Summary:

- GameStop’s future prospects are bleak due to increased competition in retail and a shift towards downloadable content in the video game industry.

- The company’s financial results show declining revenue across hardware, accessories, software, and collectibles.

- GameStop’s store closures and improved profitability metrics provide some stability, but the stock remains overpriced and a poor investment choice.

Scott Olson

For years now, I have been very bearish on a company that I personally have many fond memories of and wish all of the success to. I remember the days when I used to line up outside of my local GameStop (NYSE:GME) location, waiting for the release of the latest in the Call of Duty franchise. But those days are long gone. I am older and the industry has changed. In this new era, with increased competition in retail, and more and more of the video game space focused on downloadable content, GameStop is a shell of what it once was. The good news is that the company has a tremendous amount of cash on hand. We are also seeing some signs of stability from a profit and cash flow perspective. But at the end of the day, the long term picture for the company is probably quite negative.

Around a week ago, the management team at the video game retailer came out with financial results covering the final quarter of the 2024 fiscal year. While the company did show some positive results, the evidence is clear to me that the probability of the business ever truly recovering is very small. But then again, if you have followed my work over the past couple of years, you wouldn’t be surprised by my stance on the matter. Since I last rated the company a ‘sell’ back into September of last year, shares have seen downside of 31.1%. That stacks up poorly against the 13.5% rise seen by the S&P 500 over the same window of time. And since I initially rated the company a ‘strong sell’ in January of 2021, shares have plunged 87% while the S&P 500 has generated upside of 38.8%. You would think that the stabilization we are seeing right now, combined with how far shares have fallen, would lead me to at least become neutral at some point. But at the present moment, I only see further downside ahead.

Some worrisome signs

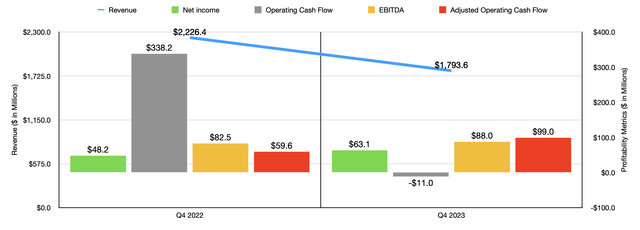

Operationally speaking, there are some positive and negative attributes that we can see when looking at GameStop. For the final quarter of the company’s 2023 fiscal year, for instance, management reported revenue of $1.79 billion. While that’s a nice chunk of change, it represents a decline of 19.4% compared to the $2.23 billion generated the same time of the 2022 fiscal year. Unfortunately, this weakness occurred across the board. Hardware and accessories revenue, for instance, plunged from $1.24 billion to $1.09 billion. Software sales fell even further, dropping an astounding 30.6% from $670.4 million to $465.3 million. And collectibles revenue dropped from $313.2 million to $233.7 million.

I have long said that while the company might generate some nice side revenue from its collectibles activities, that its hardware and accessories business is doomed to eventual failure and that any chance it has of succeeding in the long run must involve robust software revenue growth. We are seeing weakness across the board here. But there are some things that make this picture worse than it appears. For starters, things would have been worse had it not been for the fact that the final quarter of 2023 had 14 weeks in it as opposed to the typical 13 weeks that was seen the same time one year earlier. So this sales decline occurred even in spite of an extra operating week.

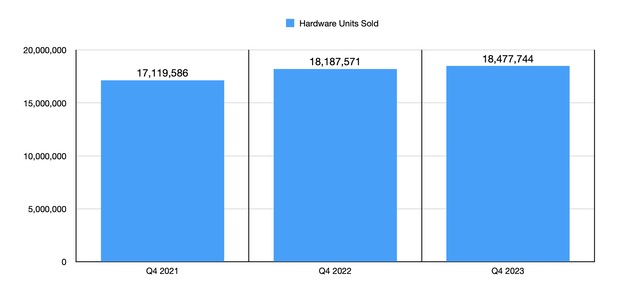

Perhaps more troubling than that is the fact that we aren’t seeing any cyclical downturn when it comes to hardware and accessories activities in the industry more broadly. In the chart below, for instance, you can see industry wide hardware sales, as measured in units, sold for the same three months that comprise GameStop’s final quarter. You can see how that stacks up against results for the 2021 and 2022 fiscal years. With 18.48 million gaming consoles sold, the industry seems to be doing quite well. That’s a 1.6% increase over the 18.19 million units sold the same time one year earlier. And it’s also up 7.9% compared to the 17.12 million units generated in the final quarter of the 2021 fiscal year. So despite seeing continued industry growth, as measured by units sold, GameStop is seeing revenue fall rather materially. Other data does not bode well for the company either. In the us alone, for the month of January, software revenue was $4.4 billion. That’s 15% higher than what was seen one year earlier. And accessory revenue was up 45% year over year in January, hitting $246 million. To see weakness on all fronts like this is downright discouraging.

Some of the company’s pain can be chalked up to the fact that it is closing down some of its stores. Domestically, it ended the 2023 fiscal year with 2,915 locations in operation. This represents a decline of 34 locations compared to the 2,949 that it had in operation one year earlier. The big decline, however, came from its international operations. The company closed 210 international stores, dropping its store count from 1,464 to 1,254. This will inevitably lead to a reduction in revenue. But ideally, it will also improve the bottom line since the company is sure to target unprofitable stores.

There is some good news. And this relates to the bottom line for the company. Net profits during the final quarter of the year totaled $63.1 million. That’s up from the $48.2 million generated one year earlier. Other profitability metrics have shown a similar trend. The one exception was operating cash flow, which declined from $338.2 million to negative $11 million. But once we adjust for changes in working capital, we get an improvement from $59.6 million to $99 million. And lastly, EBITDA for the company managed to grow from $82.5 million to $88 million.

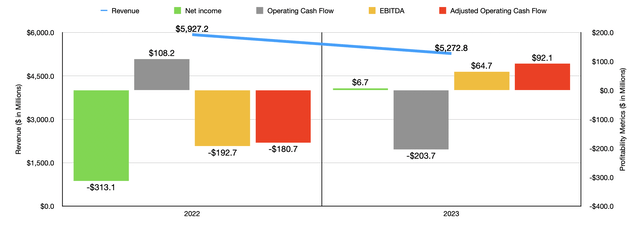

This kind of trend can be seen when looking at both the 2022 and 2023 fiscal years combined. As you can see in the chart above, revenue fell rather materially during the year while most of the profitability metrics for the company improved. But this doesn’t mean that the company is on solid footing just yet. The good news is that we are seeing some degree of stability, though I would argue that is likely temporary. Not only is it stability taking the form of improved bottom line results, it’s also taking the form of stabilized cash balances.

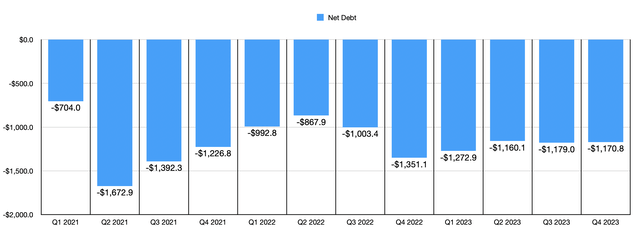

In the chart above, for instance, you can see each of the last 12 quarters. The metric in question is net debt. For the last three quarters now, net debt has been negative to the tune of between $1.16 billion and $1.18 billion. That’s a massive improvement compared to where things were during the last three quarters of the 2021 fiscal year, as well as the first two quarters of 2022, when the company was hemorrhaging cash.

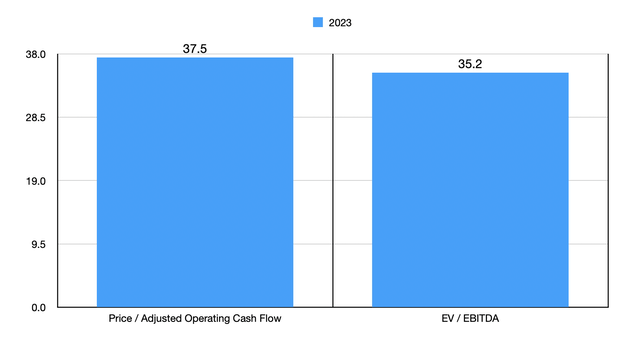

The other good development is that the stabilization of the firm, at least for now, has made it possible to actually value the company. In the chart above, you can see how shares are priced on a price to adjusted operating cash flow basis and on an EV to EBITDA basis. But this only goes to show that, even if this were to represent a new normal, shares would be drastically overpriced. A struggling retailer in an industry with a questionable future probably should not trade at multiples in excess of 7 or so. To get there, operating cash flow would have to be around $493 million and EBITDA we need to get up to around $326 million. That, or the market capitalization of the company we need to plunge by 81.3%, with the enterprise value falling as much as 97.2%. This is not a prediction of where shares are going. But it does illustrate that even in the best scenario, we have a long way to go before the stock might become even a mediocre prospect.

Takeaway

As much as I would love to see GameStop return to its former glory, I don’t believe that’s in the cards. To be perfectly honest, the business should have gone heavy into gaming development when it was in its prime many years ago. There was a long window of time, for instance, between about 2008 and 2014 when video game producer Electronic Arts (EA) had a market capitalization that was only marginally higher than what GameStop was at the time. A merger with it or some other player in the market would have done the company wonders. But there is no use crying over spilled milk. Today, GameStop is struggling to get by. In the near term, the company might stabilize to some extent. But in the long run, I see very little hope of a turnaround. Given these factors, I do believe that keeping the business rated a ‘sell’ is only logical.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is an exclusive community of investors who have a taste for oil and natural gas firms. Our main interest is on cash flow and the value and growth prospects that generate the strongest potential for investors. You get access to a 50+ stock model account, in-depth cash flow analyses of E&P firms, and a Live Chat where members can share their knowledge and experiences with one another. Sign up now and your first two weeks are free!