Summary:

- GameStop Corp. reported a 10.3% decline in Q1 2023 revenue, missing analysts’ expectations and causing shares to plummet over 19% in after-hours trading.

- While hardware and accessories sales increased, software sales plunged, and the company generated a net loss of $50.5 million for the quarter.

- Despite some bottom-line improvements and a management shakeup, the long-term outlook for GME remains bleak, with a high probability of investors permanently losing capital.

Scott Olson/Getty Images News

Unless you have a short position in video game retailer GameStop Corp. (NYSE:GME), there’s a high probability that June 7th was a rather difficult day. After the market closed, the management team at the company announced financial results covering the first quarter of the company’s 2023 fiscal year. The results caused shares to plummet over 19% in after-hours trading. This was after optimism earlier in the day sent shares up 5.8%. By mid-day on June 8th, shares remained depressed, trading down about 17.9%.

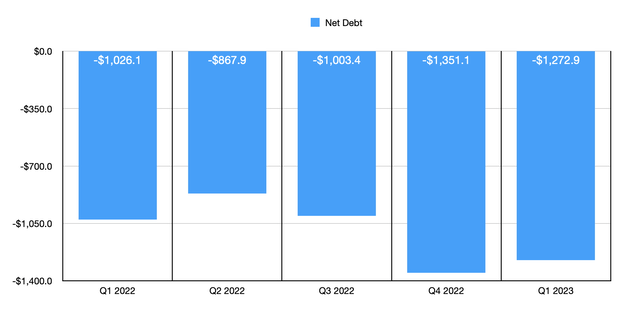

In addition to missing out on both its top and bottom line estimates, the company also revealed a change in management. To be clear, not everything about the firm was bad. Management has succeeded in improving costs. And the company enjoys cash and cash equivalents in excess of debt that totals $1.27 billion. This does provide a great deal of wiggle room.

However, not even this, and the resulting share price plunge, is enough to cause me to turn bullish on GameStop. In the long run, I still believe that further fundamental deterioration is on the table.

GameStop’s Q1 financials fell short

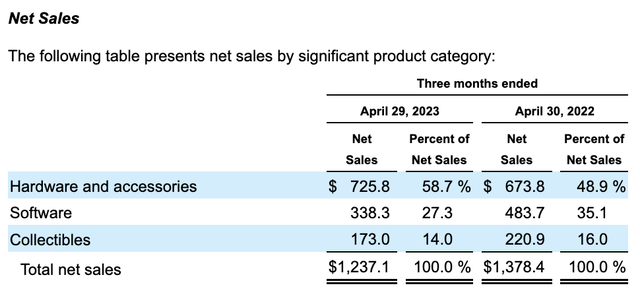

Anybody who believes that GameStop is performing anything other than poorly has not looked at the numbers. The latest numbers came out when management reported financial results for the first quarter of the company’s 2023 fiscal year. Take revenue, for instance. Overall sales for the quarter came in at $1.24 billion. That represents a decline of 10.3% compared to the $1.38 billion the company reported one year earlier. In addition to worsening year-over-year, the sales figures for the company missed analysts’ expectations to the tune of $120 million.

When you dig deeper into the revenue figures provided by management, you do end up with some interesting data points. Not everything for the company was awful. One bright spot happened to be hardware and accessories. Revenue spiked from $673.8 million in the first quarter of 2022 to $725.8 million the same time this year. For those not familiar, hardware and accessories includes both new and pre-owned hardware, accessories, hardware bundles that sometimes consist of software, and other related offerings. Strong demand for new gaming hardware, particularly in Europe, accompanied by improved supply chain conditions, ended up a boon for the company.

Sadly, this is where the good news for the company ends. Software sales, which I have long maintained is what the company needs to perform well at in order to thrive in the long run, ended up plunging from $483.7 million to $338.3 million. One area that some investors had been optimistic about over the past few years has been the collectibles portion of the company. This portion of the firm consists of apparel, toys, trading cards, gadgets, and a variety of other products. It also includes the company’s digital asset wallet and NFT marketplace activities. Revenue here, however, plummeted from $220.9 million in the first quarter of last year to $173 million the same time this year.

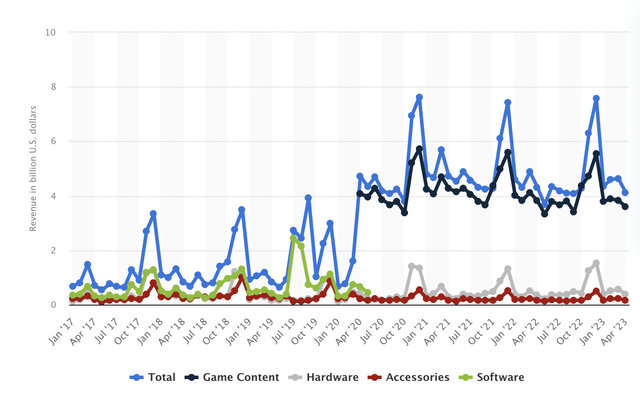

When it comes to weakness on the software side, GameStop is not alone. The entire industry seems to be experiencing some pain. Overall video game revenue in the U.S., for instance, managed to total $4.12 billion in the month of April. This was down from the $4.32 billion reported the same month one year earlier. For the three months that constitute the first quarter for the company, sales of $13.35 billion represented a 1.3% drop over the $13.52 billion reported the same time last year. No matter how you stack it, we do seem to be in a soft environment for video games.

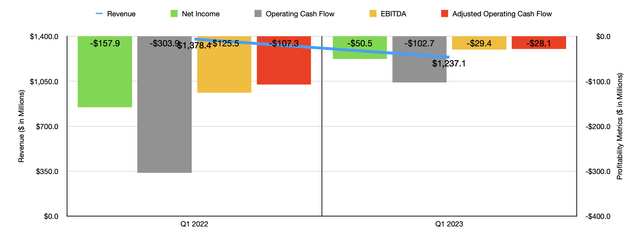

On the bottom line, we do need to pay some special attention. And this is because the results were a mixture of both good and bad. On the bad side, for instance, the company generated a net loss for the quarter of $50.5 million. On the other hand, this does represent a meaningful improvement over the $157.9 million loss generated the same time last year. On a per-share basis, the company generated a loss of $0.17. While this is better than the $0.52 per share loss reported at the same time last year, it did miss analysts’ expectations by $0.05 per share.

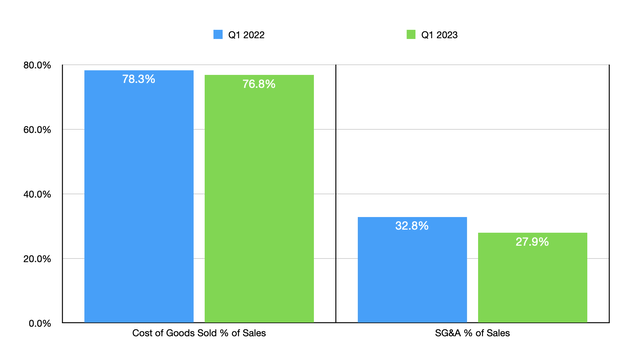

Other profitability metrics for the company also improved year-over-year. Operating cash flow, for instance, went from negative $303.9 million to negative $102.7 million. If we adjust for changes in working capital, it would have gone from negative $107.3 million to negative $28.1 million. And finally, EBITDA for the company went from negative $125.5 million to negative $29.4 million. Despite the drop in the sales, the company did benefit from changing conditions. Its gross profit margin, for instance, expanded from 21.7% to 23.2%. This is largely thanks to a decrease in freight expenses that the company achieved by focusing on cost reduction activities. Selling, general, and administrative costs went from 32.8% of sales down to 27.9%. This can be chalked up to lower labor related and consulting service costs, as the company continued to focus on a leaner operating structure.

While it is great to see improvements, the fact of the matter is that the company is still hemorrhaging cash. We also need to think that new hardware sales are not always going to be a driver for the business. These should be, in theory, rather cyclical, with high sales when new products come out and lower sales occurring at all other times. So if you look at the other aspects of the company as an indicator of its overall health, the picture is even worse than the official numbers indicate.

It is true that the company has a significant amount of excess cash. But the $1.27 billion in net cash that the company had as of the end of the most recent quarter does mark a decline from the $1.35 billion that the company reported only three months earlier. Until management can find some way to reach cash flow neutrality, we should continue to see this cash balance worsen over time.

Some of my readers may take issue with my statement that the company is hemorrhaging cash. Certainly, the year-over-year decline in net cash is not insignificant. However, those who disagree with me could accurately point out that from the first quarter of 2022 through the first quarter of this year, the company saw its net cash actually increase by $246.8 million. There are a lot of working parts that go into this. But it’s important to be cognizant of the fact that change a lot of this was driven by two primary factors.

One of these was the fact that inventory levels dropped by $158.1 million year over year. And the second is that accounts payable for the company grew by $174.6 million. So in order to keep its cash balance elevated, the company took an inventory light approach that may or may not come back to bite it and that certainly could only be considered a one-time maneuver. And it has purposely increased how much it owes its vendors. Depending on their patience, this may not last. And even if it does, it also will reach the point where it becomes just a one-time maneuver aimed at boosting cash.

Another development worth mentioning is that the company has decided to officially terminate (their words, not mine) its CEO, Matthew Furlong. As part of this maneuver, the company decided to elect Ryan Cohen to be executive chairman of the company, with responsibilities to include capital allocation and management oversight. Some other changes were made, such as the decision to appoint Mark Robinson to be the company’s general manager and principal executive officer. He will report directly to Ryan Cohen moving forward.

Truthfully, I don’t have very strong feelings about this management shakeup. Unless the company can move more in the direction of being a powerhouse for software, I don’t believe that the person in charge is going to make that much of a difference when it comes to its future. I believe that the picture for the company is rather bleak.

Takeaway

From all that I can see, GameStop Corp. is not doing well. I can and do appreciate the bottom line improvements that the company achieved. That is a great step in and of itself. But this alone is not enough evidence to sway me into being anything other than incredibly pessimistic about the company.

While the company is not at risk of going under anytime soon because of the tremendous amount of cash on its books, not to mention the very limited amount of debt that it has, I do believe that the long-term probability for investors permanently losing capital by investing in GameStop Corp. is quite high. Because of this, I’ve decided to keep the “sell” rating I last had on the company in March of this year.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!