Put another way, the company went from generating a net loss of $147.5 million in the final quarter of 2021 to generating a profit of $48.2 million during 2022. If analysts had been correct, the net loss for the business would have been around $54.2 million in the latest quarter.

It is true that the rise in revenue helped the company. But that alone was not enough to push the company into a net profit position. During this time, the company saw its gross profit margin climb from 16.8% to 22.4%. We do know also that selling, general, and administrative costs for the company improved drastically, going from 23.9% of sales to 20.4%. In its conference call with investors, management said that the firm pushed hard to pivot in the direction of cost-cutting last year. This pivot included headcount reductions as the company streamlined operations and focused on achieving efficiency across its ecosystem. And to make matters even better, management said that they are ‘aggressively’ focused on improving efficiency and cutting costs throughout this year as well. This includes cost-cutting initiatives in Europe. Other objectives outlined by management include pushing to get full console allocations in order to meet customer demand, leveraging their refurbishment capabilities even further, and continuing to build up the collectibles and toys category that the company has seen some nice success in.

One big move made by management has been a reduction in inventories. As of the end of the latest quarter, the company held inventories of $682.9 million. That’s down from the $915 million reported only one year earlier. Bloated inventories have become common in the retail space over the past year or so. So it’s nice to see management make some progress on this. Inventory is expensive to have and, if the company can do just as much with less, the end result first shareholders would be a leaner enterprise that can generate stronger returns.

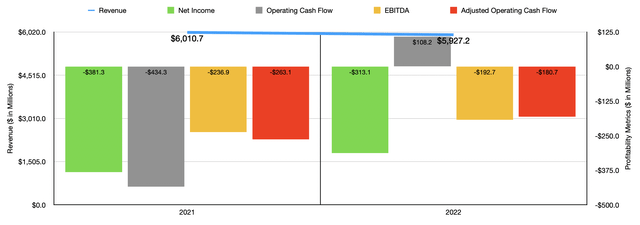

Other profitability metrics for the company followed a similar trajectory. Operating cash flow, for instance, went from negative $110.3 million to $338.2 million. If we adjust for changes in working capital, it would have gone from negative $122.5 million to positive $59.6 million. And over that same window of time, EBITDA for the business went from negative $126.9 million to positive $82.5 million. As you can see in the chart above, the results experienced during the final quarter of the year were, for the most part, a continuation of what the firm reported for 2022 as a whole relative to 2021. Sales dropped, but bottom line performance also improved markedly year over year. It’s also very important to note that the company has cash in excess of debt that totals $1.35 billion. This provides it a great deal of flexibility in the current environment.

Takeaway

From what I can see, GameStop most definitely has done well to improve its operations. In the near term, the company is benefiting nicely from strong demand in hardware, as well as from its growing collectibles business. I do believe that the hardware side of things is transitory in nature because of the frequency with which new consoles come onto the market. Add on top of this my view that the company is just not well-positioned for long-term success because of the very nature of its business model, and I am still very much bearish on the firm. At the same time, I also recognize that recent developments have been positive and that if the company can continue these developments, there is a chance that the ship could turn around. Because of this, I have decided to increase my rating on the company slightly from a ‘strong sell’ to a ‘sell’.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!