Summary:

- GameStop’s shift to trading cards and partnerships with PSA could offset declining video game sales, positioning it as a national card shop chain.

- GME’s strong balance sheet, with over $4 billion in cash and minimal debt, provides a significant runway for reinvention and new business ventures.

- The trading card market’s growth and synergies with video games offer GME opportunities to host leagues and tournaments and create content, enhancing customer engagement.

- Upgrading my view on GME to neutral due to improved financials and strategic moves in the trading card market, offering potential for future profitability.

jetcityimage

I can’t believe I am going to say this, but GameStop (NYSE:GME) may have figured out a way to reinvest itself. GME’s business model has suffered as video games have gone from physical cartridges and disks to digital. Without the need for a physical version of a video game, GME’s ecosystem suffers because the secondary market is a shadow of what it once was, and it’s more efficient for the end-user to download the game than go to the store. GME’s revenue has been on a gradual decline, falling by 51.03% since the fiscal year 2015. I have been negative about GME in the past because of its broken business model, but after the announcement today, I am upgrading my view to neutral as GME is positioning itself to become the first national card shop chain. Sports cards and trading game cards (TCG) such as Pokémon and Magic: The Gathering (MTG) are big business, and GME can become a focal point in a fragmented industry. GME amassed a $4.2 billion war chest in the June quarter with $533.5 million in total debt, most of which was from capital leases. I am very interested to see what GME does over the next several months, as they could be able to reposition themselves for a future outside of the video game industry.

Following up on my previous article about GME

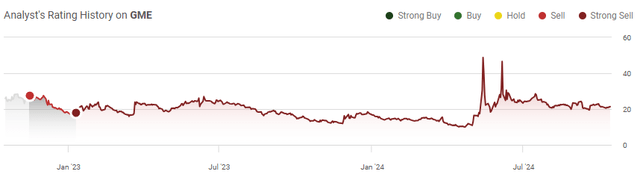

I have been bearish on GME as its main business is in decline. Total revenue has declined more than -50% since 2015 and the move to digital continues to put pressure on GME’s ecosystem. As fewer physical games are utilized, the secondary market shrinks, and there is less of a reason to visit a GME location. I wrote my last article about GME in January 2023 (can be read here), and I am following up with a new article as GME has put itself in a much better position today than it previously was. I am not a shareholder, but depending on how the transformation unfolds, I wouldn’t be opposed to investing in the future. I am upgrading my view from bearish to neutral and will pay close attention to GME in the coming months.

Risks to investing in GME

GME has fortified its balance sheet as it has $4.2 billion in cash and short-term investments on the books. GME has also turned a profit in the past 2 quarters and is no longer burning cash to keep the lights on. The main risk to GME is its ability to reinvent itself. The video game market has shifted from physical to digital, and GME’s sales have been off more than 50% since 2015. Between GME’s capital position and its ability to not burn a significant amount of cash, they have a lot of time to work on reinventing themselves. Even though GME posted a profit for the past 2 quarters, it did so because of how much interest is being generated on its cash. GME produced negative operating income in Q1 and Q2, but their interest and investment income helped turn an operating loss into a bottom-line profit. The biggest risks to GME in the short term are that the Fed takes rates lower, their interest income is negatively impacted, and their video game business continues to deteriorate before they can offset the revenue loss with new lines of business.

GME has a clean balance sheet which is its largest asset

GME disclosed on September 10th that it would sell up to 20,000,000 shares in an ATM program. The expected proceeds of around $400 million would be used for general corporate purposes and could include acquisitions and investments. The latest equity raise came after selling 45 million shares and 75 million shares during the GME mania that occurred. GME ended up bringing in around $3 billion between the 2 equity raises earlier in the year. This was the smart move because GME had an outlet to sell additional shares to its shareholder base. GME was able to go from having $1.2 billion in cash at the beginning of the year to $4.2 billion to close out Q2.

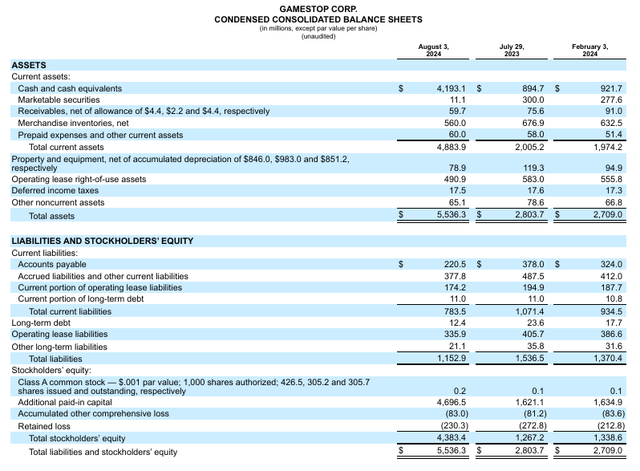

GME’s balance sheet is its largest asset at this point because it’s a cash-rich company. GME has limited liabilities on the balance sheet, with $783.5 million in current liabilities and $1.15 billion in long-term liabilities. GME only has $12.4 million in long-term debt, as operating leases are their largest form of debt, which sits at $335.9 million. GME is in an interesting position because there is still $4.38 billion in total equity on the books, and if GME were to eliminate its long-term debt and capital leases, it would still have $3.86 billion in cash on the books. Even at a 3% interest rate, well below the risk-free rate of return, GME could produce $115.68 million in interest income annually from its cash position.

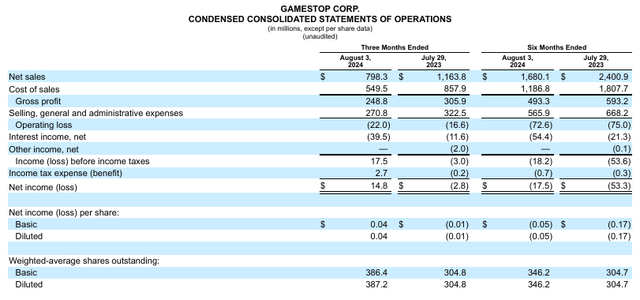

Senior leadership has done an incredible job utilizing the public markets to raise capital while the underlying business was eroding. GME’s sales in Q2 declined -31.4% from $1.16 billion to $798.3 million YoY. The only reason GME made a profit in Q2 was that it generated $39.5 million in interest and investment income. GME’s revenue reached multi-year lows across the board as hardware sales declined -24.56% from $579 million to $451 million. GME’s software sales followed hardware lower as they declined -47.61% YoY from $397 million to $208 million, and collectibles fell -18.24% from 170 million to 139 million. Without the strength of GME’s balance sheet, the overall business would continue to burn cash rather than make a profit in the past 2 quarters. The balance sheet is ultimately its greatest asset as it is able to help generate enough income from invested capital to pad the operating losses and provides GME with the flexibility to reinvest itself.

GameStop is making moves in the trading card space, and it could become the largest national card shop in the future

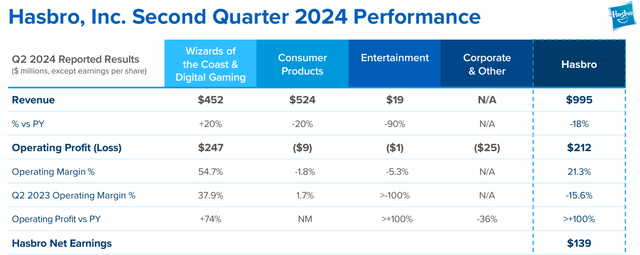

In addition to investing in equities, I also invest in alternative assets such as sports cards, sports memorabilia, and TCG cards. I follow these markets closely, and the markets have expanded tremendously over the past 4-5 years. In 2022, Fanatics, led by Michael Rubin, acquired Topps Trading cards for $500 million. MLB renewed its deal with Topps in 2018 before the deal with Fanatics, and it expires in 2025. Fanatics also acquired the trading card licenses for the NFT and NBA by guaranteeing that the partnership would generate in excess of $1 billion for those leagues over the term of the partnership. On the TCG side, the 2 of the largest franchises are MTG and Pokémon. MTG is owned by Hasbro (HAS), and in Q2 2024, that business segment made $452 million in revenue while producing $247 million in operating profit.

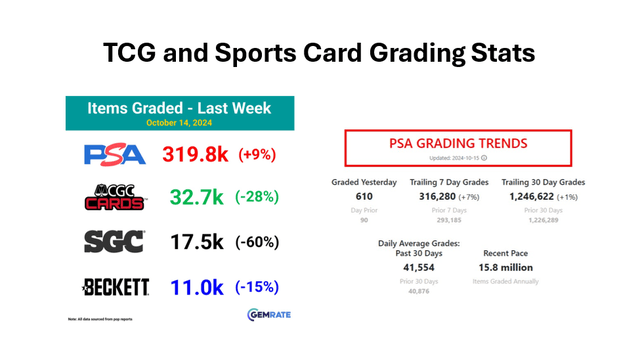

Recently, Nat Turner, the CEO of Collectors, showed off his $30 million card collection. Collectors owns PSA and recently acquired SGC, which is the 3rd largest grading company. Outside of actually collecting or investing in sports and TCG cards, there is a whole grading industry. GemRate aggregates all of the data through population reports from the grading companies to provide grading trends to the community. To put things in perspective, PSA graded 319,800 items last week and is on track to grade 15.8 million items on an annual basis. The daily average of graded items from PSA is 41,554 over the past 30 days. The base rate for PSA to grade a card worth under $500 is $24.99 if you’re not part of their collectors club. There are significant upcharges depending on the value of the item being graded if the value exceeds $500. Just on that math alone, if every card costs $24.99 to grade, PSA would be on track to generate $394.84 million in grading fees alone. The number is probably significantly higher due to upcharges, but this is just 1 segment of the actual business.

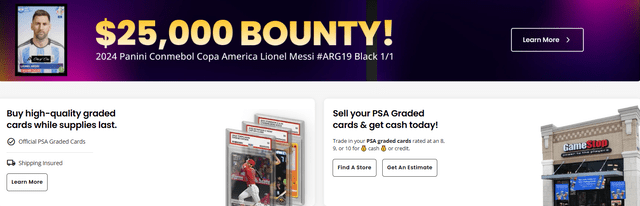

GME announced today that it has become an authorized PSA dealer. GME will now be in the card grading business by providing authentication and grading services for trading cards. This comes after GME started purchasing Pokémon cards that have been graded by PSA and received a grade of 8 or higher. GME has expanded its services, and through their website, you can purchase and sell sports and TCG-graded cards. GME is even getting in on public bounties for rare cards and is offering $25,000 for a 2024 Panini Lionel Messi 1/1 while advertising their trading card business by adding banners outside of locations. The idea through the partnership with PSA is that individuals can drop off their cards to be graded, and GME will take care of the submission from paperwork to shipping. Customers will have visibility into the process where they are authenticated, graded, and encapsulated, and then they will receive a notification when they are ready to be picked up. By getting the customer back into the store, GME can either keep their graded cards, sell them to GME, or trade them for other graded cards.

GME has the cash pile to make a pivot, and the trading card market is expanding with many different vertices from which to generate capital. If GME does this correctly, there is a chance that they can turn this into a profitable endeavor. Geoff Wilson recently spent between $2-3 million opening Cards HQ in Atlanta, and Burbank Sports Cards recently pulled its entire library off of eBay and will put their entire warehouse on Fanatics new site while building out a larger location. Card shows are getting bigger as The National is going back to Chicago for the 45th National Sports Card Convention July 30th – August 3rd, and smaller regional shows are supporting 400 and 500 tables, such as the events at the Westchester County Center and Hofstra show in NY. On the TCG side, there are regional, national, and global tournaments for trading card games.

GME has a leg up on traditional sports card shops because it is a recognized brand, a corporate entity, has a national footprint, and its locations are traditionally in malls or shopping centers anchored by supermarkets. GME is more accessible and more inviting to a wide range of customers than a local card shop off the beaten path. GME has currently made a profit and has more than $4 billion on the books. Ryan Cohen has the ability to build a fully integrated national card shop footprint backed by the GME brand. I don’t think that GME is stopping at making PSA submissions, as they have already built out the online infrastructure for a card shop. I think that they will convert around 50% of their footprint into card shops, and as the physical video game market declines, they could convert a larger portion of their footprint.

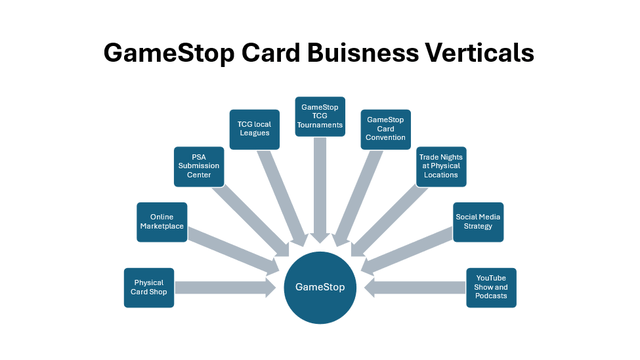

It goes back to trust, and GME already has a loyal customer base and following. There are synergies between the TCG sector and video games, as Pokémon and MTG have video game footprints. GME could host local TCG leagues, which charge a fee for the duration of the league or by the night. They can offer gift certificates as prizes, so capital is spent at their locations. GME can host regional and national tournaments, which can be individual events or extensions of a national league at their locations. GME can host trade nights at their stores and create a whole social media strategy around organic content. GME would also have the ability to create high-level production content for YouTube to monetize and create podcasts about the card business. Geoff Wilson, who runs the Sports Card Investor YouTube Channel, has 345,000 subscribers and over 100 million views on YouTube.

Conclusion

I am upgrading my view on GME to neutral as the financials have changed a great deal since the last time I wrote about them. With more than $4 billion in cash, virtually no debt, and making a small profit, GME has a lot of runway to figure out its next move. I believe that over the next year, GME will further diversify into the trading card market, and today, it has taken a big step in becoming an official partner of PSA. I think that GME can turn its retail footprint into a national trading card chain to offset the decline in physical video games. It will be interesting to see if a partnership with Fanatics happens in the future, as Michael Rubin has indicated time and time again that his goal is to 10x the hobby. I would be very interested in GME if they create a 360-degree strategy around the verticals I discussed and capitalize on their locations being in popular areas. GME has the brand awareness to succeed in conducting TCG leagues and tournaments. That same brand awareness and built-in customer base could also help scale multiple YouTube channels for sports cards and TCG content. Ryan Cohen may pull off what many investors thought was impossible at GameStop.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.