Summary:

- GameStop’s financials show a company struggling to stay relevant and profitable, with no clear trajectory for improvement.

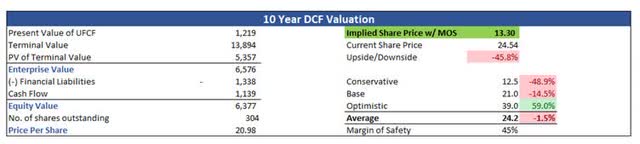

- I believe the company’s valuation is overpriced even with optimistic assumptions, implying a 45% downside from current valuations.

- GME’s share price appears to be driven by traders and enthusiasts, not fundamentals, making it a risky investment in my view.

Anski

Investment Thesis

With the management trying to become more efficient over the last couple of years, I wanted to take a quick look at GameStop’s (NYSE:GME) financials and see if it is working out as the management planned. The company is still losing money left and right and with no solid trajectory for improvements, I don’t see how this company could be an investment, apart from being a gamble and the loyal “hodlers” who are still very active to this day. I even decided to make the company profitable in the future in my model and GME is still overpriced even then.

The Nostalgia Appeal

To be honest I get the appeal of GME. Most of the people loved the store experience back in the day. I’m one of them. Got myself a GTA San Andreas back in ’07, even though it was rated mature they still sold it to mini-me, and I loved that. They probably just wanted to get rid of a 3-year-old game by then. I’d go to the store after school to just look at the games there and not buy them since I was broke. Sometimes I could buy the ones that cost a few euros and would play them non-stop for months.

Fast forward to the present day, and I honestly can’t remember the last time I’ve been in a GameStop. I switched very quickly to digital games, as far back as Xbox 360. I still bought some games for the console from GME but once I switched to a PS4, I haven’t stepped foot in the store. And now with the PS5’s decent storage, fast internet, and a cheaper disc-less version, there’s literally no need to go to the store unless I want to get a controller, but even then, I’d probably go to the Amazon store (AMZN).

Whenever I do walk by it, I get the nostalgia running over me sure, but the inside of the store hasn’t changed at all since when I was a young lad, it’s just much emptier now. The cult following is very strong since the beginning of the meme-mania back in Jan-Feb ’21. It died out a little, however, there are still very active Reddit pages dedicated to GME. I remember one day a friend of mine asked where to invest, and he said he’s got around 100 euros to invest, then I thought if that’s all you got try GameStop, it’s been on my radar for quite a while and a few months later the meme-mania happened and it shot up to over $400 a share, so I called my friend and asked if he made a lot of money, he 5x his money, however, he didn’t invest the whole 100 euros and he cashed out at around $20 a share, bummer.

Outlook

The company has been trying a bunch of different things to stay relevant, but nothing has really worked. The selling of Funko Pops and other collectibles, was the only revenue segment to see a decent growth y-o-y, while hardware sales were down 1% and software sales were down 9%. It’s even trying to jump into the e-sports scene, which has been bleeding money also.

The company is going to try and pivot back to brick-and-mortar stores. It will have to do a lot of work on that front and close down many more stores to become profitable and more efficient because right now, there are way too many stores that are losing money. The plan is to use these stores as “mini fulfillment centers” for e-commerce ventures that the current Chairman of the company Ryan Cohen was aggressively trying to pivot to.

The goal is to streamline operations and become profitable. Will this work? We will have to wait for quite a while before we see any results, but if the past is an indication, scrambling to make the company profitable did not work, so I’m not sure how well this will work either.

Financials

It’s always important to look at the company’s insides to see how it performed in the past, which may indicate where it’s going in the future. Spoiler alert, it’s not looking too good for GME on this front.

Sure, the cash and debt position has improved over the last couple of years. That, at most, will give the company a few years of survivability if it’s going to keep losing money every year as it has. Cash and very little leverage are great for companies. It gives them the flexibility to pursue new ventures as GME has in the past, with little success so far, however, something might eventually stick, so I’d say go for it!

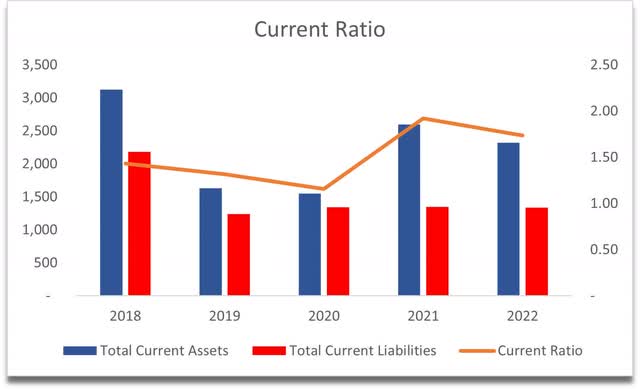

The company’s current ratio is decent enough, which suggests it has no issues paying off its short-term obligations. So, it may stay afloat a little longer.

Current Ratio (Own Calculations)

The big deal for the company is profitability and efficiency. In the latest earnings call, which by the way, was the shortest I’ve heard so far, Matt Furlong said the company is going to be very aggressive in cutting costs in ’23, especially in Europe. He was very determined to cut costs aggressively on the call. That’s a good sign sure, but since we don’t have any concrete evidence of it happening yet, we will have to wait until next year to see how many have been cut and how much of an improvement the company saw in terms of efficiency.

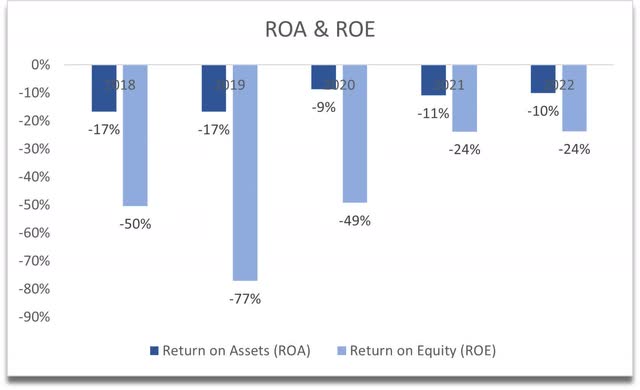

At the end of FY22, the company’s ROA and ROE have been abysmal, to say the least. Maybe one positive thing I could say about these metrics is that they’re not as bad as they were in ’19. If I was a “hodler” I would be looking at this as a very positive sign for the stock, just saying. To a neutral individual, this just tells me that the company isn’t utilizing its assets and shareholders’ capital efficiently.

ROA and ROE (Own Calculations)

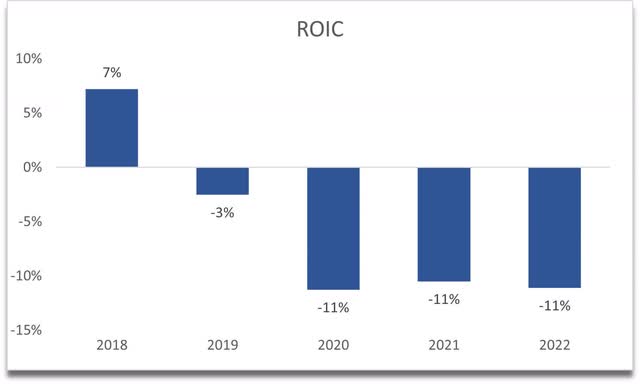

In terms of return on capital invested, it’s been quite awful too. The competitive advantage that the company may have had in the past is gone and digitization has been winning. The moat has deteriorated in my view.

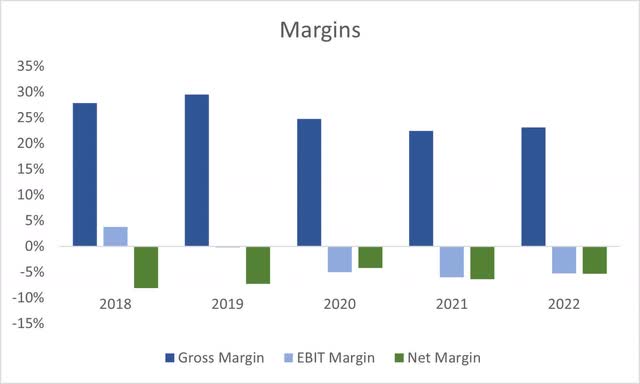

In terms of margins, it’s not looking good either. These have been going down consistently yearly, meaning that the initiatives that the company had in the past did not work at all, and it’s no wonder they’ve all been scrapped. If the aggressive cost-cutting measures work in the future, it is possible to turn the ship around, however, it’s going to take a long time before we see some results.

Overall, I see a company that’s been on the brink of extinction and if nothing works out in the near future, I think it could be going the way of the Dodo and Blockbuster. I’ve covered a couple of big players of the past that managed to pivot their business completely like Nokia (NOK), so I would like to see GME finding the right mix of products that can make it become a viable company yet again.

Valuation

To be honest, the only way of looking at a company’s valuation here would be through an optimistic lens. I’m going to assume the company manages to turn around and improve margins significantly while keeping revenue growth at around 5% CAGR for the next decade, I just don’t see it growing any more than that, especially since it’s been losing revenue every year apart from a slight bounce in ’21.

For the base case, 5% CAGR until ‘32 is still optimistic. To go even further, the optimistic case CAGR is 9%, and the conservative case is 3%.

In terms of margins, I’m going to assume the aggressive cost measures worked and gross margins improved by a whopping 15% over the next decade. I also slightly improved operating margins by around 400bps, or 4% in the next decade.

I’m also going to give a much larger margin of safety than I usually do. 45% will be sufficient I’d say.

With these very optimistic assumptions, the company’s intrinsic value is $13.30 a share, implying a 45% downside from current valuations.

Optimistic Intrinsic Value (Own Calculations)

A realistic case is not even worth doing in my opinion, as it would mean the company should technically be out of business. I usually like to keep it conservative, but conservative wouldn’t work in this case.

Closing Comments

If the fundamentals of the company don’t improve over the next couple of years, I honestly don’t know how it’s going to survive for very long. Earnings are scheduled to be on June 7th, and I’m assuming it’ll be a quick one yet again. I would like to hear more about the company’s aggressive cost-cutting measures and improvements in margins to see if it is heading in the right direction.

At this point, the company is a sell for sure, but I’m sure whoever has shares in the company won’t be selling them any time soon. It’s pretty cheap to hold on to it, in the hopes of another random rally that we may see after earnings, which if it occurs, I believe will dwindle again as it usually does.

It’s my belief that fundamentals do not drive the share price in this case. It’s the traders and enthusiasts. Even the slightest good news can propel the share price. Options premiums aren’t as juicy as they have been but now and again it is possible to sell a couple of call or put options for a decent premium and wait for that IV crush, but that’s a very risky strategy when it comes to meme stocks.

I’ll check on the company’s status now and again but will not be following it very intently. If the company is going to turn the ship around, it will not be overnight.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.