Summary:

- I value stocks the traditional and common-sense way – based on their earnings prospects.

- GameStop’s two decade earnings and revenue history show a steady decline of more than 10 years, due not to declining video games sales but of Gamestop’s market share.

- The company’s store-based retailing model continues to get badly beaten by all-digital competitors.

- Earnings and sales valuations put the stock’s fair value at $3-4.

Klaus Vedfelt

First, two confessions. First, I am old-fashioned. I have an excuse – I collect Social Security. I haven’t played a computer game since Pong. I am on no social media. I’ve watched TikTok for less than two hours. I even have a landline!

Second, I still value stocks the traditional way. I start with the fact that owning a share of stock is owning the share of a business. And owning a business is primarily about making money.

So if you want to sell me your restaurant for $400,000, my first question isn’t “What’s the short interest?” Or “My guru, Mr. Kitty, suggested I buy.” Or “Let me check with my friends, who haven’t been in the restaurant business either.” Rather, I will ask you “How much money does the restaurant make now, and what are its earnings prospects for the future?” And based on that answer, I will judge your offer for the restaurant.

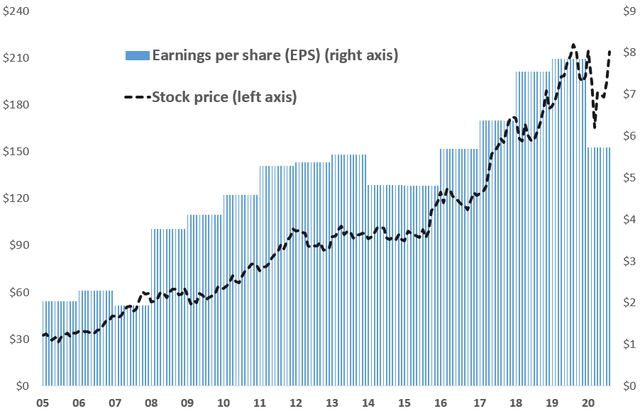

Of course, stocks over the short term will trade very differently from their earnings prospects, because humans are largely emotional, not rational, creatures. But over the long run, earnings prospects are the primary driver. For example, this chart compares McDonald’s’ stock price and EPS over nearly two decades:

company financial reports, Yahoo Finance

Sources: company financial reports and Yahoo Finance

Clearly a good correlation. So it seems reasonable to look at an investment in the business known as GameStop (NYSE:GME) in a similar manner.

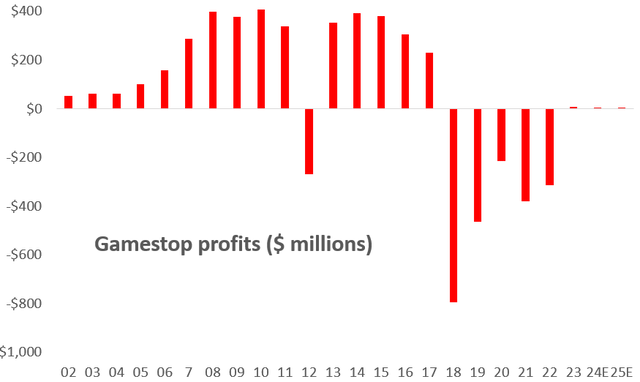

GameStop’s earnings history

Here are GameStop’s dollar earnings, back to 2002:

Sources: Company Financial Reports

GameStop’s earnings had an excellent run from 2002 to 2008. They then levelled out through 2015 except for an ugly 2012 (who’s perfect?). Then GameStop’s earnings plummeted to five years of substantial losses before the company got back to breakeven, where analysts expect it to stay this year and next year (Seeking Alpha for the forecasts). GameStop’s just-announced FQ1 loss of $32 million doesn’t give much cause for optimism about a return to consistent profitability.

If companies are valued on their earnings prospects, this chart doesn’t provide a lot of comfort.

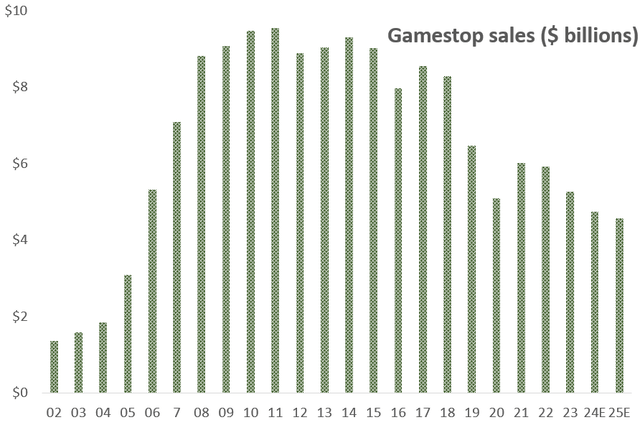

GameStop’s revenue history

Well, maybe GameStop is another Amazon, giving up near-term profits in order to take market share and use its future dominance of video game sales to make lots of money off of its customers. So let’s check out its revenue growth over the last two decades:

Sources: Company Financial Reports

Yikes. GameStop’s sales peaked in 2011, and have declined ever since. Analysts see no change in the downward trend through next year (Seeking Alpha). In fact, the FQ1 sales decline of 29% suggests an acceleration of this negative trend.

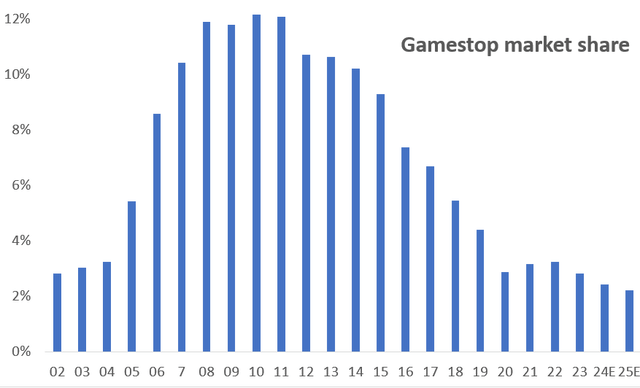

GameStop’s market share trend looks even a lot worse than that. People like computer games. According to the website Visual Capitalist, global gaming software sales rose by 7% a year on average from 2002 through 2022. Actually, not a great growth rate compared to many other tech products, but not bad. But GameStop’s market share of those sales peaked in 2011 and collapsed since then from 12% to under 3% today.

Company financial reports, Visual Capitalist

Sources: Company Financial Reports and Visual Capitalist

The problem is pretty obvious. In the movie Dumb Money, Roaring Kitty said (and I paraphrase) “The digital risk is overblown”. Wrong, Mr. Kitty. Dead wrong. You gamers reading this article – what percent of your game purchases are online? From this market share chart, I’ll guess a large and growing majority.

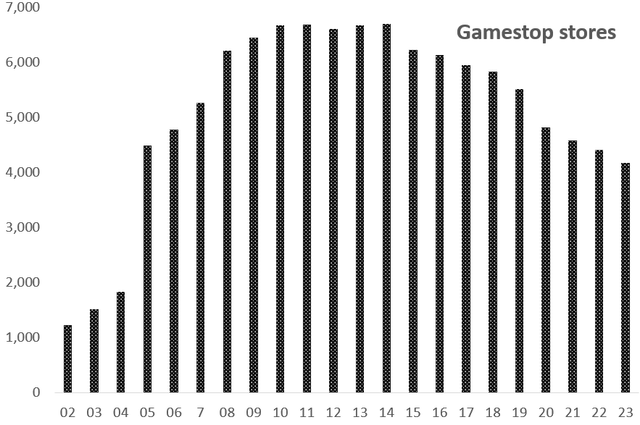

GameStop’s store count

GameStop’s management has behaved as if it recognizes the digital risk to its bricks and mortar distribution model. Here is a history of GameStop’s store count:

Sources: Company Financial Reports

GameStop’s valuation

Assuming that you agree with me that you like businesses that you own to earn money, GameStop has to be viewed as a disappointment. Earnings are expected to be about zero after cost cuts. But the steady loss of market share says that management has to keep cutting costs, just to keep at zero. GameStop has about $4 a share in cash. I’d give them $4 for that. But I can’t add any value for future earnings. Can you? So that leaves me with a $4 valuation.

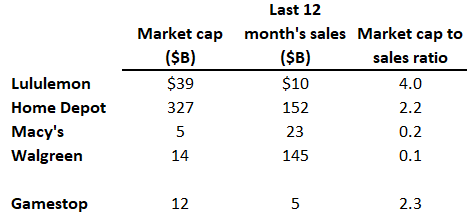

I’ll try one more valuation measure – market cap to sales. Tech investors often use this measure to value companies that don’t earn any money today, but are expected to make lots of it somewhere down the line. This table compares market cap to sales ratios for a number of retailers:

Sources: Seeking Alpha

Seeking Alpha

Source: Seeking Alpha

A star retailer, Lululemon, sells at 4.0 times sales. Home Depot, a very well-run company with only modest digital competition at present, sells at 2.2 times sales. Macy’s and Walgreens have far more challenges from digital competition, and therefore trade at 0.2 market cap to sales. You would expect GameStop, which is clearly hurting far more than Macy’s and Walgreens, to be valued at the low end of the range. But no; its future earnings relative to sales is viewed as attractive as Home Depot! BTW, a 0.2 market cap to sales valuation puts GameStop’s stock price at $3 a share.

Obviously, little to none of the above facts I just presented are being considered in the stock’s valuation today. But one day it should.

How could my valuation thesis be wrong?

Based on a traditional valuation, GameStop would have to figure out a way to consistent profitability to be worth more than $3-4 a share. I don’t see how, but we can all be surprised.

As for the actual stock price, of course, we have seen the stock ten times higher with the same weak fundamentals present. So in the short term, clearly almost anything is possible.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of GME either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.